5 Best Online Trading App in Singapore for Beginners (As low as $0 Commission Fee)

Disclaimer: The information on this page is for entertainment purposes only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

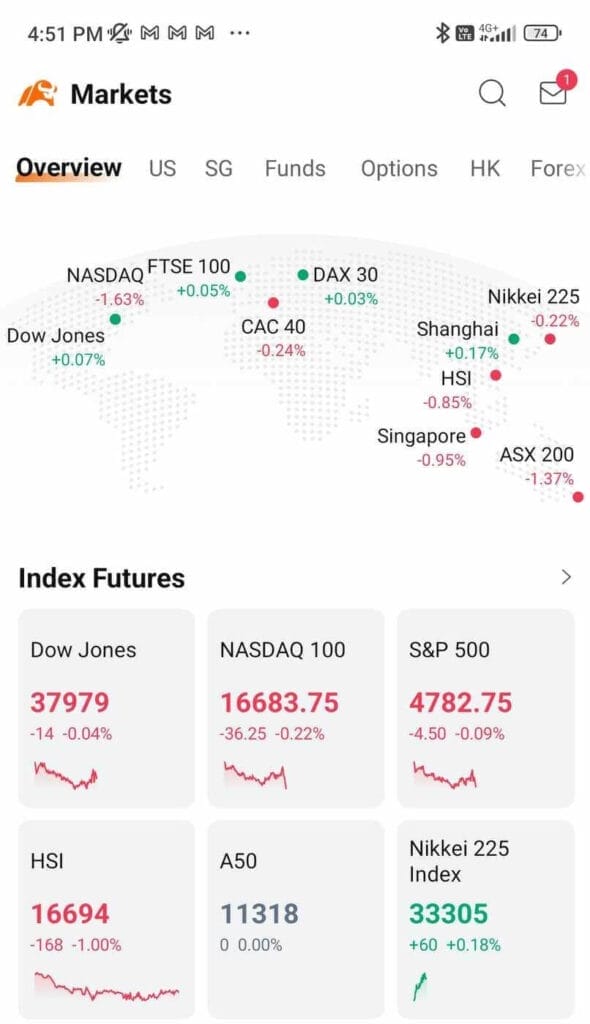

Looking for the best online trading app in Singapore that is regulated by the Monetary Authority of Singapore (MAS)?

With over +10 trading Apps in Singapore, choosing the best trading platform with the best user-friendly mobile App can be challenging.

To help you save time and money, as an investor myself, I’ve compared the best online trading platforms in Singapore that offers the best trading App for your investment journey.

Best Stock Trading App With Best Overall Trading Experience in Singapore (Handpicked)

Cheapest Online Broker

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

Beginner Friendly Trading Platform

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

International Trading Brokerage

BEST FOR: Multi-Market Investors and Professional Traders to Invest in SG, US, UK, HK, China, Malaysia and Europe.

Referral Code: BUDDIES

(Get $20 Cash Credits)

Comparing The Best Brokerage Account and Stock Trading Platform in Singapore

Honestly, finding the most user-friendly platform suitable even for beginners is never easy. (If you are a lazy investor like me who only like simple stuff, you should know what I mean.)

Choosing the best stocks trading App in Singapore depends on a few factors, such as;

- Stock market access,

- Range of trading tools,

- Choice of investment products,

- Platform fees and commission fees,

- Overall trading experience.

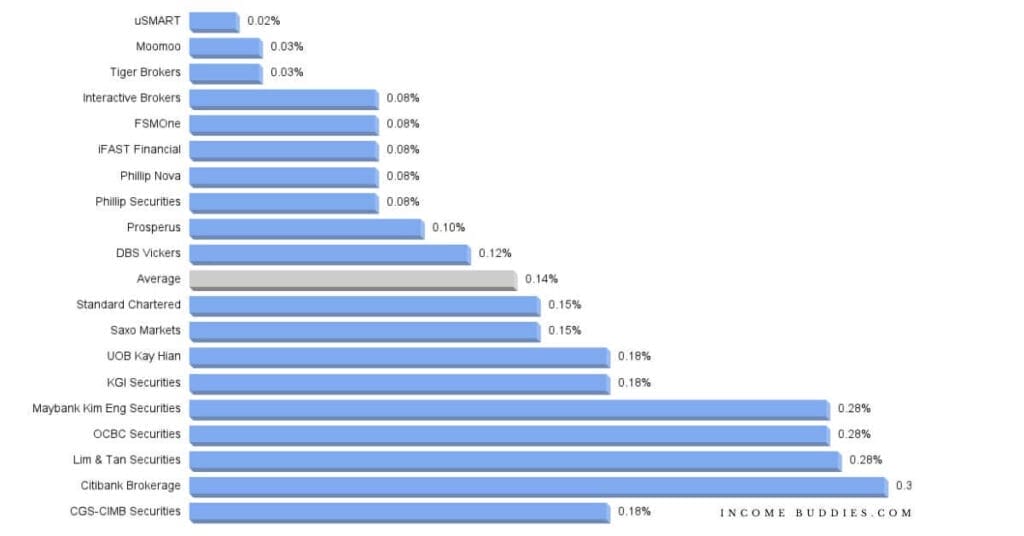

For cost conscious traders and investors, I’ve compared the trading fees of each of the online broker in Singapore to give you a nice comparison chart to help you choose the best stock brokerage platform in Singapore.

With fees ranges from 0.02% to over 0.30% of your trade value, a few of the names stood out amount the rest.

PS. I’ve spend over 18 hours researching each of the trading apps by deep-diving into the websites to dig for information manually, applying for new account and downloading the Apps to try out the platform myself, and looking through what other users says about the App. I did all these, so that you won’t need to spend the time I’ve spend to find the best Trading App for you to use for your day to day trading.

Finding the best brokerages and trading platforms is not just about fees, but a seamless trading experience.

With this in mind, I’ve handpicked the best online platform that offers the best overall trading experience for different investors.

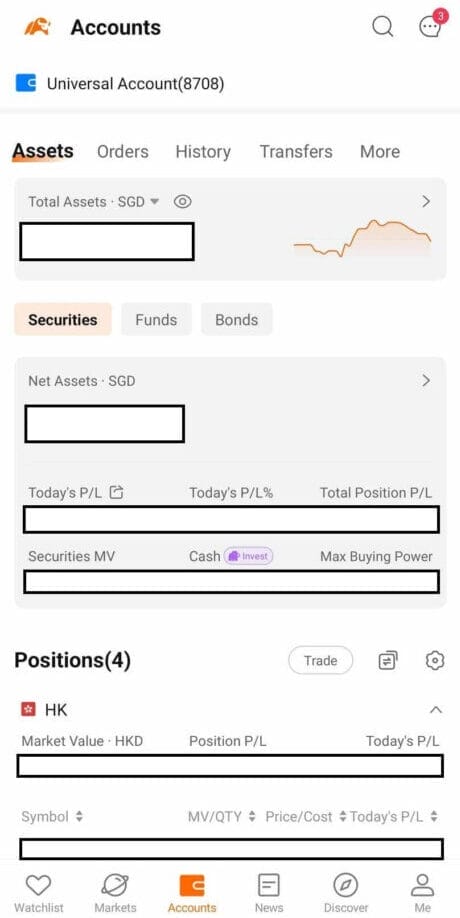

1. Moomoo SG: Best Easy-To-Use Trading App With Best Overall Trading Experience (Editor’s Pick)

Minimum investment: $0

Stock/ETF Commission Fees: $0 for US, 0.03% for SG, HK

Options Fees: $0.65 Per Contract

Markets: United States, Hong Kong, China, Singapore

Suitable For: Beginner and Experience investors looking to invest in both locally and internationally.

Available on: Both iOS and Android

Promotions and Discounts

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

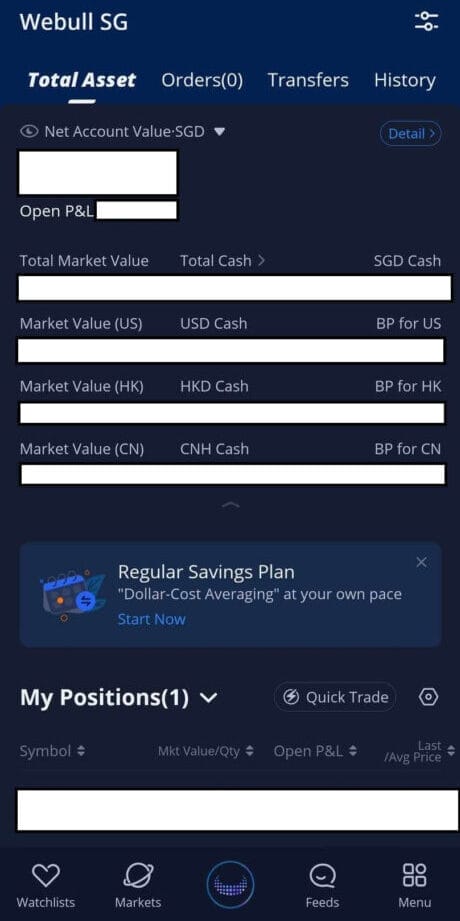

2. Webull SG: Best Stock Trading App for HK and US Stocks Market

Minimum investment: $0

Stock/ETF Commission Fees: $0 & 0.025% thereafter for US, 0.03% for HK, 0.025% for SG

Options Fees: $0.55 Per Contract

Markets: United States, Hong Kong and Singapore

Suitable For: Beginner and Experience investors or trader looking to invest both locally and internationally.

Available on: Both iOS and Android

Promotions and Discounts

- Claim up to $5,000 FREE Share when you sign up a new account here.

- $0 commission free for US stocks, ETFs, and options.

- 3-Years $0 commission for SG stocks, ETFs, and options.

- Low commission fee for SG, US and HK stocks, ETFs, mutual funds and options.

Webull Promo: Low Commission + Free Stock

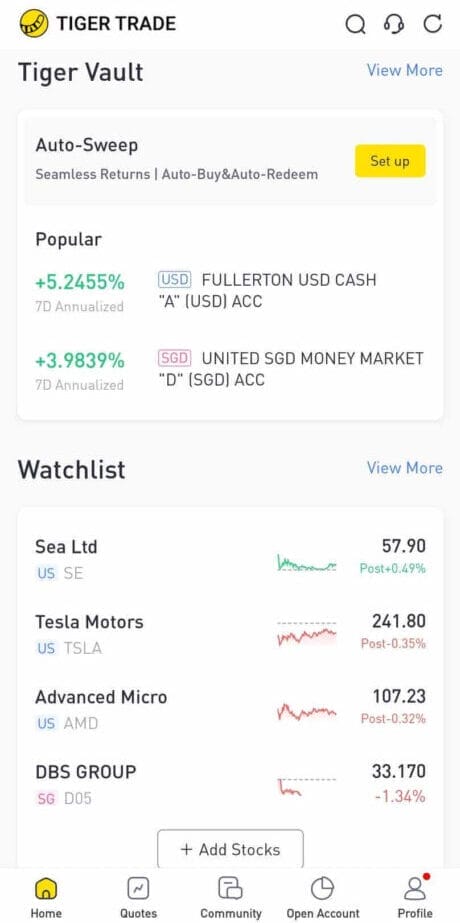

3. Tiger Brokers SG: Best International Trading Platform in Singapore

Best For International Market

Minimum investment: $0

Stock/ETF Commission Fees: 0.05% for US, 0.06% for SG, HK, CN, 0.10% for AUS

Markets: SG, US, HK, CN, AUS

Suitable For: Intermediate and Experienced Traders and Investors Looking to Invest In Australia.

Available on: Both iOS and Android

Promotions and Discounts

- Claim Free stocks when sign up a new account with our link.

- Low commission fee to trade US, HK, SG stocks, ETFs, mutual funds and options.

Promo: Low Commission + Free Stock

4. Interactive Brokers: Best Derivative Trading Platform in Singapore

Minimum investment: $0

Stock/ETF Commission Fees: 0.08% to 0.10% Trade Value

Markets: SG, US, HK, JP, AUS, NSE, LSE, etc.

Suitable For: Highly Experienced Traders and Investors Looking to Invest In International Market.

Available on: Both iOS and Android

Promotions and Discounts

- Do not offer any promotion or discount.

5. Prosperus: Best Multi-Market Online Brokerage Trading App

Best Multi-Market, Multi-Currency, Low Cost Online Trading App For Investors

Referral Code: BUDDIES

(Get $20 Cash Credits)

Minimum investment: $0

Stock/ETF Commission Fees: SG (0.06%), HK (0.15%), CN (0.12%) and US ($0.01/share)

Products: Stocks, ETFs, Options, Futures, Funds, FX, CFDs, Bonds, CryptoFX

Markets: SG, HK, CN, US, UK, MY, AUS, CA, EU Regions

Suitable For: Beginner and Experience investors looking to invest in both locally and internationally.

Available on: Both iOS and Android

Promotions and Discounts

- Claim up to $120 FREE Cash when make $100 deposit with trades

- Low commission fee for Singapore, HK, CN, MY, AUS, UK, Europe up to 30 markets and flat fee for US market.

- Special Bonus of SGD$20 FREE Cash when signup with our referral code: BUDDIES

ProsperUs Referral Code: BUDDIES

21 Best Singapore Online Trading Platform Fees and Commissions Compared

While we are looking at the various trading App in Singapore, here are some of the platform fees for each of the different trading Apps to trade SGX listed stocks.

Since the trading commission can grow pretty quickly as you trade in higher volume, I’ve arranged the fees from the lowest to the highest.

Do note: Using of the App is usually free, it is the platform and commission fees that you are charged for the trades.

| Trading Platform (SGX) | IB Rating | Min. Fees | Trading Commissions | Promotion |

|---|---|---|---|---|

Moomoo Singapore | ☆ 4.6 / 5.0 | $0.99 | 0.03% Trade Value | Get up to $800 worth of Free Shares + Perks |

WeBull Singapore | ☆ 4.6 / 5.0 | $0.80 | 0.025% Trade Value | Get up to $3,000 worth of Free Shares + Perks |

Tiger Brokers | ☆ 4.3 / 5.0 | $0.99 | 0.03% Trade Value | Get Free Share |

uSMART | ☆ 4.3 / 5.0 | $1.00 | 0.02% Trade Value | Get Cash Vouchers |

Interactive Brokers | ☆ 4.2 / 5.0 | $2.50 | 0.08% Trade Value | None |

FSMOne | ☆ 4.2 / 5.0 | $8.80 | 0.08% Trade Value | None |

iFAST Financial | ☆ 4.1 / 5.0 | $8.80 | 0.08% Trade Value | None |

Phillip Nova | ☆ 3.7 / 5.0 | $18.00 | 0.08% Trade Value | None |

Phillip Securities | ☆ 3.7 / 5.0 | $0.00 | 0.08% Trade Value | None |

Prosperus | ☆ 4.2 / 5.0 | $0.00 | 0.10% Trade Value | Get Free Shares |

DBS Vickers | ☆ 3.7 / 5.0 | $10.80 | 0.12% Trade Value | None |

Standard Chartered | ☆ 2.9 / 5.0 | $0.00 | 0.15% Trade Value | None |

Saxo Markets | ☆ 3.7 / 5.0 | $9.00 | 0.15% Trade Value | None |

UOB Kay Hian | ☆ 3.1 / 5.0 | $25.00 | 0.18% Trade Value | None |

KGI Securities | ☆ 2.9 / 5.0 | $25.00 | 0.18% Trade Value | None |

Maybank Kim Eng Securities | ☆ 2.9 / 5.0 | $25.00 | 0.275% Trade Value | None |

OCBC Securities | ☆ 2.9 / 5.0 | $25.00 | 0.275% Trade Value | None |

Lim & Tan Securities | ☆ 2.9 / 5.0 | $25.00 | 0.28% Trade Value | None |

Citibank Brokerage | ☆ 2.5 / 5.0 | $25.00 | 0.30% Trade Value | None |

CGS-CIMB Securities | ☆ 3.1 / 5.0 | $25.00 | 0.18% Trade Value | None |

| Market Average | NA | SGD $13 | 0.14% Trade Value | NA |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the brokerage platforms, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing. Fees are for Singapore Listed Stocks only.

You may have realized that my handpicked best trading apps are not always the cheapest in terms of fees.

(Apart from Moomoo SG which is the cheapest in fees and also giving me the best user experience as an investor.)

This is because the best Trading App don’t only need to be low fees, it needs to have an user-friendly interface, access to major stock markets, access to trading tools and company financial data to deliver a world-class overall user experience.

How to Choose The Best Trading App in Singapore?

Choosing a best trading platform that offers a user friendly trading App in additional to the desktop trading platform can help you easily place your trade as and when you want.

With so many options available for you to choose from, finding one that fulfil your investment goals can be tough.

However, here are some guidelines and features you should consider when finding the right stocks trading App for you.

1. Regulated by MAS

Guess you’ve see this coming. Before you start picking the right trading App based on features and market access, the most important criteria for any trading App offered by brokerage is that it must be regulated by Monetary Authority of Singapore (MAS).

While you can use many other popular trading App such as Robinhood and Acorn, these trading Apps are not regulated by MAS, which means you are not protected by the strict regulation of MAS.

Trading Apps offered by regulated brokers are holders of Capital Market Licenses and when you search the broker on the MAS website you will see something like the following:

Together with the name of the broker, the website, phone number and address, you will see the list of Licence the broker have.

A regulated broker should have the “Capital Market Service License“.

The “Capital Markets” intermediaries are licensed and regulated under the Securities and Futures Act that is enforceable in Singapore.

Using brokers which are MAS regulated helps to protect investors like us from shady trading Apps and brokers.

2. Trading Fees

Trading fees is the factor you want to consider when choosing which online brokerage to open an account for your investing journey.

An average day trader makes approx. 48 or more trades a year. Fees while often cost less than 1% can easily adds up over the year, and when adding all the fees together, it can quickly eats up your investment returns.

When choosing a trading platform choose one that:

- Low platform and commission fees

- Simple fee structure which is usually a “%” of your total trade value or a fix fee.

- Be wary of fees that is calculated by your number of shares as it can quickly add up for penny stocks.

| Fee Type | Description | Charged By |

|---|---|---|

| Platform Fee | Cost for using the trading platform’s services. | Online Trading App |

| Commission Fee | Fee per trade, either a percentage or fixed amount. | Online Trading App |

| Fractional Trading Fee | Applied when trading fractional shares, a percentage of the invested amount. | Online Trading App |

| Custodian Fee | Charged for safekeeping and managing securities in your portfolio. | Custodian Institution |

| Corporate Action Fees | Covers administrative costs during events like stock splits or mergers. | Online Trading App |

| ADR Fees | Fee for trading American Depositary Receipts, representing foreign stocks. | Online Trading App |

| Other fees | Miscellaneous fees not covered in specific categories. | Varies, check platform terms |

3. Local and Global Market Access

Know if the online broker offers local and global market access. While most brokers that are MAS registered allows you to trade stocks listed on the SGX, some only let you trade stocks that are listed in the other major stock exchange such as the US, Hong Kong and China.

- Check for local market access and fees structure

- Check for global market access and fee structure.

4. Investment Products Options

Most investors trades only stocks and equities, but some will want to perform CFD trading, Forex trading, Margin Trading, Futures trading etc.

Choosing a trading App that let you easily trade a wide range of investment products allows you to easily access your online portfolio and make your trades on the go.

Consider the following investment products options:

- General investment products: Stocks, REITs, Exchange-Traded Funds (ETFs), Bonds

- Advanced investment products: Mutual funds, options, futures, CFDs, Forex and other investment products.

5. Company Financial Data and News Updates

Easy access to the latest company’s financial data is the top of my list when finding a good platform to use for trades. Most of the time, company financial data are hidden at each of the company’s website, and financial reports.

The old way of fundamental research is very tedious, you need to read hundreds of pages of financial report to get the information you need.

One of the best trading App’s perk is it’s ease of accessing company’s financial data making the research process much easier.

Consider the following when finding the best trading App for you:

- Easy access to company and industrial data to understand the companies fundamentals.

- Easy access to financial reports, earnings releases, and analyst coverage.

- Real-time updates on the company news and reputable financial news sources.

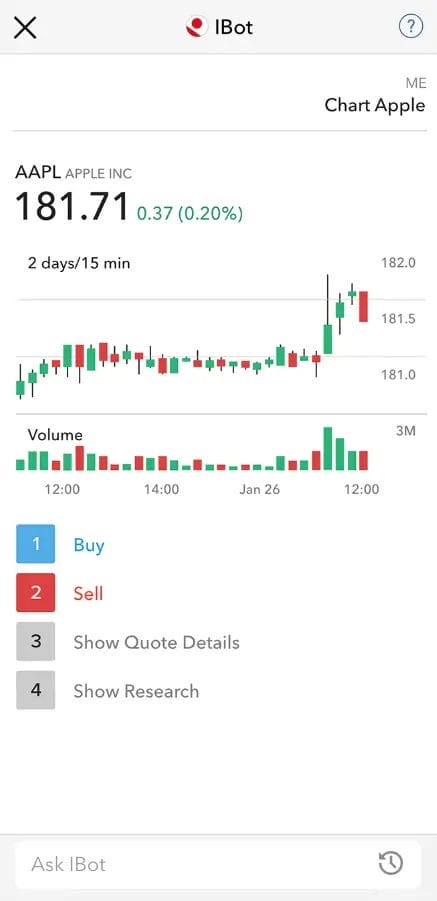

6. Trading Tools and Charting Tools

The best trading platform offers wide range of trading tools and charting tools that help you in making sound investment decisions for your trades.

Regardless if you are a dividend investor, a value investor, a growth investor or a day trader, the right investing tools can help you in investing online. Features that you may want to look for are:

- Technical Analysis: Technical indicators which you can use for trading.

- Charting Tools: Basic and advanced charting tools for you to see the upcoming trends of the stock you are analyzing

- Fundamental analysis: Company and industrial data to understand the companies fundamentals.

- Order types: Stop-loss, limit orders, market orders etc.

- Customization: Watchlists, alerts and dashboard customization.

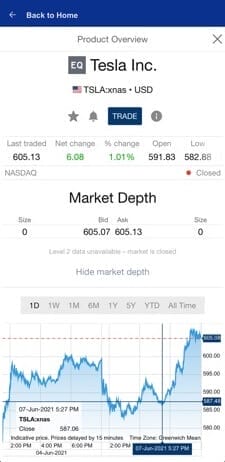

7. Real-Time Quotes

Real-time quotes that allow investors and especially day-traders more insight on the trades itself, letting you executing trades and tracking your investments effectively. Look for the following:

- Real-time stock quotes for bid/ask prices

- Historical price data and trading volumes

- Level 2 quotes for day-traders to identify the supply and demand of the price levels.

8. Platform Ease-Of-Use

Ease-of-use can let you enjoy your overall trading experience, making your investment journey easy.

When I talk about the ease-of-use of an trading App, it means to have the following criteria:

- Initiative App interface that make it simple even for beginner.

- Big buttons on the trading App that makes it easy for people with big fingers like us to use.

- Smooth user experience when clicking each of the buttons and links.

The perfect trading app should have a Good User Interface and User Experience (UI/UX). It should help us avoid any unwanted clicks such as clicking “Buy” when you want to “Sell” or vice versa.

Bonus. Look For Promotions and Perks

Want perks like, “No commission fees”, “Cashbacks”, “Free stocks”?

Many of the best trading platforms in Singapore offers a range of promotion and perks that helps to attract new traders while rewarding current users.

Platforms like Moomoo SG and Webull SG have one of the best promotion package for welcoming new users.

As a frequent user for both of these platforms myself, I find them pretty good platform to get started, offering many free advance tools for both beginner and professional traders. Some of the promotion and perks includes:

- Promotional offers: Commission free trades, free stocks, cash rebates

- High volume Traders: Lower trading fees, priority customer services, exclusive VIP events.

- Ongoing Programs: Loyalty programs and referral programs.

Wonder which trading platform to get started?

Here are a few that are amazing and are currently having some of the best promotion for all new signups.

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Frequently Asked Questions (FAQs)

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

21

Brokerage Reviewed & Analyzed

Driven by data, run by a investors with real-world experience.

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).