Best Broker For US Stocks in Singapore: Beginner’s Guide

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Want to get started in trading United States Stocks with the best broker in Singapore?

Beginner Friendly $0 Commission Broker for US Stocks

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

Whichever broker you want to open a brokerage account it is always good to know what options do you have.

Today, we have many stock brokers in Singapore that offers trading in the US market, with 10+ trading platform available to choose from, choosing the right one for you can be quite confusing. Having invested in US stock for quite some time, I’ve compared the top stock brokerage for trading US Stock in Singapore, so you can find the best broker for you.

Best Online Brokers For US Stocks Compared

| Brokerage for US Stocks | IB Rating | Min. Fees/ Trade (USD) | Trading Commissions/ Trade (USD) | Custodian Fees (USD) | Promotion |

|---|---|---|---|---|---|

Moomoo Singapore | ☆ 4.6 / 5.0 | $0.99 | $0 for Lifetime | No Custodian Fees | Get up to $800 worth of Free Shares + Perks |

WeBull Singapore | ☆ 4.6 / 5.0 | $0.00* | Min. $0.89 Max. 0.030% Trade Value | $0.01 to $0.03/ Share | Get up to $3,000 worth of Free Shares + Perks |

uSMART | ☆ 4.3 / 5.0 | $0.00* | Min. $1/ Order $0.005/ Share Max. 0.50% Trade Value | $0.01 to $0.03/ Share | Get Cash Vouchers |

Tiger Brokers | ☆ 4.3 / 5.0 | Min. $1/ Order $0.005/ Share Max. 0.5% Trade Value | Min. $0.99/ Order $0.005/ Share Max. 0.5% Trade Value | $0.01 to $0.05/ Share | Get Free Share |

Prosperus | ☆ 4.2 / 5.0 | $5.00 | $0.01/ Share | No Custodian Fees | Get Free Shares |

Interactive Brokers | ☆ 3.9 / 5.0 | $1.00 | 1.0% Trade Value | No Custodian Fees | None |

FSMOne | ☆ 4.2 / 5.0 | $8.80 | Min. $3.80/ Order Max. 0.08% Trade Value | $0.01 to $0.05/ Share | None |

Phillip Nova | ☆ 3.7 / 5.0 | $5.00 | 0.01% to 0.18% Trade Value | No Custodian Fees | None |

Phillip Securities | ☆ 3.7 / 5.0 | $1.88 | 0.50% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

DBS Vickers | ☆ 3.7 / 5.0 | $19.62 | 0.15% to 0.45% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

Standard Chartered | ☆ 2.9 / 5.0 | $0.00* | 0.20% to 0.25% Trade Value | No Custodian Fees | None |

Saxo Markets | ☆ 3.7 / 5.0 | $2.00 | 0.02% to 0.06% Trade Value | 0.06% to 0.12% p.a. of Stockholding Balance | None |

UOB Kay Hian | ☆ 3.1 / 5.0 | $40.00 | 0.18% to 0.30% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

KGI Securities | ☆ 2.9 / 5.0 | $20.00 | 0.30% to 0.40% Trade Value | None Stated | None |

Maybank Kim Eng Securities | ☆ 2.9 / 5.0 | $10.00 | 0.12% to 0.30% Trade Value | $2 Per Counter Per Month, Max $150 Per Quarter | None |

OCBC Securities | ☆ 2.9 / 5.0 | $20.00 | 0.30% to 0.415% Trade Value | $2 Per Counter Per Month, Max $200 Per Quarter | None |

Lim & Tan Securities | ☆ 2.9 / 5.0 | $20.00 | 0.30% Trade Value | $2 Per Counter Per Month | None |

Citibank Brokerage | ☆ 2.5 / 5.0 | $18.00 | 0.12% to 0.30% Trade Value | 0.0165% p.a. of Stockholding Balance (Monthly Avg.) | None |

CGS-CIMB Securities | ☆ 3.1 / 5.0 | $18.00 | 0.18% to 0.50% Trade Value | $2 Per Counter Per Month | None |

| Market Average | NA | USD $10 | 0.32% Trade Value | $2 Per Counter Per Month | NA |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the brokerage platforms, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing. Fees are for US Listed Stocks only.

From the list we see that there are some brokers with fees as low as zero commission ($0 Commission fees) and some with a minimum of USD $40 in fees, others even have commission fees of up to 1%. The difference in fees is absolutely huge.

For US Stocks in particular, we need to be exceptionally careful, as some fees are calculated very differently from what we used to:

- Fees in the form of Percentage (%) of Trade Value: Very common practice and easy to calculate.

- Flat Fees regardless of your Trade Value: Not as common, extremely rare and very good news for investors.

- Fees per number of shares: Fees can adds up very quickly if you are buying penny stocks or massive number of shares.

However, we should not only look at fees but also the other “perks” you get from the broker.

So why Invest in US Stocks? While investing in Singapore stock market is all stable and relaxing, the US stock market is filled with excitement and volatility. However higher volatility also means higher risk, thus you need to be more cautious when investing in US Stocks.

Best Online Brokers For US Stocks (Handpicked)

Filtering through dozens of top brokerage to trade US stocks, here is our top picks for best online brokerages to invest in US stocks:

- Cheapest for trading US stocks with Lifetime $0 Commission Fees: Moomoo Singapore

- Most user friendly trading platform for US Stocks: Webull Singapore

- Best for holding long-term US Stocks: ProsperUS

Having tested and used many of the options listed, I find these 3 stock broker to be the best for trading US Stocks, and my assessment is not only based on fees, but more importantly the ease of use, and clear fees structure.

Focusing on investing in US Stocks from Singapore, here we will quickly look into why each broker are being selected.

1. Moomoo: Cheapest Online Broker For US Stocks (Editor’s Pick)

Minimum investment: $0

Stock/ETF Commission Fees: $0 for US, 0.03% for SG, HK

Options Fees: $0.65 Per Contract

Markets: United States, Hong Kong, China, Singapore

Suitable For: Beginner and Experience investors looking to invest in both locally and internationally.

| Pros of Moomoo | Cons of Moomoo |

|---|---|

| Lifetime $0 commission fee for United States stocks and ETFs with flat $0.99 platform fees per order. | No access to London or Japan stock exchange |

| Highly competitive fees for Singapore and Hong Kong stocks and ETFs. | More expensive currency exchange rates compared to banks. |

| Beginner friendly platform with mobile trading App | |

| Grow idle cash ($USD) with money market funds through Moomoo Cash Plus | |

| Multiple trading options; Stocks, ETFs, Options, Margin, Bonds, Mutual Funds. | |

| Dollar cost averaging through Regular Saving Plan (RSP). | |

| Advanced trading and charting tools. |

Promotions and Discounts

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

2. Webull: Easy-To-Use Online Broker For Trading US Stocks

Minimum investment: $0

Stock/ETF Commission Fees: $0 & 0.025% thereafter for US, 0.03% for HK, 0.025% for SG

Options Fees: $0.55 Per Contract

Markets: United States, Hong Kong and Singapore

Suitable For: Beginner and Experience investors or trader looking to invest both locally and internationally.

| Pros of Webull | Cons of Webull |

|---|---|

| Highly competitive fees for Singapore, Hong Kong and United States stocks and ETFs. | No access to London or Japan stock exchange |

| Beginner friendly platform with mobile trading App | More expensive currency exchange rates compared to banks. |

| Grow idle cash ($USD) with money market funds through MoneyBull by Webull | |

| Multiple trading options: Stocks, ETFs, Options, Margin, Bonds, Mutual Funds. | |

| Dollar cost averaging with Regular Saving Plan (RSP). | |

| Advanced trading and charting tools. |

Promotions and Discounts

- Claim up to $5,000 FREE Share when you sign up a new account here.

- $0 commission free for US stocks, ETFs, and options.

- 3-Years $0 commission for SG stocks, ETFs, and options.

- Low commission fee for SG, US and HK stocks, ETFs, mutual funds and options.

Webull Promo: Low Commission + Free Stock

3. ProsperUS: Best Long-Term Investing Brokerage For Trading US Stocks

Best Multi-Market, Multi-Currency, Low Cost Online Trading App For Investors

Referral Code: BUDDIES

(Get $20 Cash Credits)

Minimum investment: $0

Stock/ETF Commission Fees: SG (0.06%), HK (0.15%), CN (0.12%) and US ($0.01/share)

Products: Stocks, ETFs, Options, Futures, Funds, FX, CFDs, Bonds, CryptoFX

Markets: SG, HK, CN, US, UK, MY, AUS, CA, EU Regions

Suitable For: Beginner and Experience investors looking to invest in both locally and internationally.

| Pros of ProsperUS | Cons of ProsperUS |

|---|---|

| Highly competitive fees for countries like United States, Singapore etc. stocks and ETFs. | Complex trading and charting tools suitable for more advanced user. |

| Access to multiple global markets; US, SG, HK, CN, UK, MY, AUS, CA and EU etc. | Uncommon user interface experience unlike what is expected. Some may like this new interface though. |

| Multiple trading options: Stocks, ETFs, Options, Margin, Bonds, Mutual Funds. | |

| Option to choose between simplified and advanced trading platform | |

| Mobile trading App access |

Promotions and Discounts

- Claim up to $120 FREE Cash when make $100 deposit with trades

- Low commission fee for Singapore, HK, CN, MY, AUS, UK, Europe up to 30 markets and flat fee for US market.

- Special Bonus of SGD$20 FREE Cash when signup with our referral code: BUDDIES

ProsperUs Referral Code: BUDDIES

How to Choose the Best Broker for US Stocks in Singapore?

When jumping into US markets from Singapore, it’s important to know how to select a broker that aligns with your investment needs before opening your brokerage account. Here’s we will go through the few steps to find the right broker for trading US stocks, ETFs, and more.

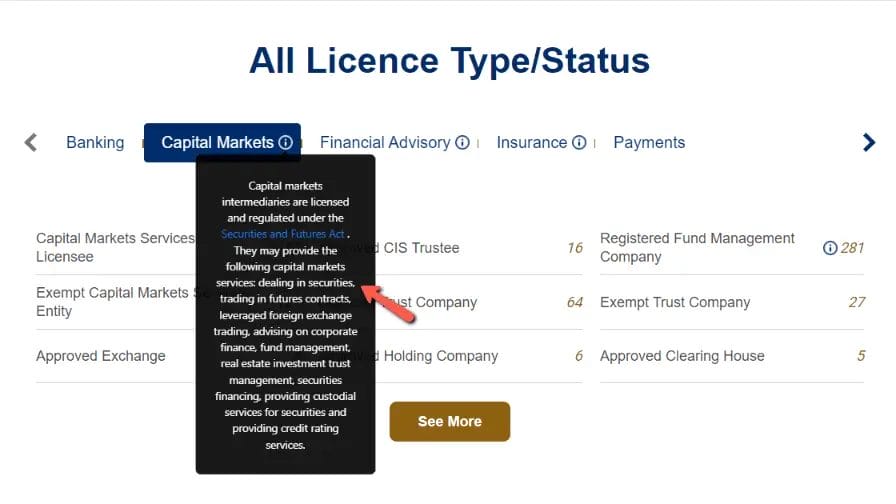

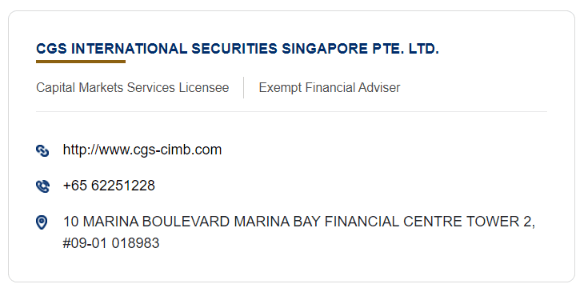

1. Check For MAS Regulated Broker

Guess, you’ve probably see this coming.

First and foremost, you SHOULD only (not advice but from my own personal experience) open brokerage account that is regulated by Monetary Authority of Singapore (MAS).

Seek a broker regulated by the Monetary Authority of Singapore (MAS), ensuring compliance with local laws for your security.

MAS oversight offers an added layer of protection for your investments.

A brokerage who is a licensed broker under MAS will show something like the following on the MAS website.

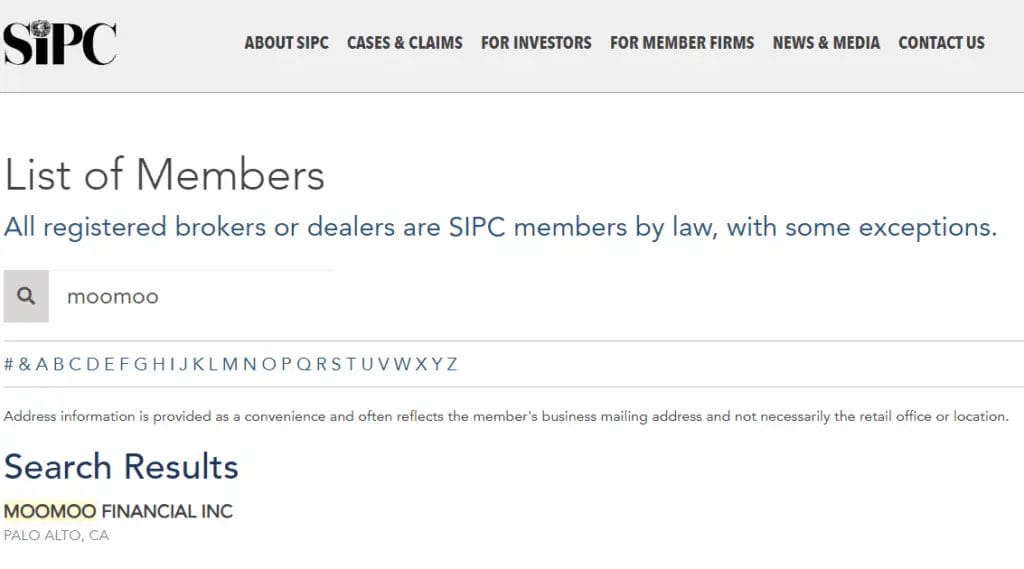

2. Member of Securities Investor Protection Corporation (SIPC)

For US stocks, we want to check if the broker is a member of SIPC.

Confirming if the broker is a member of the SIPC helps to protect you in the case of a brokerage failure.

If the brokerage is a member, SIPC can protect up to $500,000 of your securities, including a $250,000 limit for cash claims.

Moomoo and Webull are both members of SIPC, but if you want to check out other brokerage if they are as well, you can take a look at the list of SIPC Members directly from their website.

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

3. Evaluating Trading Platforms and Tools

Ensure the trading platform is user-friendly, and if possible find a broker that offers trading App which let you trade on the go.

- Access through desktop and mobile app.

- Access to real-time data.

- Access to multiple analytical tools.

With the right tools at your disposal, you can trade with confidence.

4. Understand Types of Brokerage Fees and Commissions Fees For Investing in US Stocks

When you’re looking to invest in US stocks from Singapore, understanding the fees involved is crucial. Here’s a breakdown of the key expenses you should be aware of:

- Platform Fee: This is fees charge per order to use the broker’s trading platform. It’s your cost for accessing their system to make trades.

- Trading Commissions: These are fees charged by the broker for executing each trade. They can vary based on the type and volume of the trade.

- Minimum Commission Fee: This is the least amount you’ll pay in commissions on a single trade. Some brokers have no minimum, while others set a base level.

- Custodian Fee: This is the fees the brokerage charge to help keeping your stocks in their custody, the amount you’ll pay usually depends on the number of shares or value of your share with the broker.

Here’s a quick comparison of fees:

| Type of Fee | Description | Charged By |

|---|---|---|

| Platform Fee | Fee charged by the trading platform for use of its services. | Trading Platform/ Brokerage |

| Trading Commissions | Fee for executing buy or sell orders on the stock market. | Trading Platform/ Brokerage |

| Minimum Commission Fee | Minimum amount charged for trading commissions. | Trading Platform/ Brokerage |

| Custodian Fee | Charge for holding and safeguarding securities in an account. | Custodian or Brokerage |

| SEC Fees | Fees collected by the U.S. Securities and Exchange Commission. | SEC (U.S. Government) |

| Settlement Fees | Cost associated with the settlement of trades. | Clearing House (US Settlement Agency etc.) |

| Trading Activity Fees | Fees linked to specific trading activities or order types. | Financial Industry Regulatory Authority (FINRA) |

For trading US stocks, it comes with many other fees we don’t usually see when trading Singapore stocks, and these fees are charged by the US authority.

Thus, it’s always important to check the fee structure for any broker you’re considering, as costs can impact your investment returns.

Always selecting a broker with transparent and competitive fees.

5. Assessing US Market Open and Close Time and Brokerage Trading Time

Match your trading schedule with the broker’s trading hours. Remember, the US market operates from 9:30 PM to 4:00 AM Singapore Time. Your chosen broker should allow trading within these hours.

Generally the trading time for US stocks are separated into 3 types:

- Premarket session: Before the market start trading

- Regular trading hour: When the market is trading live

- Postmarket session: After the market have end the trading for the day

And to make the life of us Singaporeans easier, here is a table comparing the trading time between US and Singapore.

| Trading Session | US Eastern Standard Time (EST) | Singapore Time (SGT) |

|---|---|---|

| Premarket session | 4:00 AM – 9:30 AM | 5:00 PM – 10:30 PM |

| Regular trading hours | 9:30 AM – 4:00 PM | 10:30 PM – 5:00 AM (next day) |

| Postmarket session | 4:00 PM – 8:00 PM | 5:00 AM – 9:00 AM (next day) |

This table shows the importance of getting a brokerage which allows you to trade during the Premarket session (5:00 PM to 1:30 PM), otherwise you need to stay up all night from 10:30 PM to 5:00 AM (regular trading hours) to make your trade.

And if you are an early riser, then getting a brokerage that offers Postmarket session trading (5:00 AM to 9:00 AM) can be a good idea as well.

Picking Your Broker to Start Trading US Stocks Listed on Nasdaq or NYSE

I think this article should be long enough and detailed enough to help you learn more about picking the right brokerage for US stocks trading.

From the fees involved, to the regulations, to trading time offered by the brokerage, you’ve probably have an rough idea on which broker to choose from.

And personally, as an investor myself, I too have my top favorite broker for buying and selling US stocks.

So as a quick recap, here are my top picks for the best broker for Trading US stocks in Singapore.

Cheapest Online Broker for Investors

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

Beginner Friendly Trading Platform

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

These are some familiar names you’ve probably heard and they are there for a good reason.

Hopefully, you’ve found the right broker that can help you in your financial journey. Otherwise, you can check out these other articles that you maybe interested as well:

- Most easy to use trading App for stocks trading

- Best brokerage for trading Singapore stocks

- Starter’s trading platform for beginner

- Top options trading platform for day traders

- Best trading platform in Singapore for general investors.

Personally, I use Moomoo for most of my trade, especially for US stocks. The interface is user-friendly, buttons are big enough for my fat fingers, I get access to multiple advance charting tools and market insights.

And the good news is they are currently offering some sweet promotions for all new users.

If you want, you can go and check it out!

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

21

Brokerage Reviewed & Analyzed

Driven by data, run by a investors with real-world experience.

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).