Price Moat: Powerful Economic Moat For Profitable Stock Investing

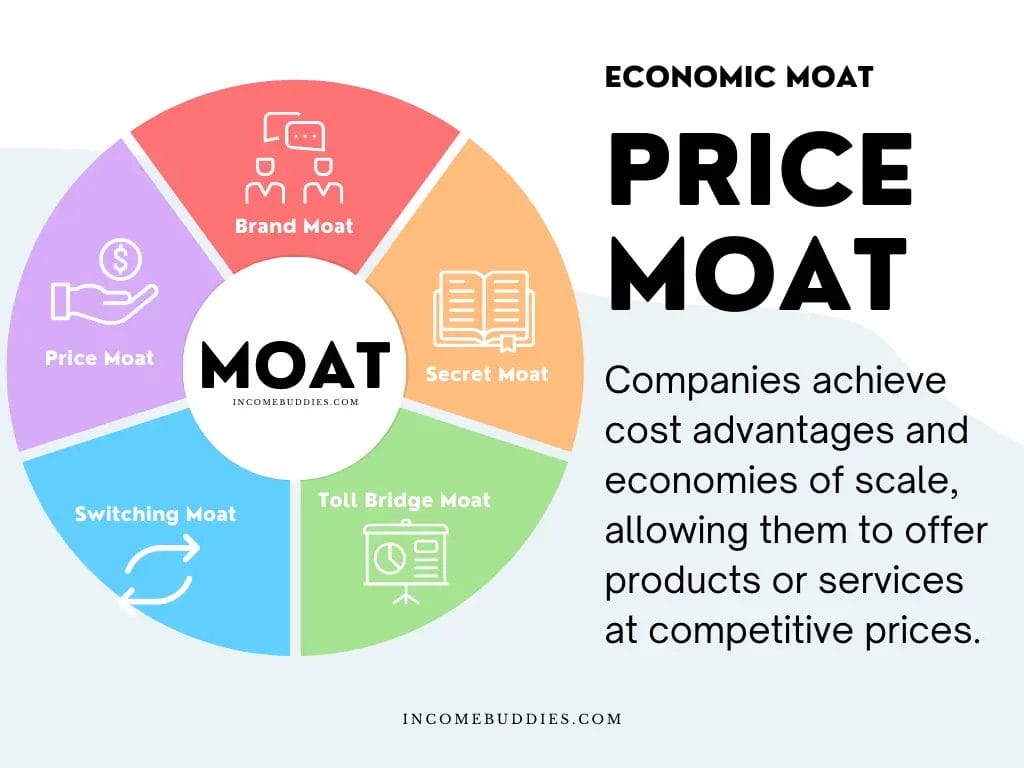

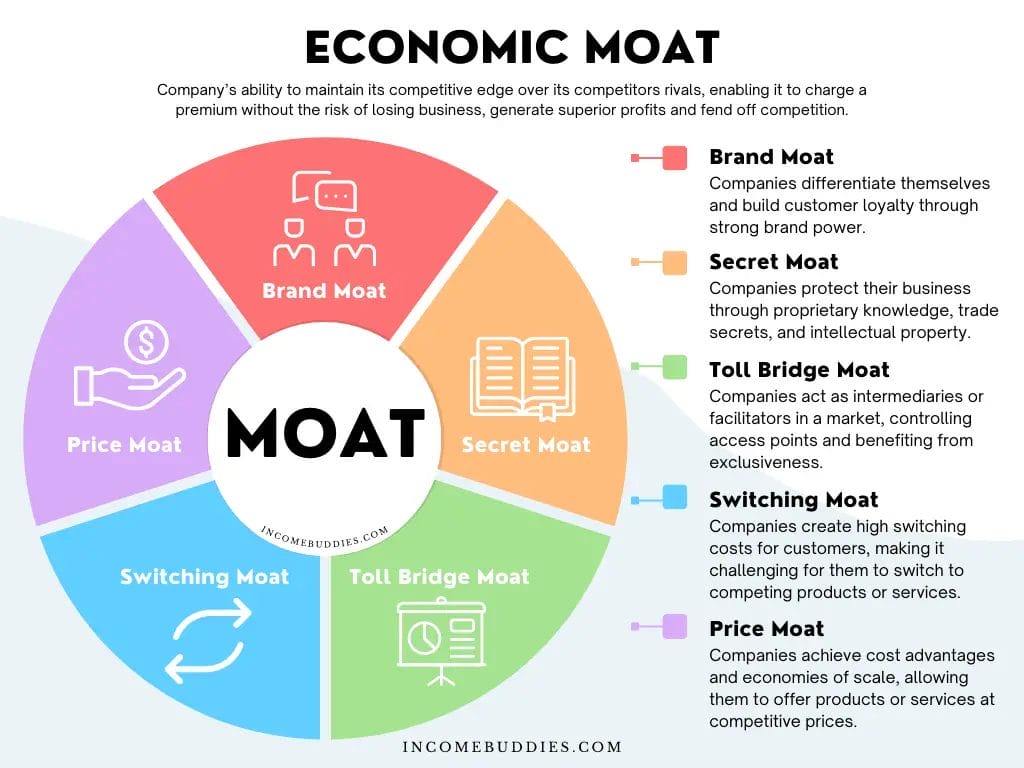

Price Moat is one of the five types of economic moats in investing.

Companies with price moat are more likely to succeed and grow than those who don’t. If you are an investor who see sustainable competitive advantages for the companies you like to invest, looking out for companies with price moat can help.

So what exactly is price moat?

KEY TAKEAWAYS

- Price Moat is one of the economic moat use to identify profitable business to invest as an investor.

- Price Moat is build by achieving cost efficiencies through economic of scale and leveraging size advantage, allowing the company maintaining a low production and operating cost while ensuring high quality in it’s product and service.

- Benefits of companies with strong Price Moat are; sustainable competitive advantage, steady profit margins and shareholder value creation.

What is Price Moat in Terms of Economic Moat?

Price Moat a term coined to describe the strategic advantage companies gain by achieving cost efficiencies and leveraging their size. This is one of the 5 types of economic moat found in successful companies and is a part of fundamental analysis used by investors.

Companies with price moat gain the strategic advantage by achieving cost efficiencies in their business. It enables them to offer products or services at more competitive prices than their rivals, without compromising on quality.

How Price Moat Works?

There 2 main ways companies can the strategic advantage of having a price moat.

Price moat works when the company is able to achieve cost advantages while not sacrificing quality, allow them to offer products or services at more competitive prices than their rivals.

There 2 main ways companies can gain price moat.

1. Achieving Cost Advantages through Economies of Scale

Companies that leverage economies of scale can lower down the cost of production as they increase their output.

- Gained through the expansion of operations

- Increase production efficiency

- Maintain or lower fixed costs

As production scales up, the cost to product each unit become lower, as the fixed costs get spread over a larger production volume.

2. Leveraging Size Advantage

Companies with a larger market presence can have an advantage over their competitors due to their size and distribution channels.

- With their size they can negotiate better terms with suppliers

- Larger volume will secure lower input costs, and access cheaper raw materials.

Size advantage will translates into cost savings, allowing them to offer products or services at more competitive prices with maintaining their quality.

Importance of Investing in Companies with Price Moat

As an investor, recognizing companies with robust Price Moats can help you in your investment decisions. Investing in companies with Price Moat in your investment strategy gives you a few advantage as an investor.

1. Enhanced Profitability and Competitive Edge

Companies with Price Moats can maintain substantial profit margins, even when offering their products or services at lower prices.

The Price Moat acts as a barrier to entry, deterring potential competitors and preserving the company’s market share, allowing them to outperform competitors and sustain profitability.

2. Resilience During Market Downturns

Price Moat companies exhibit resilience during economic downturns due to their cost efficiencies.

Companies with price moat can weather market volatility by adjusting prices without compromising on quality or eroding profit margins.

Providing them resilience even during challenging times, making them attractive long-term investment options.

Types of Price Moats

There are a few key types of Price Moat that that you can identify in successful business that have strong price moat.

1. Lower Production Costs

Companies can lower their production cost through optimizing their production processes and streamline operations. Factors contributing to lower production costs include:

Efficient Manufacturing Processes:

- Investments in advanced technologies for automation and streamline of production processes.

- Process optimization to reduce waste, increase efficiency, and reduce costs.

- Lean manufacturing principles to eliminate non-value-added activities.

Access to Cheaper Raw Materials:

- Setup strategic partnerships with suppliers to get lower pricing.

- Diversifying the number of supplier to get competitive pricing.

- Vertical integration by acquiring suppliers or raw material sources directly, reducing dependency and costs.

This is the main reason why companies such as Walmart, Amazon and many other big companies have manufacturing plant setup in developing countries.

2. Efficient Supply Chains

Companies can become more efficient in managing their supply chains to achieve cost advantages. Key aspect of this includes:

Effective Logistics and Distribution Networks:

- Streamlining transportation and warehousing operations to minimize costs.

- Implementing sophisticated inventory management systems to optimize stock levels and reduce holding costs.

- Embracing data analytics and technology to enhance visibility and responsiveness across the supply chain.

Collaboration with Reliable Suppliers:

- Establishing long-term partnerships with reliable suppliers.

- Negotiating favorable terms, such as bulk purchasing discounts or extended payment periods.

- Maintaining open lines of communication to address supply chain disruptions promptly.

3. Purchasing Power

Companies with significant purchasing power can get cost advantages and negotiate favorable terms with suppliers. Key aspects of leveraging purchasing power include:

Bulk Purchasing Advantages:

- Bulk buying allows companies to negotiate better prices, discounts, and preferential terms with suppliers.

- Larger order quantities provide companies with economies of scale and lower per-unit costs.

- Consolidating purchases across business units or divisions to harness collective bargaining power.

Negotiating Favorable Terms with Suppliers:

- Proactive engagement with suppliers to establish mutually beneficial relationships.

- Negotiating longer payment terms to optimize cash flow.

- Building a reputation as a reliable customer to gain preferential treatment from suppliers.

Benefits of Companies With Strong Price Moat for Investors

Investors who invest in companies with strong Price Moats can unlock several compelling benefits.

1. Sustainable Competitive Advantage

Price Moat companies possess competitive advantages that act as a protection shield for their business due to the high barrier of entry for another company who want to build the same moat.

Not only the competition need to scale their company big enough to compete on the price, the competition need to provide a similar quality product which is hard to achieve at low price. This give companies with price moat a sustainable competitive advantages.

- Long-Term Profitability: Cost advantages and ability to offer competitive prices shield them from price wars and eroding profit margins. Well-positioned to generate consistent profits over the long haul.

- Reduced Risk of Disruptive Competition: Protection against new entrants and disruptive forces. As their cost efficiencies and economies of scale make it challenging for competitors to replicate their success.

2. Steady Profit Margins

Price Moat companies often display high stability in their profit margins, this give investors a sense of security and predictability.

- Ability to Maintain Profitability: Operational efficiencies and strategic advantages enable them to offset lower prices while maintaining margins.

- Stability in Performance: Maintain a stable performance track record which instills confidence in investors and reduces the risk of significant value erosion during economic downturns.

3. Shareholder Value Creation

Companies with Price Moat often reward their shareholders with stable and consistent dividends with the potential for stock price appreciation.

- Consistent Dividends: Paying regular dividends to shareholders that provide a steady income stream, making these investments attractive for income-focused investors.

- Potential for Stock Price Appreciation: The ability to generate consistent profits and maintain a competitive edge can drive investor confidence and demand for their shares, gaining stock appreciation over the long term.

How to Identify Companies With Price Moat?

There are a few ways you can help identify a company with a strong price moat as an investor. Let’s see how we can spot Price Moat companies and incorporate them into your investment decisions.

1. Understanding Key Indicators of a Strong Price Moat

To assess a company’s Price Moat, consider the following indicators:

- Analysis of Historical Financial Performance: Review the company’s financial statements over multiple years to identify consistent profitability and steady profit margins with the ability to generate strong cash flows.

- Assessment of Market Share and Customer Loyalty: Analyze the company’s market share and its ability to retain customers through factors such as; customer loyalty programs, brand reputation, and customer satisfaction ratings.

2. Studying Industry Dynamics and Competitive Landscape

Understanding industry dynamics and competitive landscape can help you identify companies with sustainable cost advantages.

- Evaluating Barriers to Entry and Competitive Advantages: Identify barriers to entry that prevent new competitors from easily replicating the company’s success such as; uniqueness of the company’s products, services, or business model that sets it apart from competitors.

- Identifying Companies with Sustainable Cost Advantages: Look for factors that can provide cost efficiencies such as; economies of scale, and strong supplier relationships.

3. Examining Management Quality and Strategic Decision-Making

Management team of the company pay a big part in sustaining a Price Moat. While we cannot talk to the management themselves, we can look at a few other factors to understand how the management sustain the price moat of the company.

- Focus on Long-Term Value Creation: Assess if the company’s management focus on long-term value creation over short-term gains. You can look at evidence of strategic planning, innovation, and a track record of adapting to market changes.

- Consistent Operational Optimization and Innovation: Determine the company’s commitment to continuous improvement, operational efficiency, and innovation. You can look at how much they put on the investment in technology etc.

Case Studies: Companies with Price Moat

Some examples of companies with notable price moats are Walmart and Amazon. These companies are able to produce and sell their products at a low price through leveraging their ability to lower the cost of production while maintaining the quality of the product.

Let’s take a look at some real-world examples of companies that have successfully built and maintained strong Price Moats.

Example 1: Walmart Inc. – Lower Production Costs

Walmart Inc. has created a Price Moat in their business by focusing on achieving lower production costs. Their strategies include:

- Streamlined Logistics and Distribution Networks: Walmart Inc. has implemented systems to optimize transportation, warehousing, and order fulfillment.

- Supplier Partnerships: Developed strategic partnerships with multiple suppliers, ensuring access to high-quality raw materials at favorable prices.

- Economies of Scale: Though expanding their operations, Walmart Inc. achieves economies of scale, spreading fixed costs over a larger production volume.

Result: Significant cost advantage that offer products at competitive prices while maintaining healthy profit margins.

Example 2: Amazon Inc. – Efficient Supply Chains

Amazon Inc. has built a formidable Price Moat by creating a highly efficient supply chains. Their key strategies include:

- Collaborative Supplier Relationships: Cultivated long-term partnerships with suppliers to negotiate favorable terms and secure cost advantages over their competitors.

- Utilizing Advanced Technologies: Amazon Inc. invests in technologies to automate and streamline manufacturing processes, reduce waste, and enhance efficiency.

- Data-Driven Supply Chain Management: Leverages data analytics, AI and real-time insights to gain better visibility, increase responsiveness, and improve overall efficiency.

Result: Gaining competitive edge, with more efficient supply chains that offer products at attractive prices, at shorter time while maintaining profitability.

Final Thoughts on Price Moat

Investing in companies with Price Moat can guide your investment decisions towards long-term success. These companies often shows high level of resilience, profitability, and sustainable competitive advantages.

Companies can sometimes display more than one form of economic moat, thus when assessing an investment opportunity, it is good to understand the types of the moat the company have in additional to the width of the moat.

As an investor, investing in companies with economic moat will help you increase your chances of success.

Check out my other article on Economic Moat to gain a better understand of Moats in an investment.

Read Also:

- Moomoo SG Promotion! $970 Worth of Free Stocks + Perks for New User | April 2024 Updated 🟢

- WeBull SG Promotion! Claim Up to SGD$10,000 FREE + $0 Platform Fee | April 2024 Updated 🟢

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).