5 Best Gold ETFs to Buy For Profitable Gold Investing Portfolio in 2024 (New)

Disclaimer: The information on this page is for entertainment purposes only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Gold investing is known as the best way to protect yourself against inflation, a popular commodity trade by investors for centuries.

As an investor, Gold Exchange-Traded Fund (ETFs) offers you an easy way to gain exposure to gold, helping you to diversify your investment portfolio, even if you’ve just started learning about investing.

Here we’ve put together a list of Gold ETF that you may want to consider if you are looking to invest in gold in this uncertain time.

KEY TAKEAWAYS

- Gold ETFs offers you high liquidity, low cost, simple solution to physical gold investing without requiring you to buy gold bars and gold bullions to put in your home..

- There are different types of Gold ETFs; Gold ETFs that tracks the price of physicals gold, Gold ETFs that tracks the performance of business that engage in the business of gold mining.

- Choosing the right online trading platform will give you more Gold ETFs options to trade as these specialized ETFs are only listed in the major stock exchange such as; United States, China, Hong Kong and Singapore.

5 Best Gold ETFs to Buy To Create Your Gold Portfolio

Gold ETFs offers investors to invest in gold market without holding the physical gold.

To make your life easier, here is a quick comparison table to compare some of the best Gold ETFs you can buy today.

| Best Gold ETFs | Index or Benchmark | What It Tracks | Stock Exchange | Expense Ratio |

|---|---|---|---|---|

| SPDR Gold Shares GLD NYSE: O87 SGX: GSD HKEX: 2840 | LBMA Gold Price PM | Price of gold bullion market. | United States (NYSE Arca) Singapore (SGX) Hong Kong (HKEX) | 0.40% |

| abrdn Physical Gold Shares ETF NYSE: SGOL | London PM fix for Gold | Price of gold bullion market. | United States (NYSE Arca) | 0.17% |

| iShares Gold Trust NYSE: IAU | LBMA Gold Price PM | Price of gold bullion market. | United States (NYSE Arca) | 0.25% |

| SPDR® Gold MiniShares® NYSE: GLDM | LBMA Gold Price PM | Price of gold bullion market. | United States (NYSE Arca) | 0.10% |

| iShares MSCI Global Gold Miners ETF NASDAQ: RING | MSCI ACWI Select Gold Miners Investable Market Index | Track the performance of companies engaged in the business of gold mining. | United States (NASDAQ) | 0.39% |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the Gold ETFs, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing.

Best Gold ETF To Create Your Gold Portfolio

If you don’t want to buy physical gold, the best way to invest in gold and other precious metals is through the stocks market.

1. SPDR Gold Shares GLD (NYSE: O87)

SPDR Gold Shares GLD is the largest physical Gold ETF backed by gold, designed to reflect the performance of the price of gold bullion.

As the oldest Gold ETFs in the United States, it offers the highest level of liquidity for investors to buy and sell their gold holding in the market. The shares of this Gold ETF are traded in multiple biggest stock exchanges around the world.

Stock Exchange includes United States (NYSE), Singapore Stock Exchange (SGX) and Hong Kong Stock Exchange (HKEX):

- Name (Code): SPDR Gold Shares GLD (O87) in the United States

- Name (Code): SPDR Gold Shares GLD (GSD) in Singapore

- Name (Code): SPDR Gold Shares GLD (2840) in Hong Kong

Important details:

- Expense ratio: 0.40%

- Index: LBMA Gold Price PM

- Tracking: Price of gold bullion market

Information on the Gold ETF:

- Physical Gold Held: 29,640,129.54 ounce.

- Assets Under Management: US$57,147 Million

- Vault Location: London and several other custodians worldwide

- Custodian: HSBC Bank Plc

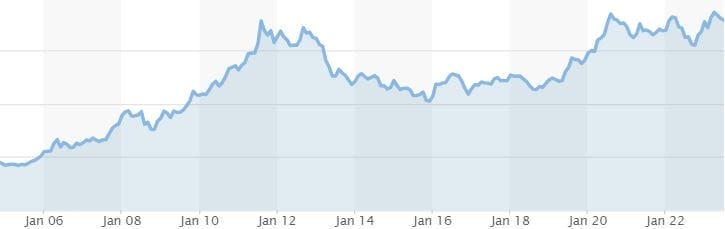

Here is the performance of SPDR Gold Shares GLD for the past 5 years, the returns are shown as annual return.

My Opinion

SPDR Gold Shares GLD is the largest Gold ETFs that holds physical gold in various locations. Among Gold ETFs, this is one of the few that is listed in multiple foreign exchanges. Offering the highest level of liquidity for gold investors to play on gold prices. With this, you can easily trade on the fluctuation of the gold prices.

2. abrdn Physical Gold Shares ETF (NYSE: SGOL)

abrdn Physical Gold Shares ETF is a physically-backed Gold ETFs that holds physical gold bullion bars stored in secure vaults. This is one of the few Gold ETFs that have it’s vault location located across the different region such as London, UK, Zurich, and Switzerland.

Stock Exchange includes United States Stock Exchange (NYSE):

- Name (Code): abrdn Physical Gold Shares ETF (SGOL)

Important details:

- Expense ratio: 0.17%

- Index: London PM fix for Gold

- Tracking: Price of gold bullion market

Information on the Gold ETF:

- Physical Gold Held: 1,347,398.18 ounce.

- Assets Under Management: US$2,810 Million

- Vault Location: London, UK, Zurich, Switzerland, etc.

- Custodian: J.P. Morgan Chase Bank, N.A

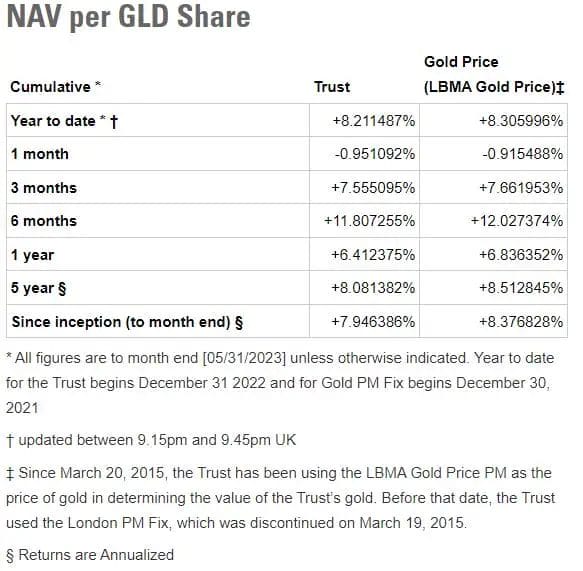

Here is the performance of abrdn Physical Gold Shares ETF for the past 10 years, the returns are shown as annual return.

My Opinion

abrdn Physical Gold Shares ETF is not as popular as the other Gold ETFs, but it offers one of the lowest expense ratio making it a good choice for long-term investing. If you are looking to buy and hold gold, this maybe a good option.

3. iShares Gold Trust (NYSE: IAU)

iShares Gold Trust is one of the largest Gold ETFs with billions in assets that tracks the day-to-day movement of the price of gold bullion. Amount Gold ETFs, this is one of the few companies where the vault is located in New York London and several other custodians worldwide. Helping you to diversify your portfolio of gold and help protect you against inflation.

Stock Exchange includes United States Stock Exchange (NYSE):

- Name (Code): iShares Gold Trust (IAU)

Important details:

- Expense ratio: 0.25%

- Index: LBMA Gold Price PM

- Tracking: Price of gold bullion market

Information on the Gold ETF:

- Physical Gold Held: 14,427,192.78 ounce.

- Assets Under Management: US$27,820 Million

- Vault Location: New York, London and other custodians worldwide

- Custodian: J.P. Morgan Chase Bank, N.A

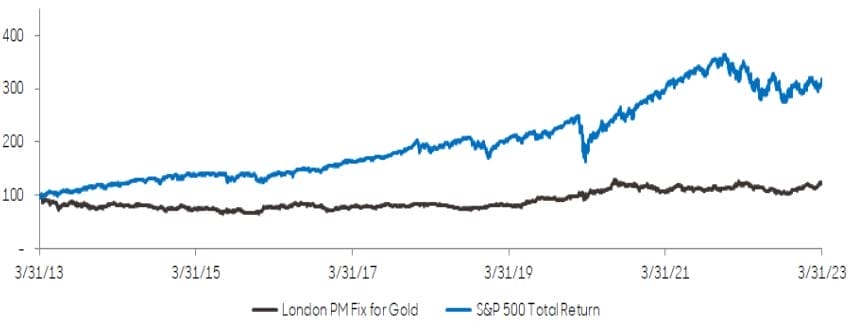

Here is the performance of iShares Gold Trust for the past 10 years, the returns are shown as annual return.

My Opinion

iShares Gold Trust offers a low cost option to invest in physical gold bullion and gold bars. With it’s gold held in various location, it offers diversification of your gold assets making it even more safer as an low risk investment.

4. SPDR Gold MiniShares (NYSE: GLDM)

SPDR® Gold MiniShares® is a physically gold-backed ETF listed on the U.S. stock exchange. While it is highly similar to SPDR Gold Shares GLD, SPDR Gold MiniShares offers one of the lowest expense ratio for physically gold-backed ETF option. The ETF was created for retail investors that focus on cost, so they don’t lose market share to other low cost Gold ETF.

Stock Exchange includes United States Stock Exchange (NYSE):

- Name (Code): SPDR® Gold MiniShares® (GLDM)

Important details:

- Expense ratio: 0.10%

- Index: LBMA Gold Price PM

- Tracking: Price of gold bullion market

Information on the Gold ETF:

- Physical Gold Held: 3,203,869.58 ounce.

- Assets Under Management: US$6,178 Million

- Vault Location: London and several other custodians worldwide

- Custodian: ICBC Standard Bank Plc

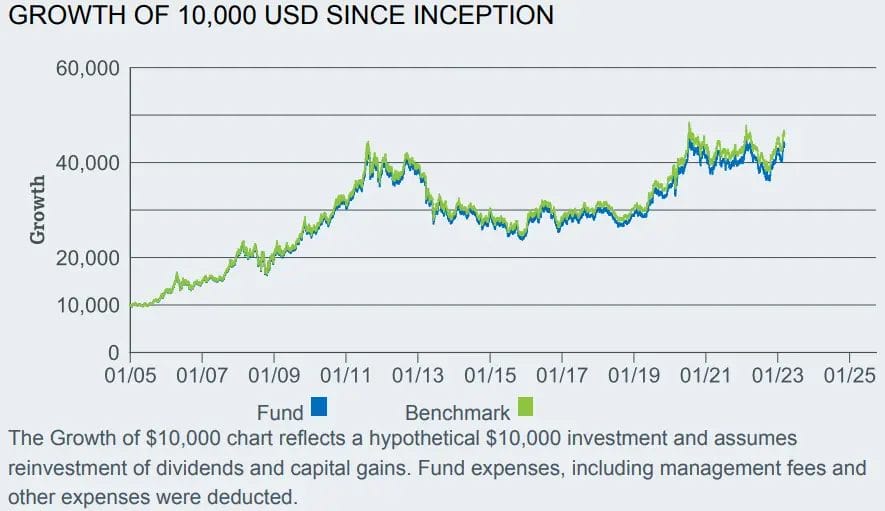

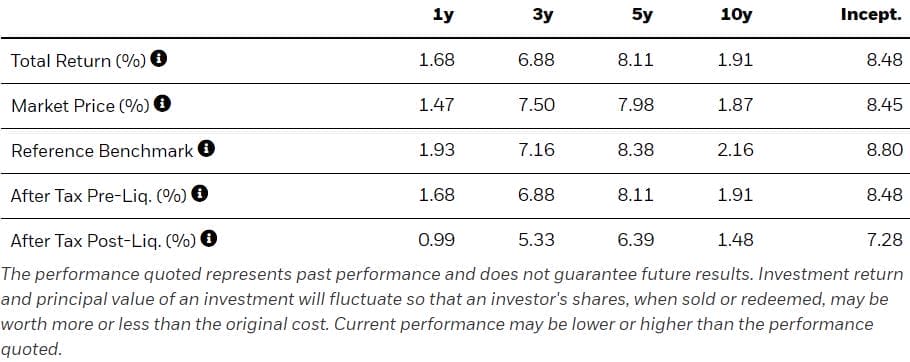

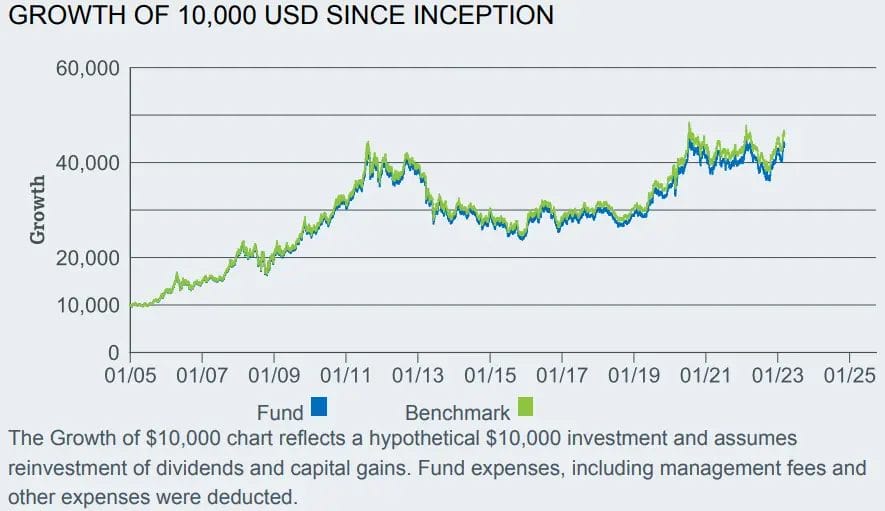

Here is the performance of SPDR Gold MiniShares since the inception of the ETF, the returns are shown as annual return.

My Opinion

SPDR Gold MiniShares is a great option for those who are looking to investing in physical gold for the long term. While it’s liquidity is not as high as the rest of the Gold ETFs, it offers one of the lowest expense ratio making it a good option for long-term gold investing.

5. iShares MSCI Global Gold Miners ETF (NASDAQ: RING)

iShares MSCI Global Gold Miners ETF is one of the largest Gold ETF that tracks the performance of companies primarily engaged in the business of gold mining. Gaining an indirect exposure to gold prices without holding physical gold itself.

- Exposure to companies that generate revenue from gold mining.

- Holds a basket of global gold mining stocks.

- Expose to global gold sector that is influence by the future price of gold as well as the management of the mining business.

Amount Gold ETFs, this offers the perfect opportunity for investors who are interested in gold investing as well as investing in income generating business.

Stock Exchange includes United States Stock Exchange (NYSE):

- Name (Code): iShares MSCI Global Gold Miners ETF (RING)

Important details:

- Expense ratio: 0.39%

- Index: MSCI ACWI Select Gold Miners Investable Market Index

- Tracking: Track the performance of companies engaged in the business of gold mining.

Information on the Gold ETF:

- Assets Under Management: US$405.97 Million

- Distribution: Semi-Annual

- Annual Dividend Yield: 2.17% (Approx.)

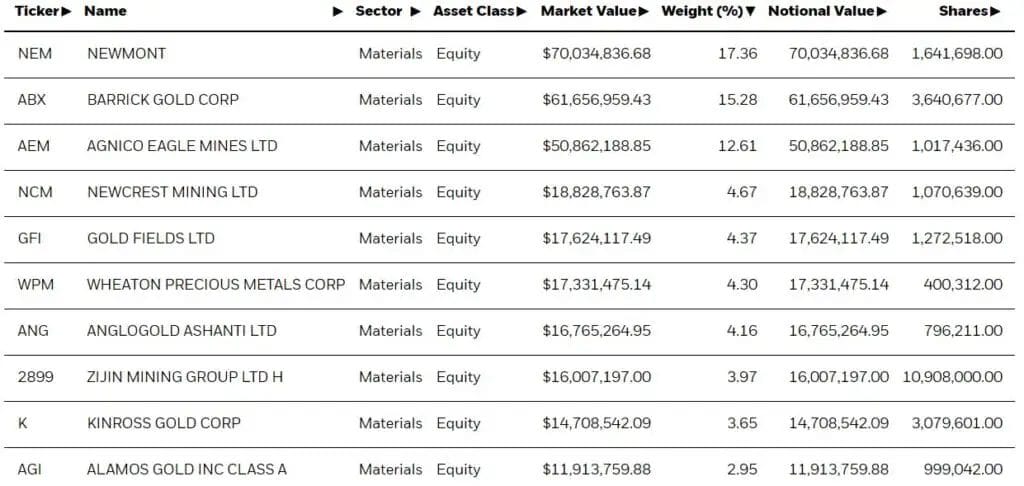

Holdings & Weightage

As one of the largest mining Gold ETF, the top 10 holding of the ETF sum up to 73.32% of the overall portfolio. The top 3 holding weighing almost half of the overall portfolio at 45.25% of the ETF’s portfolio.

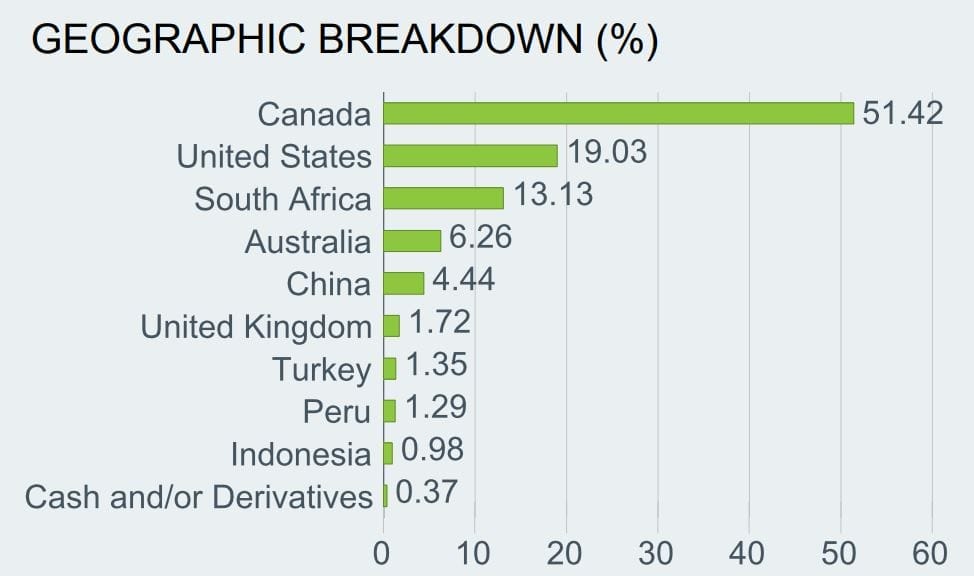

Country and Sector Allocation

With this mining Gold ETF, most of the companies it holds is mainly located in Canada, followed by United States and South Africa.

My Opinion

iShares MSCI Global Gold Miners ETF is an good option for those who are looking to invest in business that is influence by the prices of the gold. Unlike other Gold ETFs, it is one of the few best Gold ETFs with dividends.

Why Should You Consider Investing In Gold ETFs?

Investing in precious metal such as gold is a great way to protect yourself against market uncertainties and a hedge against inflation.

However, investing in physical gold comes with a few huge disadvantages such as:

- Lacks liquidity to quickly liquidate your gold for cash.

- Extremely bulky and heavy making it extremely difficult to store a huge amount of gold.

- Requires investment in storage facilities and secures of the physicals gold to protect your gold from being stolen.

Gold ETFs on the other hand offers investors a simple way to buy and sell gold like stocks while protecting the investors from inflation.

- High level of liquidity

- No requirement of storage huge amount of gold.

- No requirements of investing in storage facilities and security to protect your gold.

How to Choose The Right Gold ETF to Buy?

Choosing the right Gold ETF for your investment depends on your investment goal. Today, there are many types of Gold ETFs you can choose from, such as:

- Gold ETF that tracks the price of gold.

- Gold ETF that tracks the performance of gold related business.

Choosing Gold ETFs That Tracks Price of Physical Gold

Depending on what you want, most investors will choose to invest in Gold ETFs that tracks the price of gold.

However, when looking at these form of ETFs, you need to take note of the following:

- Replication Method: Check if the Gold ETFs is backed by physical gold bullion. A good Gold ETF should be backed by gold deposits.

- Expense ratio: Understand the expense ratio for the Gold ETF: This is the expense you need to pay for managing the fund, thus lower the expense ratio the better.

- Asset Under Management (AUM): Review how much asset is the ETF managing. Generally, more AUM the better.

- Custodian: Understand who are the custodian of the Gold ETF, check for trustworthiness of the custodian.

- Vault Location: Understand the vault location of the gold. This is up to your own preference on where the vault should be located.

As an investor, it is good to know that invest in Gold ETFs that tracks the price of gold, this ETFs are tracking the price of a commodity and not a business, thus there will not be any dividend payout for the investors.

Choosing Gold ETFs That Tracks Performance of Gold Related Business

Gold related business mainly refers to gold mining companies, these companies’ profitability is highly related to the value of gold. Some Gold ETFs are made up of a basket of mining stocks as well as other gold related business.

When choosing these types of Gold ETFs, here are some things to take note:

- Size of Mining Business: Understand if they are Junior gold miners or Senior gold mining companies. Junior gold miners are prime beneficiaries of rising gold demand while Senior gold mining companies are less sensitivity to underlying gold price movements.

- Benchmark: Similar to investing in regular ETFs, you’ll want to understand the holding and weighing of each companies that make up the Gold ETF.

- Expense Ratio: Expense you will need to pay for managing your fund. Lower the better.

Investing in Gold ETFs that tracks the performance of gold related business offer investor the possibility of getting an dividend income as it is tracking the performance of income generating business.

These Gold ETFs are the only few Gold ETFs with dividends.

While the dividend paid is not as high as common dividend paying stocks, Gold ETFs that pay dividends can be a good option for investors who love passive income and gold.

However, dividend payment is not mandatory, it depends on the management of the companies for any dividend payment to it’s shareholders.

How to Invest in Gold ETFs?

Investing in Gold ETFs is simple, it is similar to how you invest in any stocks. As Gold ETFs are essentially commodity funds that trade on the stock exchange.

To invest in Gold ETFs here are the steps:

- Understand the different Gold ETFs on the market.

- Identify the top Gold ETFs you are looking to buy.

- Understand which stock market is the Gold ETFs listed.

- Create an online brokerage account that let you gain access to buying the Gold ETFs.

- Fund your brokerage account and invest directly in gold through the stock exchange.

Should You Consider Investing in Gold ETF?

Gold ETFs that tracks the price of gold will have it’s price moves similar to the price of physicals gold, this will allow investors looking to invest in gold without holding the gold itself.

If you want to gain exposure to physical gold but do not want the headache of storing the gold itself, Gold ETFs may help you to do just that. Gold ETFs provide many benefits such as:

- Higher level of liquidity and letting you liquidate your Gold ETF holdings anytime like normal stocks.

- Buy and hold gold at low fees in the form of expense ratio.

- Protects you from the volatility of the other investment assets.

Investing in Gold ETFs is a great alternative to buying and holding physical gold.

Having a small portfolio of your investment in gold can be a good option, if you have a lot of spare cash to put aside.

However as an dividend investor who is actively building my wealth and income, I will still prefer to invest in things that pays a dividend, or business that generates an income.

Check out these handpicked articles that you might be interested:

- Best Dividend Stocks In Singapore

- Best High Dividend REITs in Singapore

- Best Singapore Bank Stocks For Dividend

- Best REITs ETFs to Buy for High Dividend in Singapore

- Best S&P 500 ETF to Buy for Long-Term

- Best Dividend ETFs to Buy in Singapore

Disclaimer: I may or may not have invest in any of them, what’s listed here is only for entertainment purpose only and it should never be used as any form of investment advice. This is my diary on my stock analysis, while I’ve been investing for +15 years, I am still learning. I wish to share what I learn during my investment journey so you may learn from both my success and mistakes. Enjoy!

- Dividend Investing Singapore: Complete Beginners Investor Guide

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Price to Sales Ratio (P/S Ratio): Investor’s Guide to Valuation Metrics When Profit is Absent

- Price to Earning Ratio: Dividend Investor’s Essential Metric to Know

- 3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).