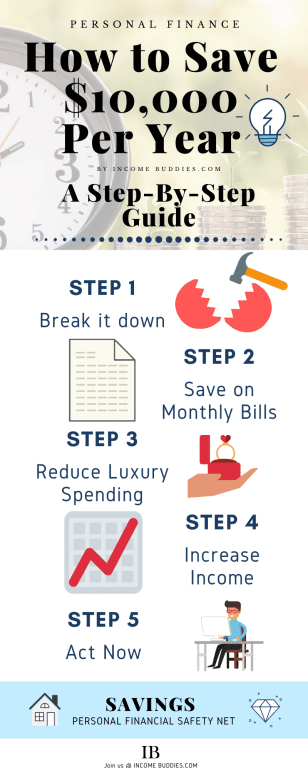

How To Save Money Fast With The “5-Steps Saving System”

Although money doesn’t solve everything, not having money can be a big problem. If you are a young adult in your 20s or 30s, you should set saving goals and start saving money.

Creating your 10K, 20K, 50K, or even a 100K savings plan, through budgeting and planning can help you save fast, cut back on impulse spending, and make saving a priority.

In fact, building personal wealth and reaching your saving goals to become financially secure is possible with the right money-saving tips and a plan to save money every month.

Wondering how to save money fast?

Here we’ll go through the “5-steps saving system” to help you save more money and reach your savings goal in a year or less. Let’s stop living paycheck to paycheck and let’s start saving with a save 10k in a year challenge!

How To Save Money Fast On Low Income

Saving money fast on low income requires you to plan your finance properly. The steps you’ll take to save $10,000 is similar to how you save $20,000, $30,000, or $50,000 a year.

By using the 5-step saving system, it gives you the plan to save which helps you to find ways to cut non-essential expenses and earn extra money along the way. Here are the best ways to save money fast on a low income.

Interested? Let’s take a look at how it works!

1. Break Down the Numbers

Break down your saving goal into easily digestible numbers. Breaking down the numbers allows us to easily understand the smaller goals that are required for us to achieve to reach our final saving goal.

How?

Because all big goals are made from hundreds or thousands of smaller goals.

Breaking down the goal will guide us to take appropriate actions.

Break the goal of your target saving into easily digestible numbers.

Breaking down the numbers allows us to easily understand the smaller goals that are required for us to achieve and reach our saving goal.

How?

Because all big goals are made from hundreds or thousands of smaller goals, and the same goes for saving 10k or more in a year.

Breaking down the goal will guide us to take appropriate actions.

Money-Saving Goal Chart

We’ve created a simple chart where you break down massive saving goals into smaller pieces.

- Amount ($) Saved per Year

- Amount ($) Saved per Month

- Amount ($) Saved per Week

- Amount ($) Saved per Day

| Year | Month | Week | Day |

|---|---|---|---|

| $1,000 | $83 | $19 | $3 |

| $2,000 | $167 | $38 | $5 |

| $3,000 | $250 | $58 | $8 |

| $4,000 | $333 | $77 | $11 |

| $5,000 | $417 | $96 | $14 |

| $6,000 | $500 | $115 | $16 |

| $7,000 | $583 | $135 | $19 |

| $8,000 | $667 | $154 | $22 |

| $9,000 | $750 | $173 | $25 |

| $10,000 | $833 | $192 | $28 |

| $15,000 | $1,250 | $288 | $41 |

| $20,000 | $1,667 | $385 | $55 |

| $50,000 | $4,167 | $962 | $137 |

| $100,000 | $8,333 | $1,923 | $275 |

PS. Break down of your saving goal per Year is approx. value.

Example of breaking down your goal

Let’s say someone wants to save $1000, $10,000, $20,000, $50,000, or $100,000 a year.

Each of these goals is larger than the previous, thus it is separated into 5 levels of difficulty.

- Low: Saving $1,000 per year

- Mid-Low: Saving $10,000 per year

- Mid: Saving $20,000 per year

- Mid-High: Saving $50,000 per year

- High: Saving $100,000 per year

Each difficulty level requires a different set of actions for us to achieve them.

- Saving $1,000 per year will require you to save $83 per month, $19 per week, or $3 per day.

- Saving $10,000 per year will require you to save $833 per month, $192 per week, or $28 per day.

- Saving $20,000 per year will require you to save $1,667 per month, $385 per week, or $55 per day.

- Saving $50,000 per year will require you to save $4,167 per month, $962 per week, or $137 per day.

- Saving $100,000 per year will require you to save $8,333 per month, $1923 per week, or $275 per day.

In order to save $10,000 a year, you’ll need to save $28 per day.

2. Save on Monthly Bills

Saving on monthly bills is one of the best ways to save, and having a monthly budget for your monthly bills is the easiest and fastest way to save $10,000 in a year, and $28 per day. Every month, you need to pay your bills on both the essentials and non-essentials in life.

Essential Bills:

- Rental (If applicable)

- Utilities

- Hand-phone

- Transportation

- Insurance

Non-Essential Bills:

- Credit Card

- Gym membership

How can we cut our spending on our monthly bills?

Essentials Bills

Rental

A place called home is essential, but are you sure you need that swimming pool for the house you rent? Or that facility that you almost never use? Maybe it is a good idea to look for a place where the rental can be much lower. By simply doing this, you can probably save a couple of hundred bucks per month.

Example:

- Current rental of $1,200 per month

- You can easily rent a place that cost $1,000 per month in a similar location, this will probably save you $200 per month.

Utilities

Utility and electric bills are a must to pay, but maybe you can consider using electronics that have higher energy savings, this will probably cut your electrical bills by a few hundred bucks per month. (My utility bills reduce from $362 per month to $78 per month just by changing my air-con and refrigerator to an energy-saving version.)

Hand-phone

Hand-phone is almost as important as our wallet, and an average cell phone bill can cost from the low $10’s to over $100 dollars per month.

The average monthly cell phone bill for Americans is $114 per month and in the UK is $67 per month.

If you find yourself, overspending on this, you may probably want to look for a change of the hand-phone plans. By finding the cheapest plan and best deal, you can save hundreds of dollars a year.

Transportation

Getting from point A to B requires us to take some form of transport. We can take public transport, a reliable family car, or a luxurious car BMW 320 Series with leather seats and tainted glass.

The difference is simply the amount you need to spend on transport. And depending on your needs, public transport almost always gives you the most savings.

Example.

- Public transport costs an average of $200 per month

- A reliable family car with petrol and maintenance fee cost $600 per month

- A luxurious car BMW 320 Series with leather seat, tainted glass with 360 all surround sound sounds system with petrol, and a maintenance fee cost $2500 per month.

Insurance Policy

Insurance is one of those necessary expenses that can take up a large portion of our monthly budget. Regardless of if it is our home insurance, car insurance, life insurance, or health insurance, with the rising costs of insurance premiums, with rising costs of insurance premiums, it’s easy to feel overwhelmed.

However, there are ways to save money on insurance so you don’t have to break the bank.

With the increasing number of financial institutions offering insurance plans, finding the best deal in the market has become much easier.

- Take advantage of loyalty discounts offered by companies, often these discounts are provided automatically, but sometimes you need to request the discount.

- Shop around online for better rates from the different insurance offered in the market and find the best deals with the most coverage at a reasonable price.

- Consolidate all insurance to the same provider and ask for additional savings, as some insurance policies are offed as a package which can help you save time and save money.

Personally, I’ve known a friend that changed his auto insurance plan from one in which he paid around $3,000 a year to a more suitable plan which cost around $1,000 per year.

According to statistics, car insurance can range from $561 per year to $3,139 per year.

If you are trying to save money, insurance is a great place to start.

Non-essentials Bills:

Credit Cards

Credit cards can be handy in times of need. But if you are spending more than what you earn and not paying your credit card debts. The bill you will get will probably give you a shock and a run for your life. Credit cards are known to have high-interest rates if you didn’t pay your dues promptly.

With the power of compounding, these interests can become a fairly huge number, which will take you a long time to pay down the debt.

There are many things you should know before taking on debt. The interest rate for credit cards bill is known to be in the double digits, paying off all credit card bills at the end of each month is going to help you save money on the interest.

Gym Membership

Having a goal to live healthier is great and most people took up gym membership because they want to become healthier. But do you know we can do exercise outside of a gym as well?

If you seldom go to a gym (less than 3 times a week) probably you may want to consider canceling your gym membership.

Choose to jog around the neighborhood or go to the beach, it is free.

You can probably save $100 to $300 per month by doing this simple change.

So…

After saving on these monthly bills and making all these changes to your spending habits.

You can essentially save $500 to $1000 per month ($6,000 to $12,000 per year) depending on your current lifestyle and your willingness to change them.

But if you have not reached your goal of saving $10,000 per year even after these changes, we will proceed to the next step.

3. Reduce Luxury Spending

We love to be pampered and enjoy the good stuff. I understand as well.

Don’t worry, we are not suggesting taking away all the good stuff in life, but striking a balance between achieving your saving goal and enjoying what you love.

Here is a famous coffee example.

I believe most of us love to grab a cup of coffee from the café to start our day or during our break.

It is like a ritual to us and spending that $6 bucks for the coffee seems so normal.

With a little math magic, you will find just how much are you spending on that coffee.

Example:

- Total coffee per day: 2 cups of coffee

- Cost of each cup of coffee: $6

- Spending on Coffee per day: $12

- Spending on Coffee per week: $84

- Spending on Coffee per month: $360

- Spending on Coffee per month: $4,320

If your goal is to save $10,000 per year ($833 per month), your coffee habit of buying from a café isn’t going to help you much.

You may consider making your own coffee for just $0.50 per cup.

This simple change can probably save you hundreds per month and thousands (approx. $4,000 with this example) per year!

Reducing luxury spending applies to eating out or buying a new handbag every month.

If you are unsure how much should you spend on a luxury item or service.

You may follow this simple rule on spending:

Rule on luxury spending: Set aside not more than 10% of your salary on luxury service or items.

4. Increase Your Income

Some of you may not have $833 per month to cut from your expenses. And this applies to many who are from the lower-income group. If cutting on spending doesn’t work, the only other way is to increase your income. Earning a higher income might not be an easy task, but if you have the will, it is possible.

Just to refresh your memory, with the goal to get $10,000 savings per year, you will only need the following:

- Saving $10,000 per year

- Saving/earning $833 more per month

- Saving/earning $192 more per week

- Saving/earning $28 more per day

Do you think you can earn $28 more per day?

I surely do think so.

How to earn extra income?

Method 1: Get a part-time job.

Working part-time gives you an average of $15 per hour, which means, you will just need to work 2 more hours per day and you will be able to save an extra $10,000 per year.

Here is also an article from HQHire.com you can learn how to ace that first interview and get hired.

Method 2: Negotiate or get a higher-income job.

A workday is usually 8 hours. The goal of earning $28 per day means you need to earn $3.50 more per hour.

Simply find a job that earns you $3.50 more per hour and you will be able to save an extra $10,000 per year.

You can probably check out this article from HQHire.com on how to get a pay raise, I find this article quite entertaining and probably helpful to you.

5. Act Now

Act now means that you will stop procrastinating and start working towards your goal.

Take massive action and start working on your saving plan by creating a home budget.

- Break down your saving goals into smaller numbers.

- Cut your monthly bills and increase your savings.

- Reduce your luxury expenses.

- Get a part-time job to earn an extra income.

Without action, you can never achieve your goal!

“Act now” is probably, this is the most important step to achieve your saving goal.

You can read 100’s articles about saving $10,000 per year, or even $100,000 per year.

You can be reading all our articles on personal finance, getting that passive income, investing, or getting to know how to be a good dividend investor.

But if you do not act now, you will be just reading lots. Nothing will change in your finance and income.

No, I am not asking you not to read.

Reading allows you to learn from the experience of the most successful people.

Multi-millionaire like CEOs of big companies and billionaires like Warren Buffett read at least 1 book per week.

Books found in My Library are some of the best books which I think you should read.

I am humbly requesting that you take action, in addition to reading our articles.

Because…

By taking action you can help to improve your finance and reach your saving goal of saving $10,000, or $100,000 per year.

Savings Calculator

And if you are wondering is there a easy way to know how much you’ll need to save each day, week, month to achieve your saving goal, here is a simple saving calculator you can use to get a rough idea on how much you’ll need.

Is $10,000 A Lot To Save A Year?

Saving $10,000 in a year is not a lot to save for a year. The recommended amount saved for each individual is three to six months of monthly expenses.

If your monthly expenses are from $1,667 to $3,334, then having $10,000 saved up is just the right amount.

The median balance that an American household saved in the bank is $5,300 and the average balance is $41,700 according to data collected by Federal Reserve.

The average monthly expense for each household in the United States is $5,577. And to meet the required 3 to 6 months of living expenses saved, the average American should save approx $16,731 to $33,462 to reach financial stability.

Saving $10,000 a year is a great accomplishment. The earlier you reach this goal the better you are able to secure your financial future. But depending on your monthly expenses, it may not be enough.

If You’ve Saved $10,000 Dollars Now What?

When you’ve saved $10,000 you should use it to build up your emergency fund or pay down high-interest debt.

If you’ve done those, you can choose to use this cash to invest and one of the best investment options is to increase your 401(k) contribution or open an IRA.

Although $10,000 might sound like a lot of money, it is far from sufficient for you to retire.

| Age | Median American Savings |

|---|---|

| The 20s | $16,000 |

| The 30s | $45,000 |

| The 40s | $63,000 |

| The 50s | $117,000 |

| The 60s | $172,000 |

After you’ve saved your first $10,000, start saving for retirement.

Saving $10,000 is only the first step to saving money for a better financial future. With sufficient money saved, you will become less stressed about financial-related issues and have fewer sleepless nights to worry about.

Why Is It Important To Have A Savings Plan When Saving Money

Having a saving plan is important if you want to distribute your limited resources in a manner that maximizes benefits and minimizes costs. When you have a plan in place, you put the money away every week or month consistently to reach your saving goals.

Saving money is a smart move that provides individuals with security and financial independence. The act of saving money is a conscious decision to accumulate wealth and resources in order to protect against future financial instability.

In the event of unexpected expenses or to finance long-term goals. The money saved provides both financial securities and allows for flexibility in case of emergency.

In addition, with extra cash saved, individuals are able to leverage their disposable income for potential investments during a market crash or when offered a business opportunity, providing them with the opportunity to generate additional wealth.

Top 10 Reasons Why We Save Money

Saving money is a smart move that provides individuals with security and financial independence. It is a financial move that allows us to build wealth, plan for retirement, and have access to emergency funds.

We save money for a variety of reasons,

- Buying a house

- Buying a new car or other big-ticket items

- Paying down debt

- Planning for your retirement

- Building a college fund for children’s education

- Building an emergency fund

- Building a rainy day fund

- Building an investment fund

- Building a traveling fund

- Building financial freedom

With so many reasons to save money, teaching your child early on the importance of saving is essential for their future well-being.

And if you are wondering what are the opportunities for you to save your money on the things you experienced every day;

How Much Should I Have Saved By Age?

At every age, you should have a different amount saved in preparation for retirement.

- By age 30: Save the equivalent of your annual salary.

- By age 40: Save the equivalent of three times your annual income.

- By age 50: Save the equivalent of six times your annual income.

- By age 60: Save the equivalent of eight times your annual income.

Nonetheless, this is just a general guideline and it is highly dependent on where you choose to retire and if inflation is not considered in the calculation.

You can read my other article on retirement to understand how much you really need to retire.

Hey Buddies!

We love writing these articles because we want to help each other in our financial success.

If you are looking to save for your retirement, you may want to check out How much do you really need to Retire?

Oh, just before I forget, we are currently building a forum for our Buddies to gather and share their BIG ideas.

Join us in the conversation at our forum when it is up!

Till Next Time!

Kopi Buddy, Signing Out!

Saving $10,000 per year can be tough for some, but with determination and following our 5 steps guide, you will definitely achieve your financial goal.

Read Also:

- 7 Streams of Income to Build Wealth Now! (Powerful Income Ideas)

- How to Create Passive Income With Your Expertise Today (5-Easy Steps)

- How to Create a Budget for Beginners (Personal Finance Budgeting 101)

- How To Use The Debt Lasso Method To Pay Off Debt (Debt Free)

- How Much Do I Need to Save For Retirement at 55, 60, 65? (Retirement Calculator)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).