5 Types of Economic MOAT In Investing, The Competitive Advantage Of Long-Term Investing Success

When investing in company stocks, the concept of an economic moat helps protect your investment. Just like a fortress that protects a kingdom from external threats, an economic moat shields a company from competitors and ensures its long-term success.

As a value investor, and an investor who like simple stuff, having the understanding and knowing how to identify companies with strong economic moats is crucial for investing success.

Here, we will look at the relationship between economic moats and your success as an investor.

KEY TAKEAWAYS

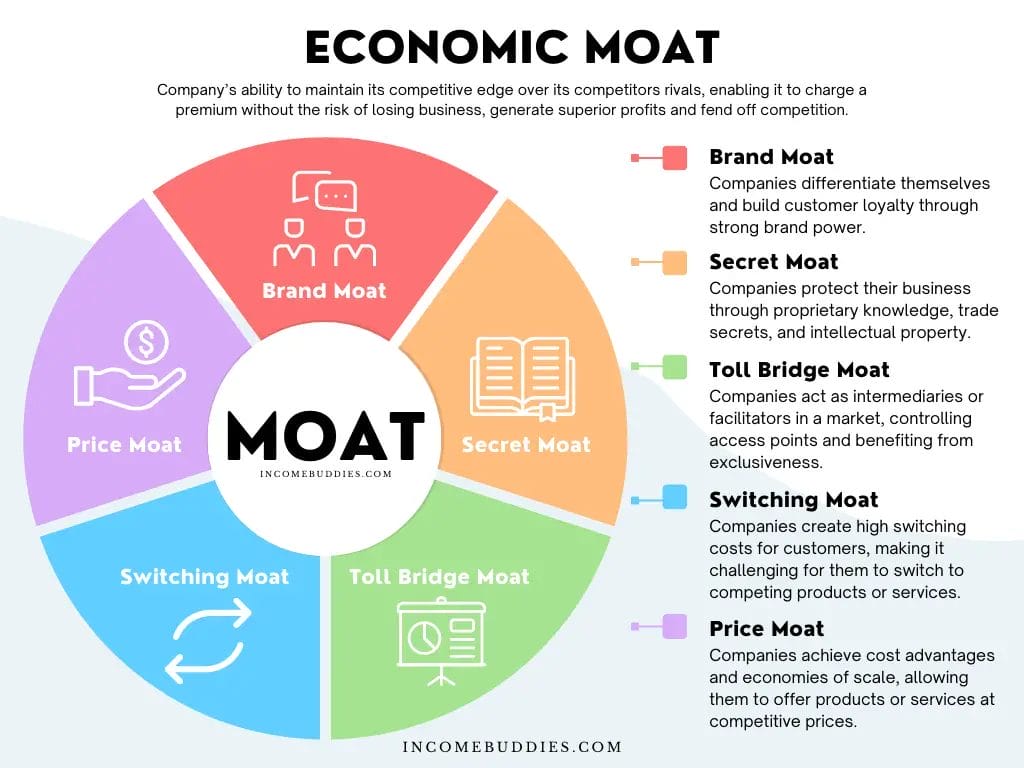

- There are 5 types of economic moats for investing and business; Brand Moat, Secret Moat, Toll Bridge Moat, Switching Moat and Price Moat.

- Company with wide moat can be great investment, while company with narrow moat may not.

- Building economic moat into your investment portfolio is key to successful investing.

Understanding Economic Moat

The term “economic moat” was coined by renowned investor Warren Buffett, he describe the “economic moat as the company’s sustainable competitive advantage over it’s competitors, like a medieval castle with a moat such as the castle wall or a water body that protects the castle.

An economic moat represents a company’s ability to maintain its competitive edge over its competitors rivals, enabling it to charge a premium without the risk of losing business, generate superior profits and fend off competition.

“The most important thing in evaluating businesses is figuring out how big the moat is around the business.”

Warren Buffett, 1991

Types of Economic Moats in Investing

There are 5 different types of economic moats, and company can have one or more economic moats. While each moat is very different from each other, each moat is just as important as the other.

1. Brand Moat

A Brand Moat is a powerful tool for business to differentiate themselves and build a loyal customer base.

Brands with strong brand power enjoy benefits such as: recognition, trust, and customer preference, giving them a competitive edge and influencing their customer to choose them over their rivals.

By nurturing brand loyalty and recognition, companies can create barriers to entry and reduce the impact of price competition.

The brand moat is usually build by effective brand-building strategies such as consistent messaging, exceptional customer experiences, and marketing campaigns, companies can solidify their position in the market.

2. Secret Moat

The Secret Moat focus on protecting its business through proprietary knowledge, trade secrets, and intellectual property that provide a company with a distinct advantage.

Companies with strong Secrets Moats have developed unique technologies, manufacturing processes, or formulas that are difficult to replicate. These are intangible assets that act as a barrier to entry, preventing competitors from easily imitating their products or services.

Secret moat is build through continuously investing in research and development, protecting intellectual property, and leveraging their exclusive knowledge.

3. Toll Bridge Moat

A Toll Bridge Moat is created when a company acts as an intermediary or facilitator in a market, controlling access points and benefiting from exclusiveness in the industry.

High entry barriers, these companies provide essential services, connecting different participants and leveraging the power of their connections.

Barriers to entry can include regulatory hurdles, licenses, capital requirements, and technological expertise.

4. Switching Moat

A Switching Moat is formed when companies create high switching costs for customers, making it challenging for them to switch to competing products or services. An invisible barrier that help to retain customers and grow the company.

The switching moat is also sometime called the soft moat where the strength of this moat lies in the the amount of switching cost and the power of networking effect.

Network effects occur when a product or service becomes more valuable as more people use it.

These switching costs can be financial, time-based, or effort-based. By locking in customers and making it costly to switch, companies can maintain a loyal customer base and deter competitors.

5. Price Moat

The Price Moat revolves around achieving cost advantages and economies of scale through size advantage. The price moat enable companies to offer products or services at more competitive prices than their rivals.

Companies with Price Moats can benefit from lower production costs, efficient supply chains, or significant purchasing power.

These advantages allow them to maintain a substantial profit margins even when the product is offered at a lower prices without compromising quality.

Achieved through continually optimizing their operations, streamlining processes, and leveraging economies of scale, companies can strengthen their Price Moat.

How To Tell If A Company Have a Strong Economic Moat?

Company’s economic moats represent the company’s ability to maintain a competitive advantage over its competitors.

While most business have some sort of moat, but not all economic moats are build the same, some have strong and wide moat, some have weak and narrow moat.

| Economic Moat | Description | Example |

|---|---|---|

| Brand Moat | Companies differentiate themselves and build customer loyalty through strong brand power. | Coca-Cola: Recognized globally, trusted, and preferred by consumers. |

| Secret Moat | Companies protect their business through proprietary knowledge, trade secrets, and intellectual property. | Google: Unique algorithms and search technology that competitors struggle to replicate. |

| Toll Bridge Moat | Companies act as intermediaries or facilitators in a market, controlling access points and benefiting from exclusiveness. | Visa: Provides payment services, connecting merchants and consumers globally. |

| Switching Moat | Companies create high switching costs for customers, making it challenging for them to switch to competing products or services. | Social media platforms: Network effects make it difficult for users to switch platforms. |

| Price Moat | Companies achieve cost advantages and economies of scale, allowing them to offer products or services at competitive prices. | Walmart: Efficient supply chain and purchasing power result in competitive pricing. |

Wide Economic Moat

Wide economic moats describe companies with a strong competitive advantage over it’s competitors and have moats that are difficult to replicate.

Companies with wide economic moats have the characteristics of:

- High barriers to entry, safeguarding the company from intense competition and ensuring sustained profitability. These barriers can be in the form of patents, regulations, or significant capital requirements, dissuading potential competitors. Unique intellectual property, proprietary technology, or exclusive access to resources strengthen a company’s position.

- Strong brand recognition and customer loyalty are vital. Companies with wide moats have built trusted brands that customers prefer, granting them pricing power and shielding them from price-based competition.

- Network effects and large-scale operations reinforce wide moats. Ability to becomes more valuable as more people use it. Evolving into large-scale operations enable companies to benefit from economies of scale, reducing costs and enhancing profitability.

Companies with a wide moat have more pricing power and are less likely to get replaced by their competitors.

Narrow Economic Moat

Narrow economic moats indicate companies with less competitive advantages. These companies have lower barriers to entry, allowing competitors to easily encroach their market share.

Companies with narrow economic moats have these characteristics:

- Limited brand recognition and customer loyalty, a generic product or service which is more like a commodity. These companies find it hard to differentiate themselves from competitors, making it difficult to maintain customer loyalty.

- Low barriers to entry where their competitors can easily replicate similar products or services easily, increasing competition and eroding pricing power.

- Lack network effects or scalability, which limits their competitive advantage and growth potential.

Companies with narrow moats have little to no pricing power and is always following someone’s lead in the business.

However, these companies with narrow moat can employ strategies to strengthen their position.

- Niche market differentiation, specialized products/services, continuous innovation, and exceptional customer experiences

These are some ways companies can help create a unique competitive edge and build a stronger wider economic moat.

Wide Economic MOAT vs Narrow Economic MOAT

When assessing the strength of the economic moat of a company for stock investing, here are some comparison between a company with a strong wide economic moat, and another with a weak and narrow economic moat.

| Aspect | Wide Economic Moat | Narrow Economic Moat |

|---|---|---|

| Competitive Advantage | Strong and durable | Less robust |

| Barriers to Entry | High | Low |

| Brand Recognition and Loyalty | Strong | Limited |

| Pricing Power | Higher pricing power | Susceptible to price competition |

| Market Share | Dominant | More vulnerable |

| Network Effects | Strong network effects | Lack of network effects |

| Scalability | Large-scale operations | Limited scalability |

| Sustainability | Long-term sustainability | Vulnerable to market changes |

| Potential for Growth | Potential for significant growth | Limited growth potential |

| Investment Consideration | Lower risk and potential for higher return | Higher risk with uncertain return |

However, this table should only be serve as a guide in assessing the economic moat for a company stock, many other factors should be assess together to get a better picture of the company current and future performance.;

- Financial health of the company

- Macroeconomic factors of the market

- Microeconomic of the industry and company

Evaluating Economic Moat Width When Investing

As an investor, knowing how to assess a company’s economic moat width prior to investing is vital for investment success. This is especially important if you are investing for the long term.

Company with strong wide moat let you invest in peace, while a narrow one don’t.

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Warren Buffett

Several factors contribute to the assessment of a company’s economic moat.

1. Complete understanding of the industry and company

Every industry is different, in terms of the moat and how to assess the strength of the moat. Understanding the industry and company can give you insights into assessing the level of competition and the company’s ability to maintain its competitive advantages over time.

2. Company finance in related to the industry

Financial metrics and ratios offer indicators of profitability, market share, and return on invested capital (ROIC).

Gaining understanding on the company finance and how it is in related to the overall industry can provide investor a few important insight on the investment:

- Management team’s ability to management the company through metric such as; ROIC, ROE, ROA, D/E Ratio, Current Ratio.

- Profitability of the business through metric such as; Profit margin.

- Future potential of the business through metric such as; EPS Growth rate.

These metrics help gauge the strength and width of the moat.

3. Long-term sustainability of competitive advantages

Long-term sustainability is another key consideration especially in this ever changing environment. With the introduction of disruption technology, some company’s once wide moat might become irrelevant, and quickly get over taken by their competitors.

Look at the company’s adaptability to market changes, understand potential disruptions, and technological advancements that reveals the longevity of its moat.

Case Studies of Companies with Strong Economic Moats

1. Coca-Cola

Coca-Cola has a strong economic moat primarily due to its powerful brand. Coca Cola have a multiple economic moat including; Brand Moat, Secret Moat and Price Moat (Size Advantage).

The Coca-Cola brand is recognized globally and enjoys high customer loyalty, giving the company a significant competitive advantage in the beverage industry. This brand strength acts as a barrier to entry for potential competitors.

2. Microsoft

Microsoft possesses multiple economic moats including; Switching Moat (Networking effect), Brand Moat, Secret Moat.

Most of the world use Microsoft to power their laptops and computers, its network effect-driven moat is created through its ecosystem of operating systems, software applications, and cloud services.

As more users adopt Microsoft products and services, the value of the ecosystem increases, creating a strong network effect that attracts and retains customers.

With Microsoft’s diverse product portfolio and extensive intellectual property rights, it provide further competitive advantage for Microsoft to be the leader in the industry.

3. Visa

Visa has built a strong economic moat including; Toll Bridge, Switching Moat (Networking Effect), Brand Moat.

As a global payment company that connects merchants, financial institutions, and consumers, it have a strong toll bridge moat, in additional, the size and reach of this network create a strong network effect, making it valuable for all participants.

With a strong trusted brand called “Visa”, people trust their money with this company and making it challenging for merchants to switch to another company even when the fees is lower.

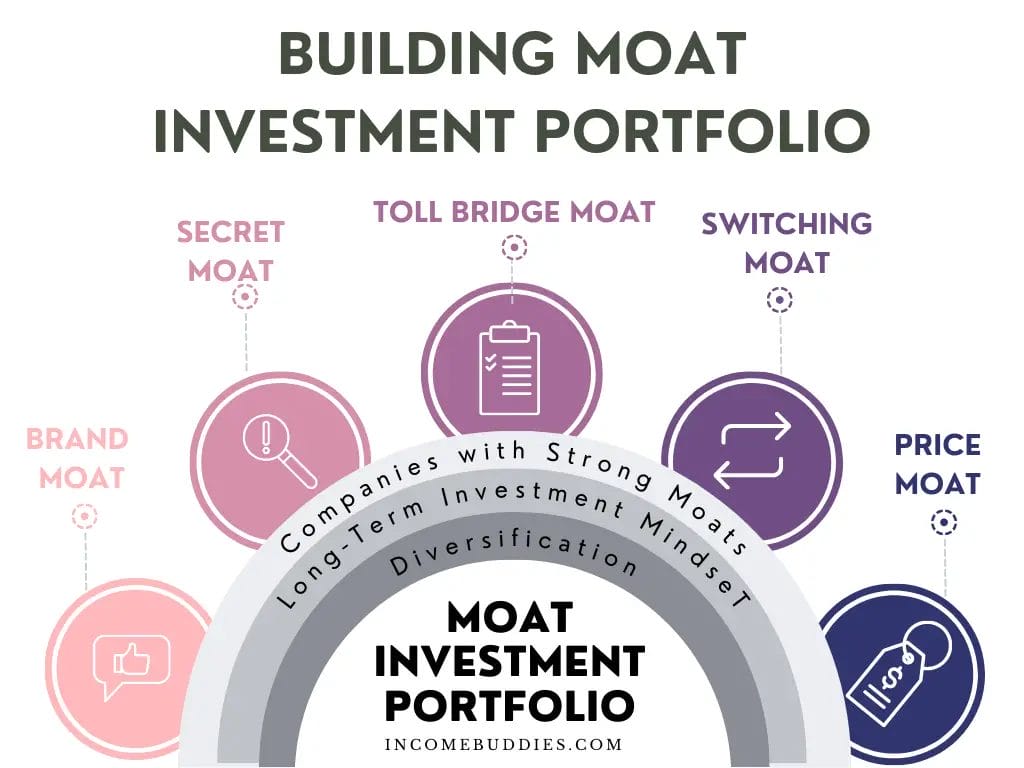

Building Economic Moat into Your Investment Portfolio, The “MOAT Investment Portfolio” Strategy

As an investor, I combination of different investing strategies to build my own portfolio. A strong portfolio with strong upside potential and limited downside risk, a portfolio that can withstand market crash and day-to-day market volatility.

I call this portfolio the “MOAT Investment Portfolio“, meaning a portfolio with a strong moat where I can be quite sure my investment will be still there even after 10 or 20 years.

To create your own “MOAT Investment Portfolio”, these are the 3 simple steps.

1. Identifying Companies with Strong Moats

To create an investment portfolio that have strong moat enable you to weather any storm and protects you from market crash or any form of black swan events. Here are the steps to identifying companies for your portfolio:

- List and identify companies with strong unbeatable moats .

- Identify what type of moat each company have.

- Look at key indicators such as the financial statement to identify the moat strength.

- Look at market news and industrial news to understand the strength of the moat.

- Score the width of the moat for each of the company.

2. Long-Term Investment Mindset

A long-term investment mindset means to have an mindset where you intent to invest for at least 5 to 10 years without the intention of selling your stock.

With a long-term investment mindset, it is focus on being patient, discipline, and taking advantage of market fluctuations. Leveraging the compounding power of reinvesting dividends and its role in long-term wealth creation.

However, when the fundamentals of the company or the “story of the company” changes, you should reassess the situation and make proper adjustment to your portfolio.

3. Diversification and Risk Management

Diversification and risk management helps you create a well-rounded moat-focused investment strategy.

However, diversification do not mean to buy the second best stock, or rather to diversify into stocks that is in another industry, this way you spread out your risk while focusing on stocks that have strong moats.

How Understanding Economic MOAT is Key To Investing

By recognizing the various types of moats, evaluating their strength, and implementing strategies to build an economic moat in your investment portfolio, you can enhance your chances of achieving investment success.

Understanding the concept of an economic moat is key to successful long-term investing, and the key to fundamental analysis. The moat protects your downside risk and give you all the advantage of having unlimited upside potential.

Lets embrace the wisdom of legendary investor, Warren Buffett, and leverage economic moats to fortify your path to financial prosperity.

Read Also:

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).