Best Broker For Singapore Stocks: Beginner’s Guide to Trading on SGX

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Want to get started in trading on the SGX with best broker for buying and selling Singapore Stocks?

Opening a brokerage account to get started trading in Singapore is easy, and with SGX offering hundreds of stocks, investing in Singapore stocks can be a great way to build wealth.

Beginner Friendly Broker for Singapore Stocks

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

With dozens of trading platforms available in Singapore, knowing which to choose can be confusing. As an experienced investor myself, I’ve compared the top stock trading platforms in Singapore, so you can find one that is best for you.

Best Online Brokers For Singapore Stocks Compared

| Trading Platform (SGX) | IB Rating | Min. Fees | Trading Commissions | Promotion |

|---|---|---|---|---|

Moomoo Singapore | ☆ 4.6 / 5.0 | $0.99 | 0.03% Trade Value | Get up to $800 worth of Free Shares + Perks |

WeBull Singapore | ☆ 4.6 / 5.0 | $0.80 | 0.025% Trade Value | Get up to $3,000 worth of Free Shares + Perks |

Tiger Brokers | ☆ 4.3 / 5.0 | $0.99 | 0.03% Trade Value | Get Free Share |

uSMART | ☆ 4.3 / 5.0 | $1.00 | 0.02% Trade Value | Get Cash Vouchers |

Interactive Brokers | ☆ 4.2 / 5.0 | $2.50 | 0.08% Trade Value | None |

FSMOne | ☆ 4.2 / 5.0 | $8.80 | 0.08% Trade Value | None |

iFAST Financial | ☆ 4.1 / 5.0 | $8.80 | 0.08% Trade Value | None |

Phillip Nova | ☆ 3.7 / 5.0 | $18.00 | 0.08% Trade Value | None |

Phillip Securities | ☆ 3.7 / 5.0 | $0.00 | 0.08% Trade Value | None |

Prosperus | ☆ 4.2 / 5.0 | $0.00 | 0.10% Trade Value | Get Free Shares |

DBS Vickers | ☆ 3.7 / 5.0 | $10.80 | 0.12% Trade Value | None |

Standard Chartered | ☆ 2.9 / 5.0 | $0.00 | 0.15% Trade Value | None |

Saxo Markets | ☆ 3.7 / 5.0 | $9.00 | 0.15% Trade Value | None |

UOB Kay Hian | ☆ 3.1 / 5.0 | $25.00 | 0.18% Trade Value | None |

KGI Securities | ☆ 2.9 / 5.0 | $25.00 | 0.18% Trade Value | None |

Maybank Kim Eng Securities | ☆ 2.9 / 5.0 | $25.00 | 0.275% Trade Value | None |

OCBC Securities | ☆ 2.9 / 5.0 | $25.00 | 0.275% Trade Value | None |

Lim & Tan Securities | ☆ 2.9 / 5.0 | $25.00 | 0.28% Trade Value | None |

Citibank Brokerage | ☆ 2.5 / 5.0 | $25.00 | 0.30% Trade Value | None |

CGS-CIMB Securities | ☆ 3.1 / 5.0 | $25.00 | 0.18% Trade Value | None |

| Market Average | NA | SGD $13 | 0.14% Trade Value | NA |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the brokerage platforms, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing. Fees are for Singapore Listed Stocks only.

From the list we’ve observed that the fees for each broker varies greatly from as low as 0.02% up to as high as 0.28%. That is more than 10 times difference in fees.

However, we should not only look at fees when choosing the right platform, there are a few more things we should consider.

Best Online Brokers For Singapore Stocks (Handpicked)

Amount dozens of online brokerage for Singapore stocks, here is our picks for best online brokerages in Singapore:

- Cheapest for trading SG stocks with access to overseas stocks: Moomoo Singapore

- Most easy to use and amazing sign-up promo: Webull Singapore

- Best for CDP-linked account, CPF/SRS investing and RSP of SG stocks: DBS Vickers

I find these 3 stock broker to be the best for trading Singapore stocks when considering the top 3 most important different criteria when choosing a broker to trade:

- Ease of use and mobile trading App access.

- Acceptable platform and commission fees.

- Acceptable access to investment options.

All 3 of them have mobile trading App which offers investors like us to invest on the go.

Focusing on investing in Singapore Stocks, here we will quickly look into why each broker are being selected.

1. Moomoo: Cheapest Online Broker For Singapore Stocks (Editor’s Pick)

Minimum investment: $0

Stock/ETF Commission Fees: $0 for US, 0.03% for SG, HK

Options Fees: $0.65 Per Contract

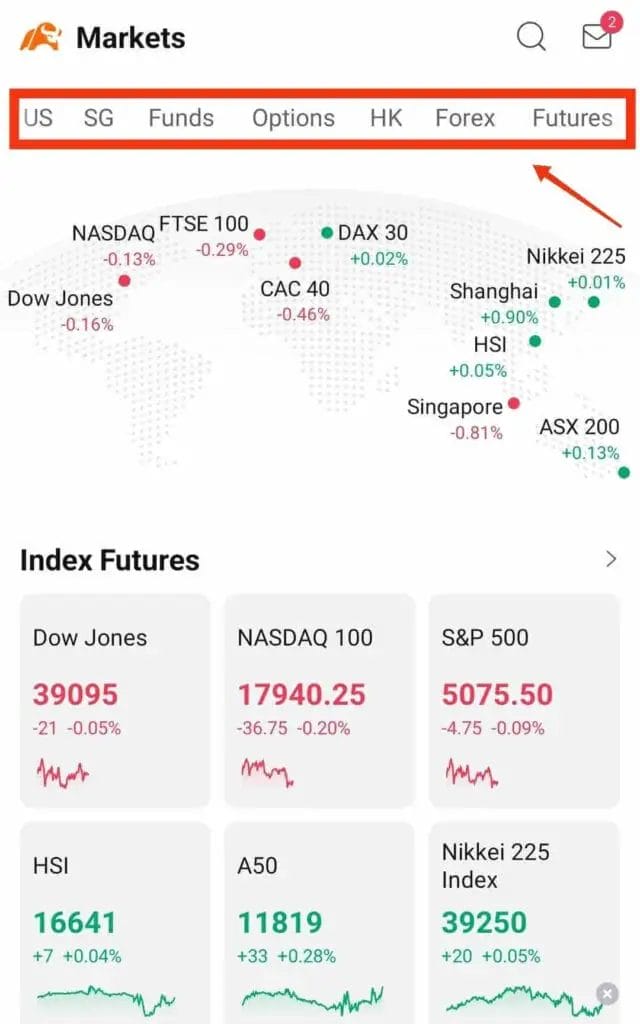

Markets: United States, Hong Kong, China, Singapore

Suitable For: Beginner and Experience investors looking to invest in both locally and internationally.

| Pros of Moomoo | Cons of Moomoo |

|---|---|

| Highly competitive fees for Singapore, Hong Kong and United States stocks and ETFs. | Not able to invest with CPF/SRS funds |

| Beginner friendly platform with mobile trading App | No access to London or Japan stock exchange |

| Direct access to money market funds through Moomoo Cash Plus | More expensive currency exchange rates compared to banks. |

| Wide trading options: Stocks, ETFs, Options, Margin, Bonds, Mutual Funds. | |

| Dollar cost averaging through Regular Saving Plan (RSP). | |

| Advanced trading and charting tools. |

Promotions and Discounts

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

2. Webull: Easy-To-Use Online Broker For Trading Singapore Stocks

Minimum investment: $0

Stock/ETF Commission Fees: $0 & 0.025% thereafter for US, 0.03% for HK, 0.025% for SG

Options Fees: $0.55 Per Contract

Markets: United States, Hong Kong and Singapore

Suitable For: Beginner and Experience investors or trader looking to invest both locally and internationally.

| Pros of Webull | Cons of Webull |

|---|---|

| Highly competitive fees for Singapore, Hong Kong and United States stocks and ETFs. | Not able to invest with CPF/SRS funds |

| Beginner friendly platform with mobile trading App | No access to London or Japan stock exchange |

| Direct access to money market funds through MoneyBull by Webull | More expensive currency exchange rates compared to banks. |

| Wide trading options: Stocks, ETFs, Options, Margin, Bonds, Mutual Funds. | |

| Dollar cost averaging with Regular Saving Plan (RSP). | |

| Advanced trading and charting tools. |

Promotions and Discounts

- Claim up to $5,000 FREE Share when you sign up a new account here.

- $0 commission free for US stocks, ETFs, and options.

- 3-Years $0 commission for SG stocks, ETFs, and options.

- Low commission fee for SG, US and HK stocks, ETFs, mutual funds and options.

Webull Promo: Low Commission + Free Stock

3. DBS Vickers: Best CDP-Linked Local Bank Online Trading Platform

Best Local Bank Stock Trading

Minimum investment: $0

Stock/ETF Commission Fees: 0.28% for Cash Account and 0.12% for Cash Upfront Account

Markets: SG, US, HK, CN, AUS, JP

Suitable For: People who just want to try using their bank account.

| Pros of DBS Vickers | Cons of DBS Vickers |

|---|---|

| Able to invest with CPF/SRS funds; CPF Investment Scheme (CPFIS) supported | High trading and platform fees. |

| Access to global markets; Singapore, United States, Japan etc. | Limited investment options: no margin, options, mutual funds. |

| Simple-to-use platform. | Limited trading and charting tools. |

| CDP-Linked Account and direct linking to your DBS bank account. | Average user experience with DBS Vickers App. |

| Dollar cost averaging with Regular Saving Plan (RSP). |

Promotions and Discounts

- Do not offer any promotion or discount.

How to Pick the Best Online Brokerage and Trading Platform for Trading Singapore Stocks

Selecting the best online brokerage and trading platform is crucial when you’re interested in trading Singapore stocks. Your choice will impact your investment strategy, your profits, and the ease with which you can manage your portfolio.

1. Consider Between CDP-linked Accounts and Custodian Accounts

Understanding the right account type is crucial when dealing with Singapore stocks.

CDP-linked Accounts

Your ownership of Singapore Exchange (SGX) listed securities is direct with a Central Depository (CDP) account. This means the stocks you buy are credited to your CDP account, giving you legal title, along with voting rights at shareholder meetings.

While it doesn’t offer much advantage unless you are looking to invest millions into a single stock, this type of account is ideal if you want to have a say with your votes with the companies you invest in.

However, direct ownership leads to your trade becoming a public information, and you might encounter higher fees for the privilege.

| Pros | Cons |

|---|---|

| Direct Ownership | Public Ownership |

| Voting Rights | Charges May Apply |

| Direct Dividends | Limited to SGX Stocks |

CDP vs Custodian Account: Which is a Better Option For Singapore Investors? provides further insights into making an informed choice.

Custodian Accounts

Custodian Account offers safekeeping of your assets, including stocks, bonds, and mutual funds, by a broker or financial institution.

This protects your privacy and often comes with lower fees, making it an attractive option for frequent traders or those looking to invest in international stocks.

| Pros | Cons |

|---|---|

| Privacy Protection | Custody Fees May Apply |

| Lower Fees Overall | Perception of Less Control |

| Wide Market Access | Dividend Clearance Fees |

Custodial services are particularly favorable for investors seeking exposure to global markets and looking to minimize costs associated with buying and selling securities.

2. Assessing Brokerage Fees and Commissions

When considering an online brokerage for trading Singapore stocks, it’s crucial to evaluate the fees and commissions they charge. These costs, specifically the brokerage commission and settlement fees, can significantly affect your return on investment.

Brokerage Commission Fees

Brokerage Commission Fees are incurred each time you buy or sell stocks.

- Fees are calculated as a percentage of the trade value, which is advantages for small investors.

- Fee are calculated as a flat minimum fee per trade, which can have more impact if your trade value is small.

While during promotion period some broker in Singapore offers zero commissions fees, but in general, Custodian accounts often have lower commission fees compared to CDP-linked accounts.

Fees For CDP-Linked Account

| Trading Platform | Min. Fees | Trading Commission (SGD) | Account Type |

|---|---|---|---|

| Phillip Securities | $25.00 | 0.08% Trade Value | CDP-Linked |

| KGI Securities | $25.00 | 0.18% Trade Value | CDP-Linked |

| Lim & Tan Securities | $25.00 | 0.28% Trade Value | CDP-Linked |

| FSMOne | $8.80 | 0.08% Trade Value | CDP-Linked |

| DBS Vickers | $10.80 | 0.12% Trade Value | CDP-Linked |

| UOB Kay Hian | $25.00 | 0.18% Trade Value | CDP-Linked |

| CGS-CIMB Securities | $25.00 | 0.18% Trade Value | CDP-Linked |

| Maybank Kim Eng Securities | $25.00 | 0.275% Trade Value | CDP-Linked |

| OCBC Securities | $25.00 | 0.275% Trade Value | CDP-Linked |

| Average | $21.62 | 0.18 % Trade Value | NA |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author according to our editorial guidelines but always do your own due diligence before investing.

Fees For Custodian Account

| Trading Platform | Min. Fees | Trading Commission (SGD) | Account Type | Custodian Fees (SGD) |

|---|---|---|---|---|

| Moomoo | $0.99 | 0.03% Trade Value | Custodian | No custodian fees |

| WeBull | $0.80 | 0.025% Trade Value | Custodian | No custodian fees |

| uSMART | $1.00 | 0.02% Trade Value | Custodian | No custodian fees |

| Tiger Brokers | $0.99 | 0.03% Trade Value | Custodian | No custodian fees |

| Interactive Brokers | $2.50 | 0.08% Trade Value | Custodian | No custodian fees |

| iFAST Financial | $8.80 | 0.08% Trade Value | Custodian | No custodian fees |

| Phillip Nova | $18.00 | 0.08% Trade Value | Custodian | No custodian fees |

| Prosperus | $0.00 | 0.10% Trade Value | Custodian | No custodian fees |

| Standard Chartered | $0.00 | 0.15% Trade Value | Custodian | No custodian fees |

| Saxo Markets | $9.00 | 0.15% Trade Value | Custodian | 0.06% to 0.12% p.a. of Stockholding Balance |

| Citibank Brokerage | $25.00 | 0.30% Trade Value | Custodian | 0.0165% of your monthly avg. stockholding balance |

| Average | $6.10 | 0.10% Trade Value | NA | NA |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author according to our editorial guidelines but always do your own due diligence before investing.

Fees For CDP-Linked Account vs Custodian Account Compared

Summarizing both types of broker in Singapore; CDP-linked Account and Custodian Account, here is a quick comparison table on the fees between the 2.

| Brokerage | Commission Fee (%) | Minimum Commission Fee (S$) |

|---|---|---|

| CDP-linked | 0.080% to 0.25% | $8.80 to $25 |

| Custodian Account | 0.025% to 0.30% | $0.00 to $25 |

Most Expensive Broker For Singapore Stocks:

- Custodian Account: Citibank

- CDP-Linked Account: Lim & Tan Securities

Cheapest Broker For Singapore Stocks:

- Custodian Account: Webull Singapore

- CDP-Linked Account: FSMOne

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

3. Trading Platform Features and User Experience

When selecting an online trading platform for Singapore stocks, it’s vital to assess the quality of trading tools and resources as well as the user interface’s intuitiveness.

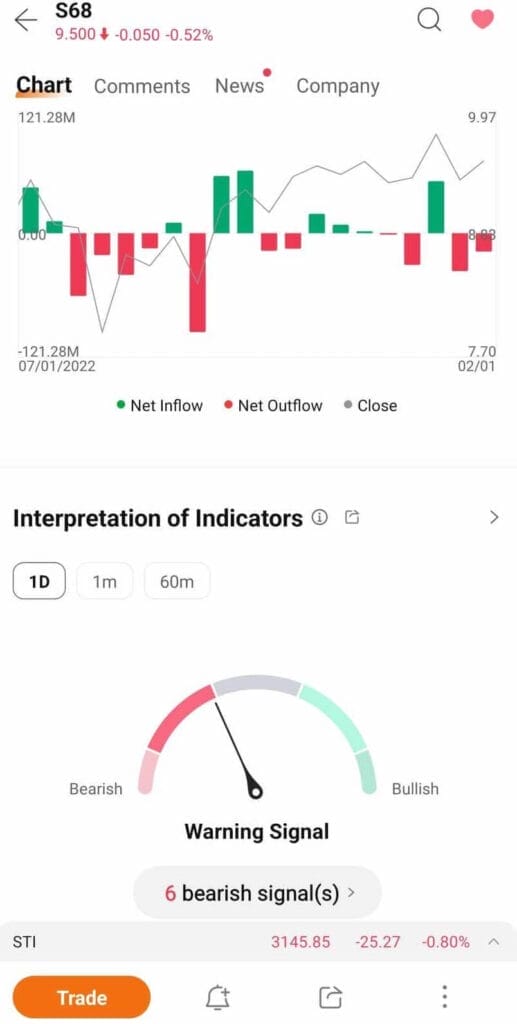

Analyzing Trading Tools and Resources

Trading tools and resources offers insights into the stocks you are looking to buy or sell, these tools and resources offers you the ability to make well informed decisions before you trade.

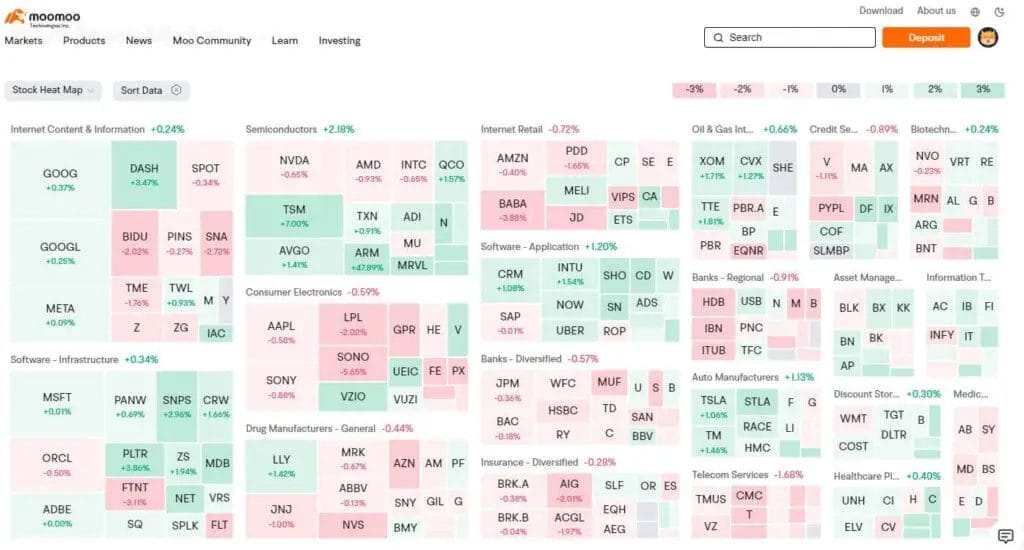

- Look for platforms that offer real-time market data, market news and insights from professional analyst

- Platforms with access to company financials and indicators for fundamental analysis

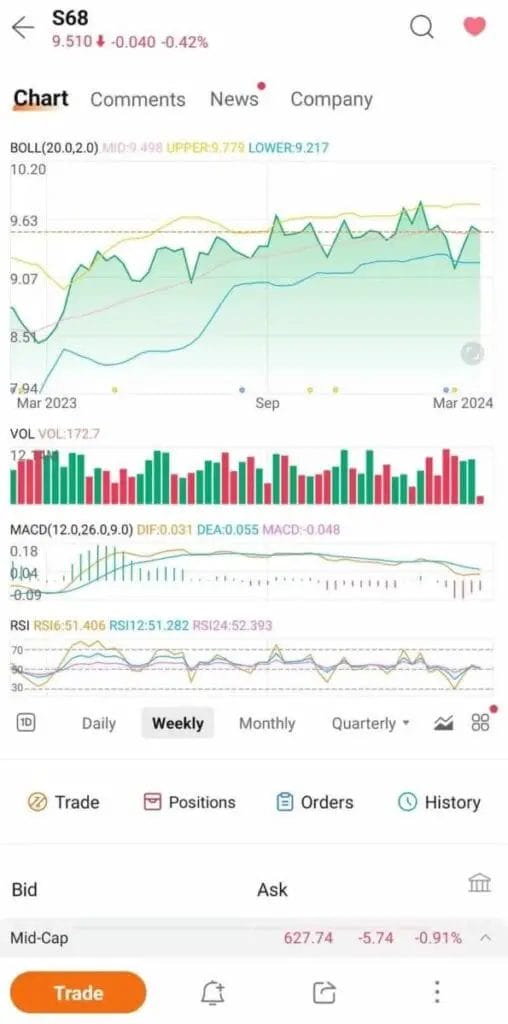

- Platforms with advanced charting capabilities for technical analysis

| Brokerage Platform’s Feature | Utility of Feature |

|---|---|

| Real-time Market Data | Essential for timely decisions |

| Advanced Charting | Crucial for technical analysis |

| Technical Analysis Indicators | Helps in identifying trends |

| Market News and Insights | Stay informed about current events affecting the markets |

| Access to Company Financials | Essential for fundamental analysis |

| Fundamental Analysis Indicators | Utilize indicators for in-depth fundamental analysis |

| Platforms with advanced charting | Facilitates detailed technical analysis for informed decisions |

Ensure the platform provides educational resources to help you further understand the markets and refine your strategies.

Evaluating User Interface and Ease of Use

A user-friendly interface can significantly enhance your trading experience.

Important UI Aspects:

- Clarity: Clear menu options and icons enhance efficiency.

- Responsiveness: Fast load times prevent missed opportunities.

- Accessibility: Easy access to key functions like trade execution, account management, and support.

When comparing different online trading platforms, prioritize those offering a balance between comprehensive features and a seamless user experience.

This combination will support both your immediate trading activities and long-term investment growth.

4. Selecting a Brokerage with Diverse Investment Products

When finding the best online brokerage for trading Singapore stocks, your portfolio’s potential hinges on access to a broad range of investment products.

Access to Basic Investment Products: Equities, REITs and ETFs

You’ll want to pinpoint brokerages offering extensive equity markets, including the Singapore Exchange (SGX) and global markets. A diverse offering should include general SGX-listed stocks, dividend stocks, REITs (Real Estate Investment Trusts), and various Exchange-Traded Funds (ETFs).

| Investment Type | Benefits |

|---|---|

| Equities | Direct stock ownership in SGX-listed and global companies |

| REITs | Exposure to real estate markets without physical property ownership |

| ETFs | Diversification across various sectors and regions |

Access to Diverse Advanced Investment Products: CMA, Bonds and Options

In addition to equities, it is ideal if the platform also provides advance instruments like Contract for Differences (CFDs), forex, bonds, and options.

And personally, I really like if the brokerage offers a Cash Management Account (CMA) to manage my cash when it is sitting idle waiting for an investment opportunity.

| Product Type | Advantage |

|---|---|

| CFDs | Leverage positions with less capital |

| Forex | Trade currencies in the global market |

| Bonds | Stable income through interest payments |

| Options | Flexibility in executing strategies |

Securing a brokerage with access to these diverse products helps you to customize your trading strategy to your individual financial goals and market conditions.

5. Choose Only MAS Regulated Brokerage (Important!)

My top priority is making sure that all my funds that is invested is in safe hands.

Fortunately, there are many stock broker that are MAS registered giving me a strong vote of confidence that my money is safe and I can sleep peacefully.

Ensuring Brokerages are Licensed by Monetary Authority of Singapore (MAS)

Monetary Authority of Singapore (MAS) is Singapore’s central bank and financial regulatory authority. With MAS, it oversees all financial institutions in Singapore, ensuring they operate within an established set of rules designed to maintain the integrity of the financial markets.

You can check if the broker is MAS licensed broker by simply visiting the MAS website.

Understand The Types of License For Your Brokerages

The Licence you want to look for for the brokerage you are looking to invest are:

A brokerage that is licensed by the MAS adheres to strict regulations that protect investors and their assets. It is important that your chosen trading platform is listed on the MAS as a licensed securities broker.

An example of such broker is Moomoo, Webull and DBS Vickers, and it will look like the following:

Licensed brokerages are required to implement robust security measures to safeguard investors’ interest.

These measures include secure online trading platforms and proper handling of personal and financial information making it a safe environment for you to trade.

Finalizing Your Choice of Broker for Trading Singapore Stocks Listed on SGX

Now, hopefully you are much clearer in how to choose the best broker for buying and selling Singapore stocks.

So as a quick recap, here are my top picks for the best broker for Singapore stocks.

Cheapest Online Broker for Investors

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

Beginner Friendly Trading Platform

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

CDP-Linked Local Bank Stock Broker

BEST FOR: Risk Adverse Singaporean Beginner Investors Looking to Invest in Singapore Stocks.

securely through DBS’s website

Found the broker you want to get started?

Hopefully so.

For myself, I generally use Moomoo for most of my trade, and the good news is, they are currently offering some sweet promotions for all new users.

If you want, you can go and check it out!

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

21

Brokerage Reviewed & Analyzed

Driven by data, run by a investors with real-world experience.

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).