5 Best Dividend ETFs to Invest in Singapore in 2024 (Beginner’s Guide)

Disclaimer: The information on this page is for entertainment purposes only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Investing in Exchange Traded Funds (ETFs) in Singapore is the easiest way to get started in investing and build wealth. By investing in high yielding dividend ETFs listed on the Singapore Stock Exchange, you can build a dividend portfolio that helps you grow your wealth.

These top ETFs in Singapore invest in a basket of high quality dividend stocks listed on the Singapore Exchange as well as internationally.

Interested?

KEY TAKEAWAYS

- Singapore ETFs offers a simple way to invest in a diversified basket of stocks, REITs, bonds while enabling you to earn a passive dividend income creating your own dividend portfolio.

- Each ETFs are differentiated from each other by the different index it tracks, the expense ratio, selection methodology, and region as well as sectors that it is focus on.

- Buying ETFs is best way to start investing, and getting started with a good online brokerage platforms that offers low fees trading is key.

Best ETFs in Singapore For Singapore Investors That Offers High Returns on Investment

In our research for this list of best dividend ETFs, we’ve looking into various ETFs listed on the Singapore Exchange (SGX) that tracks the performance of various index including;

- Singapore Real Estate Investment Trust ETF (S-REIT ETF)

- Bond ETF (High Yield Bond Index ETF)

- Commodity ETF (Gold ETF in Singapore)

- ETF that tracks the performance of high-quality companies listed on the Singapore Stock Exchange

- ETF that tracks the top US publicly listed companies

(I was actually looking for a good ETF to diversify my portfolio, thus this is what I’ve found. You maybe surprised at the list though.)

With that, here are the best ETFs listed on the Singapore Stock Exchange you should consider investing.

| Best ETFs in Singapore | Index | What It Tracks | Expense Ratio | Dividend Yield |

|---|---|---|---|---|

| SPDR Straits Times Index ETF SGX: ES3 (SGD$) | Straits Times Index | Top 30 companies ranked by market capitalization that is publicly listed on the Singapore Stock Exchange. | 0.30% | 3.77% |

| SPDR S&P 500 ETF Trust SGX: S27 (USD$) NYSE: O87 (USD$) | S&P 500 Index | Top 500 publicly traded companies ranked by market capitalization in the United States Stock Exchange. | 0.09% | 1.67% |

| LION-PHILLIP S-REIT ETF SGX: CLR (SGD$) | Morningstar® Singapore REIT Yield Focus Index℠ | Top 25 Singapore and regional high-yielding REITs screened by Morningstar. | 0.60% | 5.39% |

| NikkoAM-StraitsTrading Asia ex Japan REIT ETF SGX: CFA (SGD$) SGX: COI (USD$) | FTSE EPRA Nareit Asia ex Japan REITS 10% Capped Index | Top regional REIT located in China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. | 0.55% | 6.03% |

| ABF Singapore Bond Index Fund SGX: A35 (SGD$) | iBoxx ABF Singapore Bond Index total return series | Indicator of investment returns of debt obligations guaranteed by the Asian Governments (Government bonds). | 0.24% | 2.90% |

Note: Data are consolidated, checked for accuracy and ensure outmost reliability by the Author through hours of research into each of the ETFs, the author aims to provide the most accurate data by following strictly according to our editorial guidelines but always do your own due diligence before investing.

The top 3 criteria that is taken into account for this are, expense ratio, index that each ETF tracks, and the dividend yield.

- Expense Ratio Range: 0.09% to 0.60%

- Index Tracking Includes: Straits Times Index, S&P 500 Index, Morningstar Singapore REIT Yield Focus Index, FTSE EPRA Nareit Asia ex Japan REITS 10% Capped Index and iBoxx ABF Singapore Bond Index total return series.

- Dividend Yield Range: 1.67% to 6.03%

From the comparison, a few observation can be made as an investor:

- SPDR S&P 500 ETF Trust (SGX: S27 and NYSE: O87) have the lowest expense ratio.

- NikkoAM-StraitsTrading Asia ex Japan REIT ETF (SGX: CFA, COI) has the highest highest dividend yield.

Buying ETFs offers the easiest way to diversify your portfolio while earning a great dividend return on your investment.

With a high level of certainty that your portfolio is relatively safe from the impact of market fluctuation cause by each individual stocks and being relatively low risk, this is one of the most popular investment Singaporeans invest.

Let’s take a look at each dividend ETFs you can invest in Singapore Exchange (SGX) for passive income.

What follows, are my handpicked list of my favorite ETFs to buy in Singapore. For each of the ETFs, I’ve make a note to myself on the risk level, the volatility level and the moat level which are extremely subjective depending on each person. This is not investment advice, but my own personal opinion that I am sharing here.

Best Index ETFs For Index Fund in Singapore

1. SPDR Straits Times Index ETF (SGX: ES3)

SPDR® Straits Times Index ETF is Singapore’s first locally created exchange traded fund. The fund is to replicate as closely as possible, before expenses, the performance of the Straits Times Index (STI) by putting assets in Index Shares on the same weightings as reflected in the Index.

Investing in the top 30 companies ranked by market capitalization that is publicly listed on the Singapore Stock Exchange, this ETF reflect the overall stock market performance in Singapore.

Securities listed on SGX:

- SPDR Straits Times Index ETF (SGX: ES3)

Important details:

- Expense ratio: 0.30% per annual

- Fund Size: $1,473.25 Million (Approx.)

- Benchmark Index: Straits Times Index

- Dividend Distribution: Semi-Annual

- Annual Dividend Yield: 3.77% (Approx.)

- Liquidity: Trading Volume >300,000 per day (High liquidity)

My Opinion

SPDR Straits Times Index ETF is probably the most stable, reliable and extensively traded ETF listed on the SGX. The STI ETF track the performance of the top 30 companies on SGX, including familiar companies listed on the Singapore market, such as the banking stocks, largest REITs and various blue-chip high quality Singapore stocks.

The STI ETF dividend ranges from 3% to 4% per annual, and with the benefits of being highly diversified, offering high level of liquidity, being relatively low risk, this is a great alternative to Singapore Government Bonds or T-Bills.

Perfect for long-term investors, passive dividend investors and beginners who just started investing.

Risk Level:

Low

Volatility Level:

Low

MOAT Level:

Good

Dividend Frequency:

Semi-Annually

Do note the analysis is purely my personal opinion.

2. SPDR S&P 500 ETF Trust (SGX: S27 and O87)

SPDR S&P 500 ETF is the oldest and largest S&P 500 US ETF that tracks the performance of largest 500 publicly traded companies listed on the New York Stock Exchange (NYSE) through full replication method. This is the only S&P 500 ETF that is listed in the Singapore Stock Exchange (SGX), and the only ETF Singaporeans can invest in the top 500 companies in the US on the Singapore Exchange.

Securities listed on SGX and NYSE:

- SPDR S&P 500 ETF (SGX: S27) in Singapore Exchange

- SPDR S&P 500 ETF (NYSE: SPY) in the United States Stock Exchange

Important details:

- Expense ratio: 0.09% per annual

- Fund Size: US$415 Billion (Approx.)

- Benchmark Index: S&P 500 Index

- Dividend Distribution: Quarterly

- Annual Dividend Yield: 1.67% (Approx.)

- Liquidity: Trading Volume <1,000 per day (Low liquidity)

My Opinion

SPDR S&P 500 ETF offers Singaporean investors to diversify their dividend portfolio overseas into one of the largest stock market index in the world “S&P 500” without the headache of opening an account that can access to the international stock exchange (NYSE or Nasdaq).

However, as a Singapore investor you need to take note that:

- All dividend income you earn from this ETF is subjected to Dividend Withholding Tax (DWT) of 30%, as the fund is domicile in the United States.

- Investing in this ETF will require you to change your currency into USD, which can expose you to currency exchange risk.

Having said that, this ETF is prefect for those who want to invest in the United States and do not want to open an online brokerage that have direct access to the US stock market.

Risk Level:

Low

Volatility Level:

Mid

MOAT Level:

Good

Dividend Frequency:

No Dividends

Do note the analysis is purely my personal opinion.

Best REIT ETFs in Singapore to Invest For High Dividend Yield

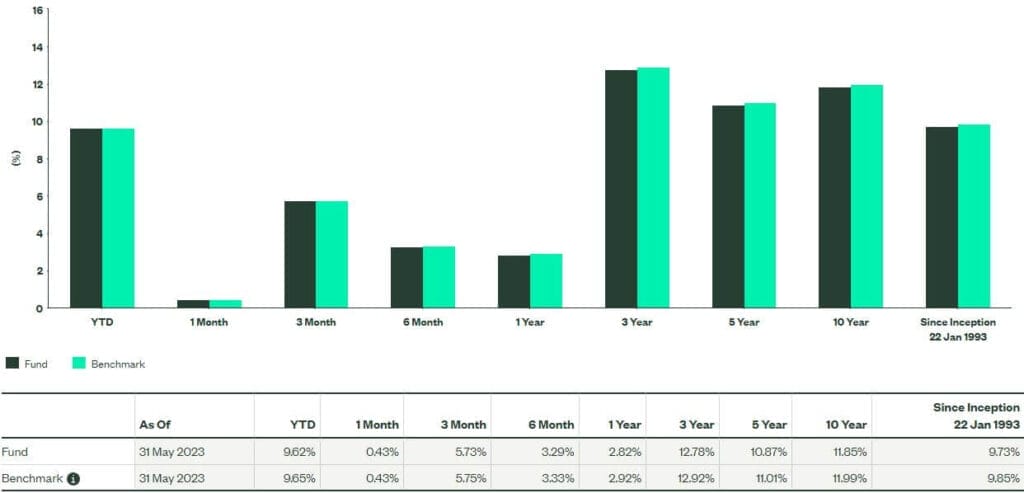

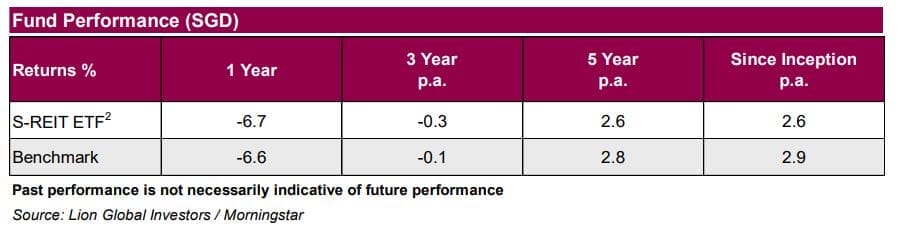

3. LION-PHILLIP S-REIT ETF (SGX: CLR)

Lion Phillip S-REIT ETF is the first Singapore REIT ETF that focus on high-quality Singapore REITs. Including only REITs ETF (S-REIT ETFs) listed on the Singapore Exchange, this ETF let investors to focus on their exposure to Singapore REITs only.

Screened by Morningstar Research Pte. Ltd., this ETF offers investing in EFTs that are of high quality and have sound financial health.

Securities listed on SGX:

- LION-PHILLIP S-REIT (SGX: CLR)

Important details:

- Expense ratio: 0.60% per annual

- Fund Size: S$325.40 million (Approx.)

- Benchmark Index: Morningstar® Singapore REIT Yield Focus Index℠

- Dividend Distribution: Semi-Annual

- Annual Dividend Yield: 5.61% (Approx.)

- Liquidity: Trading Volume >200,000 per day (High liquidity)

My Opinion

Lion Phillip S-REIT ETF is the best REIT ETFs listed in Singapore that tracks the Morningstar Singapore REIT. With a strong focus on local REIT, you will not be exposed to currency risk or political risk that can occur in other some other countries.

Investing in Singapore REITs such as CapitaLand Integrated Commercial Trust that is valued over $10 billion dollar in assets, Lion Phillip S-REIT ETF give a diverse exposure to +20 REITs listed in Singapore.

Perfect high dividend yield REITs ETF for long-term dividend investors or beginner investors looking to build a stable dividend portfolio.

Risk Level:

Low

Volatility Level:

Low

MOAT Level:

Good

Dividend Frequency:

Semi-Annual

Do note the analysis is purely my personal opinion.

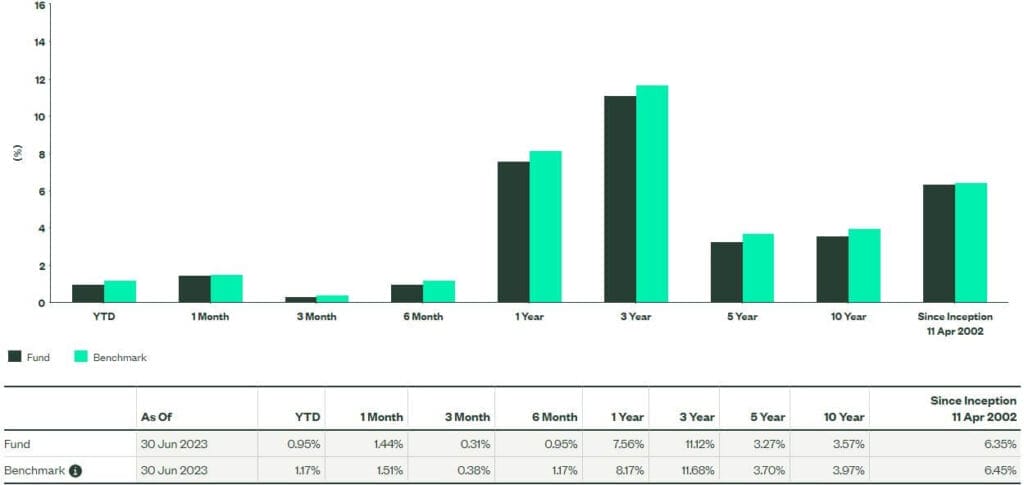

4. NikkoAM-StraitsTrading Asia ex Japan REIT ETF (SGX: CFA and COI)

NikkoAM-Straits Trading Asia Ex-Japan REIT ETF is one of the top Singapore REIT ETFs that offers regional exposure to qualifying REITs located locally in Singapore and regionally in China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, South Korea, Taiwan and Thailand.

Tracking the FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index, this ETF tracks the performance of REITs in the developed and emerging countries in the Asia ex Japan region by market capitalization. Quarterly rebalanced this ETF offer some of the most attractive dividend yields across the world.

Securities listed on SGX:

- NikkoAM-STC Asia REIT S$ (SGX: CFA)

- NikkoAM-STC A_REIT US$ (SGX: COI)

Important details:

- Expense ratio: 0.55% per annual

- AUM: S$388.70 million (Approx.)

- Benchmark Index: FTSE EPRA Nareit Asia ex Japan REITs 10% Capped Index

- Dividend Distribution: Quarterly

- Annual Dividend Yield: 6.03% (Approx.)

- Liquidity: Trading Volume >500,000 per day (High liquidity)

My Opinion

NikkoAM-Straits Trading Asia Ex-Japan REIT ETF allow investors to invest in regional REITs without the headache of picking your own portfolio of REITs that represents the performance of the region.

Focusing on both developed and emerging countries, this REIT ETF offers Singapore investors to participate in the real estate growth of the region.

Perfect for long-term investors who have a positive outlook of the future of REITs in the region. A great option for dividend REITs investors who want to diversify their dividend portfolio.

Risk Level:

Mid

Volatility Level:

Low

MOAT Level:

Average

Dividend Frequency:

Quarterly

Do note the analysis is purely my personal opinion.

Best Investment Grade High Yield Bond Index ETF in Singapore

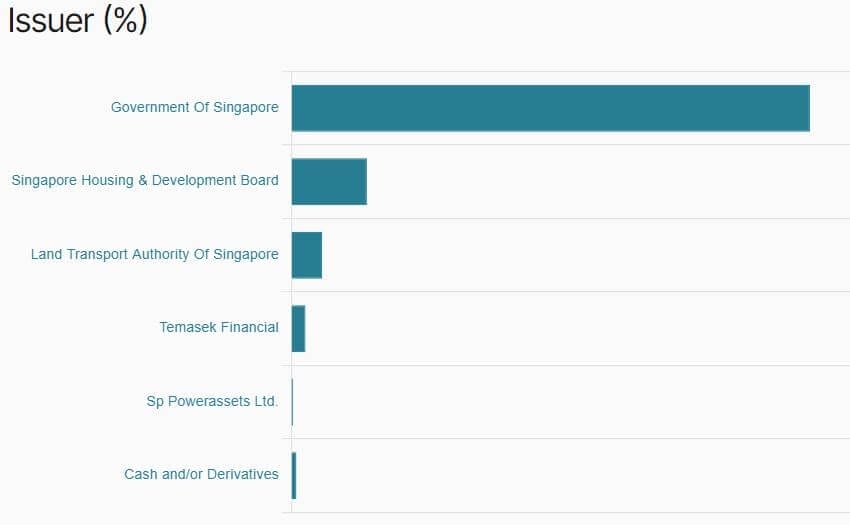

5. ABF Singapore Bond Index Fund (SGX: A35)

ABF Singapore Bond Index Fund seeks investment results that correspond closely to the total return of the iBoxx ABF Singapore Bond Index before fees and expenses.

The ETF will reflect the total investment returns of debt obligations issued or guaranteed by the Asian Governments including:

- Government of Singapore or in some cases, government of People’s Republic of China, Hong Kong SAR, Indonesia, Korea, Malaysia, Philippines or Thailand.

Securities listed on SGX:

- ABF SG BOND ETF (A35)

Important details:

- Expense ratio: 0.24% per annual

- Fund Size: S$983.36 Million (Approx.)

- Benchmark Index: iBoxx ABF Singapore Bond Index total return series

- Dividend Distribution: Semi-Annual

- Annual Dividend Yield: 2.90% (Approx.)

- Liquidity: Trading Volume >1,000 per day (Low liquidity)

My Opinion

ABF Singapore Bond Index Fund is the most liquid bond ETF that is traded in the Singapore Exchange (SGX). Re-balanced monthly on the last calendar day of the month, this is the most comprehensive ETF that tracks the returns of the bonds offered by the Asian Government.

Perfect for bond investors, looking for low fluctuation ETF to park their money while waiting for future opportunities to invest in other high yielding dividend ETFs.

Risk Level:

Low

Volatility Level:

Low

MOAT Level:

Good

Dividend Frequency:

Annually

Do note the analysis is purely my personal opinion.

How to Choose The Best ETFs to Invest in Singapore

Choosing the best dividend ETF to build your dividend portfolio will require you to look at a few important metrics. Since each investor have a different investment goal, you may find one metric more important than the other.

Here are some things to look for when choosing the right dividend ETFs to invest:

1. Dividend Yield And Distribution

Consider ETFs with consistent and attractive dividend yields. While high yield can be attractive, it may be an indication of unsustainable payments or risks. Yields of within 3% to 8% are generally considered acceptable.

It is good to note that not all ETFs payout dividend to investors, however for those ETFs that does, it is good to note the dividend distribution frequency.

Generally the dividend distribution frequency are as follow:

- Monthly

- Quarterly

- Semi-Annually

- Annually

2. Dividend Growth

While it is not as easy to identify dividend growth of an ETF, identifying ETFs that tracks index of sectors with growth can offer some quick insight on possible dividend growth of the ETF.

3. Expense Ratio

Low expense ratio is the key to profitable investing for dividend ETFs. This is especially true if you are an long-term investor looking to compound your annual return on your investment.

An expense ratio of less than 1% is often consider acceptable.

4. Index Tracking

Depending on your investment goal, you may want to invest in different dividend ETFs that tracks various index. Some examples of the index are:

- Index that tracks the performance of the general stock market performance.

- Index that tracks the return on bond investments.

- Index that tracks the performance commodities like gold and silver.

- Index that tracks the performance of REITs.

These index can be further separated into their different tracking mythology, investment strategy, ranking and weighing methodology etc.

Understand what the ETF tracks before you buy.

The rule of thumb, “if you don’t understand, don’t buy”.

5. Fund Size and Liquidity

Fund size shows how much money are pooled into the fund. Bigger the fund size, higher the level of liquidity is the fund.

When buying ETF, you always want to invest in one that offers higher level of liquidity, so that you are able to easily buy and sell the fund when you want.

Depending on your investment objective, a fund size of more than 100 million is better than another that is 10 million.

As a guideline, invest in ETF that is more than $100 Million if you want your investment to be highly liquid.

How to Start Investing in ETF Listed on The Singapore Exchange (SGX)?

Getting started in investing in ETFs listed in Singapore is the same as how you invest in common stocks listed on the SGX.

Here are the steps you’ll need to take:

- Get an CDP Securities Account

- Select the best online brokerage platform that is regulated by the Monetary Authority of Singapore (MAS)

- Ensure it is able to access the SGX then sign-up and open your an online trading account with a licensed stockbroker .

- Fund your trading account with your investment fund.

- Start trading your desired EFTs listed on the SGX.

If you are unsure which brokerage to get started, check out the online broker below.

BEST FOR: Beginner Retail Investors and Professional Traders Looking For All-In-One Trading App to Invest in SG, US, HK and China.

securely through Moomoo’s website

BEST FOR: General Investors and Traders Looking to Invest Internationally in SG, US, HK and China stock market.

securely through Webull’s website

Should You Start Investing in Singapore ETFs?

Today, there is over +60 ETFs available to trade on the Singapore Exchange, offering you a wide range of options to invest in the top ETFs that tracks the performance of various index.

As an dividend investor, I will very much prefer to invest in REIT ETFs as they offers the highest potential of giving a high dividend yield.

The current dividend yield of the top performing REITs ETF is over 6%, while a bond ETFs offers less than 3%, just slightly higher than our CPF which is at 2.5%.

Nonetheless, if you are looking to invest in Singapore, check out our handpicked list that you’ll probably be interested:

- Best Dividend Stocks In Singapore

- Best High Dividend REITs in Singapore

- Best Singapore Bank Stocks For Dividend

- Best REITs ETFs to Buy for High Dividend in Singapore

- Best Gold ETFs to Invest Now

- Best S&P 500 ETFs for Passive Income

Frequently Ask Questions (FAQs)

Disclaimer: I may or may not have invest in any of them, what’s listed here is only for entertainment purpose only and it should never be used as any form of investment advice. This is my diary on my stock analysis, while I’ve been investing for +15 years, I am still learning. I wish to share what I learn during my investment journey so you may learn from both my success and mistakes. Enjoy!

- Dividend Investing Singapore: Complete Beginners Investor Guide

- Best Undervalued Stocks in Singapore That Pays High Dividend in 2024 (Updated)

- Price to Sales Ratio (P/S Ratio): Investor’s Guide to Valuation Metrics When Profit is Absent

- Price to Earning Ratio: Dividend Investor’s Essential Metric to Know

- 3 Best Singapore Bank Stocks To Buy Now For High Dividend Yield in 2024 (Updated)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).