Toll Bridge Moat: Impressive Wide Economic Moat That Gives Business Competitive Advantage For Investing

Why some companies have a business moat so strong that it is almost impossible to compete? Amount the different types of economic moats of a business there is one particular types of moat that you should never ignore. The name of the moat is “Toll Bridge Moat”.

The Toll Bridge Moat is a special type of moat, that only a selected few can have, but what exactly is a toll bridge, and how does this help to create a moat for a company?

KEY TAKEAWAYS

- Toll Bridge Moat is measured by the ability to command an exclusivity in the industry, monopolizing the industry and preventing competitors from coming into the picture.

- Toll Bridge Moat works by being the middleman that connects the different parties in the market, a middleman that is essential for the industry to work smoothly.

- Benefits of companies with strong Toll Bridge Moat includes; better pricing power, long-term stability, and lower competition.

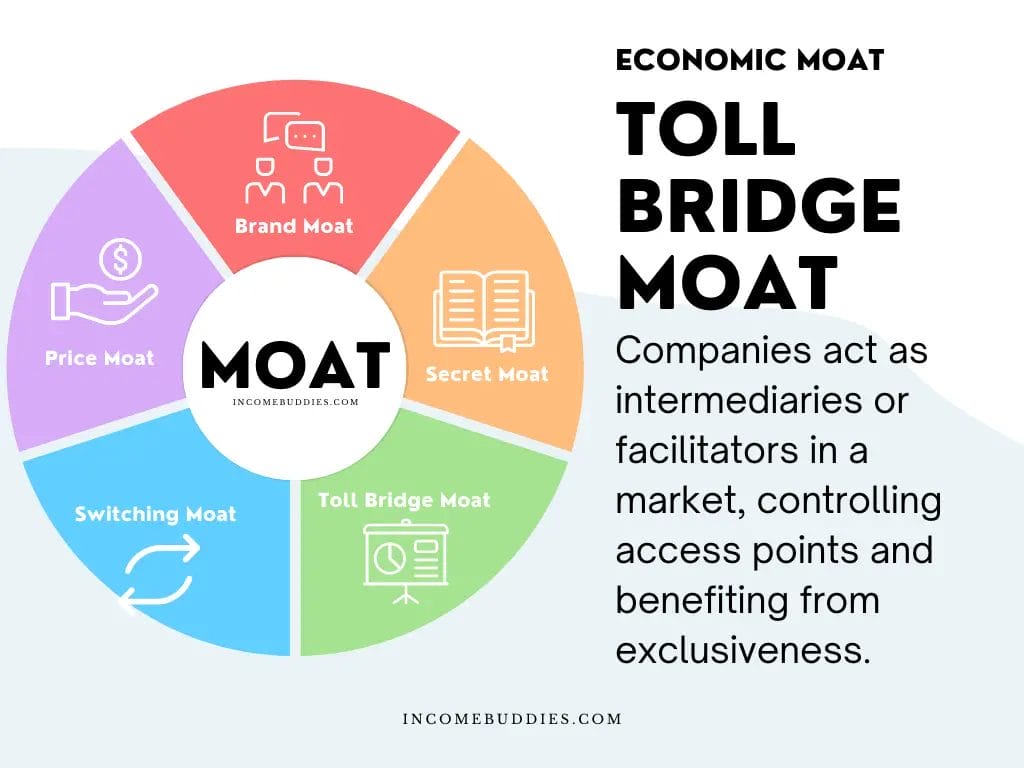

What is Toll Bridge Moat in Terms of Economic Moat?

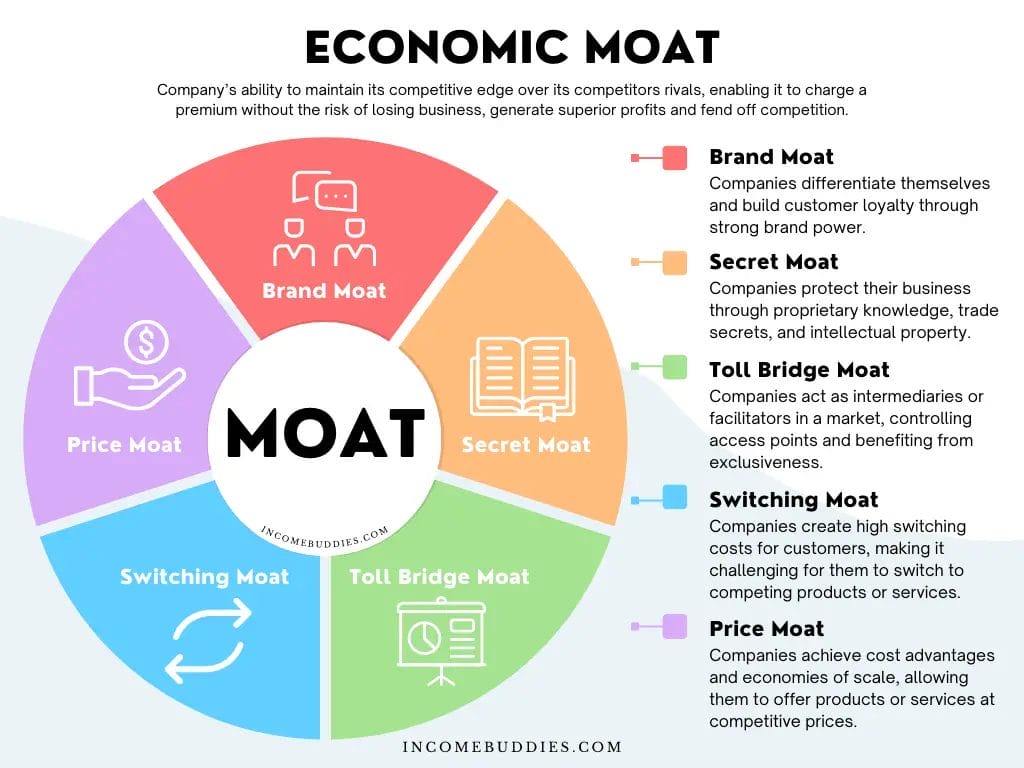

Toll Bridge Moat is a specialized types of Economic Moat that is difficult to replicate, but a type of moat that is build into the business.

Like an middleman, Toll Bridge Moat is formed when a company’s role is to act as a facilitator of a market. The role of the company is to control the access points of the particular market, making it impossible for anyone to grant access tot he market without going through the company.

The specialized business helps the company to build an economic moat around the company, making it hard for any competitors to compete directly with the company, granting the company some form of exclusivity in the business.

How Toll Bridge Moat Works

The concept of a Toll Bridge Moat is similar to a physical toll bridge that connects two points and collects tolls. By assuming the role of an intermediary or facilitator, this company becomes the gatekeeper, controlling the flow of goods, services, or information between various participants.

These companies with the Toll Bridge Moat build a competitive edge in their business by:

- Acting as the middleman and a vital connector to ensuring a smooth and efficient functioning of the market.

- Offering essential services that connect suppliers, consumers, and other relevant parties.

- Leveraging the power of their connections to control over access points and exclusivity.

With high entry barriers, the Toll Bridge Moat is include regulatory hurdles, licenses, capital requirements, and technological expertise. By controlling these access points, companies with Toll Bridge Moat create a significant competitive advantage that often leads to increased profitability and market dominance for the company.

Types of Toll Bridge Moats

Toll Bridge Moats can come in different forms, and like any other types of economic moats, Toll Bridge Moat can further differentiated into a few unique ways.

1. Regulatory

The most common type of toll bridge moat is regulatory requirements. These companies benefit from regulatory hurdles that deter new entrants into the industry, leading to business exclusivity in the industry.

New companies that want to compete in this business requires to obtain licenses, permits, or certifications that are challenging to acquire.

Examples: Highly regulated industries such as healthcare, finance, telecommunications, or energy.

2. Licensing

Licensing is often required for most business, but a few certain license that falls in the category of “Your Money Your Life” will required a much higher hurdle for the license to be issued to the company.

Companies that hold these exclusive licenses, granting them control over important resources or services, that are highly demanded by others. The procession of these licenses becomes a barrier for potential competitors, creating a business exclusivity for those company that holds this license.

Examples: Broadcasting, finance, telecommunications, or intellectual property licensing.

3. Capital Requirement

Capital intensive business creates a toll bridge moat where it makes it hard for anyone without the required capital to jump into the business. The high investment capital create a barrier to entry, any potential entrants may struggle to match the financial resources required to establish a similar infrastructure.

While this is a useful moat, it is usually paired with other forms of economic moat to make this effective.

Examples: Airline companies, toll road operators, shipping builders, or large-scale manufacturing companies.

4. Technological Expertise

Access to advance technology and knowledge that helps to create helps to build a toll bridge moat in companies. Overlap to the other form of moat called the secret moat, the access to specific technology acts as a barrier for new entrants.

Examples: Software companies with proprietary technology, biotechnology firms with patented processes.

5. Geographical Advantage

Location of the business can sometime become the moat where it makes it hard for competitors to come into the business. Geographical advantage is always paired with the weather condition, the landscape and the overall natural environment of the location.

Certain business thrive in certain location where it gives it geographical advantages, while the same business will not be able to succeed if the geographical location is not suitable.

Examples: Plantations, mining and agriculture business.

Benefits of Companies With Strong Toll Bridge Moat for Investors

Companies with strong toll bridge moat have numerous advantages for the business, which in turn give investors a much higher probability of investment success and enjoy high return on capital invested.

Here are some key benefits of investing in companies with Toll Bridge Moat.

Increased Pricing Power and Profitability

Companies with Toll Bridge Moat often enjoy almost monopoly control of the market share of the business. This exclusive control give the company the ability greater control over pricing and can charge premium fees for their services.

- Set favorable pricing leads to enhanced profitability.

- Higher potential returns for investors.

- Possible long term growth.

Sustainable Competitive Advantage

Toll Bridge Moat provides a durable competitive advantage for the business, like a economic castle with strong walls and huge water bodies protecting it from any attacks by its competitors

This sustainability provides investors with confidence in the company’s ability to generate consistent returns over the long term.

- Highly stable

- Little to no competition

- Enjoy exclusivity and monopoly in the industry

Resilience to Competition and Market Fluctuations

Companies with Toll Bridge Moat face reduced the number of competition due to the high entry barriers.

Even in times of market fluctuations, market crash or economic downturns, these companies will less likely be impacted.

Like a toll bridge, regardless if you like it or not, as long as you need to get from point A to point B, you need to pay the toll.

This special feature of company with toll bridge moat create higher level of resilience to market changes compared to their competitors.

How to Identify Companies With Toll Bridge Moat?

Knowing how to identify companies with Toll Bridge Moat is much easier than identifying companies with other forms of economic moat.

These companies are often companies which everyone know, companies which you have heard of.

In fact, these companies are so well-know often times, we use their names on a daily basis and may even forget that they are a listed company themselves.

- If you invest in the United States such as Nasdaq, you’ll definitely heard of the name Nasdaq Inc.

- If you invest in the United Kingdom, you’ll definitely heard of the name London Stock Exchange Group plc (LSEG).

- If you invest in stocks in Singapore, you’ll definitely heard of the name Singapore Stock Exchange (SGX).

These companies have a strong Toll Bridge Moat, if you want to invest, you’ll need to invest through any of these companies. (No, I will never tell you what to invest, I not a financial advisor remember? I am just listing some examples of companies in my opinion that have this particular moat.)

However, here are some ways to help you in identifying a company with a toll bridge moat.

1. Financial Indicators and Performance Metrics

Fundamental analysis is the most scientific way to find any companies that have this form of moat. And here are some suggestions:

- Financial History: Evaluate the company’s financial health, profitability, and growth trajectory over the years

- Current Finance: Look for consistent revenue streams, high profit margins, and positive cash flows.

- Current Business Value: Analyze the company’s return on invested capital (ROIC) and other relevant financial ratios.

2. Market Analysis and Competitive Landscape Evaluation

Understanding the business is the key to identifying companies with a toll bridge moat. This can be done by studying the industry dynamics, and the company’s positioning within the market.

Ask questions such as:

- Is the company having a monopoly in the business?

- Is there any trends in the market that can undermine the business?

- What is the growth prospect of the business in the next 5 to 10 years?

3. Examining Barriers to Entry

Probably the most important of all, is the ability to create a high barrier of entry. Moat companies have some form of toll bridge moat, but it is the ability to have a high barrier of entry that makes the toll bridge moat relevant, a moat that is strong enough to keep the company growing for years to come.

- What is the specific barriers to entry the company possesses?

- What is the nature of these barriers and their long-term sustainability?

- What is the current company’s ability to defend its Toll Bridge Moat against potential threats?

Here we want to look at how wide is the moat and not just the presence of it. A narrow moat is worthless, but a wide moat in business can create an exclusive competitive advantage that keep competitors at bay for a long time.

Case Studies: Companies with Toll Bridge Moat

Toll Bridge Moat can have a major impact in a business success, and as an investor, we own part of the business when we invest our money with it. Lets take a look at a few case studies of companies that have some form of toll bridge moat.

Case Study 1: Chicago Mercantile Exchange (CME)

Chicago Mercantile Exchange, also known as CME, is a prime example of a company with a Toll Bridge Moat. Benefits from exclusivity, high entry barriers, and a network effect that attracts market participants. It is the only place in America where you can trade commodities.

Case Study 2: China Railway

China Railway is the national railway operator in China. With its extensive rail network, China Railway controls access to transportation infrastructure in China. Having a significant barriers to entry due to the immense capital requirements, regulatory approvals and dominance in the transportation sector, this ensure a steady stream of revenue.

Case Study 3: MasterCard:

MasterCard, a global payment technology company, exemplifies Toll Bridge Moat through creating a technological barrier, and licensing requirement to establish a company such as MasterCard.

As a leading provider of payment processing services, MasterCard is a trusted intermediary that connects merchants, banks, and consumers, acting as a middleman that help create a smooth transaction between parties.

The company’s extensive network, reinforced by its exclusive partnerships, creates a Toll Bridge Moat that is difficult for competitors to penetrate.

Final Thoughts on Toll Bridge Moat

Toll Bridge Moat is vital for investors seeking long-term success in the stock market. Unlike the other economic moat, this moat is highly dependent on the types of business you are in and not all business are able to establish a toll bridge moat.

By possess a unique advantage that allows companies with Toll Bridge Moat to control access points, it benefit the company in the form of having exclusivity in the industry, and enjoy sustained profitability.

Economic Moats comes in all forms, and understand all the different types of economic moats can help you become a better investor.

If you want to unlock opportunities for enhanced returns, sustainable competitive advantage, and long-term growth, understanding moats, is key.

Warren Buffett and Charlie Munger invest in companies that shows strong Economic Moats.

“I don’t get to where I am going after mediocre opportunities.”

Charlie Munger, Vice Chairman of Berkshire Hathaway

Read Also:

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).