6 Popular Low Risk Investment In Singapore (High Return Savings Investment)

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Ready to kick-start your investment journey?

Investing in any investment have some form of risk, but amount all the different types of investment, a few of them are considered as low-risk investment, or safe investment option where your investment capital is very much protected.

These low-risk investments products often helps protects investors from inflation, while providing some form of liquidity, and diversification of their portfolio.

- For experienced investors, these are popular investment options to park your money while waiting for investing opportunity.

- For beginner investors, these financial products are good investment opportunities to get started in learning how to invest your money with minimal risk.

Best Low Risk Investment In Singapore

In Singapore, other than CPF, there are many other low-risk investment instruments and alternatives that investors want to invest with their spare cash to get higher interest rate while getting protected from the high volatility of traditional investments such as stocks and real estates investment trusts.

Here are some popular investment options you can consider to park your money in Singapore.

Low Risk Investment | Risks | Returns (p.a.) | Fees | Tenure | Liquidity |

|---|---|---|---|---|---|

| Cash Management Account | Low-Risk^ | 2.00% to 5.00% | Approx. 0.15% p.a. | No Min. No Max. | High |

| Savings account | Risk-free* | 0.05% | Fees if below minimum balance | No Min. No Max. | High |

| Fixed deposit | Risk-free* | 0.30% to 4.00% | None | Min. 1 month Max. 5 years | Low (Penalty For Early Withdrawal) |

| Singapore Savings Bonds (SSB) | Risk-free` | 2.76% to 3.63% | S$2 per transaction | Approx. 10 years | Medium (7-30 days) |

| Singapore Government Securities (SGS) Bonds | Low-Risk^` | 0.678% to 3.626% | S$2 per transaction | 2, 5, 10, 15, 20, 30 or 50 years | Low (Sell on Market) |

| Singapore Treasury Bills (T-Bills) | Low-Risk^` | 0.115% to 4.476% | S$2 per transaction | 6 months, 1 year | Low (Sell on Market) |

^Price volatility risk, applicable to SGS and T-Bills only if early withdrawals.

*Insured up to S$75,000 by the Singapore Deposit Insurance Corporation Limited (SDIC)

`SSB, SGS and T-Bills are backed by Government of Singapore with “AAA” credit rating.

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the low-risk investment options, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing.

1. Cash Management Account

Cash management account is a nonbank cash account where you can park your cash while enjoying competitive interest rate with the freedom of withdrawing your money anytime you want.

These accounts are typically offered by financial institution such as brokerages, investment platforms and nonbank financial institutes.

5.32%

p.a. (Approx.)

$1,330

Est. earning over 1 year at $25,000

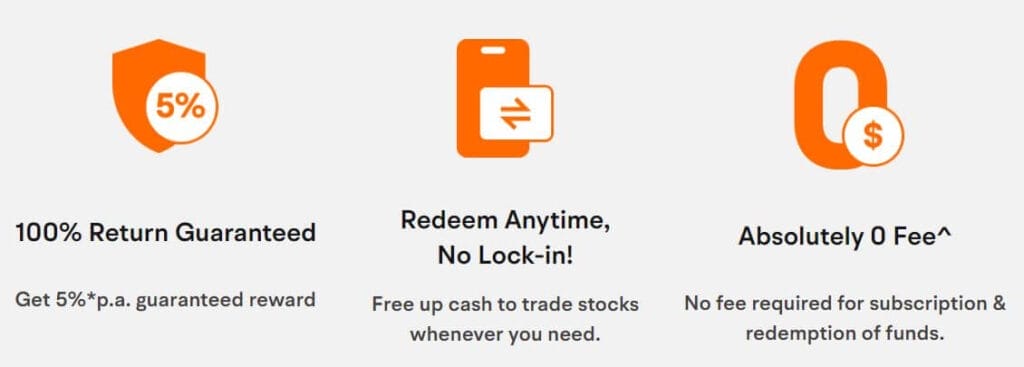

- $1 Min.

- No Lock-in

- No Redemption Fee

- No Subscription Fee

5.30%

p.a. (Approx.)

$1,325

Est. earning over 1 year at $25,000

- $1 Min.

- No Lock-in

- No Redemption Fee

- No Subscription Fee

Note: The information is accurate at the time of writing.

Biggest advantage of cash management account is that:

- Cash management account gives investors the liquidity required to buy and sell shares as and when they need.

- Allow the investors to enjoy low-risk high interest return by simply parking your money in the cash management account.

To enjoy higher interest rate by parking your cash at an highly liquid cash management account here are the steps:

- Choose a major online brokerage or financial service that is also a registered MAS-licensed financial institution.

- Pick the best Cash Management Account service to park your money.

- Open your cash management account and fund your account accordingly.

Few things to lookout for when choosing your Cash management account are:

- Projected return on your money that is parked with the account.

- Management fees related to the account.

- Minimum deposit amount.

- Ease of depositing and withdrawing your money.

- Funding options such as; Cash and SRS.

We’ve picked and selected the best cash management account in Singapore for you to consider, here just some example of cash management accounts:

- Moomoo Cash Plus (Approx. 5.0% p.a. or market, whichever is higher)

- Moneybull by Webull (Approx. 4.52% p.a. projected return)

- MoneyOwl Wise Saver (Approx. 4.1% p.a. projected return)

- StashAway Simple (Approx. 3.3% p.a. projected return)

- Endowus Cash Smart (Approx. 3.5% p.a. projected return)

- Syfe Cash+ (Approx. 3.3% p.a. projected return)

Apart from Moomoo Cash Plus (MAS registered Online Brokerage in Singapore) that offers up to 5% p.a., all the rest offer lower return of around 3% to 4%.

Moomoo Cash Plus is the only Cash Management Account that provides a return that rivals investing in index funds.

Key Take Away: Cash Management Account

- Minimum Investment: Depends

- Maximum Investment: Depends

- Tenure: Flexible

- Liquidity: High liquidity

- Risk Level: Low-Risk

- Funding: Cash, Supplementary Retirement Scheme (SRS) funds

2. Savings account

Saving account is the most popular way people save their money for future use. While I was a bit reluctant to put this into this list, saving account is probably the best way to park your emergency fund and rainy day fund.

While it offers the lowest rate of return amount all investment, it is a must-have if you are looking for the highest level of convenience in terms of liquidity and capital protection.

To invest in a saving account simple follow the following steps:

- Find local banks that are licensed by the Monetary Authority of Singapore.

- Compare between the local banks on the saving account interest rates.

- Open a saving account with the bank and fund your account.

Singapore Deposit Insurance Corporation (SDIC) insure Deposit Insurance (DI) Scheme members $75,000 of what you’ve placed in your saving account to be protected, giving you a strong sense of assurance that you will have your money in you account whenever you want.

Key Take Away: Saving Accounts

- Minimum Investment: NA

- Maximum Investment: NA

- Tenure: Flexible

- Liquidity: High liquidity

- Risk Level: Risk Free

- Funding: Cash

3. Fixed deposit

Fixed deposit or what is also commonly known as Fixed-D is a popular first investment any investor made before investing in other investment asset. Like saving account, you can start investing in a fixed deposit with a local bank, but unlike a saving account, you get a higher interest rate by putting your money in an fixed deposit account.

To invest in fixed deposit here are the steps:

- Find local banks that are licensed by the Monetary Authority of Singapore.

- Compare the fixed deposit rate between the local banks that offers fixed deposit.

- Pledge a fixed amount with your selected local bank for a predetermined period of time.

Investing in fixed deposit is consider as risk-free investment because your principal and returns are guaranteed as long as you do not withdraw before the maturity. Furthermore, fixed deposit is protected by SDIC, where $75,000 are insured in the event that the bank fails.

Key Take Away: Fix Deposit Accounts

- Minimum Investment: Depends

- Maximum Investment: NA

- Tenure: Short-Term to Long-Term

- Liquidity: Low liquidity

- Risk Level: Risk-Free

- Funding: Cash

4. Singapore Savings Bonds (SSB)

Singapore Savings Bonds are flexible risk-free investment for risk adverse individuals who wish to invest a fixed amount and enjoy an increasing returns over the long term, while giving investors the ability to redeem their SSB any month without penalty.

With SSB, the interest rate changes every month, thus as an investor, you need to know when is the best time to buy the bonds.

To invest into Singapore Saving Bonds (SSB) here are the steps:

- Go to the Singapore Saving Bond website.

- Open an account with one of the local banks; DBS, OCBC and UOB.

- Setup and activate your individual CDP Securities account.

- Understand the interest you are getting for the current month, each month will have a different “issue code”. Eg. GX23050W, GX23040S, N596100W

- Use to the Savings Bond calculator to get an idea on the amount you will get by buying this bond. The bond will have a tenor of 10 years, with increasing interest rate the longer you hold the bond.

- Apply the Saving Bond through local banks’ internet banking and ATMs.

SSB is government bond issued by the Singapore government and backed by the Singapore government with an “AAA” credit rating.

Key Take Away: Singapore Saving Bonds

- Minimum Investment: $500

- Maximum Investment: $200,000

- Tenure: 10 Years

- Liquidity: Medium liquidity

- Risk Level: Risk-Free

- Funding: Cash, Supplementary Retirement Scheme (SRS) funds

5. Singapore Government Securities (SGS) Bonds

Singapore Government Securities (SGS) Bonds long term tradable debt securities with a typical maturity periods of 2, 5, 10, 15, 20, 30 or 50 years.

These tradable debt securities are issued by the government to enable the various development of Singapore, and there are 3 main categories of SGS bonds to choose form:

- Market Development SGS Bonds

- Infrastructure SGS Bonds

- Green Infrastructure SGS Bonds

Each SGS Bonds have a few information that you may want to take note:

- Issue date

- Maturity date

- Coupon rate

To invest into Singapore Government Securities (SGS) Bonds here are the steps:

- Go to the Singapore Government Securities (SGS) Bonds website.

- Open a bank account with one of the local banks; DBS, UOB and OCBC.

- Setup and activate your individual CDP Securities account.

- Choose to buy between the new SGS issued (required full bid amount) and reopened bonds (requires 115% of bid amount).

- Understand the coupon rate you are getting for the SGS Bonds, each Bond will have a different “issue code”. Eg. NZ19100S.

- Understand the details of the SGS Bond; maturity date, interest yield, current price.

- Apply the Saving Bond through local banks’ internet banking and ATMs.

SSBS and SGS Bonds are both issued by the Government of Singapore, and both are backed by the Singapore government with an “AAA” credit rating making these investment to be considered as risk-free.

Key Take Away: Singapore Government Securities (SGS) Bonds

- Minimum Investment: $1,000

- Maximum Investment: None

- Tenure: 2, 5, 10, 15, 20, 30 or 50 Years

- Liquidity: Low liquidity

- Risk Level: Risk-Free

- Funding: Cash, Supplementary Retirement Scheme (SRS) funds or CPF Investment Scheme (CPFIS) funds

6. Singapore Treasury Bills (T-Bills)

Treasure Bills (T-Bills) are short term government issued securities issued at a discount to their face value, meaning T-Bills do not pay a coupon, but instead the interest is paid upon maturity of the T-Bills which is typically 6 months or 1 year.

To invest into Singapore Treasure Bills (T-Bills) here are the steps:

- Go to the Singapore Treasure Bills (T-Bills) website.

- Setup and activate your individual CDP Securities account.

- Apply T-Bills through a primary dealer (PD); DBS, UOB, OCBC, etc.

- Choose the T-Bills you intended to buy and copy down the “issue code”. Eg. BS23106N.

- Understand the details of the T-Bill; auction date, maturity date average yield, average price.

- Apply the T-Bill through primary dealer such as our local banks’ internet banking and ATMs.

Similar to SSB and SGS Bond, T-Bills are backed by the Singapore Government with an “AAA” credit rating, making it one of the best risk-free investment for short term investor.

Key Take Away: Singapore Treasury Bills

- Minimum Investment: $1,000

- Maximum Investment: None

- Tenure: 6 months to 1 Years

- Liquidity: Low liquidity

- Risk Level: Risk-Free

- Funding: Cash, Supplementary Retirement Scheme (SRS) funds

What Are Low Risk Investment?

Low risk investments are various investment options which have low relevance to the market fluctuations with lower level of volatility compared to the general market.

Low-risk investment are considered to be safer investment options available to investors looking for capital preservation who are also looking for a low to moderate rate of investment return.

Can You Lose Money With Low Risk Investment?

All investment have some form of risk, this includes low-risk investment. With low risk investment you can lose money, but the probability of losing money is far lower than traditional investment such as stocks and REITs.

These are a few common ways where low-risk investment can lose money:

- Withdraw your investment prior to maturation of your investment.

- Low-risk investment are subjected to price volatility risk, where you can sell your investment at a lower price than your investment price.

- Default of the financial institution, organization or service where you invest your investment.

Where To Park Your Money in Singapore?

Depending on your financial goals, you should have a different investment strategy and create a different investment portfolio.

Investment such as bonds are great alternative investments for higher return compared to saving accounts.

Investment in money market fund or cash management account are great way for investors to put their spare cash aside for investing in the Singapore stock market or for property investment.

Personally, I will choose to park my money in saving account and cash management account.

- Saving account will be used as emergency fund and rainy day fund.

- Cash management account with Moomoo Cash Plus for investing in stocks or other investment vehicles.

5.32%

p.a. (Approx.)

$1,330

Est. earning over 1 year at $25,000

- $1 Min.

- No Lock-in

- No Redemption Fee

- No Subscription Fee

5.30%

p.a. (Approx.)

$1,325

Est. earning over 1 year at $25,000

- $1 Min.

- No Lock-in

- No Redemption Fee

- No Subscription Fee

Note: The information is accurate at the time of writing.

Nonetheless, please consult your financial adviser for any forms of financial advice or investment advice that may suit you the best.

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

* T&C Applies

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Read Also:

- Best Singapore Blue Chip Dividend Stocks to Buy Now in 2024 (New)

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Moomoo SG Promotion! $970 FREE Stocks + Perks for New User | May 2024 Updated 🟢

- WeBull SG Promotion! GET 8.4% p.a. + USD1,000 Cash Voucher | May 2024 Updated 🟢

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).