How to Start Investing in Stocks (Ultimate Guide For Beginners)

Want to start investing and grow your income towards financial independence?

Getting started is hard, I’ve been there, but there are certain ways you should get started in investing that can help you make your investing journey much easier and safer.

Investing can seems intimidating for beginners who are new to the world of investing, however, with the right approach you can build immense wealth, earning passive income that rival your job income.

Interested? Lets get started!

KEY TAKEAWAYS

- Set clear financial goals and understand your own risk tolerance level before choosing what to invest and how to invest.

- Investment options open to investors includes; stocks, REITs, bonds, and treasury bills. Always consider factors like risk level, investment time horizon, and potential return to make informed decisions that align with your goals.

- Always choose a reputable stock brokerage account when investing, and consider building a well-rounded ETF portfolio based on your preferences and investment goals over picking individual stocks.

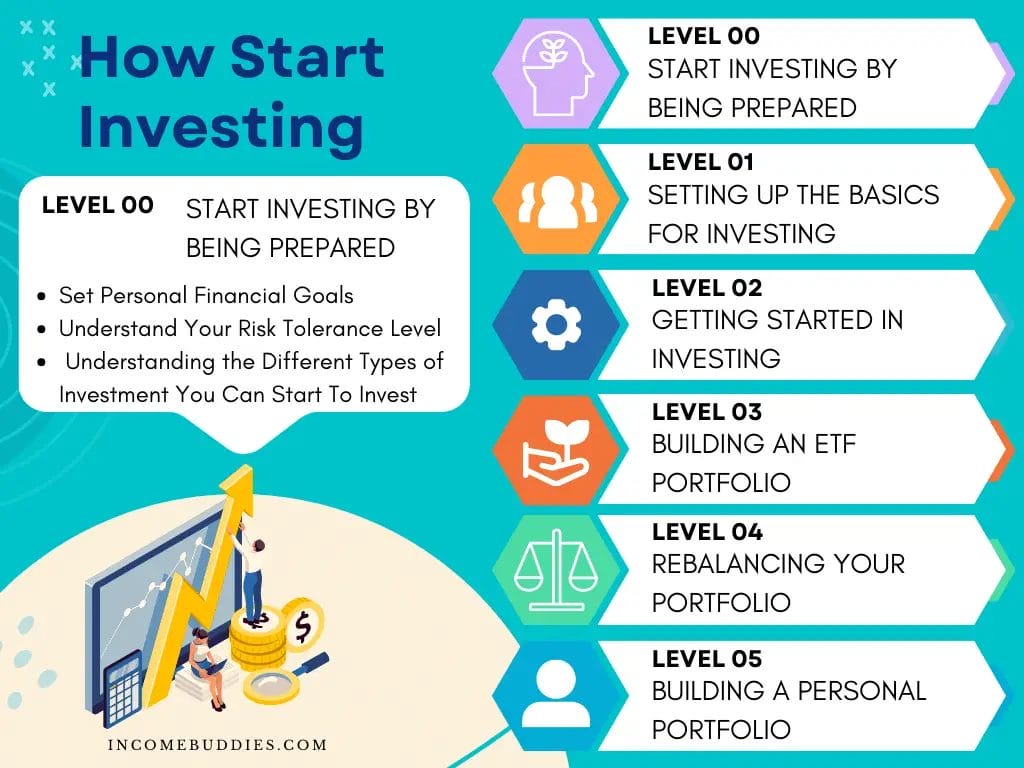

Guide to Start Investing Your Money & Build Wealth for Beginners

Wondering how to get started in investing? Here we’ve created a complete guide that walks you step-by-step, helping you get better in investing and meet your investing goal faster.

Starting from the basics, to the intermediate level to advance, this complete beginner’s guide will help you get started regardless your current knowledge level on investing.

Let’s start small and dream big in the world of investing!

- Level 0: Start Investing By Being Prepared

- Level 1: Setting up the Basics For Investing

- Level 2: Getting Started in Investing as a Beginner Investor

- Level 3: Building an ETF Portfolio

- Level 4: Rebalancing Your Portfolio

- Level 5: Building a Personal Portfolio

Level 0: Start Investing By Being Prepared

Preparation is the best weapon against ignorance. People losses money in the investing mainly due to not knowing what they don’t know. Meaning most people jump into investing without the required knowledge to help them succeed as an investor.

Thus, before opening a brokerage account and put your money into any stocks, learn how to make smart investment decision by going through the following process.

1. Set Personal Financial Goals

The first step towards becoming an investor is to set clear financial goals.

Ask yourself the following the big question: “What do you want to achieve through your investments?“

It means to identify what is your investment goal, the underlying reason, the “why” you choose investing amount all other options to grow your money.

- You invest so you can save for retirement?

- You invest so you can fund your children’s education?

- You invest so you can build a passive income portfolio and live a life of financial freedom?

Identifying your financial objectives will guide your investment decisions, and the actions you’ll need to take to bring you closer to your financial goals.

2. Understand Your Risk Tolerance Level

Investing involves risks, there is no 100% or full certainty that you will not loss your capital in any form of investment. This includes investment that is consider low-risk or no-risk.

- When investing, there is a risk of you losing your capital

- When not investing, there is risk of you losing your buying power due to inflation.

Regardless if you are investing or not, there is risk involved.

The key is to understand your personal risk tolerance level.

- Assess how comfortable you are with potential fluctuations in the value of your investments.

- Are you willing to take on higher risks for potentially higher returns?

- Do you prefer more conservative investments?

Knowing your risk tolerance will help you select suitable investment options. With this, it will help you limit the choices you have to make in understanding which investment suit you.

3.Understanding the Different Types of Investment You Can Start To Invest

Today, there are a wide range of investment options, each with its characteristics and risks.

Get yourself familiarize with the different types of investment so that you can make a better informed decision.

For each of the investment choice consider these factors:

- The risk level of the investment and your own risk tolerance level.

- The investment time horizon for the investment and your ability to set aside your money for the stated period.

- The potential return of the investment and your desired return on your investment.

Of this list, the risk level of the investment and your risk tolerance level is the most critical. Having a misalignment on this will lead to many sleepless nights and heart attacks when your investment fluctuates.

Investing options where you can put your money to work are:

- Stocks: Owning part of the company in the forms of shares that gives you a stake in its success, some stocks even pays out regular dividend earning you passive income.

- Real Estate Investment Trusts (REITs): Investing in real estate properties and earn regular income from rental yields REITs without the headaches of managing the property yourself.

- Bonds: Fixed-income securities that provide regular interest payments for investors, issued by governments or corporations to raise capital it is a popular choice amount investors.

- T-Bills: Treasury bills are short-term debt obligation backed by the government that pays investors a fixed interest rate and having a maturity of one year or less.

Regardless which investment you choose, investing is never a “get rich fast” game on money. Investing is long-term strategy to build wealth.

Investing with a short time horizon is simply speculation and not investing.

“In the short term, the market is a voting machine. In the long term, it’s a weighing machine.”

Warren Buffett

Level 1: Setting up the Basics for Investing

Once you’ve done the preparation and laid the groundwork, it’s time to set up the basic infrastructure for your investment journey.

The infrastructure for investing involves:

- Choosing the right type of account for your long-term investment.

- Open an investment account to get started in investing your first dollar.

1. Setting up a Stock Brokerage Account

To get started in invest in stocks, you’ll need a stock brokerage account that helps you buy and sell stocks listed in the various stock exchange.

Choosing the right stock brokerage account to begin investing is critical for investing success, here are some factors to consider:

- Choose a reputable brokerage firm that is regulated by the respectively authorities such as SEC, FCA, and MAS.

- Offers a user-friendly online platform, equip with features that can help you trade easier, preferably offering trading App or mobile access.

- Competitive commission and trading fees.

Opening an account is typically a straightforward process, and once you’ve created your investing accounts you’ll gain access to a wide range of stocks listed on the respective stock exchanges.

2. Setting up a Regular Saving Plan

Regular Saving Plan (RSP) is a perfect way for investors who want to take a more discipline approach to build your investment portfolio gradually over a long period of time without taking the effort to make the decision of when to invest.

Heard of the term “Dollar Cost Averaging“?

With a RSP, investors can perform Dollar Cost Averaging (DCA) for their investment allowing you to invest a fixed sum of money at regular intervals regardless of the market condition.

Regular Saving Plan (RSP) are often offered by financial institutes, banks or brokerage. And opening a RSP is often quite easy, simply ask your provider and check if you are eligible for their RSP.

3. Setting up a Robo-Advisor Account

Robo-advisors takes the guess work out of investing, it automates your investment process by creating and manage a diversified portfolio for you.

If you trust AI can do a better job than humans in investing, robo-advisor uses the algorithm set by the platform to select suitable investments based on your risk profile and investment goals.

Opening a robo-advisor account is a convenient and cost-effective way to start investing, especially for beginners.

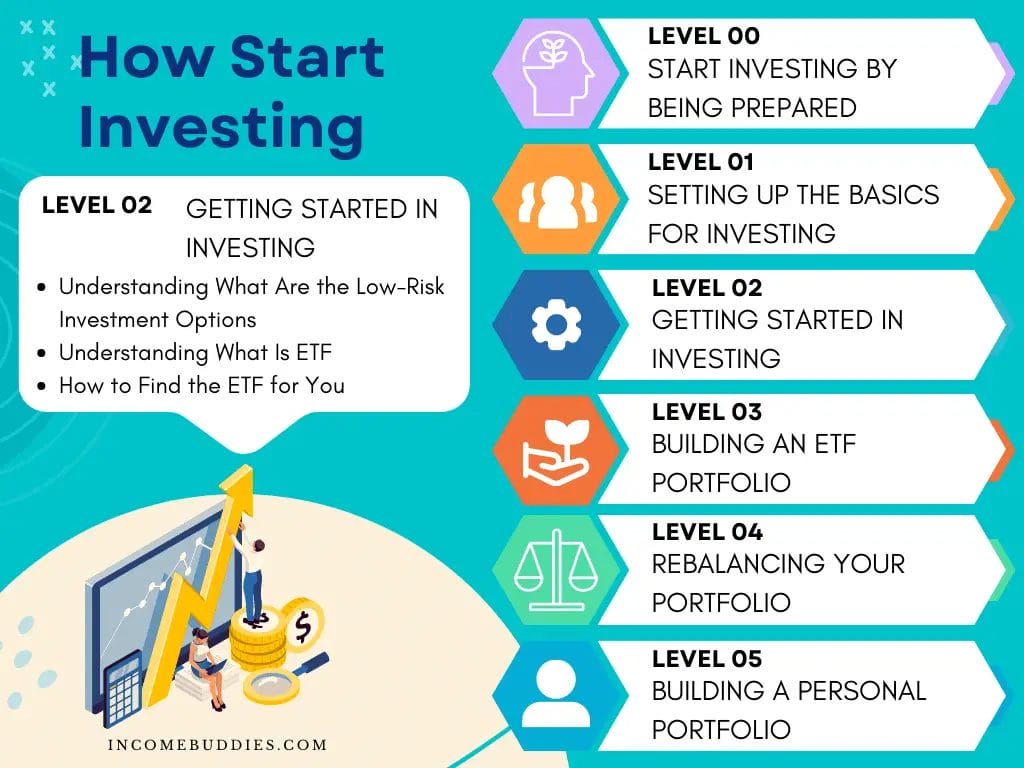

Level 2: Getting Started in Investing as a Beginner Investor

With the basics in place, it’s time to get our hands dirty by exploring what are some of the best options to invest.

While investing as early as possible is great advice, investing in investments that give a good returns on your money at low risk is just as important as well.

There are two types of investors:

- Investor that choose long-term investing, these are investors such as Warren Buffett and Charlie Munger.

- Investor that choose short-term investing, these are traders who opt for active investing.

Regardless what type of investor you are, as a new investor, it is always good to get started with some low-risk investment options namely; Exchange Traded Funds (ETFs) that tracks the performance of a specific index.

1. Understanding What Are the Low-Risk Investment Options

Low-risk investment are investment that are generally stable with low level of volatility in compared to the market index. These are investment such as:

- Exchange Traded Funds (ETFs)

- Gold and Precious Metal (ETFs & Gold IRAs)

- Cash Funds (Cash Management Account)

- Fixed Deposit and Saving Accounts

- Government issued bonds and Treasury Bills

- Bonds with investment grade rating from AAA to BBB.

Risk in investment is generally calculated by it’s Beta’s value, low-risk investment options are investment choices that are considered relatively stable in relation to the overall market.

However, it is always good to remember that low-risk does not mean the absence of risk.

2. Understanding What Is ETF

Exchange-Traded Funds (ETFs) are investment funds that is being traded on stock exchanges. While it is similar to trading an individual stocks, ETFs allow you the ability to invest in a diversified portfolio of assets, such as;

- Stocks (Tracking certain index, industry, or markets)

- Bonds (Government and or companies)

- Commodities (Gold, Silver, Oil etc.)

ETFs providing flexibility and liquidity for the investor while offering a low cost way to diversify your portfolio.

Inbuild with an automated “cleansing” mechanism, the ETF will only consider of the top companies of the selected industry that make up the index.

Investing in ETFs is an excellent option for beginners seeking instant diversification without the headache of managing and picking the right stocks.

3. How to Find the ETF for You

Choosing the right ETF will take some research and understanding of your own personal financial goals and personal values. Always invest in investments that aligns with your own personal value, once it is aligned, you can start asking these guided questions:

- Who manage the ETF?

- What is the expense ratio of the ETF?

- Which are the components of the ETF?

- What market does the ETF tracks?

- What is the sectors or asset classes the ETF tracks?

- What is the tracking error of the ETF?

- What is the dividend paid for owning the ETF?

Conduct research and look for the ETFs that align with your investment objectives. Amount the many questions you should ask, consider the fund’s track record, expense ratio, and the underlying assets it holds.

Level 3: Building an ETF Portfolio

Now that you understand the basics, it’s time to take a closer look into building a well-rounded ETF portfolio.

1. Investing in REITs ETFs

Real Estate Investment Trusts (REITs) are special investment vehicles offers to payout a portion of their earnings on a periodic basis for investors in the form of dividend.

With a REITs ETF, it allows you to invest in a diversified portfolio of real estate properties, spreading the risks associated with individual properties amount a portfolio of different REITs.

- Invest in Real Estate at low cost.

- Earn regular passive income through dividends.

- Highly diversified portfolio of properties.

2. Investing in Stocks ETFs

Stocks ETFs provide exposure to a basket of stocks listed on the stock exchange. Investing in a stock ETF is the most popular way where beginners invest in a bucket of stocks like the S&P 500 with small amount of capital.

When you invest in ETFs such as the S&P 500, you essentially diversifying your investment into the top 500 companies listed on the United States stock exchange.

These ETFs enable you to invest in various sectors and industries, diversifying your portfolio.

- Market specific ETFs: US, Europe, Asia, China, Japan etc.

- Industry specific ETFs: High Technology, Agriculture, Logistic etc.

- Company size specific ETFs: Small Cap, Mid Cap, Large Cap etc.

- Investment strategies specific ETFs: Value Stock, Dividend Stock, Magic Formula etc.

Look for ETFs that align with your investment preferences, whether you’re interested in specific sectors or broad market exposure there will be an ETF for you.

3. Investing in Gold ETFs

Gold and precious metal are often considered a safe haven asset and a hedge against inflation. Gold investing comes in many forms, and investing in Gold ETFs gives you the option to invest in gold without the need for physical ownership.

These Gold ETFs track the price of gold and any other precious metal, giving you the convenience of diversifying your portfolio while having the liquidity of selling your gold when required.

4. Investing in Bonds ETFs

Bonds ETFs provide exposure to a diversified portfolio of bonds issued by governments and corporations.

These ETFs are unique in its own ways as it is consider some of the lowest risk investment.

Offering income stability, this is suitable for investors looking for fixed-income securities.

However, do consider your risk profile and investment goals when selecting bonds ETFs. While most bonds ETFs consist of investment grade bonds, some consist of “Junk Bonds” which are much more risky than normal bonds.

Level 4: Rebalancing Your Portfolio

Rebalancing is the one step where most investors fail to do, but doing this will help you get towards your investing goals faster.

Rebalancing your portfolio is like looking onto your compass when you are tracking in the jungle. Regularly review and rebalance your portfolio can help to:

- Ensure what you are doing remains aligned with your financial goals

- Ensure you are not taking too much risk on your investment.

Rebalancing involves adjusting the weights of your investments to maintain the desired asset allocation.

Level 5: Building a Personal Portfolio

As you proceed further into your investment journey, you’ve gain better understanding in investing in various stocks and bonds.

You think you are ready to start investing in individual stocks, you want to buy individual stocks and create your own personal portfolio.

Becoming an advanced investor is another type of ball game, while this is a guide for beginners, we will list down a few critical things about learning how to pick individual stocks.

1. Know the Difference Between a Blue Chip Stock and a Penny Stock

By now, you should have a concrete idea on the difference between a blue chip stocks and a penny stock.

- Blue chip stocks are shares of large, established companies with a history of stable earnings and a solid reputation.

- Penny stocks, on the other hand, are shares of small, less-established companies with higher volatility and greater risk.

Understanding the differences between these two types of stocks is crucial if you are picking individual stocks to buy and sell.

2. Get Educated on Fundamental Analysis and Technical Analysis

Heard of the term “Value investing”, “Growth Investing” or “Dividend Investing“?

These are few different investing strategies used by investors worldwide.

To be successful in executing your own investing strategy, you need to understand two important concept:

- Fundamental analysis

- Technical analysis

Fundamental analysis involves evaluating a company’s financial health and industry trends to assess its long-term potential.

- Understanding the importance of Economic Moat

- Reading market trends and industry news

- Learning how to read and analyze financial statements

- Perform valuation technique and use ratios to evaluate the business

Technical analysis focuses on analyzing price patterns and market indicators to predict short-term price movements usually caused by human nature.

- Use of advanced charting tools to analyze price movements.

- Use of tools to understand if the stock is oversold or overbought.

With these analysis methods, you can make informed investment decisions based on both intrinsic value of the company and market trends of the stock.

3. Getting to Know How to Pick the Best Dividend Stocks for Your Investment

Dividend stocks are shares of companies that have an history of distributing a portion of their earnings to shareholders as dividends.

Investors who buy dividend stocks are known as dividend investors, income investors or passive investors.

I personally love to invest in dividend paying stocks, this is because by simply holding the stocks investors get to earn an income without selling the stocks or doing anything.

Check out these articles on dividend investing:

- Complete guide to dividend investing

- Guide to pick the best dividend stocks like Warren Buffett.

- Guide to find dividend paying stocks.

- Types of dividend you’ll get as dividend investor.

- Types of dividend policy you’ll need to know.

- Good and bad of dividend investing.

- Reason why you should invest in dividend stocks when you are young.

When selecting dividend stocks, consider factors such as:

- Company’s financial health

- Dividend history

- Dividend yield

Look for companies with a consistent track record of dividend payments and sustainable growth.

4. Investing in Global Stock Market

Investing in the global stock market is very different from investing in your local stock stock market. In order for you to invest in the global market you’ll need to:

- Open an online brokerage account that have access to the international stock market.

- Understand the risk of currency exchange when investing in international market.

- Understand the difference in taxation for investing in the other stock market.

Gaining the access to investing in the international market offers a range of benefit such as:

- Allowing you to diversify geographically.

- Gain exposure to international companies and economies.

- Invest in popular stocks and companies that is growing rapidly.

If you are considering to invest in the international market here are a few complete guide that will help you in getting started:

- Investing in the United States Stock Exchange (Nasdaq, New York Stock)

- Investing in China Stock Exchange (SZSE, SSE)

- Investing In Singapore Stock Exchange (SGX)

- Investing in Hong Kong Stock Exchange (HKEX)

Research global market trends, assess currency risks, and get a full understanding of what you are investing before you start putting your money into buying or selling any stocks.

Common New Investor Mistakes

There are a few common mistakes that new investors make, and if any of these seems familiar to you, jump back to this guide. Proceed step-by-step from learning the basics at level 0 to creating your own portfolio at level 5.

Most common mistakes that new investors make are:

- Buy a new stock because their friend say the stock will “go to the moon” in the next few months.

- Buy a stock and expect it will double or triple their money in a short time.

- Start investing because everyone around them say investing is the best way to wealth.

Surprised?

Well, it’s ok to have mistakes, and in fact everyone make some form of mistake one a while. No one is perfect.

What’s matters is what you do after making a mistake.

Do you learn from your mistake? Or do you repeat your mistake again?

Investing is a journey, a long journey where you get to learn something new even after decades in investing.

Key Takeaway On Learning How To Invest

Starting your investment journey requires careful planning, learning the basics, getting success from it and slowly progress towards the more advanced options.

By setting clear financial goals, identifying your risk tolerance, and exploring various investment products, you can create a well-diversified investment portfolio that suits you.

Everyone is different, and thus everyone have their own investing style that works for them.

- Dividend Investing

- Value Investing

- Growth investing

Investing is a long-term investment that have a certain level of risk. If you don’t want risk, investing may not be the best option for you.

However, even if you don’t do anything, your money will be eaten away at 3-5% per annual by inflation.

The key to protecting your wealth is to investing as early as possible, investing when you are still young.

Learn how to make smart decisions, stay informed, regularly review your portfolio, and adjust your investments as needed to align with your changing financial goals.

Knowledge is the key to successful investing as a beginner.

Read Also:

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).