Dividend Investing: Ultimate Guide To Investing in Dividend Stocks For Passive Income

Are you looking to earn a passive income that pays you on a periodic basis without requiring you to do anything?

Dividend investing is one of the most popular investing strategy used by investors. An investing strategy where you can passively earn an income by investing in dividend paying stocks.

It doesn’t matter if you just start your investing journey, dividend investing is a great choice for both new and experienced investor. Knowing how to become a smart dividend investor can make you very wealthy.

KEY TAKEAWAYS

- Dividend investing is a great way to create passive income and generational wealth through creating a new stream of income.

- Both new investors and experienced investors are suitable for dividend investing. And with the power of compounding young investors have the added advantage.

- High dividend yield stock don’t always translate to a good dividend stock. When investing, look for good quality stocks that grow their dividend over time.

What is Dividend Investing?

Dividend investing is a form of investment strategy that focus on building a portfolio of dividend stocks and dividend paying assets that generates an income in the form of dividend.

The strategy of investing in dividend paying stocks is also referred to as income investing or passive investing because it allows you to generate a steady stream of income passively, without the need for constant buying and selling of stocks.

Not relying on capital gains, which can be unpredictable, dividend investors earn a regular income regardless of market conditions.

As an lazy investor, this is the investing style I prefer, and you might find this interesting as well.

So What is Dividend?

Dividends are usually excess profits or earnings distributed to shareholders by the company.

When you invest in dividend stocks, you become a partial owner of the company and in return, you’ll receive a portion of the company’s profits in the form of dividends.

As a dividend investor need to understand a few critical information about dividend itself:

- Types of Dividends: Cash Dividend, Stock Dividend, Property Dividend, Scrip Dividend, Liquidating Dividend

- Types of Dividend Policy: Stable Dividend Policy, Constant Dividend Policy, Residual Dividend Policy

Gaining a deep understanding on what exactly is dividend will give you a clearer picture on what you can expect as an dividend investor.

How is The Dividend Yield Calculated?

Dividend yield is the most popular metric many dividend investors takes priority when picking any individual dividend stocks.

Presented as a percentage, the dividend yield indicates the annual dividend payment relative to the stock price.

However, the dividend yield is calculated based on the past annual dividend payment, thus it can only be used as a reference for future dividend payment.

Gentle Reminder: The dividend yield is not an indication of the amount of dividend paid in the future.

Dividend Yield Formula

The formula to calculate the dividend yield is as follow:

Dividend Yield = Annual Dividend Per Share / Current Stock Price Per Share

The two elements for the dividend yield formula are:

- Annual Dividend Per Share: Past annual dividend paid to shareholders.

- Current Stock Price Per Share: Current price of the stock which changes according to the market’s sentiments.

The dividend yield provides a way to compare different dividend paying stocks and evaluate their income potential.

Example on Calculating the Dividend Yield

Let’s say a dividend stock “Company X” has an annual dividend of $1 per share, and its current price per share is $50.

The dividend yield for the stock would be:

Dividend Yield = $1 / $50 = 2%

The dividend yield calculated for the Company X is 2%.

Example on Calculating the Dividend Yield

The same dividend stock “Company X” has an annual dividend of $1 per share, and one week later, the current price per share is $25.

The dividend yield for the stock would be:

Dividend Yield = $1 / $25 = 4%

The dividend yield calculated for the Company X is 4%.

How Much Do You Need To Build a Dividend Portfolio?

A dividend portfolio is a portfolio of assets and stocks that have a history of dividend payment, and when combined these assets, together they generates a stable income in the from of dividend payments.

The amount you’ll need for your dividend portfolio depends on a few factors:

- Monthly Dividend Income: Your desired monthly dividend income generated by your dividend portfolio.

- Dividend Yield: Average dividend yield of your dividend portfolio.

- Dividend Tax Rate: Dividend tax paid to the government. This depends on the country you reside in, some countries do not requires you to pay dividend tax.

Here is a dividend calculator that will help you estimate the required size of your personal dividend portfolio for your desired amount of dividend income. A portfolio where it generate a monthly dividend income passively by simply owning the stocks.

To build a well-rounded dividend portfolio, investing in multiple stocks from different sectors have many benefits:

- Diversification helps mitigate risk.

- Not overly reliant on the performance of a single company or industry.

- More stable dividend income with a wide diversified dividend portfolio.

Consider investing in a range of companies with different market capitalizations and industry.

- Large-cap, mid-cap, and small-cap stocks etc.

- Technology, logistics, real estate, etc.

By diversifying your dividend portfolio you can balance potential returns and volatility.

How Do You Identify Good Dividend Stocks?

Identifying good dividend stocks involves evaluating various factors that indicate the company’s ability to sustain and grow its dividend payments.

- Know how to find stocks that pays dividend

- Understanding the characteristics of good dividend stocks

- Perform in-depth fundamental analysis on the moat of the stocks.

While there are many other information you need to consider, here are a few key metrics to get started.

1. Dividend Payout Ratio

The dividend payout ratio is used to calculate the amount of dividend being distributed from the company’s earning. It is generally used to determine if a company is distributing a reasonable portion of its earnings as dividends.

- Payout ratio that is too high can means the company is not retaining enough of its earning for the future of the company.

- Payout ratio that is low means the dividend yield will be low which makes it not as attractive dividend stock.

A sustainable payout ratio is typically below 80%, but this number varies depending on the industry.

2. Dividend Yield

The dividend yield measures the annual dividend payment relative to the current stock price.

- Dividend stock with a higher dividend yield indicates a higher return on investment in the form of dividends.

- Dividend stock with a lower dividend yield indicates a less return on investment in the form of dividends.

General dividend yield for companies that pay a dividend range from 2% to 10%.

3. Dividend Growth Rate

The dividend growth rate is a measurement on the growth on the company’s dividend payment over time.

Investors who chooses dividend growth investing find dividend stocks that are also growth stocks. These individual stock grow as time passes.

For long-term investors, these stocks will eventually become high dividend yield stocks that offers high yield on cost for the investors.

Benefits of Dividend Investing

Regardless, if you are an young investor with no experience or an experienced investor looking to build a passive come. Dividend investing offers many advantages for investors.

1. Generate Passive Income

Dividend investing provides a reliable source of passive income. Without needing to sell the stocks for an investment return, dividend investor can get an return on investment through holding the dividend paying stocks.

Here are some example of the assets that help you generate a passive income:

- REITs that pay dividend to investors as regulated by the authorities.

- ETFs that pays dividend to investors on a periodic basis.

- Individual dividend paying stocks that have a track record of dividend payment

By investing in dividend-paying stocks, you can receive regular dividend payments that can supplement your other income sources, helping you building multiple income streams.

2. Dividends Grow with Company’s Profits

As the company’s earnings grow, the amount of dividend paid to its shareholders grow as well. The dividend growth rate is a critical determinant when choosing which dividend paying stocks to invest.

By investing in dividend stocks with track record of dividend growth, you get to grow your dividend income without buying more of the particular stock.

- Understand the dividend growth rate

- Review historical annual dividend payout

- Identify special dividend issued by the company

3. Less Volatility and Lower Risk

Dividend stocks generally exhibit less volatility compared to non-dividend-paying stocks. The main reason why dividend stocks are less volatile and have lower risk is because of these reasons:

- Dividend-paying stocks pays out dividend on a periodic basis, which helps to cushion the impact of market fluctuations.

- Dividend stocks are generally blue chip companies with a large market cap, these companies are generally more stable compared to penny stocks.

- Companies that distribute dividends are generally companies which have excess cash.

With consistent income stream from dividends, it provides stability to your investment portfolio.

Risk Of Dividend Investing

While there are many benefits for dividend investing, it’s important to be aware of potential risks and limitations of this investing strategy as well. Here are a few things to watch out for.

1. Dividend Is Never Guaranteed

Dividend paying stocks does not guarantee dividend payment for its shareholders.

Unlike REITs, where by law they must pay out 90% or more of their taxable profits to shareholders in dividends.

For normal dividend paying stocks, the amount of dividends distributed to their shareholders is depending on the management’s decision.

- During economic downturns or business challenges, management may choose to cut dividend payouts or suspend the dividend distribution totally.

- During good times, when the company is earning record high profits, the management team may announce special dividends to be issued to their shareholders.

Always evaluate a company’s financial health and track record before investing.

2. Miss Opportunity In Investing High Growth Stock

Dividend investors only invest in stocks that pays their shareholders dividend. Some great stocks that have the potential of high growth are often ignored as they do not offer dividends to the shareholders.

Investors who focus solely on dividend leads to miss opportunities in investing in high growth stocks, companies that reinvest their profits for future expansion.

Smart dividend investor counter this drawbacks by identifying dividend stocks which are also growth stocks. By buying these high growth dividend stocks, the investor can enjoy advantage of both dividend investing and growth investing:

- Gaining the benefit of capital appreciation offered by buying growth stock.

- Enjoying the benefit of earning dividend income offered by dividend stock.

How To Use Dividend Reinvestment Plans (DRIPs) To Boost Your Returns

Dividend Reinvestment Plans (DRIPs) helps dividend investors to automate their investment and leverage the power of compounding through automatically reinvesting your dividend back into buying shares of the company.

DRIPs offers a few advantages to a dividend investor:

- Automates the investing process where you automatically purchase additional shares, instead of receiving the dividends in cash.

- Leverage on the compounding effects to grow your investment over the long term, increasing your overall share ownership.

- Provide the option to purchase additional shares at a discounted price, further enhancing the compounding effect.

- Reinvest your dividends and getting more shares of the company without incurring transaction fees.

- Depending on where you are located, dividend income including DRIP is taxed, however some countries’ dividend income is not taxed.

Together, DRIPs helps you harness the power of compounding and accumulate more shares over time, potentially accelerating the growth of your investment.

How To Generating Dividend Income With Income Investing

Developing a dividend investing strategy is key to maximizing profit, protect yourself from market fluctuation and create a stable streams of passive income.

If you are looking to generate dividend income with dividend investing, here are some things to consider:

- Set clear investment goals: Define your investment objectives, create an investing strategy to guide you on your stock selection.

- Focus on Dividend Aristocrats: Invest in companies with a consistent history of stable dividend distribution.

- Consider yield and growth: Find companies with reasonable dividend yield and track record of long-term dividend growth.

- Diversify your dividend portfolio: Spread investments across sectors, industry and market to reduce risk.

- Reinvest your dividends: Use DRIPs to compound investment returns and grow your portfolio.

- Monitor and review: Review your portfolio periodically and evaluate dividend prospects.

- Consider investing in dividend ETFs or REITs: Invest in REITs or diversified funds with low expense ratio, clear fee structure and stable performance.

Dividend investing is an investment strategy that focus creating a portfolio of high quality dividend stocks where you will hold for a long-term.

By adhering to a well-defined strategy, you can increase your chances of achieving your financial goals and enjoy the benefits creating an extra stream of income through dividend investing.

Investor’s Pro Tip: To be successful as a dividend investor, you need to be aware not to be too focus on unrealistic high yields stocks or get influenced by short-term gains.

Is Dividend Investing Worth it?

Dividend investing is a great investment strategy for both new and experienced investors. If you are an investor who prefer more passive management of your portfolio while enjoying getting some form of returns from your investment without selling your portfolio, dividend investing is a good option for you.

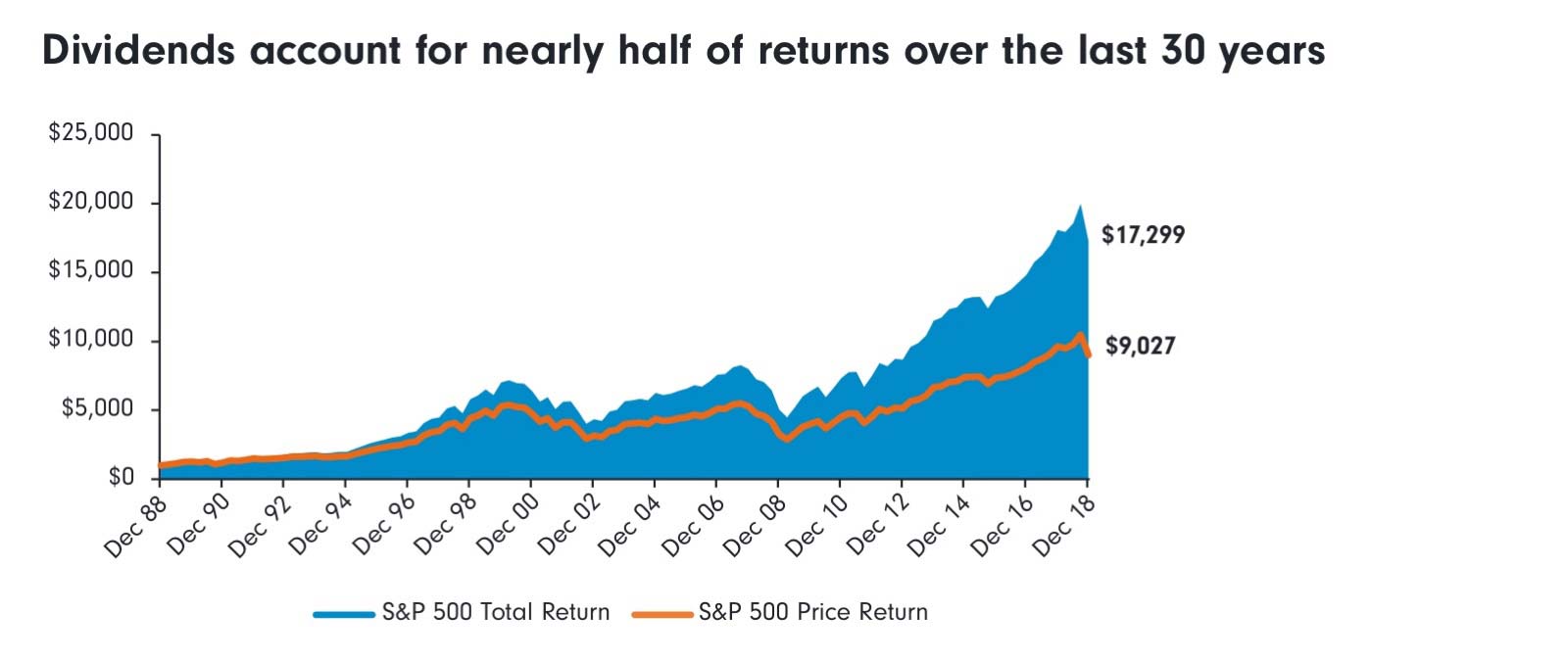

Since 1988, dividend returns account for nearly 47.82% of the total returns of S&P 500.

Capital appreciation of S&P 500 only amount to a little more than 50% of the total returns of the S&P 500. What’s more, the calculated returns includes the four significant recessions during these time periods:

- 1990s The Gulf War Recession

- 2000s Dot-Com Bubble Recession

- 2007-2009 Great Recession

- 2020 Covid-19 Recession)

Historically, when invested over the long-term, dividend stocks will outperform the S&P 500 with less volatility in both rising and falling markets. This is because, unlike non-dividend paying stocks, dividend stocks provide two distinct sources of return for investors;

- Regular income from dividend payments.

- Capital appreciation of the stock price.

With the help of compounding, the total return add up over time.

Time To Start Investing in Dividend Stocks?

As a lazy investor, and an investor who is looking to create generational wealth through investing, dividend investing is the perfect investing strategy to do so.

- Dividend investing is the best way to create true passive income for investors.

- Dividend investing offers a simple way to build wealth over time with the help of compounding.

- Dividend investing reduce the possibility of investors making the wrong decision at the wrong time. i.e. Buy when the price is high, and sell when the price is low.

Like all forms of investing, dividend investing need investors like you to learn about fundamental analysis and learn how to identify great companies with strong moat.

Thus, if you are new to investing, check out these articles:

- Ultimate guide to start investing as a beginner.

- Complete fundamental analysis guide to investing.

- Learning how to identify great companies through economic moat.

I am not sure about you, but if you are looking to create financial freedom, knowing how to find high growth dividend stocks is key to succeed as an dividend investor.

By conducting thorough research on companies and gaining more knowledge on investing you can become a better investor at no time.

Read Also:

- Moomoo SG Promotion! $970 Worth of Free Stocks + Perks for New User | April 2024 Updated 🟢

- WeBull SG Promotion! Claim Up to SGD$10,000 FREE + $0 Platform Fee | April 2024 Updated 🟢

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).