5 Best Singapore REIT EFTs To Create High Dividend Yield Portfolio (Updated)

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Real Estate Investment Trust (REITs) offers a low cost, low risk way to invest in real estate while generating dividend income for you as the investor. However, investing in a particular REIT may mean you are overly concentrated in a certain sector or industry.

The solution? Consider investing in Exchange Traded Fund (ETFs) for REITs.

KEY TAKEAWAYS

- REIT ETFs offers a simple way to invest in a diversified basket of REITs while earning passive dividend income with minimal effort in managing your dividend portfolio.

- REIT ETFs are differentiated from each other by the different indices that it tracks, expense ratio, selection methodology, and region as well as sectors that it is focus on.

- Buying REIT ETFs is best when you have the access of a good online trading platforms that trade stocks listed on the Singapore Exchange. With the right tool, you can get all the required information within minutes to make better investing decision.

Best Singapore REIT ETFs Listed on SGX Singapore Compared

Regardless if you’ve just started investing or are an experienced investor, choosing the best Singapore REIT ETF offers a great way to create a diversified income generating dividend portfolio, making it perfect for dividend investing.

Here we’ve listed the best REIT ETFs listed in Singapore Stock Exchange (SGX) that offering high dividend yield.

| Best REIT ETFs Singapore | Index Tracking | What It Tracks | Expense Ratio |

|---|---|---|---|

| NikkoAM-STC Asia REIT SGX: CFA | COI | FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index | Top regional REIT from China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. | 0.55% (Capped) |

| CSOP iEdge SREIT ETF SGX: SRT | SRU | iEdge S-REIT Leaders Index | Top Singapore REITs listed on the SGX | 0.50% to 0.80% |

| LION-PHILLIP S-REIT SGX: CLR | Morningstar® Singapore REIT Yield Focus Index℠ | Top 25 Singapore and regional high-yielding REITs screened by Morningstar. | 0.60% |

| UOB AP GRN REIT SGX: GRN | GRE | iEdge-UOB APAC Yield Focus Green REIT index | Top 50 regional REITs focused on environmental performance based on GRESB’s real estate assessment. | 0.50% to 2.05% |

| PHIL AP DIV REIT SGX: BYJ | BYI | iEdge APAC Ex-Japan Dividend Leaders REIT Index | Top 30 regional REITs ranked and weighted by total dividends. | 1.31% |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the REIT ETFs, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing.

Expense ratio is one of the top criteria when assessing the right ETF to choose from and by analyzing the different Singapore-listed REIT ETFs here are the findings:

- Expense ratio range from approx. 0.50% to 2.05%.

- Lowest expense ratio is approx. 0.50%.

- Highest expense ratio is approx. 2.05%.

- Median expense ratio is approx. 0.50%.

From the comparison, it show that NikkoAM-STC Asia REIT, CSOP iEdge SREIT ETF and LION-PHILLIP S-REIT offers the lowest expense ratio compared to the rest of the REITs, ranging from 0.50% to 0.80%.

However, choosing the right REIT ETF for you depends on many other factors as well, each of us have different preference, so lets take a look at each of the individual REIT ETF and decide for yourself which is the right one for you.

Best Singapore REIT ETFs to Invest For High Dividend

Investing in REITs is a great way to generate income for your investment, and buying the right REITs ETFs will add an additional “protection” through diversification of your investment. Let’s take a look at each of these REIT ETFs listed on the Singapore Exchange.

1. NikkoAM-Straits Trading Asia Ex-Japan REIT ETF

NikkoAM-Straits Trading Asia Ex-Japan REIT ETF is one of the largest REIT ETF listed on the Singapore exchange. Designed to represent the performance of qualifying REITS from China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand.

The selection includes only companies that have a certain level of liquidity threshold.

Securities listed on SGX:

- NikkoAM-STC Asia REIT S$ (SGX: CFA)

- NikkoAM-STC A_REIT US$ (SGX: COI)

Important details:

- Expense ratio: 0.55%

- AUM: S$384.66 million

- Benchmark: FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index

- Distribution: Quarterly

- Annual Dividend Yield: 5.97% (Approx.)

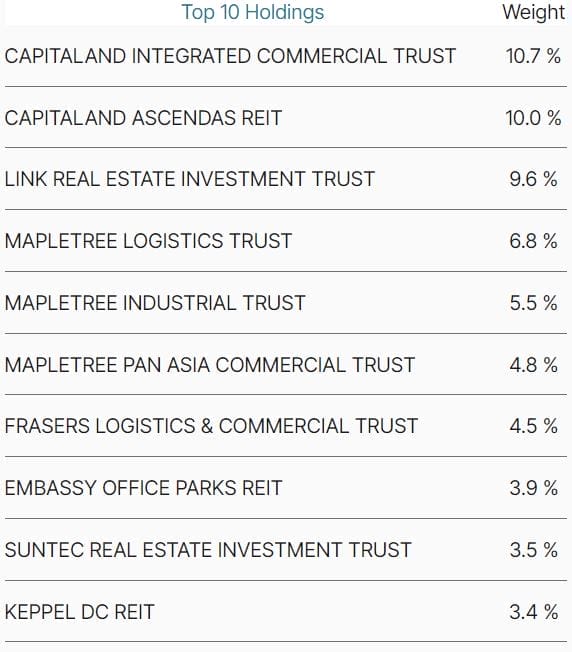

Holdings & Weightage

As one of the largest Singapore REIT ETF the top 3 holding of the ETF sum up to 42.6% of the overall portfolio:

- Capitaland Integrated Commercial Trust

- Capitaland Ascendas REIT

- Link Real Estate Investment Trust

- Mapletree Logistic Trust

- Mapletree Industrial Trust

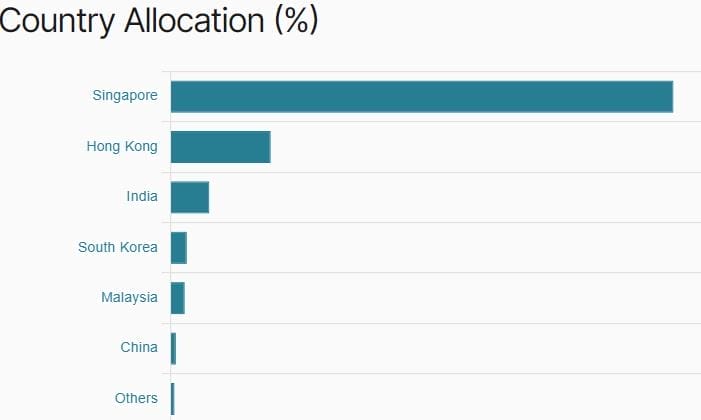

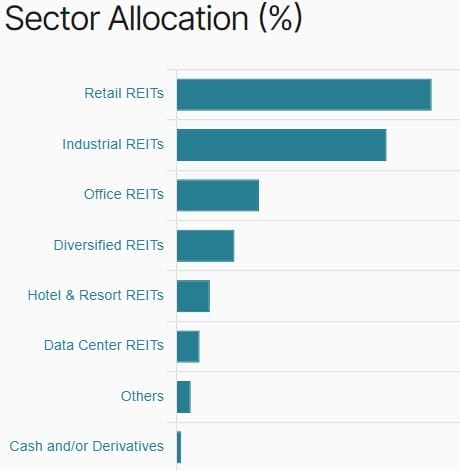

Country and Sector Allocation

With this REIT ETF is mainly focus on Singapore.

While it is Singapore focus, you will be getting some exposure to the rest of the regions such as:

- Hong Kong

- India

- South Korea

- Malaysia

- China

The sector allocation on the REIT ETF is widely diverse with main focused on Retail REITs, Industrial REITs and Office REITs.

My Opinion

NikkoAM-Straits Trading Asia Ex-Japan REIT ETF is Singapore focused with some exposure to the regional market.

Amount this list of REIT ETFs, I think this is probably one of the best option for beginners as it is highly diversified and widely trade with high level of liquidity.

2. CSOP iEdge S-REIT Leaders ETF

CSOP iEdge S-REIT Leaders ETF is designed to reflect the Singapore REITs market segment, reflecting the performance of the iEdge S-REIT Leaders Index which is regarded as the Singapore’s -S-REIT benchmark.

The list of REIT only includes REITs listed on the SGX in SGD.

Securities name listed on SGX:

- CSOP iEdge SREIT ETF S$ (SGX: SRT)

- CSOP iEdge SREIT ETF US$ (SGX: SRU)

Important details:

- Expense ratio: 0.50% to 0.80%

- Fund Size: S$70.24 million

- Benchmark: iEdge S-REIT Leaders Index

- Distribution: Semi-Annual

- Annual Dividend Yield: 5.58% (Approx.)

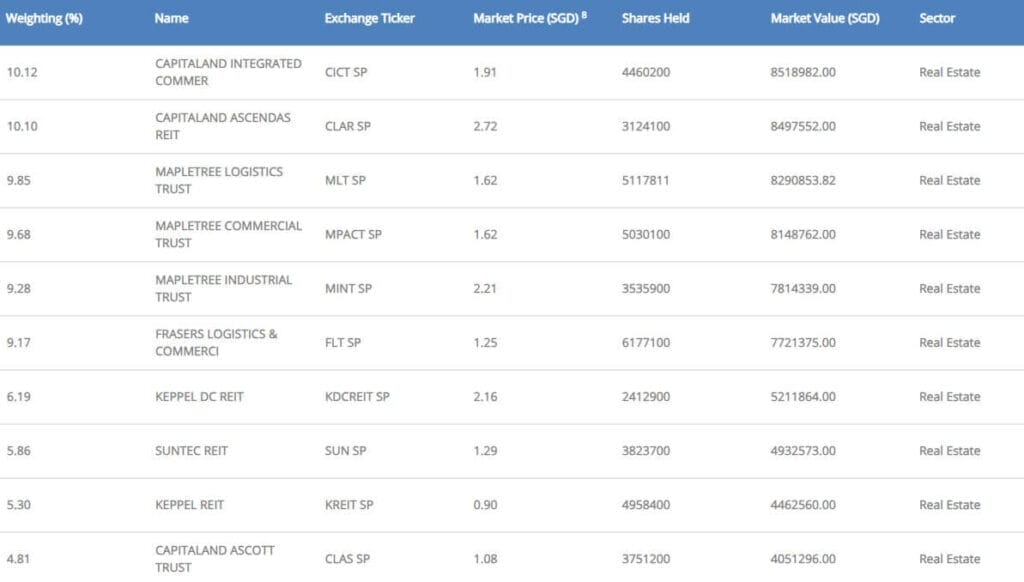

Holdings & Weightage

Focus solely on Singapore listed REITs top 5 holding of the ETF sum up to 49.0% of the overall portfolio:

- Capitaland Integrated Commercial Trust

- Capitaland Ascendas REIT

- Mapletree Logistic Trust

- Mapletree Commercial Trust

- Mapletree Industrial Trust

Country and Sector Allocation

With this REIT ETF is only focus on Singapore listed REITs.

The sector allocation on the REIT ETF is mainly focused on Retail REITs, Industrial REITs and Office REITs.

My Opinion

CSOP iEdge S-REIT Leaders ETF is focused solely in the S-REIT, it is a good option for those who want only to invest in Singapore. However, it is good to note that the top 5 holding that amount to almost 50% of the ETF are of the CapitaLand and Mapletree groups.

In my opinion, I think this maybe a good ETF if you are looking to invest in Singapore REIT and is confidence in the performance and management of CapitaLand and Mapletree groups.

3. Lion-Phillip S-REIT ETF

Lion-Phillip S-REIT ETF is the first ETF in Singapore that let investors to invest in high-quality S-REITs at a low cost.

Screened by Morningstar Research Pte. Ltd., this REIT ETF is designed for creating a basket of high-yielding REIT that is both high quality and have good financial health.

Securities listed on SGX:

- LION-PHILLIP S-REIT (SGX: CLR)

Important details:

- Expense ratio: 0.60%

- Fund Size: S$319.80 million

- Benchmark: Morningstar® Singapore REIT Yield Focus Index℠

- Distribution: Semi-Annual

- Annual Dividend Yield: 5.74% (Approx.)

Holdings & Weightage

As the first REIT ETF in Singapore the top 5 holding of the ETF sum up to 55.4% of the overall portfolio:

- Frasers Centrepoint Trust

- Mapletree Industrial Trust

- Keppel DC REIT

- Capitaland Integrated Commercial Trust

- Capitaland Ascendas REIT

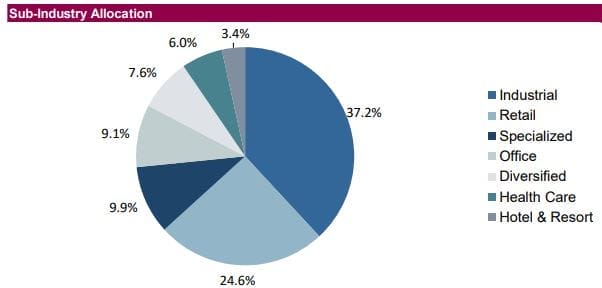

Country and Sector Allocation

As a reflection of the S-REIT, this REIT ETF is focus solely on Singapore.

Having said so, the sector allocation is widely diversified in a few industry with main focused industrial REITs. Sector of the REIT includes; Industrial, Retail, Specialized, Office, Diversified, Health Care and Hospitality.

My Opinion

Lion-Phillip S-REIT ETF is a Singapore focused REIT with over 300 Million asset under it’s management, making it one of the biggest REIT ETF in Singapore.

With a diversified holdings of various REITs listed in Singapore, I personally think this is a good choice for beginner investors, or any investors looking to build a passive dividend portfolio.

4. UOB APAC Green REIT ETF

UOB APAC Green REIT ETF is APAC’s first Green REIT listed on the Singapore stock exchange.

Unlike other REIT ETFs on this list, UOB APAC Green REIT ETF focus on selecting the top 50 higher yielding REITs based on the GRESB’s real estate assessment. These REITs display real estate operations and management practices that shows:

- Lowering carbon and other greenhouse gas emissions.

- Better energy and water conservation

Underlying REITs are weighted by their relative environmental performance using GRESB data in addition to their ESG performance.

Securities listed on SGX:

- UOB AP GRN REIT S$ (SGX: GRN)

- UOB AP GRN REIT US$ (SGX: GRE)

Important details:

- Expense ratio: 0.50% to 2.05%

- Fund Size: $66.61 million

- Benchmark: iEdge-UOB APAC Yield Focus Green REIT index

- Distribution: Semi-Annual

- Annual Dividend Yield: 3.07% (Approx.)

Holdings & Weightage

Unique in it’s approach, this is the world’s first APAC Green Real Estate Investment Trusts (REITs) ETF with the top 5 holding of the ETF sum up to 30.8% of the overall portfolio:

- Capitaland Integrated Commercial Trust

- Scentre Group

- Stockland

- Mirvac Group

- Dexus

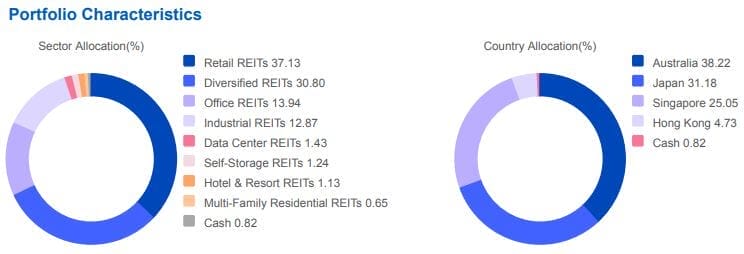

Country and Sector Allocation

Focused in the APAC region, most of the REITs in it’s portfolio are located in Australia.

Country of the REITs in the portfolio includes; Australia, Japan, Singapore and Hong Kong.

The sector allocation for this REIT ETF is somewhat diverse with main focused on Retail REITs, including REITs in sectors such as:

- Retail

- Diversified

- Office

- Industrial

- Specialized (Data Center, Self-Storage etc.)

- Hospitality (Residential etc.)

My Opinion

UOB APAC Green REIT ETF offers you the opportunity to help protect the environment by investing only in REITs that shows sustainable operation and management of the real estate.

Depends on your investment objective, this can be a good option for environmental enthusiasts.

Personally, I think this is not suitable for beginner investors. However, if you want to play a part in supporting business practice that is environmental sustainable, then why not.

5. Phillip SGX APAC Dividend Leaders REIT ETF

Phillip SGX APAC Dividend Leaders REIT ETF is a dividend focused REIT ETF with a portfolio including REITs located in the APAC region.

Selecting the top 30 REITs that offers the highest dividend yield. This ETF consist of a portfolio of the 30 regional REITs ranked and weighted by total dividends paid in the previous 12 months instead of the traditional market capitalisation-weighted indices.

Securities listed on SGX:

- PHIL AP DIV REIT S$D (SGX: BYJ)

PHIL AP DIV REIT US$ (SGX: BYI)

Important details:

- Expense ratio: 1.31% (Varies widely)

- Fund Size: S$9.65 million

- Benchmark: iEdge APAC Ex-Japan Dividend Leaders REIT Index

- Distribution: Semi-Annual

- Annual Dividend Yield: 5.28% (Approx.)

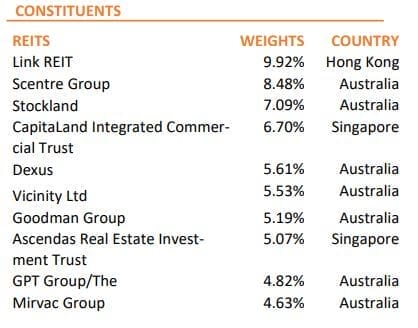

Holdings & Weightage

One of the smallest REIT ETF listed on the Singapore exchange, the top 5 holding of the ETF sum up to 37.8% of the overall portfolio:

- Link REIT

- Scentre Group

- Stockland

- Capitaland Integrated Commercial Trust

- Dexus

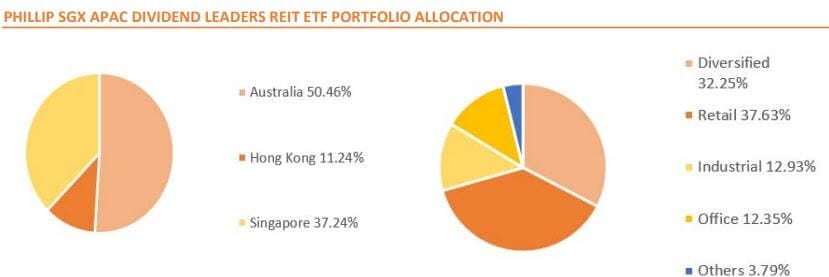

Country and Sector Allocation

Looking into the whole of the APAC region, this REIT ETF create a portfolio that is mainly focus on Australia REITs.

While it is currently Australia focus, the composition of the REIT changes frequently from time to time. With this REIT you will get exposure to rest of the regions such as:

- Australia

- Hong Kong

- Singapore

The sector allocation on the REIT ETF is mainly focused on Diversified REITs with portfolio including REITs of the sector including:

- Diversified

- Retail

- Industrial

- Office

My Opinion

Phillip SGX APAC Dividend Leaders REIT ETF aims to help investor generate a higher dividend yield by focusing on high dividend paying REITs.

However, the expense ratio for this REIT ETF is far too high, it is over 1%, which ‘eats’ into your dividend yield.

Personally, I think investors who are looking for the possibility of getting a higher dividend yield may consider this REIT ETF, but this is not suitable for new investors.

How to Invest in REIT ETFs Listed on SGX?

Getting started in investing in REIT ETFs is simple and it follow the similar process of investing in any other securities like stocks or REITs.

To invest in REIT ETFs, you’ll just need to follow these easy steps:

- Apply and Open a CDP Securities Account through the CDP website.

- Review the best online brokerage trading platform that offers buying and selling stocks, ETFs and other forms of securities listed on the SGX.

- Open an online trading account with your desired online broker.

- Fund your brokerage account with your investment fund.

- Start trading from the list of REIT EFTs listed on the SGX offered by the broker.

Just take note, when you are buying and selling any form of ETFs, there is fees involved:

- Expense ratio for the fund manager to manage the fund you are buying.

- Platform fees for the trading platform.

- Commission fees for brokerage.

- Custodian fees if your securities is not held in the CDP account.

If you are unsure which brokerage to get started, check out the online broker below.

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

Should You Consider Investing in REIT ETF?

REITs is a great way to invest in real estate without the headache of having to manage the properties, and ETF is probably the best way to diversify your investment.

Investing in REIT ETFs gives you both the advantage of investing in REITs and ETFs, investing at low cost, low risk investment that is professionally managed to reflect the index it is tracking.

If you are an dividend investor, who don’t want to spend too much time analyzing which REITs to buy, investing in REIT ETFs offers a easy way for you to buy a basket of REITs to earn passive dividend income without you doing much management.

However, if you are looking to pick the REITs yourself, you may want to learn more about how to pick a good REIT using analysis such as:

- Fundamental analysis to understand the REIT’s fundamentals.

- Technical analysis is to get an idea on the general consensus of the price of the REIT.

Before you go, here are some handpicked articles that you maybe interested:

Disclaimer: I may or may not have invest in any of them, what’s listed here is only for entertainment purpose only and it should never be used as any form of investment advice. This is my diary on my stock analysis, while I’ve been investing for +15 years, I am still learning. I wish to share what I learn during my investment journey so you may learn from both my success and mistakes. Enjoy!

- Dividend Investing Singapore: Complete Beginners Investor Guide

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Price to Sales Ratio (P/S Ratio): Investor’s Guide to Valuation Metrics When Profit is Absent

- Price to Earning Ratio: Dividend Investor’s Essential Metric to Know

- 3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).