7 Streams of Income to Build Wealth Now! (Powerful Income Ideas)

According to a study by the IRS on the tax return of 6,053 wealthy individuals, it shows wealthy individuals build up multiple streams of income. Of these multiple streams of income, each may show characteristics of a mix between 2 main types of income.

- Active income – Income earn by completing a task actively. Active income usually requires you to exchange time for money.

- Passive income – Income earn at intervals due to a decision or task performed previously. Passive income does not usually require you to exchange time for money.

In this article, you’ll be able to learn the different great ways to generate revenue streams that let you diversify your income and start earning money that helps you reach financial freedom.

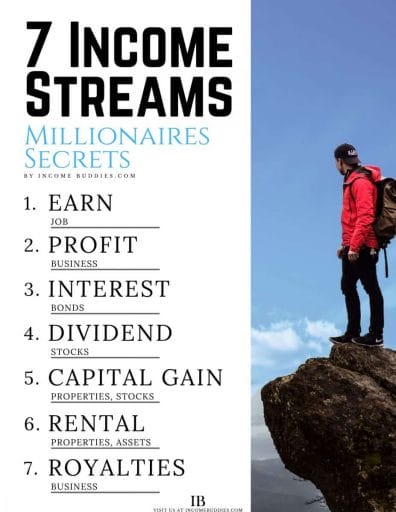

7 Income Streams Of Most Millionaires

Most millionaires have multiple sources of income that bring in steady cash flow. With more than one income stream, they are able to secure financial security and become more resilient against a market crash or any unexpected events that may happen in life.

Having more than one income streams increase their ability to generate more wealth faster, which opens the door of opportunity for them to invest in income-producing assets and let money work for them, and not the other way around.

Here, we’ve ranked each income stream in terms of their “income type” and the “popularity” amount wealthy individuals:

- Income Type: Passive Income or Active Income

- Popularity: Low or High

1. Earned Income

Earned income is also known as salary income, which is any income that is received from a job or through self-employment. Earned income includes salary, tips, bonuses, and commissions. Earned income generally requires you to exchange your time for money.

Examples of earned income:

- Salary received from the job.

- Tips received from the customers.

- Bonus received from the job.

- Commission received from sales.

Not a lot of millionaires are made from earning from this type of income stream.

Unless you are a CEO, or a director of the company, becoming a millionaire by earned income can be quite difficult.

Some people even jokingly said,

“JOB means Just Over Broke.”

In other words, having just a job is just one step from being broke. Not that I will like to agree with such a statement, but most people who only have an earned income may become broke once they lose their job.

Having just a JOB is like putting all your eggs in just one basket.

Unfortunately, most people stick to this one stream of income, because this is the easiest to obtain, and having a job keeps them in their comfort zone.

People like getting a job because their next payday is somewhat predictable. Having just earned income is also the main reason why many never become a millionaire.

“Earned income is a great way to start as your first stream of income, but if you want to become a millionaire, you should adopt a few more streams of income to increase your chances of success in becoming a millionaire.”

If you are really passionate about your job and wish to excel in your career. You can check out some of the best career tips by hqhire.com to help you succeed in your career.

Type: Active Income

Popularity: Low

2. Profit Income

Profit income is the net income you get from a business. Profit income is what you get after your expenses from running the business. Businesses earn a profit by buying goods or services at a low price and selling them at a higher price. The difference in price is where you make the profit.

Example of profit income:

- Selling physical goods such as a lemonade stand business or a café.

- Selling services you’ve offered such as house agents, plumbers, etc.

- Selling goods from an online store such as eCommerce.

- Selling in an online marketplace such as Etsy, eBay, and Amazon.

You can make a profit income by starting your own business.

With the help of the internet, businesses can be set up with relatively low risk and capital.

Many successful start-up entrepreneurs starts their business as a side hustle to earn extra money as a secondary income. Many of these side hustles are online eCommerce stores selling different items to billions of customers worldwide.

These online stores are open 24/7 every day, all day.

With as low as $100 you can too set up your own business and earn your first profit income.

The $100 Startup by Chris Guillebeau is a great book to start learning how others have achieved this.

Many millionaires are made from earning a profit income.

Type: Active/ Passive Income

Popularity: High

3. Interest Income

Interest income is the amount earned from lending or letting another entity, or financial institution use a fund. When you lend your money to an organization or an individual, you will receive an agreed amount of interest paid over a period of time.

Examples of interest income:

- Certificate of Deposit (CD) or Fix Deposit.

- Bonds from the bond market

- Treasury bills from the government.

Buying Bonds or Treasury bills means that you are willing to borrow the organization or government money for a said period of time for a certain interest rate.

The interest rate of a government bond can lie between -0.38% to 47.05% depending on the risk of default and the time frame you are willing to lend your money to the borrower (organizations or government).

The amount of interest income you can earn from a government bond is highly dependent on the defaulting risk of the borrower.

United States Government Bond 10Y

source: tradingeconomics.com

Interest income for U.S. Treasury Bills or Government Bonds for the last 10 years ranges from 1.37% to 5.405%. This lower-interest rate is because of the low risk of the U.S. government defaulting on the money that you are lending them.

Here are some of the best-performing bonds for the past 10 years according to the most recent data just for your reference:

- High-Yield Bonds 7.98%

- Emerging Markets Bonds 7.78%

- Long-Term U.S. Corporate Bonds 6.97%

- Long-Term U.S. Government Bonds 6.78%

- Barclays U.S. Aggregate Bond Index 4.62%

Higher defaulting risk usually result in a higher interest rate

Lower defaulting risk usually result in a lower interest rate.

Having an interest income is a great way to generate passive income for most of the population. Not only it takes little to no effort to earn a side income, but it is also one of the easiest ways to get started on investing.

Type: Passive Income

Popularity: High

4. Dividend Income

Dividend income is the income you get from the distribution of a company’s earnings to its shareholders. Some companies pay their dividend on a half-yearly basis, while most pay their dividend on a quarterly basis.

Types of dividends paid by companies:

- Cash dividend – Company shares a portion of its net earnings with its shareholders in the form of cash.

- Stock dividend – Company gives out shares to its shareholders proportional to the number of shares the shareholders holds.

- Stock repurchase – Company give the investor an option to sell their shares back to the company at a fixed rate.

In fact, dividend income is my favorite type of income. Simply because dividend income is a great way to earn income without much effort.

Dividend income comes from investing in stocks that pay dividends on a periodic basis.

- Yearly dividend

- Half-Yearly dividend

- Quarterly dividend

- Monthly dividend

What Makes Dividend Income a Powerful Passive Income Stream

What makes dividend really special is that you can automate your dividend income by reinvesting the dividend payments through Dividend Reinvestment Plan (DRIP).

- Automating your investing plan

- Automate the growing of your passive income stream.

- Get started with a small amount of capital.

Furthermore, when invested correctly, the return on investment can be double-digit.

I am currently holding some dividend-paying stocks that give a double-digit dividend yield. And if you want to learn how to invest in dividend-paying stocks, you may want to check out my other post on dividend investing.

Harvesting the power of compounding, dividend income not only can help you to retire without worries, but it also helps young investors to build their wealth and reach financial independence.

“Compound interest is the 8th wonder of the world.”

Albert Einstein

How much dividend income does Warren Buffett make?

Warren Buffett created a high dividend yield portfolio through sound investing in great companies for the past few decades.

According to Nasdaq, Warren Buffett received $3.8 Billion dollars dividend income in 2021 by investing in just 6 companies.

- Apple (NASDAQ: AAPL): $791,070,204

- Bank of America (NYSE: BAC): $743,653,444

- Coca-Cola (NYSE: KO): $656,000,000

- Kraft Heinz (NASDAQ: KHC): $521,015,709

- American Express (NYSE: AXP): $260,770,404

- U.S. Bancorp (NYSE: USB): $251,311,662

This dividend income has been increasing every year.

When investing is done right, the power of compounding will help you create miracles.

So, does dividend income create Millionaires?

No, dividend income creates Billionaires.

Type: Passive Income

Popularity: High

5. Rental Income

Rental income is the total amount of rent and related payments you receive from renting out your asset. Rental income can be subjected to income tax. The total amount of net rental income you can receive from your investment will be after any expense you are required to pay for renting out your asset.

Examples of Rental Income:

- Rent that you receive by renting out your assets.

- Late charges you receive for the late payment of rent.

You can gain a rental income by renting out an asset that you own.

This asset is usually a house, a room, or even a car.

“Oh, so my car is my asset?”

The answer is ‘Yes’ and ‘No’.

Your car can be an asset or a liability. The difference is pretty simple. As explained in Robert Kiyosaki’s Bestseller ‘Rich Dad Poor Dad‘.

Asset are things that help you bring in money. Liabilities are things that take money out from your pocket.

So, if you buy your car for daily use such as commuting around the town. It is basically a liability, as you have to pay its car loan, maintenance, etc.

But, if you rent out your car, or use it as a tool to help you earn an income. It is now an asset that helps you to bring money into your pocket.

Increase your rental income by building your asset.

Millionaires earn their millions by buying rental properties.

- Understand the rental market.

- Assess the rental properties and their potential rental returns.

- Buy rental properties in a good location with a high return on investment.

By renting out each property, they create multiple streams of rental income through a portfolio of properties.

Rental income with properties is not only a great passive income, but also gives high return on investment due to leveraging.

But there is one big drawback to the rental income.

Rental income usually requires you to have a certain amount of money to buy your first asset. Thus, it is not that easy to start having a rental income until you have accumulated a certain level of wealth.

Alternative ways to make rental income

- Rent out your spare room for an extra passive rental income.

- Rent out your car when you are on a long holiday for extra income.

- Rent out your bicycle for the community to use and earn rental income

- Rent out an asset that is in demand by others.

- Buy Real Estate Investment Trusts (REITS) which allow you to invest in a large portfolio of properties.

Invest in rental property in the form of REITs

Buying Real Estate Investment Trusts (REITS) can be a great way to invest in properties.

Although the income you get from investing in REITs is called dividend income, I will still like to mention it here as a great alternative to rental income.

With just a few hundred dollars, you can invest in a portfolio of professionally managed properties.

If you want to learn more about REITs, you can check out my REITs investing series as well.

REITs have many benefits over buying the whole property which you might be interested in. Each type of REIT has its own characteristics.

My favorite is Healthcare REITs, what’s yours?

Type: Passive Income

Popularity: High

6. Capital Gain Income

Capital Gain is the appreciation (increase in value) of an investment and it is considered to be realized when the investment is sold. Capital gain can be subjected to capital gain tax in certain countries, where taxation usually differs between short-term (one year or less) or long-term (more than one year).

Example of capital gain income:

- Financial investment – Profit gain from the sale of stocks.

- Real estate – Profit gain from the sale of properties.

- Collectables – Profit gained from the sale of your personal collectibles.

Great stocks or properties that are located in a good area usually increase in value over time.

These assets can sometimes double or even increase ten times the original value over time.

Example of a capital gain on stocks:

- You buy 100 shares of a great company at the price of $10, 10 years ago. You paid $1000 for 100 shares.

- Today, after 10 years of holding the stocks. Each share of the company raise to $20 per share and you decided to sell the 100 shares you own.

- You sell 100 shares at the price of $20, you received $2000 for selling 100 shares.

- $2000 (You Received Today) – $1000 (You Paid 10 Years Ago) = $1000 (Capital Gain)

The difference between the price you pay, and the price you sell is the capital gain.

Many millionaires earn their money through sound investing and getting a good capital gain from each of their investments.

But the downside of this investment is that it is non-recurring.

Once you have sold the asset, you need to find a good valued asset again and repeat the process.

Type: Semi-Passive Income

Popularity: High

7. Royalty Income

Royalty income is income received from allowing others to use your original products, ideas, content, design, or process in return for payment. Royalties are legally binding, thus the person who uses the property will be required to pay for the right of using the property.

Generally, people buy these rights to generate revenue for themselves.

Examples of Royalty Income:

- Patents – New Technology, Pharmaceutical products

- Copyrighted works – eBook, Music, and photos

- Natural resources – Oil, gas, or mineral

- Franchises – MacDonald, KFC, Pizza Hut, Dominos Pizza

How to create Royalty Income?

Royalty income can be earned by first creating an original product or idea.

Then you will sell these temporary usage rights to someone who wants to use them in exchange for a cut from what they earn from your product.

“What they pay is a royalty fee and what you earn is called royalty income.”

Some of the most famous companies build through royalty income are MacDonald and KFC. People who want to open a new MacDonald franchise will pay MacDonald a royalty fee for using their logo, marketing, and process.

You, on the other hand, can get royalty income by writing eBooks and selling them on Amazon, or any other publisher. Each book they sold, will give you a certain percentage as a royalty income.

Why should you consider creating royalty income?

- Starting cost for creating royalty income is very low, which gives you a very low risk to start.

- No limit on how many original products you can create.

- No limit on how many products, or types of products you can sell.

- Everyone has almost an equal chance to succeed.

- Success is determined by your own creativity and ability.

- Starting cost for creating royalty income is very low, which gives you a very low risk to start.

- No limit on how many original products you can create.

- No limit on how many products, or types of products you can sell.

- Everyone has almost an equal chance to succeed.

- Success is determined by your own creativity and ability.

Type: Semi-Passive Income

Popularity: High

Does The Average Millionaire Have 7 Streams Of Income?

The average millionaire only has at least 3 streams of income and not 7. According to a 5 years study on self-made millionaires, research has found most millionaires have 3 to 5 streams of income.

The study shows an interesting correlation between a self-made millionaire and the number of income streams.

Evidence shows that having 3 to 5 income sources gives you a higher chance of becoming a millionaire.

How many streams of income does the average millionaire have?

Contradictory to popular belief that an average millionaire must have 7 streams of income. 65% of millionaires have 3 streams of income.

- 65% of self-made millionaires had at least 3 streams of income.

- 45% of self-made millionaires had at least 4 streams of income.

- 29% of self-made millionaires had at least 5 streams of income.

Having multiple streams of income is the same idea as diversifying your portfolio during an investment.

People with a single source of income will suffer when something happens to their income stream.

Events such as retrenchment from their job, or facing a major market crash from the stock market will be devastating.

With the same idea of not wanting to put all your eggs in one basket, you don’t want to have only 1 stream of income.

Note: Creating multiple income streams and aim to have at least 3 or more streams of income will greatly enhance your success in becoming the next millionaire and secure your financial future.

How Can Your Build Wealth With Multiple Income Streams?

You can creating multiple streams of income by getting started in building one stream of income at a time. You goal is not about quality, but ensuring each source of income offers the opportunity to move you closer towards your financial goal.

To create multiple sources of income streams here are a few popular suggestions you can consider:

Active and Passive Income Ideas With High Earning Potential

- Build a business online and sell a product or service.

- Become an edupreneur and create an online course and share your expertise.

- Create and host webinars to sell products or services to targeted audience.

- Create an YouTube Channel, and become a creator online.

- Create an eBook, or any other form of digital products and make money online when people makes a purchase.

- Start a side hustle such as taking up freelancing.

And for those, who will prefer to take a more passive approach to building your wealth and achieve your financial goals, here are some ideas you can create multiple income with little or no effort:

Passive Way To Build Wealth

- Learn to invest in stocks, mutual funds, ETFs, REITs and bonds.

- Earn passive income through dividend investing, or let your money work for you in a high-yield savings account.

- Renting out properties or assets for a monthly fee.

As are many different ways to create multiple streams of income, it’s important to find one that works best for you.

Multiple Streams Of Income Can Help Your Reach Financial Freedom

Multiple income streams have made thousands of individuals wealthy.

Today, there are 21,951,000 millionaires in the United States according to the Global Wealth Report.

Although having more streams of income will greatly increase your chances to become a millionaire. But the key to success is to be focused on what you do and do it well.

- Aim to have at least 3 streams of income with which you are highly passionate.

- Work on each of them and grow each of your stream of income.

- Focus on quality over quantity. (I learn this the hard way)

With discipline and determination to succeed, you can become wealthy.

Personally, I prefer interest income, dividend income, rental income, and royalty income. As you’ve noticed, most of these income streams are passive income.

What about you?

How many income streams do you have right now?

Read Also:

- 7 Streams of Income to Build Wealth Now! (Powerful Income Ideas)

- How to Create Passive Income With Your Expertise Today (5-Easy Steps)

- How to Create a Budget for Beginners (Personal Finance Budgeting 101)

- How To Use The Debt Lasso Method To Pay Off Debt (Debt Free)

- How Much Do I Need to Save For Retirement at 55, 60, 65? (Retirement Calculator)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).