Gold IRA: Do You Know How The Rich Protect Their Retirement? (Here’s How)

Are you looking to better use your IRA account and invest in alternative investment that can better protect your retirement investment such as investing in gold or other precious metals?

Today, investing in a Gold IRA is becoming an increasingly popular option for savvy investors who are looking to diversify their investment portfolio.

While traditional IRAs let you invest in stocks, bonds, and mutual funds, these investment are considered higher risk and can fluctuate greatly and have the potential of losing hundreds of thousands of dollars during an economic downturn such as:

- 2008 Financial Crisis

- 2019 Covid Pandemic Recession

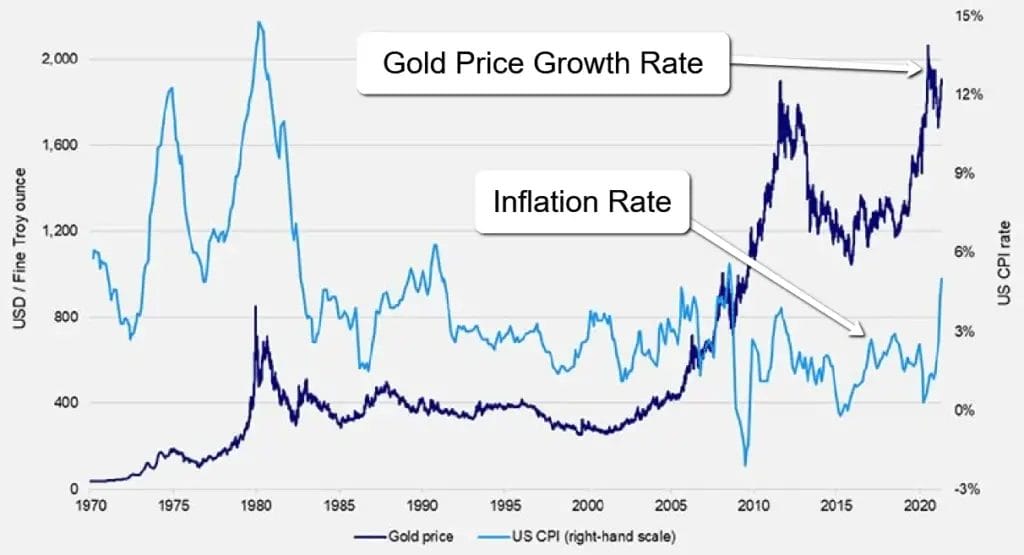

On the other hand investing in Gold IRA offers the potential for greater stability and protection against inflation for your retirement.

If you are looking for one of the best ways to safeguard your retirement plan and ensure you’ll have the saving required to retire comfortably, precious metal IRA such as Gold IRA can be a good option. Let’s take a look and learn more about investing in Gold IRA.

KEY TAKEAWAYS

- Gold IRA is a self-directed individual retirement account (SDIRA) that invest in physical gold and other precious metals like silver, platinum and palladium.

- Investing in gold using Gold IRA requires you to find the right custodian and Gold IRA companies to get started.

- Gold IRA is a good hedge against inflation and let you take advantage of tax savings through setting up traditional Gold IRAs or Roth Gold IRAs.

- Physical gold purchased through Gold IRA must be stored by a national depository, a financial institute such as a bank or a third-party trustee approved by the IRS.

- Investing in physical gold is a popular method for high net worth individuals to protect their assets and diversify their investment portfolio.

What Is Gold IRA?

Gold IRA is a type of specialized individual retirement account (IRA) that allows you to invest in physical gold and other precious metals such as silver, platinum and palladium through a qualified broker-dealer or other custodian.

With Gold IRA, you can invest in gold and other precious metal such as:

- Bullion

- Coins

- Precious metal related securities

When you are setting up a Gold IRA account for your retirement planning, a gold IRA must be held separately from a traditional retirement account. Depending on the state you are staying, rule involving things such as contribution limits varies.

Gold IRA vs Physical Gold

Gold IRA and buying physical gold are similar in the sense that both are investing in gold and precious metal, tangible assets that can be held physically by the precious metal investor.

Investing in Gold IRA and physical gold are different in a few ways such as; taxation, custodian fees, investment options, liquidity, storage, level of security, control of your assets.

| Feature | Gold IRA | Physical Gold |

|---|---|---|

| Taxation | Allow tax-deferred growth and potential tax-free withdrawals. | Capital gains taxes apply upon sale. |

| Custodian fees | Yes, custodian fees is charged by the IRA custodian. | No custodian fees. |

| Investment options | Can invest in a wide range of precious metal including physical gold and other precious metals, as well as gold ETFs | Can invest in bullion coins, bars, and rounds. |

| Liquidity | Can be sold through the IRA custodian, but may take time to liquidate. | Can be sold quickly, but may incur additional fees and premiums. |

| Storage | Must be stored in an IRS-approved depository such as national depository, a bank or a third-party trustee approved by IRS. | Can be stored anywhere, including keeping your gold at home, but may incur additional expenses if storage facilities is required. |

| Security | High level of security provided by the IRS-approved depository. | Incur additional expenses to add required security measures. |

| Control | Limited control over investment decisions, type of investment depends on your IRA custodian. | Full control over investment decisions, but requires more effort and responsibility. |

While investing in physical gold is the most straightforward, offering more control of your investment, higher level of liquidity and easiest to setup. Essentially, for you to invest in physical gold you’ll just need to:

- Withdraw your money.

- Buy physical gold from jewelry shops and pawn shops.

Investing in physical gold offers less financial advantages on the long term, and you will incur many unnecessary expenses which you can potentially save if you invest in Gold IRA instead.

Investing in Gold IRA offers tax advantages, wider range of precious metal investment options, less worry about storage and security compared to investing in physical gold.

When deciding between investing in Gold IRA vs physical gold, it is important to consider your personal financial goal and preference.

But if you are like me, who will like to take advantage of the potential benefit of investing in Gold IRA when given the opportunity, lets take a look at how to invest in Gold IRA.

How To Invest In A Gold IRA

In order for you to invest in gold or other precious metal using your IRA, there are a few steps you’ll need to take and since it is not as popular as regular IRA account, the process is simple when you have a great Gold IRA company to assist you. But here we will take you step by step on how to start investing in a Gold IRA.

1. Open a Self-Direct IRA Account

Before you can start investing in gold using a Gold IRA, you’ll need to first open a Self-Directed Individual Retirement Account (SDIRA), an IRA account which you can manage directly.

A self-directed IRA account can be open with your custodian.

While there are many custodian for you to choose from most of these financial service and companies only offers regular IRA thus finding the right custodian to open your SDIRA is essential.

- Check with the custodian to see if they allow you to open a Self-Directed IRA account.

- Understand if physical gold is one of their offering prior to opening an account.

- Custodian do not select metal dealers for their IRA clients, you have to choose the right metal dealer for yourself.

However, some dealers may recommended an IRA custodian, and if you have a metal dealer in mind, it is better to ask your trusted metal dealer on which custodian will be a good choice.

There is no right or wrong on which route you choose.

- Start by getting a custodian which offers SDIRA then find your metal dealer.

- Start by find your preferred metal dealer then a getting a custodian that offers SDIRA.

There are many metal dealer and Gold IRA Companies available, such as GoldBroker which is rated 4.8 out of 5.0 on Trustpilot with 39 verified reviews.

Always do your homework before choosing the custodian or the metal dealer for your investment.

2. Find The Right Gold IRA Custodian

Finding the right Gold IRA custodian is probably one of the hardest step you’ll need to take. The custodian needs to be an IRS-approved financial institute such as a bank, trust company, or a brokerage that offer gold for your IRA.

If you are going to purchase Gold or other precious metal using your IRA, you cannot hold physical gold or any precious metal at home. You must find a custodian that can help you process these assets to a safe depository.

Your IRA custodian is responsible to help you manage and safeguarding your assets that is held within your gold and silver IRAs.

When choosing the right custodian you may want to consider these criteria:

- Reviews: Look and research on the reviews of the custodian service by independent websites.

- Secure: Excellent security with system in place to protect your assets and your personal data.

- Fees: Acceptable or low fee structures that is simple to understand and no hidden charges.

- Assets: Wide range of asset choice including buying physical precious metal such as gold IRA investment.

- Ease-of-Use: Ease of account setup and investing processing can help you reduce your headaches when you are doing your investment with your self-directed IRA.

- Expertise: Industry expertise and size of the custodian maybe something you may consider, some custodian are more specialized, while others are more general.

When you invest in precious metal using a self-directed gold IRA these are just some things to consider when finding the right custodian that can help you process your assets to a safe depository.

3. Setting Up Self-Directed IRA

When setting up your SDIRA, you can offer to set it up in one of the 2 different ways:

- Traditional IRA: Contribution to your IRA account before it is being Taxed, meaning your tax will be deferred till your withdrawal as current income after age of 60.

- Roth IRA: Contribution to your Roth IRA account after-tax dollars, essentially letting you grow your money tax-free, allowing you to make tax-penalty-free withdrawal after age of 60.

While traditional IRA may make sense to give you more buying power now, some may prefer a Roth IRA over traditional IRA which give you the option to grow your money tax free.

Depending on your personal preference, there is no right or wrong in this matter.

4. Fund Your Account

With your self-directed IRA setup, you will now fund your account through a transfer or a rollover from a qualified plan such as a 401(k), 403(b), or 457 plan.

A rollover is basically the term used to move your fund from an eligible retirement plan or IRA to another. When it is done correctly, the money keeps its tax-deferred status, and doesn’t trigger taxes or early withdrawal penalties. However, you must check with your financial advisor who will advice you what are the process necessary to perform a proper rollover.

5. Choose The Right Gold IRA Company or Precious Metal Dealer

Choosing the right precious metal dealer to use for your gold and precious metal investment is complicated, and it is a task that requires you to do your homework.

While having said that, today there are many Gold IRA companies available for you to choose from. In order to help you to find one that may suit you, here are a few criteria you may want to consider when choosing the right Gold IRA company to use:

- Transparency: Know all the fees and cost upfront, understand any hidden fees that you may need to know before you decided to invest.

- Flexibility: Ensure that the company allow you to have a certain level of flexibility and not just an one-size fit all approach, giving your more level of control for your investment.

- Qualification: Make sure that the company you are dealing with have all the necessary licenses, registrations, insurance to protect your investment. Feel free to ask for verification and clarification before you start trusting your money with them.

Choosing the right metal dealer is probably one of the most important step when investing for your retirement.

Personally, I will choose to invest my money with a reputable Gold IRA company over another which charge less fees but less reputable.

Reputation of the Gold IRA company is my top priority.

6. Select Your Investment

After getting all setup, all you’ll need is to select the type of investment you will want to invest.

- Gold

- Silver

- Platinum

- Palladium

With Gold IRA, you can’t just buy any coin, bar or ingot. In order to qualify as IRA allowable metals and be accepted by STRATA, it must meet a minimum fineness requirement:

- Precious metal must meet 99.5% pure requirement.

- Proof coin must be encapsulated including a certificate of authenticity.

- Bars, ingot, rounds and coins must be accredited and certified by NYMEX,COMEX,NYSE, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government meeting minimum fineness requirements.

The few acceptable gold and other precious metal products are:

- American Eagle bullion and/or proof coins (Eg. American Gold Eagle)

- Australian Kangaroo Nugget bullion and/or coins

- British Britannia

- Chinese Panda coins

- Canadian Maple Leaf coins

- U.S. Buffalo bullion and/or coins

- etc.

7. Start Your Gold And Precious Metal Investment

With your Self-Directed IRA account you get to take advantage of the different price of gold to invest your money in gold and silver at the right time.

As an Gold IRA investor, as the value of gold increases your retirement portfolio increases in it’s value as well.

Gold is generally consider a safe asset to help you beat inflation while hedging against the risk of the market fluctuation of other forms of paper assets such as stocks, bonds and REITs.

Setting Up A Gold IRA Account

The three main things you’ll need to setup a Gold IRA account are:

- Self-Direct Individual Retirement Account (SDIRA) created through preferred self-directed IRA custodian

- Self-Directed IRA custodian that offers investing in physical gold and silver or any other precious metal and works directly with Gold IRA company.

- Gold IRA company or precious metal dealer that are reputable.

With everything setup, your metal dealer or Gold IRA company will help you complete all the necessary transaction and paperwork on your behalf for your gold or precious metal investment.

Finding a good Gold IRA that let you own gold directly is essential if you really want to be sure that you own the gold you invest and pay for.

Check out this quick video by GoldBroker and understand more about what I mean.

Personally, I’ve learn quite a lot on Gold IRA from Augusta Precious Metals, voted as one of the best Gold IRA companies of 2022.

Currently, they have a free gold and silver web conference, if you are interested to learn more, you can click this link and register for their free web conference where they will teach you more about investing in physical gold with Gold IRA. You can ask them any questions in the free conference as well.

Types Of Gold IRA

Gold IRA comes in different forms and as an investor you can choose from one of these few types of Gold IRA.

- Traditional Gold IRAs: Retirement accounts that is funded with pre-tax money, meaning the contribution and growth of any earning are tax-deferred. Generally all withdrawals are taxed only at retirement.

- Roth Gold IRAs: Retirement accounts that is funded with after-tax money, meaning the contribution is after tax is applied. The growth of any earning will not be taxed at withdrawal at your retirement.

- Simplified Employee Pension (SEP) Gold IRAs: Retirement account that are similar to traditional Gold IRA but are designed for self-employed individuals. It is a tax-deferred retirement account where all withdrawals are taxed only at retirement.

Gold IRA Pros and Cons

Like all investment, Gold IRA have its own pros and cons, here are some of the reasons why you may or may not want to consider to use a Gold IRA for your retirement planning.

| Pros | Cons |

|---|---|

| Provides Asset Diversification | Custodian Fees |

| Protection Against Inflation | Storage and Security Costs |

| Tax Benefits | Limited Control Of Asset |

| Potential for High Rate of Returns | Limited Investment Options |

| Professional Guidance | Less Liquidity |

| Hedge Against Market Volatility | High Initial Investment |

Personally, I think Gold IRA investment is a great way to perform diversification of your portfolio if you are looking for a safe way to protect your nest egg against inflation while taking advantage of the tax benefit you can gain from using your IRA.

18% of Americans consider Gold IRA as the best way to invest for the long term and to protect your assets for your retirement.

Many high net worth individuals are moving onto investing in physical Gold using Gold IRA, if you have more than $50,000 lying around, investing in and Gold IRA might be a wise choice.

Alternative Ways To Invest In Gold

Buying physical metal such as gold and silver coins, gold bullion, gold bar using gold or silver IRA from the top Gold IRA companies is probably the best ways to get into gold investment.

Having said so, there are other ways for you to buy gold if you are looking for other alternative ways to invest in gold.

Gold Stocks

Investing in gold related stocks such as companies that perform gold mining can be a great way to invest in gold indirectly.

As an investor, you can profit in two ways.

- Inflation and market’s fluctuation can cause the change of the gold prices. As time passes, the price of gold raises, thus the miner’s profit raises.

- Miner have the ability to increase it’s production overtime, giving the opportunity to increase it’s profit.

Physical Gold

Simplest form of investing in gold is to buy and sell physical gold itself.

While investing in physical gold seems to be simple, it is good to note that buying physical gold is different from investing in physical gold.

When buying gold, there are two forms of gold:

- Investment-grade gold that is at least 99.5% pure, where its value comes form the gold content itself.

- General gold jewelry that it’s value comes from it’s gold content, craftsmanship and branding.

Investment-grade gold generally comes with a certification of accreditation, this is the only form of gold investment that I will personally buy if I am thinking about investing in physical gold.

Gold ETFs

A Gold Exchange Traded Fund (ETF) let you invest in gold without having to buy the physical gold assets.

Gold ETFs let you invest in a diversified portfolio of different gold backed assets while letting you trade gold like stocks making it liquid.

But the downside is that since it is an ETF, it is government regulated as well as subjected to capital gain tax. You may need to pay tax when you sell your shares for a profit.

The Bottom Line

Open a Gold IRA and investing in physical gold in an IRA is a great way to hedge against inflation, and it offers many tax advantages over traditional IRA where you can only invest in stocks, bonds, or REITs.

A gold IRA is a self-directed individual retirement account that allows buy gold, hold gold and sell gold as and when you want, giving you the control required to plan for your retirement.

Funding your IRA account can be done in two different ways:

- Fund your Gold IRA account with your existing retirement account by doing a Gold IRA rollover.

- Fund your Gold IRA account using fresh funds by funding your IRA account.

In order for you to be successful in investing in gold and silver using your IRA, finding the right custodian to setup your SDIRA and choosing the best Gold IRA company in the industry is crucial.

If you are considering investing in gold, trusted Gold IRA companies such as GoldBroker and Augusta Precious Metal can be a good place to get started.

Read Also:

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).