3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Disclaimer: The information on this page is for entertainment purposes only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

DBS, OCBC and UOB are the 3 largest local banks in Singapore. Regulated by Monetary Authority of Singapore (MAS), most Singaporeans entrust their money and life savings to these three local banks.

Listed on the Singapore Stock Exchange (SGX), these banks are the largest bank that holds the top position on the Straits Times Index (STI), making them an attractive investment for dividend investors to earn fat interest rate with their money.

KEY TAKEAWAYS

- DBS, OCBC and UOB are the top local banks in Singapore and these three largest banks in Singapore have been serving people in both Singapore and globally in many countries worldwide.

- Main shareholder of DBS is Temasek Holding, and main shareholder of OCBC and UOB are private individuals and companies that in total control more than 20% of the bank’s shares.

- Profitable investing required you to understand the companies and with the best online trading platforms in Singapore, you can get all the information within a few minutes to make better investing decision.

Singapore Biggest Bank’s Financials Compared

Below is a table where we compared the top banks in Singapore, looking into the few criteria that we will use to valuate each of the banks.

| Details | DBS Bank | OCBC Bank | UOB Bank | Comparison Results |

|---|---|---|---|---|

| Stock Ticker | D05 or DBSM.SI | O39 or OCBC.SI | U11 or UOBH.SI | NA |

| Price | 32.80 | 12.78 | 28.41 | NA |

| P/B Ratio | 1.444 | 1.095 | 1.039 | UOB Bank |

| P/E Ratio | 8.70 | 8.94 | 8.73 | DBS Bank |

| ROE | 16.91% | 12.22% | 12.29% | DBS Bank |

| EPS Growth (5-Year) | 13.34% | 5.91% | 6.16% | DBS Bank |

| Dividend Yield | 5.50% | 6.28% | 5.70% | OCBC Bank |

| 5-Year Dividend Yield | 4.31% | 4.45% | 4.16% | OCBC Bank |

From the quick comparison, it seems that DBS Bank is a better bank to put you money to invest for dividend income.

However, investing is never so straight forward.

Other than the hard numbers, we need to look at the MOAT, the management team and many other factors of the company before we should invest in the company.

And to do that we should first understand the business of the bank in question before we make any investment choice.

Best High Dividend SGX Listed Bank Stocks To Buy

Many readers have asked me to make a comparison between the biggest banks in Singapore; DBS vs OCBC vs UOB.

These are the three local banks which are also the largest bank in Singapore.

However, among the three banks, one of them is a better investment for dividend income than the rest.

(PS. Just my personal opinion, not an investment advice)

Let’s take a look and dive into each of the banks and gain a deeper understand on each of them now.

1. DBS Bank

DBS Bank is the largest bank amount the local banks. Headquarters in Singapore, DBS operated in over 19 markets worldwide, focusing on three areas in the world for growth:

- Greater China

- Southeast Asia

- South Asia

Offering a huge range of business, DBS offers services such as; retail banking, corporate banking, investment banking, mortgage loans, private banking, wealth management, credit cards, finance and insurance.

Names as the “Global Bank of the Year”, DBS provides a full range of services in consumer, SME and corporate banking.

- Asset under management: $743 Billion

- Employees: >36,000

- Founded In: Year 1968

Stock Financial Data

DBS Bank is trading with the following stock information at the time of writing:

| Details | DBS Bank |

|---|---|

| Stock Ticker | D05 or DBSM.SI |

| Price | 32.80 |

| P/B Ratio | 1.444 |

| P/E Ratio | 8.70 |

| ROE | 16.91% |

| EPS Growth (5-Year) | 13.34% |

| Dividend Yield | 5.50% |

| 5-Year Dividend Yield | 4.31% |

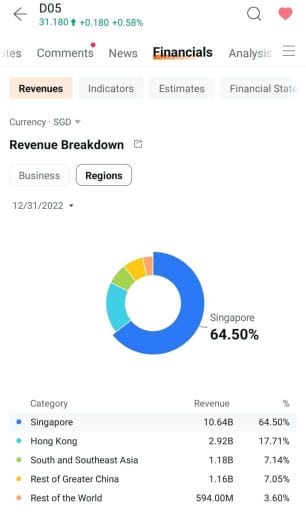

DBS Bank is focused primarily in the Asia region, with Temasek Holdings Pte. Ltd. as the company’s largest shareholder with over 28.81% of shares outstanding.

Moomoo App Snapshot

My Experience with DBS Bank

As a Singaporean, I always get to walk pass DBS branch near my home, and from my observation, I will always see that there are tones of people queuing up at any of the DBS branch.

- Lots of people in the bank

- Lots of DBS branches in Singapore

- Most of the people I know have a DBS account.

So What Does it Mean to You as an Investor?

Meaning DBS is a bank that is trusted and used by most Singaporeans, a bank where it is the leader amount all banks.

Compared to the other bank, DBS Bank is mainly owned by Temasek Holdings Pte. Ltd., which is by Singapore Minister for Finance aka. Singapore Government.

DBS Bank have a very strong MOAT.

My Opinion: DBS Bank is the best Singapore Bank stock, and a great stock to buy and hold for the long term when it is at the right price. With history of issuing special dividends after record high net profit, I am very interested in buying DBS Bank stock.

2. OCBC Bank

OCBC Bank is one of the oldest bank in Singapore, that offers a comprehensive range of banking services and financial solutions.

- Banking service including; Consumer banking, business banking, international banking, global treasury and investment management.

- Business outside of the banking sector which including; financial futures, regional stockbroking, trustee, nominee and custodian services, property development and hotel management.

Offices in 15 countries and territories including Singapore, Malaysia, Indonesia, Vietnam, China, Hong Kong SAR, Brunei, Japan, Australia, UK and USA.

OCBC Bank is named as World’s Top 50 Safest Banks that serve wide range of customer worldwide and is a known household name in many countries.

- Asset under management: $258 Billion

- Employees: >15,480

- Founded In: Year 1932

Stock Financial Data

OCBC Bank is trading with the following stock information at the time of writing:

| Details | OCBC Bank |

|---|---|

| Stock Ticker | O39 or OCBC.SI |

| Price | 12.78 |

| P/B Ratio | 1.095 |

| P/E Ratio | 8.94 |

| ROE | 12.22% |

| EPS Growth (5-Year) | 5.91% |

| Dividend Yield | 6.28% |

| 5-Year Dividend Yield | 4.45% |

OCBC Bank is focused primarily in the Asia region, with Selat Pte. Ltd. a Singaporean family owned company owning 14.45% of the bank’s share.

Moomoo App Snapshot

My Experience with OCBC Bank

Like many Singaporeans, I open bank account in OCBC because I don’t usually need to queue for a very long time to get to the counter at their bank’s branch.

- Average number of people at the bank

- Average number of OCBC branches in Singapore

- Some people who hate to queue do open their account in OCBC

So What Does it Mean to You as an Investor?

OCBC Bank is one of the oldest bank in Singapore that have been around for over 90 years. While the history of the bank is long, it is mainly controlled by a few big private companies.

This means most decision are made by a few key individuals, as long as the few key individuals make good business decision we as shareholders will be in good shape.

However, if the key shareholders make bad business decision or have internal conflicts within the company (or family drama), we will be exposed to the risk as well.

OCBC Bank have a strong MOAT.

My Opinion: OCBC Bank have a long track record of being one of the best banks in the world, with over 90 years of history of managing. With the right price, it can be a good dividend stock to buy.

3. UOB Bank

OUB Bank is a bank with over 90 years of history and it is leading bank ranked ‘Aa1’ by Moody’s Investors Service and ‘AA-‘ by both S&P Global and Fitch Ratings. UOB offers a comprehensive range of banking services and financial solutions.

- Banking service including; Personal financial services, private banking, trust services, commercial and corporate banking, investment banking, corporate finance, capital market activities, treasury services, futures broking, asset management, venture capital management, general insurance, life assurance and stockbroking service

- Business outside of the banking sector which including; travel, leasing, property development and management, hotel operations and general trading.

Offices in 19 countries and territories including Singapore, Malaysia, Indonesia, Vietnam, China, Hong Kong SAR, Brunei, Japan, Australia, UK and USA.

Headquarter in Singapore, UOB Bank have a global reach around the world.

- Asset under management: $459 Billion

- Employees: >18,303

- Founded In: Year 1935

Stock Financial Data

OUB Bank is trading with the following stock information at the time of writing:

| Details | UOB Bank |

|---|---|

| Stock Ticker | U11 or UOBH.SI |

| Price | 28.41 |

| P/B Ratio | 1.039 |

| P/E Ratio | 8.73 |

| ROE | 12.29% |

| EPS Growth (5-Year) | 6.16% |

| Dividend Yield | 5.70% |

| 5-Year Dividend Yield | 4.16% |

UOB Bank is focused primarily in the Asia region, with a few key shareholders owning most of the bank, with the top shareholder Cho-Yaw Wee owning 10.75% of the bank’s share.

Moomoo App Snapshot

My Experience with UOB Bank

My experience with UOB Bank have been quite pleasant, however unlike DBS and OCBC bank, it seems to me that UOB Bank have less branch than the other.

- Average number of people at the bank

- Quite a few UOB branches in Singapore

- Customer service in UOB is quite good

So What Does it Mean to You as an Investor?

UOB Bank like OCBC bank are one of the oldest bank in Singapore that have been around since the second world war. The bank main shareholders are mainly a few key individuals and companies.

In other worlds the business decision of the bank is determined by a few key individuals. With these individuals holding majority of the banks’ stocks, as long as they make good financial decisions we are in good hands.

Like OCBC Bank, the main risk is any form of internal conflicts within the company (or family drama) which I believe the chances should be low, since it have been around for such a long time.

UOB Bank have a strong MOAT.

My Opinion: UOB Bank have a long history of over 90 years, surviving many market crashes and world wars. With the right price, I think it can be a good dividend bank stock to buy.

Which Singapore Bank Stocks To Buy For High Dividend Yield?

All 3 Singapore Bank, DBS, OCBC, and UOB are biggest banks listed on the SGX that offers amazing investment opportunity for investors to buy and earn dividend.

Even during time of market volatility, Singapore banks have performed well for the past decades.

With business in both Singapore market and global market, OCBC, UOB and DBS banks are known for their stability and prudence in business management.

Depending on each individual, you may want to choose one over the other.

Personally, I like DBS more than the other banks, however, you may choose otherwise.

And here is why.

Criteria For Selecting The Best High Dividend Singapore Bank Stocks

Finding the best high dividend Singapore bank stocks requires you to check on a few things as an investor.

As an investor we should not only rely on 1 or 2 criteria for our assessment but a combination of them.

Here are some criteria that I personally use during my assessment:

1. Price of Stock

The bank’s current stock market price should not be confused with the value of the bank itself.

Price is NOT equal to value.

However, it is good to know what is the price now compared to the historical price to get a rough gauges of “how expensive” or “how cheap” is the bank being priced now.

2. Price to Book Ratio (P/B ratio)

Price is what the public think the bank stock should be sold at, and the book value is how much the bank is valued according to it’s tangible assets.

While it can be a good gauges for some company stocks, it do not include the value of the intangible assets such as the branding of the bank itself.

3. Price to Earnings Ratio (P/E ratio)

Earnings is what makes a business profitable and the price to earning ratio give an indication on how much you need to pay in order to earn a dollar in return.

Regardless of which company including banks, a lower number is almost always better than a higher number.

4. Return on Equity (ROE)

Like P/E ratio, the ROE look into the bank’s profitability and efficiency in generating returns from shareholders’ equity.

Meaning, a better bank will have a higher ROE, a number which I like to look at when seeing which bank is a good buy.

5. Earnings Per Share Growth (EPS Growth)

Not sure if you notice, if you buy a stock that grow it’s earnings over time, time become your friend.

Buying a Singapore Bank stock that have a good EPS growth means that it’s earning grow as you hold the stocks.

As an lazy investor who just love to hold and wait for money to come into my pocket, a bank stock with good EPS growth is always top of my priority list.

6. Dividend Yield

Dividend yield is always just a guidance, it tells me how much the bank is currently paying their investors in dividend.

A high yield may not always be a good thing, and a low yield may not always be bad.

However measuring the annual dividend payment relative to the stock’s market price will give me an idea on the return on investment in dividends.

7. Dividend Yield 5 yr-average

The 5-year dividend average give me an idea on how stable the dividend is given by the bank to their investors.

Is the dividend more now? or is it less now?

Something which I will look into when doing dividend investing.

8. MOAT

Even if all other criteria passes and the MOAT is subpar, I will not buy the bank’s stock.

Quick question, “Will you buy a stock from a bank called “Uluuluu Bank?”

No? Is it because you’ve never heard of it?

Yup, that’s the same reason why I won’t buy stock with no MOAT.

Getting The Best Low Fee Online Brokerage In Singapore to Buy Bank Stocks

There are many online brokerage in Singapore and amount them, some of these brokerage offers low-fee solution for investing, helping you increate your investing returns.

While I’ve listed some of the best online trading platform for beginners in Singapore in my other article. There is one online trading platform that stand out amount the rest.

Moomoo Singapore, a MAS regulated online brokerage platform offers the best low-cost solution to investing and trading.

- Designed as an user-friendly Trading App

- Offer various trading products with access to both local (SG) and international markets (US, HK, CN)

- Offer free advance trading tools and charting tools.

Moomoo SG platform is designed for both new and experienced investors.

Currently, they are offering some attractive promotions for all new signups. Go check it out if you are looking for a good online broker with low fees for your trades.

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Final Thoughts On Choosing The Best Singapore Bank Stocks To Buy

Setting criteria when choosing the best bank stocks to buy helps you to make informed decisions when deciding which high dividend Singapore bank stocks to buy.

With my own experience as an investor, different types of stocks requires you to utilize different criteria to assess the stocks.

There is no “one-size-fits-all” solution to stock picking.

Remember, thorough research, careful analysis, and a long-term perspective are vital for successful stock picking.

However, through learning the different fundamental analysis, technical analysis and understanding the stock you are intending to invest, it will help you make sound investment choices that you will not regret later.

- Fundamental analysis is value investor’s tool kit to identify good and even great stocks.

- Technical analysis is a great way to look at the short term movement of the stocks price and understanding the general consensus of the short-term future of the stock price.

Here are my beginner investor starters guide if you want to get to know more about investing:

- Open a New Brokerage and CDP Account To Start Trading in Singapore

- Best stock trading platform in Singapore for beginners.

- Buying Singapore Stocks For Beginners, a step guide.

- Buying US Stocks in Singapore with ZERO Commission fees.

- Buying China Stocks from Singapore.

- List of Best Low-Risk Investment to invest in Singapore.

- Best Cash Management Account (CMA) in Singapore to grow your idle cash right now.

Before you go, here are some handpicked articles that you maybe interested:

Frequently Asked Questions (FAQs)

Disclaimer: I may or may not have invest in any of them, what’s listed here is only for entertainment purpose only and it should never be used as any form of investment advice. This is my diary on my stock analysis, while I’ve been investing for +15 years, I am still learning. I wish to share what I learn during my investment journey so you may learn from both my success and mistakes. Enjoy!

- Dividend Investing Singapore: Complete Beginners Investor Guide

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Price to Sales Ratio (P/S Ratio): Investor’s Guide to Valuation Metrics When Profit is Absent

- Price to Earning Ratio: Dividend Investor’s Essential Metric to Know

- 3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).