Secret Moat: Most Unrated Economic Moat For Sustainable Competitive Advantage

Secret Moat of a business is one of the most underrated economic moat of the business. Unlike brand moat which is obvious to any investors and even to the public, the Secret Moat hides behind the sense while driving business to grow from hundreds of years.

Companies which have a strong secrets moat are the hidden gems in the market, companies that are the unicorns of the world.

But what is a Secret Moat?

KEY TAKEAWAYS

- Secret Moat is an intangible moat that grant the company a unique and sustainable advantage over its rivals through product, knowledge and market exclusivity.

- Types of secret moat includes; patented technology, proprietary algorithms, trade secrets, exclusive licensing agreements and unique manufacturing processes.

- Benefits of companies with strong Secret Moat includes; sustained competitive advantage over the long-term, higher profit margins and creation of intellectual property revenue streams.

What is Secret Moat in Terms of Economic Moat?

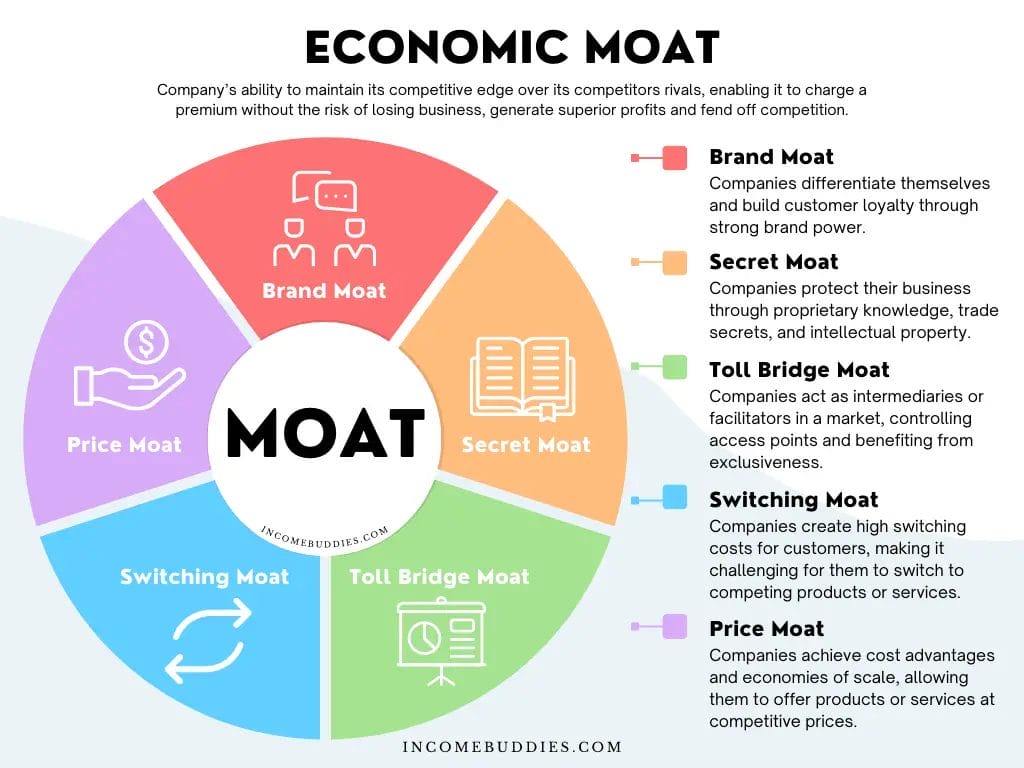

Secret Moat is an intangible Economic Moat where a companies possess a distinct advantage through proprietary knowledge, trade secrets, and intellectual property that protect a company’s market position.

Companies with a secret moat act as barriers to entry, making it difficult for competitors to replicate a company’s products or services, creating an economic moat for the business.

How Secret Moat For Business Works?

Secret Moat strategy is the development of distinctive technologies, manufacturing processes, or formulas that are hard to replicate.

Like all economic moat, a company with secret moat grant the company a unique and sustainable advantage over its rivals.

Unlike other forms of economic moat, a secret moat is cannot be replicated or imitated, because the knowledge is either protected or not known to the public.

Secret Moat works by:

- Companies continuously invest heavily in research and development.

- Stay commitment to innovation and stay ahead of the curve.

- Constantly refining their proprietary knowledge and expanding their intellectual property portfolio.

Companies with secret moat create a dynamic environment that fosters growth and protects their competitive advantage. The uniqueness in their company strategy sets these companies apart, giving them a competitive edge that can endure market fluctuations and challenges.

Types of Secret Moats For Business

Secret Moats can take up different forms, each are unique on its own and contribute to a company’s long-term success. Let’s take a look at some common types of Secret Moats.

1. Patented Technology

Patents grant exclusive rights to inventions promoting innovations and creativity to create new technology and helping to pushing our technology into newer heights.

Companies that are granted a patent have all the exclusive rights to product and sell their technology, this give companies a financial incentive to create new products for sell.

Examples: Electric lightbulb, the most famous patented inventions awarded to Thomas Alva Edison in the year 1878.

2. Proprietary Algorithms

Proprietary algorithms is probably the most well know secret moat that make Google a success in it’s “Search Engine War” against Yahoo and Bing.

- Enhancing efficiency

- Higher accuracy

- Better customer experience

These are the benefits that comes form a company with a secret moat in the form of proprietary algorithms.

Social media, and any form of search engine all have this secret moat. Their proprietary algorithms helps users to get to what they want on the platform faster and easier, keeping their user on their platform.

Examples: Google, Amazon, FaceBook and LinkedIn are just some of the most common examples.

3. Trade Secrets

These are confidential business practices or information that is not disclosed to the public, unlike Patent which the secret moat of the company is protected by the country’s law, trade secret is not protected by the law but through simple not disclosing any of the information.

Companies are build using the trade secret, and since it is a secret, it have a competitive advantages over it’s competitors.

Examples: Coca-Cola and KFC are two of the most popular companies knows to build a secret moat using trade secret.

4. Exclusive Licensing Agreements

Exclusive licensing agreements offers exclusive products or service in return for some other forms of benefits. Used mostly by B2B and less for B2C, exclusive licensing agreements grant companies sole access to particular technologies or markets.

Examples: Certain product is exclusively sole in certain platforms and not on other platforms.

5. Unique Manufacturing Processes

Companies develop specialized manufacturing processes that offers competitive advantages over its competitors. This unique manufacturing process can be in the form of:

- Time and temperature in manufacturing of the product.

- Sequence and order of adding of components into the product.

- Concentration and intensity when manufacturing the product.

The unique manufacturing process can help in a certain ways:

- Enhance efficiency

- Reduce costs

- Improve product quality

Examples: Novartis Inc., Pfizer Inc., Boeing Commercial Airplane Co. products where competitors find it difficult to replicate their products due to their manufacturing process.

Benefits of Companies With Strong Secret Moat for Investors

Investing in companies with Secret Moat offers a huge range of benefits, this is especially true for long-term investors looking to build wealth over a long time horizon.

Similar to other economic moats, here are some of the key benefits for companies with a strong secret moat.

1. Sustained Competitive Advantage Over The Long-Term

Secret Moat can help companies obtain a huge competitive advantages over its competitors over the long term.

With a strong secret moat, competitors will not be able to compete for your customers, as the products or service is exclusively yours.

Unique feature offered by secret moat enable companies to obtain market dominance with sustained profitability for a long period of time.

- Shield companies from competition

- Protecting companies from economic downturns

2. High Profit Margins

Biggest benefit of a company with strong secret moat is it’s ability to enjoy high-profit margins due to limited or no competition, giving the company increased capability of its pricing power.

The benefit of high profit margin is always accompany by:

- Stable revenue

- Consistent revenue growth

- Strong financial performance

3. Intellectual Property Revenue Streams

Intellectual property (IP) itself is an asset which helps the company to generate income. The secret moat can comes in the form of an asset where you can generate additional revenue streams through one of these ways:

- In-licensing creating a contract that allows another firm to provide capital to the development and launch process.

- Out-licensing to directly generate revenue from its assets by selling their product.

- Spin-off into new business using the new IP as leverage.

- Enforcing your intellectual property and getting compensation for other who uses your IP.

- Royalties by getting payments in exchange for the use of the licensor’s intellectual property.

Benefiting from Secret Moat

Companies that are able to display a strong secret moat can often lead to long-term stability and sustainable growth.

However, the effectiveness of the secret moat is often pairs with the company’s ability to adapt to changing market conditions and maintain their competitive positions.

How to Identify Companies With Secret Moat?

Secret Moat like the name describes, it is not always obvious in the eyes of the public. Many companies have a secret moat but not everyone know about it.

While KFC’s secret recipe of 11 herbs and spices is a well know “Secret Moat” for KFC, other company’s secret moat is less obvious and requires much more research and analysis.

Here are some ways we can identify the secret moat of a company, and uncover the hidden gems in the market.

1. History of Innovation

The easiest way to identify a company that have some form of secret moat is it’s history of innovation.

- Does the company have a track record of innovation?

- Is the company know for it’s inventions?

- Is the company always a trend setting in the particular industry?

These are just some questions we can ask to see if the company have a history of innovation and thus, the probability of a strong secret moat.

2. Intellectual Property Filings

Intellectual property filings are publicly available for anyone who want to know if the product or technology is an intellectual property.

Simply do a patent search and you will get to know how many IP filling does a company have.

There are also other IPOS such as:

Look at how does the intellectual property assets is in relation to the company’s core business, as well as how many IP does the company actually holds.

3. Competitive Landscape

Companies can be in a highly competitive landscape where there are always new technology created that can disturb the industry.

High tech industry are highly competitive, they requires the company to be always innovating and creating new and better technology. The secret moat of these companies are measured by their ability to innovate and create new products that people wants faster.

Food industry are competitive but, secret food recipe can remains unchanged for years, and still people will love it. The secret moat of the company depends on the ability for the company to keep it’s recipe a secret.

Depending on the competitive landscape, the barriers to entry in the industry varies.

Ask questions such as: “Does the company’s Secret Moat provides a huge advantage over its competitors?”

If “Yes”, then the company may probably have a secret moat.

Case Studies: Companies with Secret Moat

To understand the concept of secret moat better, let’s take a look at some examples of companies who is proven to have some form of secret moat.

Example 1: Disney

Disney’s secret moat include our childhood favorite characters, timeless stories, and iconic franchises, all of which are intellectual property of Disney.

If you are creating a product with Mickey Mouse on it, you’ll need to pay a fee to Disney, if you want to use any characters in the Marvel franchises for business purpose, you’ll need to pay a fee or else you can be sued for copyright infringement.

Attracting millions of dollars and building a loyal customer based worldwide, Disney have a strong Secret Moat.

Example 2: Pfizer Inc.

Pfizer is a Pharmaceutical giant holding over 762 patent worldwide through business acquisition and inhouse research on the newest drugs and cures that is demanded by the customers.

With the exclusive rights to develop and sell life-saving medications (i.e. 20 years generally). Pfizer will be able to generate massive amount of profits with huge margin as they are the only company that can manufacture and sell the products.

Example 3: KFC

KFC is known for it’s secret blend of 11 herbs and spice that KFC’s fried chicken its distinctive flavor that makes it “Finger Licking Good”. Having the secret recipe guarded since 1940s, only a few truly know the whole recipe that makes the KFC checking tasting so good. People goes to KFC to eat KFC chicken, because the same taste cannot be experienced anywhere else.

Final Thoughts on Secret Moat in Investing

Secret Moat is a powerful moat that protect the company’s competitive advantages and its ability to generate revenue to create a profitable business.

By investing in companies with strong proprietary knowledge, trade secrets, and intellectual property, as an investor, you will position yourself for long-term success and increases the odds of high returns.

As an investor, when we purchase a share, we are actually buying parts of the company, and with the company’s ability to get an exclusive rights in certain industry, it gives the company advantage to monopoly in the industry itself.

Identifying the Economic Moat in a company, means knowing how the company will have an sustainable competitive advantage against it’s competitors.

- Ability to charge a premium

- Ability to maintain long-term competitive advantage over its competitors

- Ability to create a value proposition not offered by other companies

Combined with other economic moats, a investors can expect durable competitive advantage for companies with wide moats.

Read Also:

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).