How to Invest in The Best S&P 500 Index ETFs From Singapore in 2024 (Updated)

Disclaimer: The information on this page is for entertainment purposes only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

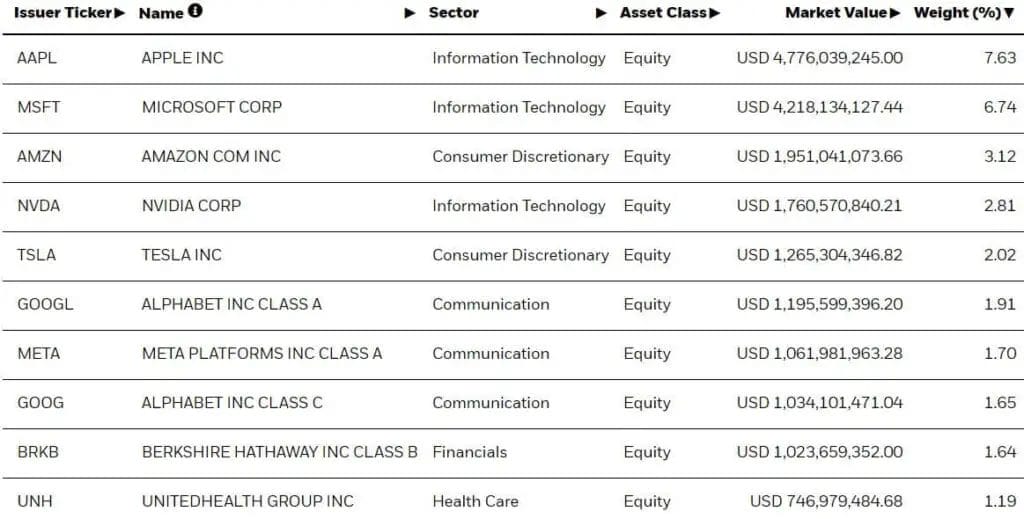

Are you looking to invest in some of the top stocks listed on the United States stock exchange such as Apple, Google and Tesla?

With S&P 500 ETF, you can invest in the top companies in the United States passively without requiring you to buy all the individual stocks yourself.

Let’s take a look at what is S&P 500 index and how you can start investing in some of the biggest companies from Singapore.

KEY TAKEAWAYS

- S&P 500 ETF offers low cost, easy access to the top 500 companies in the United States.

- SPDR S&P 500 ETF is the only ETF listed in the Singapore Exchange (SGX:S27), all other ETFs are listed in NYSE and LSE.

- Using the right online trading platform offers you more options on the type of S&P500 ETFs to invest and trade. Depending on your online brokerage account you can invest in the stock exchange listed in; United States, China, Hong Kong and Singapore.

What is the S&P 500 Index?

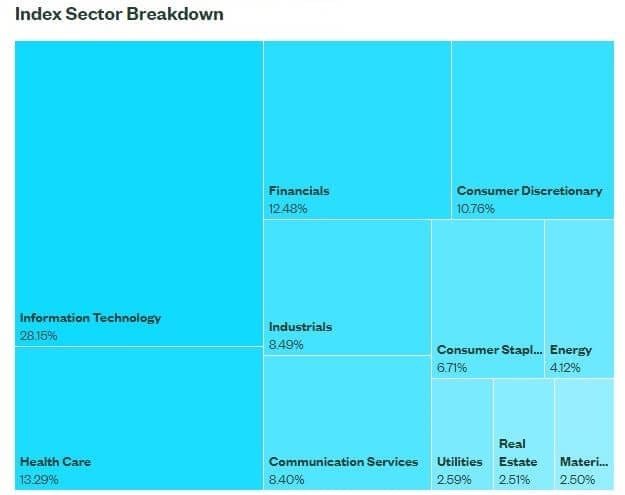

The S&P 500 Index, or Standard & Poor’s 500 Index is a stock market index that consist of the 500 leading publicly traded companies in the U.S. It is a market-capitalization-weighted index that is used to measure how well the stock market is performing overall.

In this index, it consist of companies that are publicly traded in exchanges such as the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Companies which are privately own will not be included in the index.

What are the S&P 500 ETFs?

S&P 500 ETFs are passively managed Exchange-Traded Funds (ETFs) that tracks the top 500 large-capitalization U.S. equities.

With S&P 500 ETFs it seeks to provide investment results that reflect the price and yield offered by the index before any expenses.

Low cost, highly diversified and extremely popular, S&P 500 ETFs offers Singaporeans the option to invest in the largest companies listed in the U.S. from the comfort of Singapore.

Various S&P 500 ETFs is currently listed in various exchanges such as:

- Singapore Stock Exchange (SGX)

- New York Stock Exchange (NYSE)

- London Stock Exchange (LSE)

- Swiss Stock Exchange (SWX)

- NYSE Euronext

- Santiago Stock Exchange (SSE)

- Tel Aviv Stock Exchange (TASE)

- Milan Stock Exchange (MTA)

- German Stock Exchange (XETR)

- Mexican Stock Exchange (BMV)

- Colombia Stock Exchange (BVC)

Best S&P 500 ETF to Buy or Sell For Singaporeans

Today, there are many options for investors to choose from when investing in S&P 500 ETFs. While all ETFs tracks the S&P 500 Index, each of the ETFs are different from each other in one or more ways.

Let’s take a quick look comparing the top S&P 500 ETFs in the table below:

| Best S&P500 ETFs | Expense Ratio | Assets Under Management | Fund Domicile | Stock Exchange | Fund Management | Dividend Distribution | Use of Income |

|---|---|---|---|---|---|---|---|

| SPDR S&P 500 ETF SGX: S27 NYSE: SPY | 0.09% | US$423 Billion | US | SGX, NYSE | State Street Global Advisors | Quarterly | Distributing |

| iShare Core S&P 500 ETF NYSE: IVV | 0.03% | US$331 Billion | US | NYSE | Blackrock | Quarterly | Distributing |

| Vanguard S&P 500 ETF NYSE: VOO | 0.03% | US$296 Billion | US | NYSE | Vanguard | Quarterly | Distributing |

| Vanguard S&P 500 UCITS ETF DIST LSE: VUSD | 0.07% | US$33 Billion | Ireland | LSE, SWX, NYSE Euronext | Vanguard | Quarterly | Distributing |

| iShare Core S&P 500 UCITS ETF ACC LSE: CSPX | 0.07% | US$63 Billion | Ireland | LSE, SWX, NYSE Euronext, SSE, TASE, MTA, XETR, BMV, BVC | Blackrock | NA | Accumulating |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the S&P 500 ETFs, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing.

1. SPDR S&P 500 ETF (Listed on SGX & NYSE)

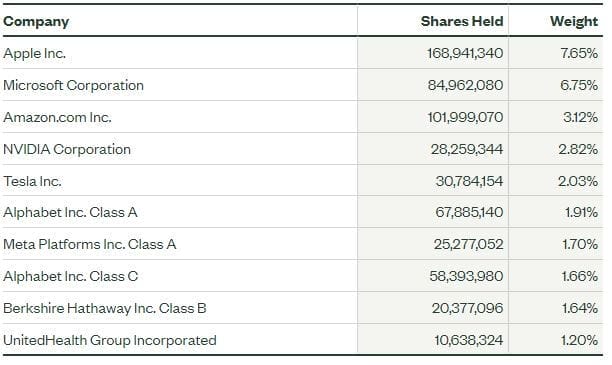

SPDR S&P 500 ETF is the first S&P 500 US ETF to be listed on the national stock exchange with the ticker symbol SPY. This is the oldest ETF that track the S&P 500 companies that made up the US index using the full replication method.

As a Singaporean, it is good to know that SPDR S&P 500 ETF is the only S&P 500 ETF listed on the Singapore Exchange. Meaning this particular ETF is regulated by the Monetary Authority of Singapore (MAS).

Stock Exchange where this ETF is listed includes United States (NYSE) and Singapore Stock Exchange (SGX):

- Name (Code): SPDR S&P 500 ETF (SGX: S27) in Singapore

- Name (Code): SPDR S&P 500 ETF (NYSE: SPY) in the United States

Important details:

- Expense ratio: 0.09% p.a.

- Currency: USD

- AUM: US$380 Billion

- Fund Manager: State Street Global Advisors

- Other: Listed on the Singapore Exchange (SGX)

Information on dividend:

- Dividend Distribution: Quarterly

- Use of Income: Distributing

- Fund Domicile: United States

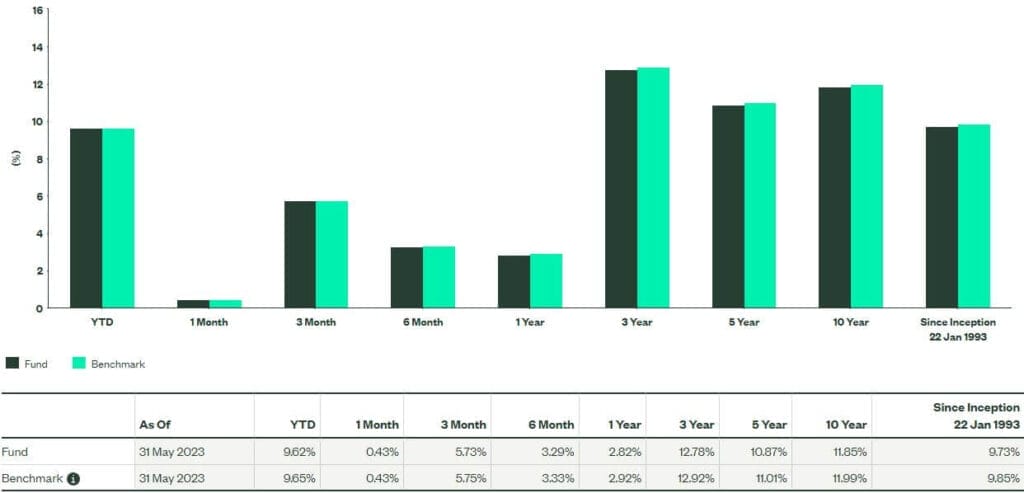

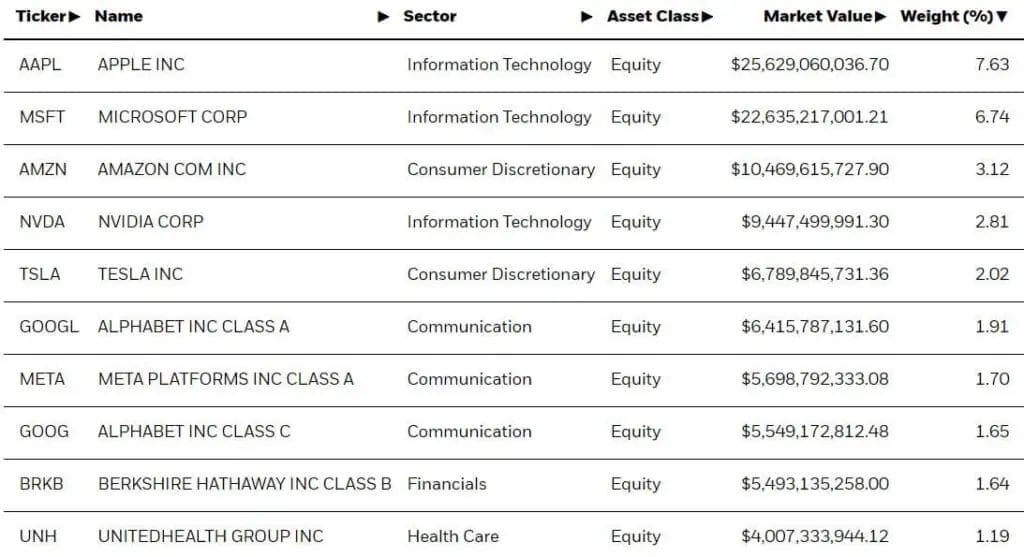

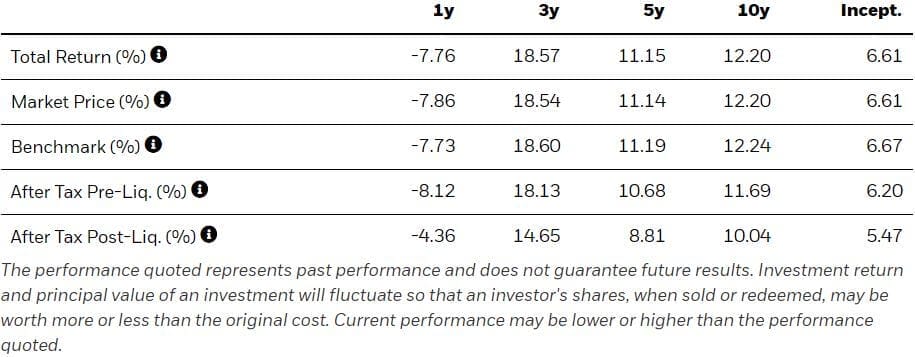

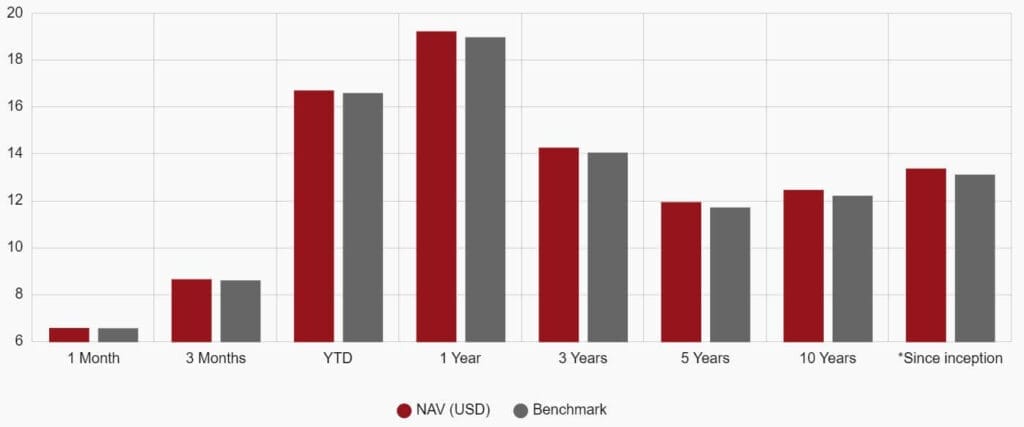

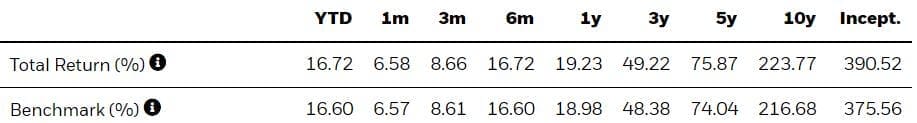

Here is the performance of SPDR S&P 500 ETF for the past 10 years, the returns are shown as annual return.

My Opinion

Listed with the ticker symbol S27 (SGX) and SPY (US) you can invest in the top 500 companies listed on the US stock exchanges.

If you are looking for S&P 500 ETF for Singaporeans, SPDR S&P 500 ETF is the only EFT that is listed on the Singapore Stock Exchange (SGX), that let Singaporeans directly invest in a S&P 500 index.

However, when trading this ETF, you will be using USD to trade instead of SGD, thus foreign currency exchange rate need to be taken into account when buying and selling in the Singapore Exchange.

2. iShare Core S&P 500 ETF (IVV)

iShares Core S&P 500 ETF utilized the physical replication method to replicate the index performance of 500 large-cap US publicly listed companies. Offering low cost, tax efficient access to 500 of the largest cap U.S. stocks.

Stock Exchange Listed: United States (NYSE)

- Name (Code): iShare Core S&P 500 ETF (IVV)

Important details:

- Expense ratio: 0.03% p.a.

- Currency: USD

- AUM: US$331 Billion

- Fund Manager: Blackrock

Information on dividend:

- Dividend Distribution: Quarterly

- Use of Income: Distributing

- Fund Domicile: United States

Here is the performance of iShares Core S&P 500 ETF for the past 10 years, the returns are shown as annual return.

My Opinion

iShare Core S&P 500 ETF offers a low-cost solution for long-term investing in the S&P 500 index. With a strong fund management and high AUM, it is one of the biggest ETF after SPDR S&P 500 ETF.

3. Vanguard S&P 500 ETF (VOO)

Vanguard S&P 500 ETF invests in stocks in the S&P 500 Index, using the full replication method. The ETF’s goal is to closely track the index’s return, representing 500 of the largest U.S. companies.

Vanguard was founded by former chairman John C. Bogle, the father of index investing. John C. Bogle was credited with the creation of the first index fund available to individual investors.

Stock Exchange Listed: United States (NYSE)

- Name (Code): Vanguard S&P 500 ETF (VOO)

Important details:

- Expense ratio: 0.03% p.a.

- Currency: USD

- AUM: US$296 Billion

- Fund Manager: Vanguard

Information on dividend:

- Dividend Distribution: Quarterly

- Use of Income: Distributing

- Fund Domicile: United States

Here is the performance of Vanguard S&P 500 ETF for the past 10 years, the returns are shown as annual return.

My Opinion

Vanguard S&P 500 ETF offers low-cost and tax efficient solution for investors to invest in the stock market index that tracks the performance of 500 large cap companies in the U.S.

With a respected reputation of the fund manager, this is a great option for new investors looking to start ETF investing.

4. Vanguard S&P 500 UCITS ETF DIST

Vanguard S&P 500 UCITS ETF DIST is a passively managed ETF that tracks the S&P 500 index through physical acquisition of securities. The ETF measures the performance of 500 biggest companies listed on the US stock market.

With the fund domiciled in Ireland,

- ETF is traded in multiple stock exchanges such as; LSE, SWX, NYSE Euronext.

- ETF is traded in the respective currency in each of the exchanges; USD, GBP, CHF, EUR.

Stock Exchange Listed: London Stock Exchange (LSE) and also listed on NYSE Euronext and SWX

- Name (Code): Vanguard S&P 500 UCITS ETF DIST (VUSD)

Important details:

- Expense ratio: 0.07% p.a.

- Currency: USD, GBP, CHF, EUR

- AUM: US$33 Billion

- Fund Manager: Vanguard

Information on dividend:

- Dividend Distribution: Quarterly

- Use of Income: Distributing

- Fund Domicile: Ireland

Here is the performance of Vanguard S&P 500 UCITS ETF DIST for the past 10 years, the returns are shown as annual return.

My Opinion

Vanguard S&P 500 UCITS ETF DIST have a relatively higher expense ratio and lower AUM compared to the other ETFs in the list, meaning it will incur higher fees when holding for the long-term and is less liquid compared to the other.

However, having the fund domicile in Ireland instead of the United States, it offers tax advantages on the dividend income distributed by the ETF.

5. iShare Core S&P 500 UCITS ETF ACC (CSPX)

iShare Core S&P 500 UCITS ETF ACC tracks the performance of the S&P index composed of S&P’s 500 large cap U.S. companies through physical replication of the index.

What makes this ETF different is that it is the one of the biggest dividend accumulating ETF that tracks the performance of the index. Helping you to reinvest your dividend to compound your growth.

Stock Exchange Listed: London Stock Exchange (LSE) and also listed on NYSE Euronext, SWX, SSE, TASE, MTA, XETR, BMV and BVC.

- Name (Code): iShare Core S&P 500 UCITS ETF ACC (CSPX)

Important details:

- Expense ratio: 0.07% p.a.

- Currency: USD, EUR, GBP, ILS, MXN, COP

- AUM: US$63 Billion

- Fund Manager: Blackrock

Information on dividend:

- Dividend Distribution: NA

- Use of Income: Accumulating

- Fund Domicile: Ireland

Here is the performance of iShare Core S&P 500 UCITS ETF ACC for the past 10 years, the returns are shown as annual return.

My Opinion

iShare Core S&P 500 UCITS ETF ACC is the largest S&P 500 ETF that offers dividend accumulation instead of dividend distribution.

If you are young, with a long time horizon to compound your investment, investing in this ETF will be a great way to grow your wealth for the long term.

Having the fund domiciled in Ireland, it further offers tax advantage when you buy and sell the ETF.

How To Buy or Sell S&P 500 ETFs in Singapore?

Buy or sell ETFs that track the S&P 500 is a great way to invest in the U.S. stock market, the key to buying the right S&P 500 ETFs is the online brokerage that you choose for the trade.

While you can read our in-depth guide on investing in US stocks in Singapore, here are the steps you’ll need to take to start trading S&P 500 ETFs:

- Understand S&P 500: Understand the different S&P 500 ETFs available, the advantages (exposure to largest 500 US listed stocks) and the drawbacks (Tax implication) from investing in the S&P 500 ETFs.

- Stock Exchange: Choose the stock exchange where you want to start investing. Decided if you want to invest in local exchange or overseas exchange.

- Online Broker: Understand which are the online brokers available that offers investing in the various S&P 500 ETFs. Some online broker offers no fees, low cost option to invest in both local and international exchanges.

- Open & Fund Your Account: Open your online brokerage account with a MAS regulated brokerage and fund your account with your investment capital.

- Buy The Best S&P 500 ETF: Understand the different aspect of the ETF and start investing in the S&P 500 ETFs.

Remember, depending on which online brokerage you choose, you maybe limited to the different ETFs available. If you are wondering which online brokerage to consider, check out this below:

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

BEST FOR: Multi-Market Investors and Professional Traders to Invest in SG, US, UK, HK, China, Malaysia and Europe.

Referral Code: BUDDIES

(Get $20 Cash Credits)

How to Choose the Best S&P 500 ETF For Singapore Investors?

1. Expense Ratio

Expense ratio is the most important factor to look for when investing in an ETF. always look for an ETF with a low expense ratio of less than 1%.

Lower the expense ratio, higher you will get for your investment return over the long run.

2. Liquidity

The liquidity of the ETF depends on the size of the Asset Under Management (AUM).

The larger the AUM, the easier for you to buy or sell any stocks, helping you to cash out or invest as and when you want.

3. Stock Exchange

Depending on where you reside, the stock exchange can be a critical factor.

As a Singaporean, many of us will want to invest in the stock exchange that is regulated by Monetary Authority of Singapore (MAS), as this give us a better sense of comfort.

SPDR S&P 500 ETF trust offers Singaporeans to buy S&P 500 index in the U.S.

This is one of the most popular S&P 500 ETF, and if you wish to invest in the S&P 500 index directly from SGX, you can check out the ticker symbol S27 on the Singapore Exchange.

4. Fund Domicile

Depending on where the fund is domiciled, it follows different Dividend Withholding Tax (DWT) rates.

Typically funds that are:

- Domiciled in the United States will have a dividend withholding tax of 30%.

- Domiciled in Ireland will have a dividend withholding tax of 25%.

As an investor, we will be subjected to the DWT even when we do not reside in the US or Ireland, so you’ll need to take note of the taxes when you are investing in S&P 500 ETF.

5. Dividend Distribution Type

Dividend are distributed when investing in dividend paying stocks. When investing in the S&P 500 ETF, you invest in a basket of stocks including stocks that pays a dividend. Depending on which ETF you choose, each offers different options in how the dividend is given to their shareholders.

- Dividend Distributing

- Dividend Accumulating

A. Dividend Distributing

Getting your dividend distributed back to you is the most common form of dividend distribution.

It pays each of the shareholders their dividend in cash which let their shareholders to decided on what to do with the dividend.

B. Dividend Accumulating

Reinvesting your dividend automatically through dividend accumulating ETF helps you to grow your ETF portfolio faster over the long term.

If you intend to buy the ETF with your dividend earning, this will be better choice.

Furthermore, it offers you the option to take full advantage of the power of compounding.

Use of Income

Both are great way to use your dividend income, and depending on your investment goals, one maybe more suitable than the other.

However, it is good to note that regardless if you are choosing ETF that use the income to accumulate more shares or distributed to you, tax have to be paid for your dividend income.

Should You Consider Investing in S&P 500 ETFs for Dividend Yield?

S&P 500 ETF offers low-cost and diverse way for you to invest in the largest public listed stocks in the United States. It is a great option for new investors who want to get exposure to international market.

However, I personally will not invest in S&P 500 ETFs due to the tax implications. Having to deduct a massive 10% to 30% of my dividend income as tax doesn’t seems like a good idea.

Nonetheless, if you are looking to invest in S&P 500 ETFs for the potential of capital appreciation and have a long-term investing strategy, buying into the S&P 500 ETFs maybe a good idea.

Before you go, check out these handpicked articles that you might be interested:

- Best Dividend Stocks In Singapore

- Best High Dividend REITs in Singapore

- Best Singapore Bank Stocks For Dividend

- Best REITs ETFs to Buy for High Dividend in Singapore

- Best Gold ETFs to Invest Now

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Disclaimer: I may or may not have invest in any of them, what’s listed here is only for entertainment purpose only and it should never be used as any form of investment advice. This is my diary on my stock analysis, while I’ve been investing for +15 years, I am still learning. I wish to share what I learn during my investment journey so you may learn from both my success and mistakes. Enjoy!

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

- Dividend Investing Singapore: Complete Beginners Investor Guide

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Price to Sales Ratio (P/S Ratio): Investor’s Guide to Valuation Metrics When Profit is Absent

- Price to Earning Ratio: Dividend Investor’s Essential Metric to Know

- 3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).