How Zero Commission Stock Brokers Make Money ($0 Hidden Truth)

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Do you always wonder how does zero commission brokers makes money? Today, there are many brokers offering zero-commission full-service stock brokerage, and as an investor myself, I’ve always wonder how is it possible for these brokerage to offer everything for free.

If you are like me, wanna to get the bottom of this mystery, here you’ll know how zero commission stock brokers make money, and it is not what you normally think.

KEY TAKEAWAYS

- Commission fee is just one of the few revenue streams that online brokers profit, other ways includes; PFOF, margin loans, interest on cash, securities lending, currency conversion fees etc.

- Payment for Order Flow (PFOF) accounts for the most significant revenue generated for most brokerage company, profiting from the difference between the price you pay and the price executed.

- Zero Commission brokerage is a great way to invest and get a higher return on your investment, especially if you choose a reputable brokerage to get started.

How Does Zero Commission Brokers Make Money?

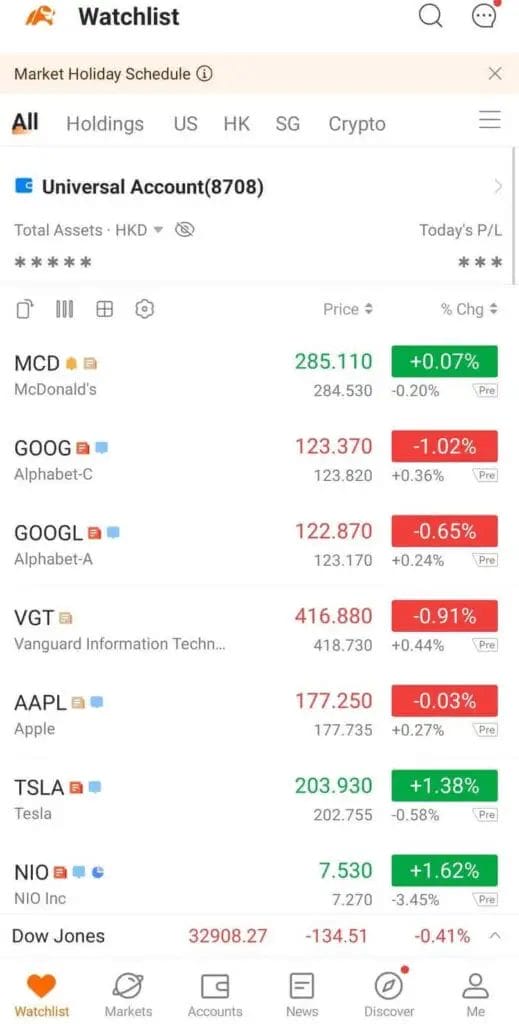

Zero-commission broker like Moomoo and WeBull are gaining more popularity in the recent years, and with +800,000 Singaporeans choose to signup for Moomoo brokerage account, it really make us wonder how does these brokerage make money, for sure these brokerage are not charity.

Here are the few most common ways zero-commission brokers make money:

- Payment for Order Flow (PFOF)

- Margin Loans

- Interest on Cash

- Lending Stocks (Securities Lending)

- Currency Conversion Fees

- Interest Rate Arbitrage

- Cash Withdrawal and Deposit Charges

- Premium Services

I will go into each of them in details and learn how zero-commission trading actually works.

1. Payment for Order Flow (PFOF)

Zero commission brokers have made quite a name for themselves by offering commission-free trading, but have you ever wondered how they manage to keep the lights on? The answer lies in a practice known as Payment for Order Flow (PFOF).

What is Payment for Order Flow (PFOF)?

PFOF is a method employed by zero commission brokers to generate revenue. Instead of charging you, the trader, a direct commission, these brokers sell your order to a market maker. This market maker, in turn, executes your trade on a public stock exchange, aiming to profit from the spread between the price you pay (A) and the price they can execute it (B).

How PFOF Works

- You place a trade on your zero commission trading platform.

- The broker sends your order to a market maker.

- The market maker aims to execute your trade at a better price than you initially paid.

- The difference between what you paid and what the market maker earned is their profit.

Oftentimes, this can become a win-win-win situation:

- You don’t pay any commission.

- The broker gets paid, and the market maker makes a profit.

Controversy Surrounding PFOF

PFOF is legal, but it is heavily regulated. The broker is obliged to ensure that you, the client, get the best price. But in practice, this doesn’t always happen.

Brokers may sell your order to the market maker that pays them more, not necessarily the one that secures the best execution for you. This is where the conflict of interest arises.

However, it will not be an issue you are only doing “Limited Order” where you have a “Set Price” on each “Buy” and “Sell” trade.

Since, I personally only do “Limited Order” and never “Market Order”, I don’t see any issue with PFOF, so it is very depending on what type of trader or investor are you.

2. Margin Loans

Another way zero commission brokers boost their income is through margin loans. These loans allow you to borrow money from the broker, using your existing stocks as collateral. While this can be a useful tool for investors, it’s essential to understand the cost associated with it.

Understanding The Price of Margin Loans

While there’s nothing wrong with zero commission brokers making money through margin loans. After all, they are offering you a financial service. However, in practice, the margin loans provided by these brokers often come at a higher cost than what you’d find with traditional brokerage firms.

For example, as of 16th July 2022, you can compare the margin loan rates of two brokers:

- Robinhood: 4.25% on USD

- Interactive Brokers Pro: 3.08% on USD

The loan from Robinhood is 1.17% more expensive than the one from Interactive Brokers. This may not seem like a significant difference, but it can add up, especially if you use margin extensively.

3. Interest on Cash

The money sitting in your brokerage account doesn’t just sit idly; it’s working for your broker. Zero commission brokers often generate income by earning interest on the cash balance held in customer accounts. While this is a minor source of revenue, it’s essential to be aware of it.

Earnings on Cash Balances

Your broker typically earns interest by sweeping your cash into more profitable locations. They might temporarily store it with their bank or invest it in a money market fund, where it can earn more interest than what they pay you.

While this practice isn’t a significant concern for most people since they don’t hold substantial cash in their brokerage accounts, it’s still a hidden fee that you should be aware of.

4. Lending Stocks

Many zero commission brokers engage in stock lending, which can be another source of income. When investors engage in short selling (selling a stock they don’t own), they borrow shares from a broker. In return, they pay an interest rate for the borrowed shares, and this interest becomes a source of income for the broker.

5. Currency Conversion Fees

Zero commission brokers often charge currency conversion fees when you trade instruments priced in a foreign currency, typically the US dollar. These fees can add up, especially if you’re a frequent trader.

To avoid excess currency conversion fees:

- Trade in GBP-denominated assets if possible.

- Choose a broker that charges the spot price for foreign exchange.

- Opt for a broker that allows you to hold multiple currencies in your account.

Not all zero commission brokers are created equal when it comes to currency conversion fees.

6. Interest Rate Arbitrage

Zero commission brokers can generate income by sweeping your cash balance to more profitable locations.

This could mean storing it with their banking partners or investing it in a money market fund. While this practice isn’t exclusive to commission-free brokers, it can significantly boost their earnings.

Interestingly, it’s a strategy that benefits from scale. The more users a platform has, the more interest it can earn.

The larger the platform, the more favorable rates it will get, which sometime, some of the top brokerage will transfer this benefits back to their user to allow user to earn a higher interest rate in the form of cash management account.

7. Cash Withdrawal and Deposit Charges

Some zero commission brokers explicitly charge to deposit or withdraw money from your account. These charges may be accompanied by an FX conversion fee, especially if the broker only deals in US dollars.

While these many of the discount brokers will require some form of charges for cash withdrawal and deposit, some of the best brokerage do not require you to pay any of the charges, making them truly free.

8. Premium Services

Zero commission brokers often offer premium services that come at an additional cost. These services can include access to a wider range of stocks, ETFs, and more advanced trading options.

For instance, some brokerage requires you to pay for US Level 2 Market Data which can be exceptionally important for traders. This is a straightforward pricing model that has been adopted in many industries, such as premium banking or subscription services like Spotify.

It’s important to consider whether these premium services align with your trading goals and whether they are worth the additional cost.

Benefits of Zero Commission Brokers

Before we conclude, let’s not forget the advantages of trading with zero commission brokers:

- No commissions and fees: You can trade without the burden of paying commissions, making it cost-effective.

- Access to a wide range of investments: Zero commission brokers typically offer a diverse selection of stocks, ETFs, and other assets.

- Ideal for cost-conscious traders: If you’re looking to minimize trading costs, these brokers are an excellent choice.

- Seamless trading experience: The convenience of trading without commissions can encourage you to invest more.

Downsides of Zero Commission Brokers

However, it’s important to consider the drawbacks:

- Potential conflicts of interest: Zero commission brokers may prioritize their interests over yours, especially when it comes to PFOF.

- Possible Hidden fees: While you avoid commissions, other fees, such as currency conversion fees, may add up.

- Higher Margin costs: Be aware of the higher cost of margin loans with these brokers.

- Premium services may add up: If you opt for premium services, you may end up paying more than you bargained for.

Should You Signup For Zero Commission Stock Brokers?

Yes, as long as the online stock broker is reputable and trustworthy, regulated by regulatory like MAS, signup for a zero commission stock broker will help you save your trading fees and gain a better investment returns on each of your trades.

Just keep in mind that while these brokers charges no commission fees for stock trades, they are business that need to generate revenue, always check on the fine print before signing up to any of the stock brokers.

Regardless, as a retail investor, there is nothing to lose to signup for a zero commission stock broker for our daily trade.

How Much Can You Essentially Save Using Discount Brokers Without Commissions For Investing?

The short answer is probably “a lot”, especially if you are a frequent day trader.

- Retail investor on average does 15 to 30 trades per year.

- Day trader on average does 3 to 5 trade per day and 780 to 1,300 trades per year.

So yes, commission fees can add up quickly especially if you trade frequently.

With the average commission fee at $25 or 0.3% commission fee of trade value for most brokerage, here we will take a look at how much you can actually save using a $0 commission fee brokerage when you do $10,000 each trade.

| No. of Trades | $25 Commission Fee | 0.3% Fee (Trade Value) | $0 Commission Fee |

|---|---|---|---|

| 1 | $25 | $30 | $0 |

| 5 | $125 | $150 | $0 |

| 10 | $250 | $300 | $0 |

| 20 | $500 | $600 | $0 |

| 50 | $1,250 | $1,500 | $0 |

| 100 | $2,500 | $3,000 | $0 |

| 200 | $5,000 | $6,000 | $0 |

| 300 | $7,500 | $9,000 | $0 |

| 400 | $10,000 | $12,000 | $0 |

| 500 | $12,500 | $15,000 | $0 |

| 1000 | $25,000 | $30,000 | $0 |

| 1500 | $37,500 | $45,000 | $0 |

And if you are wondering why, $10,000 is used, it is simply because most brokerage will say something like “$25 Commission Fee or 0.3% of trade value which ever is higher“.

Beginner’s Best Zero Commission Stock Brokerage

The best zero commission online broker needs to be a full-service brokerage platform with no hidden fees

- No inactivity fees so you can trade as and when you want

- No annual fees so you can cancel the account anytime you want

- No management fees so it won’t eat into your returns

- No deposit or withdrawal charges so you can freely move your money around

Personally, I uses Moomoo SG for most of my trades, not only it offer lifetime Zero Commission fee for US stocks, it also offer Free US Level 2 Market Data. And if you are looking to trade Singapore stock as well, Moomoo SG offers $0 commission for Singapore stocks for the 1st year and $0.99 thereafter which is pretty cheap.

- Free Level 2 US Stock Market Data for Day Trading

- Lifetime $0 commission fee for US stock market trading.

- 1 Year Commission-Free for SG Stocks

- Low commission fee for Singapore, Hong Kong and China stock market.

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

If you are wondering what to get, Moomoo which is a MAS licensed stock brokerage trusted by over 800,000 Singaporeans, so this maybe a good choice to get started. You can get started by signing up for an account using this link here.

Just checked, Moomoo is currently offering huge promotion for new signups, and if you want to take advantage of this bonus you should act fast to take advantage of the promotion offered by Moomoo by signing up here.

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

Read Also:

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).