How To Buy US Stocks For Non-Resident (with $0 Commission Fee)

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

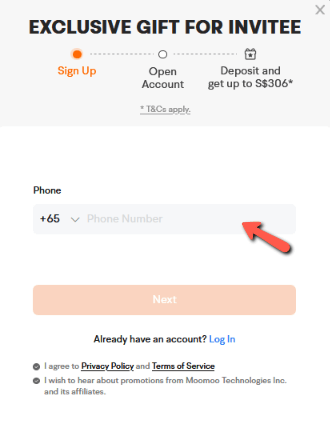

securely through Moomoo’s website

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

BEST FOR: Multi-Market Investors and Professional Traders to Invest in SG, US, UK, HK, China, Malaysia and Europe.

Referral Code: BUDDIES

(Get $20 Cash Credits)

Are you thinking of investing in the U.S. stock market?

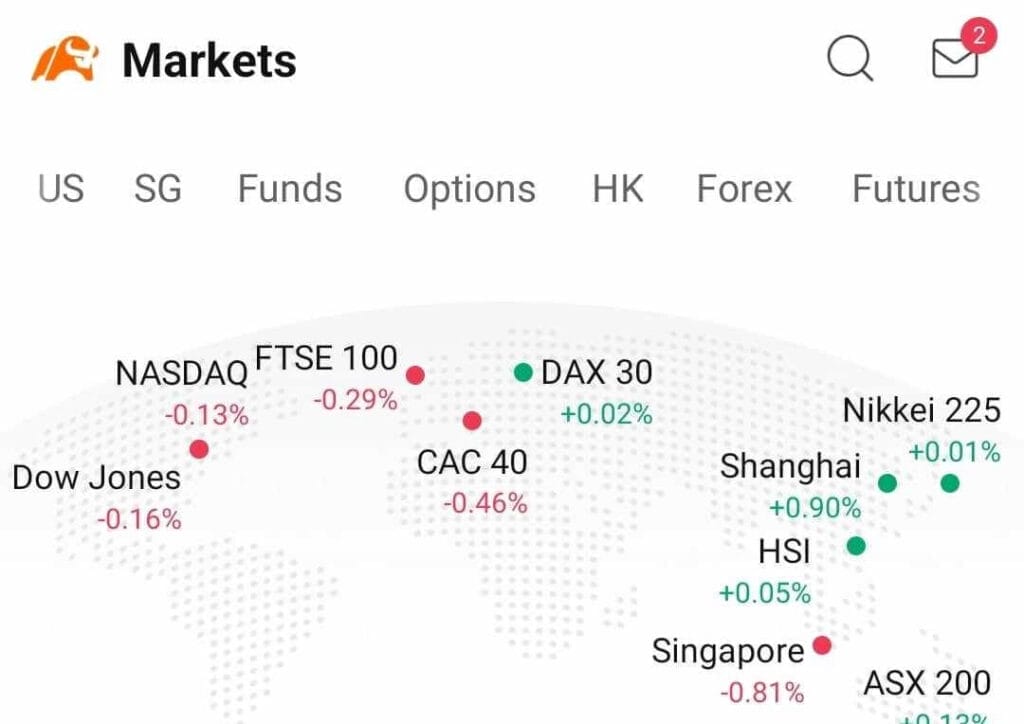

The US stock market is the biggest in the world along side other stocks exchanges such as China, Europe, Japan, Hong Kong and Singapore. However, many foreigner investor wonder how do they get started in trading stocks in the U.S.

While the easiest way for you to own US stocks is to open a U.S. trading account with the local broker, even as a foreigner there are ways for you to start trading U.S. stocks as well.

Can A Non U.S. Citizen Buy Stocks In US?

Non-U.S. investors can buy stocks in the U.S. as there is no citizenship requirements for owning stocks of American companies.

However, non-citizen of U.S. will require to open an brokerage account with an international stock broker to ensure that they are in compliance with any regulations that govern U.S. stocks and bonds.

Non-U.S. citizen are usually required to provide additional identification documents such as the proof of identity when buying stocks in the U.S.

- Visa information.

- Social Security number and/or Passport number and/or National Residential Identity Card (NRIC) number.

- Certificate of Status of Beneficial Owner for United States Tax Withholding

- W-8BEN

Thus it is important to understand which broker you should use to trade in the U.S. Depending on your country of residence, your options varies.

How To Trade And Invest In U.S. Stock As Non-Residents?

Investing in the U.S. for international clients gives you the opportunity to own part of the largest company in the world such as Alphabet, Meta, Apple and Microsoft.

There are two ways that non-resident who are not living in the United States to trade and invest in U.S. stocks. Similar services can be found in every country that offer online services to clients to start trading US stocks.

Option 1. Open a Brokerage Account With A Traditional Local Financial Institution With Access to U.S. Stock Markets

Easiest to way to start investing in U.S. stock is by opening an account with your local brokerage firms or other financial institutes in your home country that have access to U.S. stock market.

These brokerage firms or financial institutes access to the U.S. market by 2 ways:

- Partnering with U.S. financial firms

- Through American Depository Receipts (ADR)

Examples of such local brokerage firms or financial institutes are DBS Vickers, UOB Kay Hian and OCBC Securities.

Pros of Traditional Local Financial Institution

There is one big advantage to buy and sell U.S. stocks using local brokerage firms or financial institutes:

- Access to a physical location where the brokerage firms or financial institutes resides.

- Customer service can be face-to-face.

Cons Traditional Local Financial Institution

The downsides of buying and selling U.S. stocks using these brokerage can be quite a deal breaker:

- Higher trading commission per trade.

- Higher min fees per trade.

- Higher custodian fees.

- Limited stocks and investment products to trade and invest.

Trading U.S. stocks with them is generally good, but it comes with high fees and may not be the most cost effective for savvy investors.

Option 2. Open a Trading Account With An Online Broker

Online broker is the most popular way for non-U.S. residence to start investing in U.S. stocks. These brokerage firms serve international clients online allowing you to open brokerage accounts that will give you access to trade and invest in the US stock market.

Depending on where is your home country, you can open an online trading account after you’ve included your proof of identify with the online broker.

These online brokers comes in two main forms:

- US-based brokers headquartered in the U.S. that serve international clients online. These are the popular financial institutes and big brokerage that let you trade stocks and EFTs in the U.S.

- Brokers with international presence that may have offices in U.S. as well as other parts of the world. These are big brokerage firms that have access to the U.S. stock market and other markets in the rest of the world.

Examples of use online brokers are Moomoo, WeBull, TD Ameritrade, Etrade and Interactive Brokers.

Pros of Online Broker

There are many advantages for buying and selling U.S. stocks using online brokers:

- Low cost trading make frequent trading easy.

- Low or even commission free trading and investing.

- Low or no custodian fees.

- Wide range of stocks and investment products to invest and trade.

Cons of Online Broker

However great online brokers are buying and selling U.S. stocks using these online brokerage do have some disadvantages:

- No access to physical local office.

- Customer service are online.

Trading U.S. stocks with an online broker that comes with low fees and wide variety of investment products is probable something which most savvy investors are looking for, making this a great option for both beginner investors as well as experience investors.

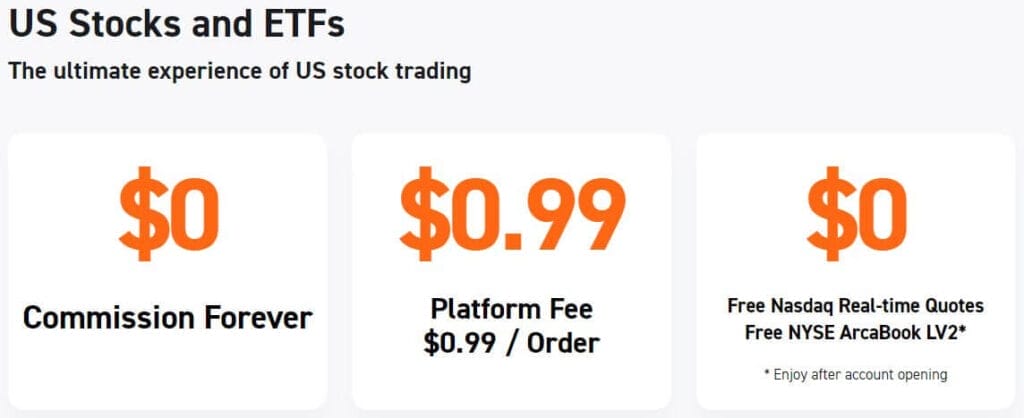

PS. Moomoo offers “Lifetime ZERO Dollar Commission” for trading U.S. stocks.

Stock Trading Platform For Non-US Resident

Buy and sell U.S. stock even when you don’t live in US is possible for most people. Similar to investing in stocks in Canada, United Kingdom, Hong Kong, China, Australia or in Singapore, it starts with choosing the right brokerage platform to start your investment journey.

Here is a comprehensive list of best brokerage options available to buy U.S. stocks:

| Brokerage for US Stocks | IB Rating | Min. Fees/ Trade (USD) | Trading Commissions/ Trade (USD) | Custodian Fees (USD) | Promotion |

|---|---|---|---|---|---|

Moomoo Singapore | ☆ 4.6 / 5.0 | $0.99 | $0 for Lifetime | No Custodian Fees | Get up to $800 worth of Free Shares + Perks |

WeBull Singapore | ☆ 4.6 / 5.0 | $0.00* | Min. $0.89 Max. 0.030% Trade Value | $0.01 to $0.03/ Share | Get up to $3,000 worth of Free Shares + Perks |

uSMART | ☆ 4.3 / 5.0 | $0.00* | Min. $1/ Order $0.005/ Share Max. 0.50% Trade Value | $0.01 to $0.03/ Share | Get Cash Vouchers |

Tiger Brokers | ☆ 4.3 / 5.0 | Min. $1/ Order $0.005/ Share Max. 0.5% Trade Value | Min. $0.99/ Order $0.005/ Share Max. 0.5% Trade Value | $0.01 to $0.05/ Share | Get Free Share |

Prosperus | ☆ 4.2 / 5.0 | $5.00 | $0.01/ Share | No Custodian Fees | Get Free Shares |

Interactive Brokers | ☆ 3.9 / 5.0 | $1.00 | 1.0% Trade Value | No Custodian Fees | None |

FSMOne | ☆ 4.2 / 5.0 | $8.80 | Min. $3.80/ Order Max. 0.08% Trade Value | $0.01 to $0.05/ Share | None |

Phillip Nova | ☆ 3.7 / 5.0 | $5.00 | 0.01% to 0.18% Trade Value | No Custodian Fees | None |

Phillip Securities | ☆ 3.7 / 5.0 | $1.88 | 0.50% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

DBS Vickers | ☆ 3.7 / 5.0 | $19.62 | 0.15% to 0.45% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

Standard Chartered | ☆ 2.9 / 5.0 | $0.00* | 0.20% to 0.25% Trade Value | No Custodian Fees | None |

Saxo Markets | ☆ 3.7 / 5.0 | $2.00 | 0.02% to 0.06% Trade Value | 0.06% to 0.12% p.a. of Stockholding Balance | None |

UOB Kay Hian | ☆ 3.1 / 5.0 | $40.00 | 0.18% to 0.30% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

KGI Securities | ☆ 2.9 / 5.0 | $20.00 | 0.30% to 0.40% Trade Value | None Stated | None |

Maybank Kim Eng Securities | ☆ 2.9 / 5.0 | $10.00 | 0.12% to 0.30% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

OCBC Securities | ☆ 2.9 / 5.0 | $20.00 | 0.30% to 0.415% Trade Value | $2 Per Counter Per Month, Max $200 Per Quarter | None |

Lim & Tan Securities | ☆ 2.9 / 5.0 | $20.00 | 0.30% Trade Value | $2 Per Counter Per Month | None |

Citibank Brokerage | ☆ 2.5 / 5.0 | $18.00 | 0.12% to 0.30% Trade Value | 0.0165% p.a. of Stockholding Balance (Monthly Avg.) | None |

CGS-CIMB Securities | ☆ 3.1 / 5.0 | $18.00 | 0.18% to 0.50% Trade Value | $2 Per Counter Per Month | None |

| Market Average | NA | USD $10 | 0.32% Trade Value | $2 Per Counter Per Month | NA |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the brokerage platforms, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing. Fees are for U.S. Stocks only.

How to Choose The Best Stock Brokerage To Invest In U.S. Stocks For You?

When choosing the best investment brokerage for the US stocks, there are a few criteria that you may want to consider:

- Fees structure.

- Number of investment options and investment products available.

- List of market access with the brokerage.

- Investor’s tools and indicators for technical analysis.

- Investment insights and company’s metrics for fundamental analysis.

- Access to real-time stocks data.

- Educational materials and support.

- Ease of platform use

- Option to perform investing and trading on the go with Apps.

These are just some criteria which I will look at when choosing the right stock brokerage to start. Depending on different investors, I personally think “fee structure”, “ease-of-use”, “investment options”, “real-time data” and “investment insight” are the most critical.

If you are in US, Hong Kong SAR, Macao SAR, Malaysia, Taiwan, Japan and Singapore, Moomoo can be a great option to start trading and investing in US stocks.

Do You Need To Pay Tax For Investing And Trading U.S. Stocks?

Tax for investing and trading mainly consist of these two types of tax:

- Capital Gain Tax

- Dividend Income Tax

Capital Gain Tax For Foreigners Investing In US Stocks

As a non-residence of U.S., you will not be subjected to U.S. capital gain tax upon the sale of your stocks investment, but capital gain tax may still be required according to the country you are currently residing in.

Countries that do not have capital gain tax includes:

- Bahrain.

- Barbados.

- Belize.

- Cayman Islands.

- Isle of Man.

- Hong Kong (China).

- Jamaica.

- New Zealand.

- Sri Lanka.

- Singapore.

Dividend Income Tax For Foreigners Investing In US Stocks

For both U.S. resident and non-U.S. resident, the dividend income you gain from your stocks investment in US companies listed on the US stock market will be taxable by IRS in the U.S. as investment income.

For normal taxation for a foreigner, IRS will apply a 30% withholding tax on your dividend income you earn from buying any of the U.S. stocks.

However, if you’re from a tax-exempted country where there is Tax Treaties with the U.S. then the percentage of withholding tax may vary.

Tax-exempted countries includes:

- Armenia, Australia, Austria, Azerbaijan

- Bangladesh, Barbados, Belarus, Belgium, Bulgaria

- Canada, China, Cyprus, Czech Republic

- Denmark

- Egypt, Estonia

- Finland, France

- Georgia, Germany, Greece

- Hungary

- Iceland, India, Indonesia, Ireland, Israel, Italy

- Jamaica, Japan

- Kazakhstan, Korea, Kyrgyzstan

- Latvia, Lithuania, Luxembourg

- Malta, Mexico, Moldova, Morocco

- Netherlands, New Zealand, Norway

- Pakistan, Philippines, Poland, Portugal

- Romania, Russia

- Slovak Republic, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland

- Tajikistan, Thailand, Trinidad, Tunisia, Turkey, Turkmenistan

- Ukraine, Union of Soviet Socialist Republics (USSR), United Kingdom, United States Model, Uzbekistan

- Venezuela, Vietnam

What mentioned are just some general information on the tax for foreigners investing in US stocks, but before you start your investing journey in the US stock market, it is always good to check with the financial institutions where you are open your brokerage account to trade.

If you are serious about investing, it is good to get a financial advisor who can give you the financial advice you need to help you in your investing journey.

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$243* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG & HK stocks, ETFs & options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Read Also:

- Moomoo SG Promotion! $970 Worth of Free Stocks + Perks for New User | April 2024 Updated 🟢

- WeBull SG Promotion! Claim Up to SGD$10,000 FREE + $0 Platform Fee | April 2024 Updated 🟢

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).