ETFs Investing For Beginners (Complete Beginner’s Guide)

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Exchange Traded Funds (ETFs) is a great investment option for both seasoned investors to diversify their portfolio and beginner investor who are looking to just getting started.

With ETFs, it give you the flexibility of trading like stocks and the ability to diversify similar to mutual funds. The ease of trading ETFs coupled with their lower expense ratios and tax efficiency makes them an appealing option for lazy dividend investor myself.

Key Takeaways

- ETFs combine the benefits of diversification and ease of trading.

- There’s an ETF for every investment strategy, whether broad-market or sector-specific.

- Starting with ETFs is simple and caters to varying levels of risk tolerance.

What Are ETFs?

Exchange-Traded Funds (ETFs) are investment funds listed and traded on stock exchanges generally tracking a specific index that is passively managed by fund managers. When you invest in an ETF, you buy a basket of assets which you potentially help you diversify your investment and lowering your risk and exposure.

Understanding The ETF Basics

ETFs investment is very similar to trading individual stocks. However, you don’t just trade a basket of stocks, it can include bonds, commodities, or a mix of asset classes as well

Passive and Active ETFs

| Type | Objective | Management Style |

|---|---|---|

| Passive ETFs | Aim to mirror an index’s return | Automatically track an index |

| Active ETFs | Attempt to outperform an index | Managed by financial experts |

While most ETFs are passive ETFs, there are active ETFs as well. Compared to a passive ETFs which aims to mirror the index and have a very low expense ratio, an active ETFs is more like a mutual fund, it aims to outperform the market and often comes with a much higher expense ratio.

Expense Ratios

ETFs come with management fees, known as the expense ratio.

- A lower expense ratio typically means more of your investment goes to work for you, rather than paying fund expenses.

- A higher expense ratio typically means more of your investment goes to paying fund expenses, than working for you.

Dividends and Reinvestment Plans

Many ETFs distribute earnings back to investors in the form of dividends. These can be received as cash or reinvested using a Dividend Reinvestment Plan (DRIP), further amplifying your investment’s potential growth.

DRIPs is a very common investment tool for dividend investors to passively grow their income even when you start off with just a little amount to spare, and many ETFs offers the same features.

Securities in ETFs

ETFs hold a collection of securities that often track a specific index or sector.

By owning shares in an ETF, you indirectly own a piece of each security within the fund without the need to buy each one individually.

What are the Differences Between ETFs and Mutual Funds?

- Trading: ETFs trade throughout the day like stocks on the open market while Mutual Funds: Traded after market close at the net asset value (NAV).

- Management Style: ETFs typically passive, tracking an index and Mutual Funds can be either passive or actively managed.

- Investment Minimums: ETFs typically lower, allowing investors to buy a single share and Mutual Funds Often have higher minimum investment levels.

| Aspect | ETFs | Mutual Funds |

|---|---|---|

| Trading | Throughout the day like stocks | After market close at the net asset value |

| Management Style | Typically passive, tracking an index | Can be either passive or actively managed |

| Investment Minimums | Typically lower, you can buy a single share | Often have higher minimum investment levels |

Different Types of ETFs

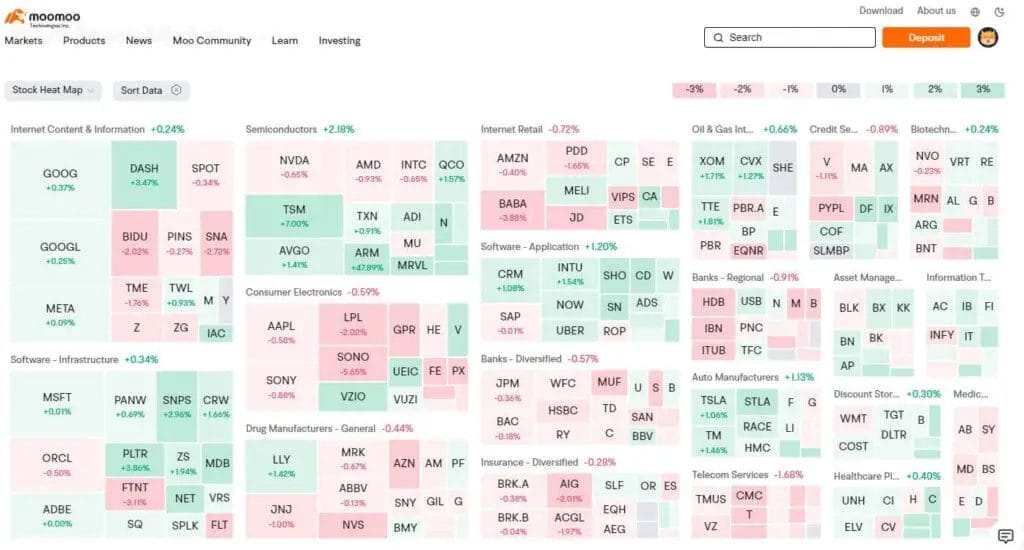

When starting your journey with ETF investing, understanding the different types of ETFs available is crucial.

From broad market ETFs to sector-specific and even commodity-based funds, there exists a variety to suit your investment objectives and risk appetite.

Stock or Equity ETFs

Equity ETFs offer exposure across various stock markets, industries, and regions, or they may focus on specific styles like growth or value. They typically aim to replicate the performance of stock market indexes. Equity ETFs allow you to invest in a diverse range of companies with a single purchase, providing a broad market exposure that can be a cornerstone for your portfolio.

Fixed-Income or Bond ETFs

Bond ETFs specialize in fixed-income securities such as government, corporate, or municipal bonds. They provide a more stable income stream compared to stock ETFs and can help balance the risk in your portfolio. Bond ETFs vary depending on the duration and credit quality of the underlying bonds, allowing you to choose based on your risk tolerance and investment horizon.

Commodity ETFs

Commodity ETFs enable investment in physical commodities like gold or oil or through futures contracts. They offer a convenient way to gain exposure to commodity prices without owning the physical asset, potentially acting as a hedge against inflation or a diversifying element in your investment mix.

Sector ETFs

Sector ETFs concentrate on particular segments of the economy, such as technology or healthcare. By investing in these ETFs, you can target specific sectors that you believe are poised for growth or complement your existing investments to achieve a well-rounded portfolio.

Thematic ETFs

Thematic ETFs focus on emergent trends and industries, such as robotics or sustainable energy. These ETFs allow you to invest in the companies that are likely to benefit from long-term global shifts and innovations, aligning your portfolio with future growth areas.

Dividend ETFs

Dividend ETFs consist of companies that regularly pay dividends. They can provide a steady income and may be especially appealing to those who prefer a more conservative investment approach that can still offer long-term growth from dividend-paying stocks.

International ETFs

International ETFs provide you with the opportunity to invest in markets outside of your home country. These ETFs can help diversify your portfolio by spreading the investment across different economies and reduce the risk of regional market volatility affecting your entire investment.

Why ETFs Are Good Investments for Beginners?

ETFs, short for exchange-traded funds, are a great match for beginner investors due to a combination of factors that make them accessible and easy to manage. Here’s why you might consider them:

- Diversify: You get access to a wide array of assets, leading to a balanced and less risky portfolio.

- Low-Cost: The fees associated with ETFs are generally lower than many other investment types.

- Simplicity: Purchasing an ETF is as straightforward as buying a stock.

- Tax Efficiency: ETFs are often more tax-efficient than other funds, potentially leaving more money in your pocket.

- Educational Resources: Plenty of material is available to help you understand and choose the right ETFs.

- Regular Savings Plan: You can invest consistently and gradually with ETFs in a disciplined way.

If you’re considering an investment that allows you to participate across various asset classes, ETFs can be a smart choice. You can invest in stocks, bonds, commodities, and more under the umbrella of a single ETF.

Moreover, services like DRIPs (Dividend Reinvestment Plans) allow you to automatically reinvest any dividends received, compounding your investment returns.

How to Get Started and Buy an ETF (Step By Step)

Investing in ETFs can be a smart avenue to enter the stock market with a lower level of risk due to their diversification.

For those starting, purchasing ETFs that track broad market indexes, like the S&P 500, can set the stage for potential long-term growth.

Step 1. Setting Up a Brokerage Account

To begin trading ETFs, you will need to establish a brokerage account. You can easily create one online through various brokerages, many of which do not require a minimum balance and do not charge transaction or inactivity fees.

- Gather all the required personal documents: Bank statement, national identity card, a mailing address.

- Choose the best brokerage firm: Choose one which is regulated, low fees and access to your desired market.

- Proceed with the application: Signup to your chosen brokerage and get approved.

If you favor a hands-off approach, consider a robo-advisor, which can manage an ETF portfolio for you.

Either case, knowing which brokerage account to open is key as it will help you in your investment journey later.

- Good Brokerage: Helps you invest with ease, get higher return on your investment, offers you more investment options.

- Bad Brokerage: Make investing complicated and error pone, high fees that eat into your return, offer minimal investment options.

Our online brokerage comparison can help you find the right broker, and if you like to trade on the go, some of the top broker even offer trading Apps for even better convenience.

Step 2. Choosing the Right ETF

After opening your brokerage account, it’s time to select the right ETF for your portfolio.

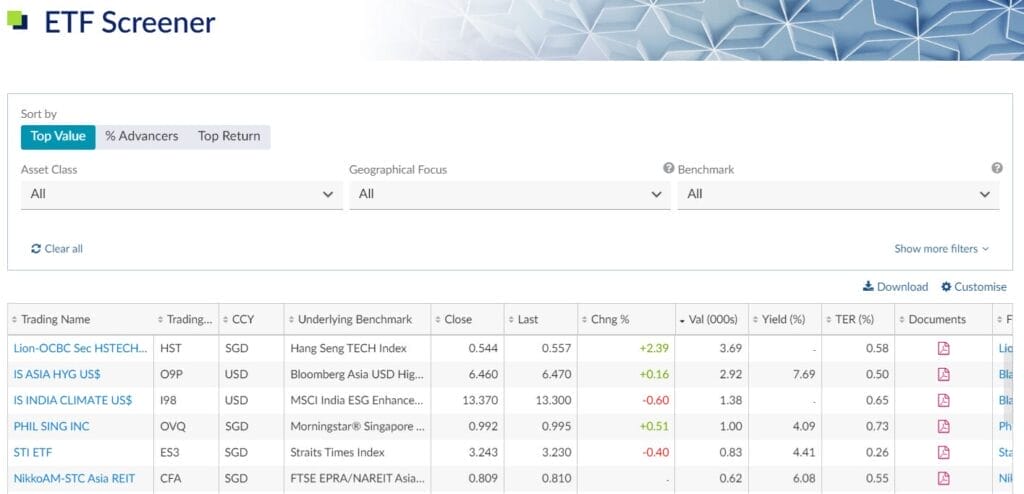

Utilize online brokerage screening tools to filter ETFs by criteria that align with your financial goals and risk tolerance. Look for aspects such as:

- Low expense ratios

- Absence of commissions

- High trading volume

- Strong past performance,

- ETF’s holdings

These are just some basic things to look for when guiding your choice.

Step 3. Placing Your Trade On Your Selected ETFs

To buy an ETF, you’ll navigate to the trading section of your brokerage’s platform. Then, use the ETF’s ticker symbol to place a trade.

Decide on the number of shares and select between a market order or a limit order.

| Order Type | Description |

|---|---|

| Market Order | Buy immediately at the current market price. |

| Limit Order | Buy only if the price is at or below a set point. |

Before confirming, ensure your linked bank account has adequate funds. Also, double-check the order’s details for accuracy.

Step 4. Keep Investing and Let Your Investment Compound

Once your ETF purchase is complete, you’ve taken a critical step towards a diversified investment portfolio.

Maintain focus on your long-term investment strategy and remember that market fluctuations are normal.

By continuing to invest and allowing for growth over time, your initial ETF investment can become a valuable part of your financial future and may even holds the key to your early retirement.

Key ETFs Terms and Glossary

Since we want to learn about ETFs, we need to have some basic understanding on the key terms used when we trade ETFs.

Here are a list of the most common terms used when you start buying and selling ETFs.

| Term | Description |

|---|---|

| Ticker Symbol | Unique identifier for the ETF; ensure accuracy before proceeding. |

| Price | Current trading price determined by bid (buyers’ highest willing price) and ask (sellers’ lowest willing price). |

| Number of Shares | Quantity of ETF shares you want to buy. |

| Order Type | Basic order types: – Market Order: Buy ASAP at the best available price. – Limit Order: Buy only at a specified price or lower. – Stop Order: Buy once a specified price (stop price) is reached. – Stop-Limit Order: Converts to a limit order when stop price is reached, filled within specified limits. |

| Commission | Price per trade charged by the brokerage for its service. Most major brokerages offer commission-free ETF trades. |

| Funding Source | Bank account linked to the brokerage; must have sufficient funds to cover the total cost. |

Got the list?

Financial education starts from knowing what each of the vocabulary actually means. And in case you don’t know we have a Financial Glossary that list down all the most common words used for investing.

Take you time and check it out >>> Financial Glossary For Investing

Frequently Asked Questions (FAQs) on ETF Investing

Disclaimer: I may or may not have invest in any of them, what’s listed here is only for entertainment purpose only and it should never be used as any form of investment advice. This is my diary on my stock analysis, while I’ve been investing for +15 years, I am still learning. I wish to share what I learn during my investment journey so you may learn from both my success and mistakes. Enjoy!

- Dividend Investing Singapore: Complete Beginners Investor Guide

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Price to Sales Ratio (P/S Ratio): Investor’s Guide to Valuation Metrics When Profit is Absent

- Price to Earning Ratio: Dividend Investor’s Essential Metric to Know

- 3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).