Switching Moat: Building Economic Moat, A Business Moat With Competitive Advantage

Switching Moat is one of the intangible assets, a competitive advantage in business that protects your business from your competitors. The kind of moat that Warren Buffett love and we can see it from his purchase of the Apple Inc. stocks.

However, amount all types of Economic Moats in business and investing, the switching moat is probably one of the hardest to understand but one of the most powerful of all.

So what exactly is switching moat, and why investors love them?

KEY TAKEAWAYS

- Switching Moat is measured by the switching cost switch to a competitor. It is an intangible moat which is also called a soft moat that creates a substantial switching cost that protected the business.

- Switching Moat works by increasing the switching cost through, financial cost, time cost, effort cost and networking effect to achieve customer loyalty and retention.

- Benefits of companies with strong Switching Moat includes; long-term stability, higher customer retention and greater pricing power of the products and services.

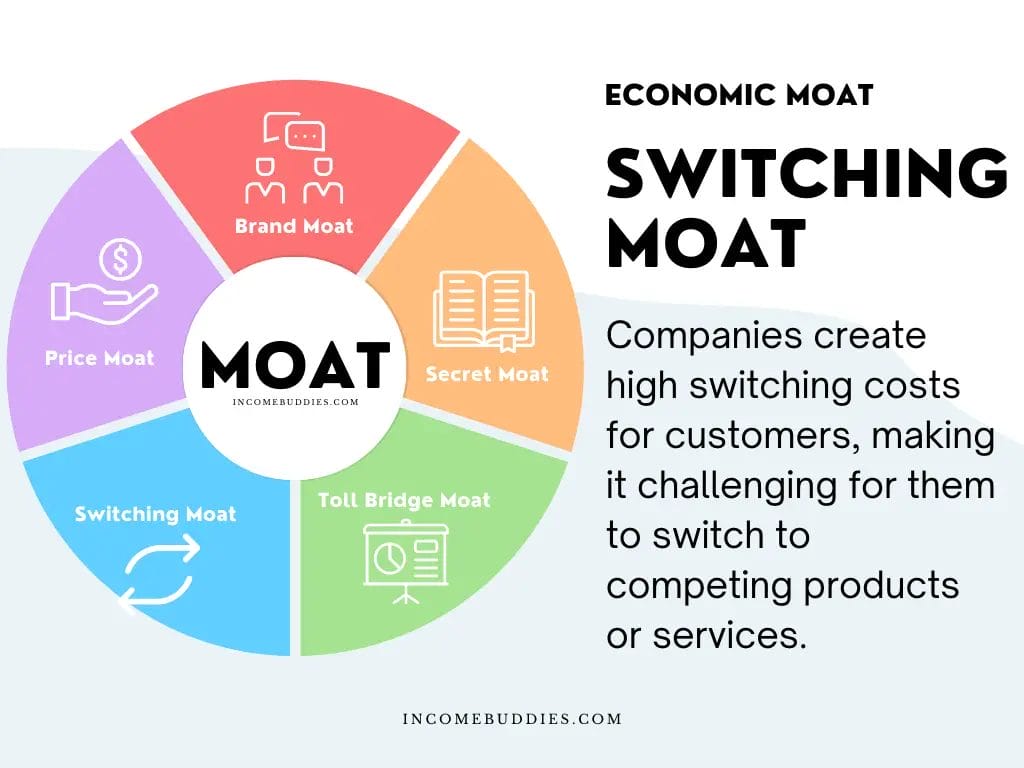

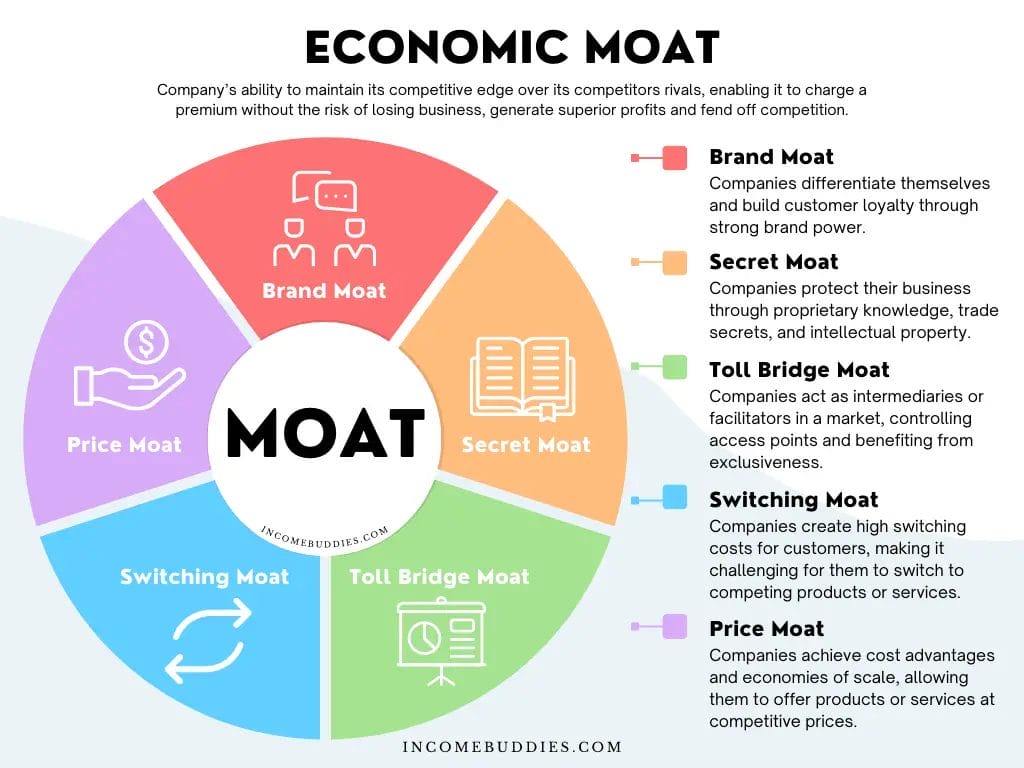

What is Switching Moat in Terms of Economic Moat?

Switching Moat is created when the companies create a high switching costs for customers, making it hard for them to switch to competing products or services. It is an economic moat that prevent the customers to switch to their competitors subconsciously through increasing high switching cost.

Switching moat is also referred to as the “soft moat”, an intangible economic moat which helps build a competitive advantage for the company.

How Switching Moat Works?

To understand the working mechanism of Switching Moat, let’s take a look at how companies create high switching costs for customers. This switching costs can be financial, time-based, effort-based or through network effects.

- Financial: Companies can use financial barriers that make it financially illogical for customers to switch. Companies use tactics such as; high cancellation fees, costly equipment or software investments, or long-term contracts with penalties for early termination.

- Time-based: Time is the another tool that companies can used to increase the switching cost for customers to switch to alternatives. Products and services attained the time-based switching moat through integrating complex systems that require extensive training or onboarding processes, or offering specialized products or service that requires a significant learning curve.

- Effort-based: Effort-based moat requires each customers to invest a significant effort to switch to a competitor. The effort can be in the form of data migration challenges, loss of personalized settings or preferences, or the need to rebuild social networks or connections.

- Network Effects: Network effects become stronger as more people are using a product or service. The business itself keep the people around you (your network) within the platform creating a significantly high switching costs. This helps companies to retain a loyal customer base and deter competitors.

Moat don’t work alone, companies often display multiple moats, and together it create a strong economic moat that protects the business from its competitors.

Types of Switching Moats

Switching moats of a company comes in various forms, depending on the industry, companies implement different strategies to protect themselves from competitors. Here are some different types of switching moats:

1. Lock-in Contracts

Lock-in contracts is probably the most common types of switching moat, where a company companies may lock customers into long-term contracts or subscription plans.

Breaking of the control may result in financial penalty, making it financially unsound or contractually binding for customers to switch to alternatives.

Examples: Telecommunication companies and any subscription services falls into this category.

2. Proprietary Platforms

Companies develop proprietary platforms or ecosystems that offer unique features, integrations, or compatibility. Customers become accustomed to these platforms, making it challenging to switch due to the loss of convenience or functionality. Less effort will be required for the customer to stay with the company than to switch to its competitor.

Examples: Technology companies such as Google, Apple and Microsoft falls into this category.

3. Interconnected Services

By providing a deeply interconnected services or products, companies create a web of dependencies that make it difficult for customers to switch without disrupting their entire workflow or experience.

Examples: Companies that have build an ecosystem within their platform such as Google, Apple and Microsoft falls into this category.

4. Data Portability Challenges

Companies that store large amounts of customer data can utilize it as a switching moat. When transferring data to a new provider becomes complex or risky, customers may hesitate to switch.

Examples: Giant technology company such as Google (Google Cloud) and Amazon (AWS Cloud) falls into this category.

5. Customer Experience Differentiation

Companies that offers exceptional customer experience can act as a powerful switching moat that connects the brand with the customer.

Companies that invest in personalized interactions, superior support, or seamless user interfaces create an emotional bond with customers, making them reluctant to switch.

Examples: Companies known for its expectational unique value such as Apple Inc. falls into this category.

Types of Switching Moats And Characteristics Summary

Each type of switching moat have their own unique characteristics, and sometimes, companies use a combination of a few different types of switching moat to increase the switching cost.

Here is a table summarizing the types of switching moats and their characteristics:

| Type of Switching Moat | Characteristics |

|---|---|

| Lock-in Contracts | Financial burden or contractual obligations |

| Proprietary Platforms | Unique features, integrations, or compatibility |

| Interconnected Services | Dependency on multiple services or products |

| Data Portability Challenges | Complex or risky data transfer processes |

| Customer Experience Differentiation | Personalized interactions, superior support, seamless user interfaces |

Creating a high switching cost can help keep customers loyal, giving the company a competitive advantage over their competitors.

Benefits of Companies With Strong Switching Moat for Investors

As an investor, identifying companies with a strong switching moat can bring a lot of benefit to us as investors. Here are some of the most important benefits:

- Long-Term Competitive Advantage Market Dominance: Companies with a strong switching moat create a distinct competitive advantage, which helps them maintain market dominance. This is because the high switching costs can act as a protective barrier, making it hard for competitors to attract and retain customers.

- Higher Customer Retention Rates and Reduced Churn: High switching costs makes customers less likely to switch to alternatives, resulting in higher customer retention rates and increased stability of revenue streams.

- Pricing Power and Ability to Maintain Profit Margins: Companies with a strong switching moat almost always command premium pricing for their products or services. Due to the perceived value, convenience, and difficulty to switch to a new provider, companies have higher pricing power even in competitive markets.

Companies with a strong switching moat means the company is able to have a higher profit margin, more stable income and greater possibility of company growth, which are all things investors look for when investing.

How To Identify Companies With Switching Moat?

Switching moat, is an intangible moat and it is often not easy to identify. The simplest way to identify a switching moat is to simply ask yourself why are you using this product instead of the competitors product.

If your answer is something like:

- …because it is costly.

- …because it takes a lot of effort.

- …because it takes a lot of time.

- …because my network are not in there.

Then, the reason that you’ve given is the switching cost and when combines this is the switching moat that the company have over its competitors.

However, if you want a more scientific way to identify the switching moat here are some suggestion.

1. Market Research and Customer Analysis

Conduct in-depth market research to understand the internal makings of the industry and customer preferences.

Look at news and article to analyze customer behavior, including the reason that influence their switching decisions and the value they get from the company’s products or services.

2. Competitive Analysis and Industry Dynamics

Look into the competitive landscape and identify companies that shows the same characteristics of a switching moat.

Study their strategies, read through their customer reviews, and see how they are positioned in the market to gain insights into their switching moat strength.

3. Utilizing Financial Statements and Annual Reports

Deep dive into their financial statements and annual reports to understand the company’s financial health, revenue stability, and profitability.

Look for areas where it indicate customer loyalty, pricing power, or any specific mentions related to switching moat strategies.

Look at what the CEO says and look at what the CEO didn’t say. See if what the CEO says is align to what the company is currently doing.

4. Network Effects and User Growth

Network effects is much more obvious and easy to identify. Look within the company’s business model and look for evidence for network effect.

If it takes you a lot of effort to find it, it means the network effect is weak or non-existent.

A strong network effect will be obvious and should not take a lot of effort to find.

Look for indications of strong user growth, growing user base, or indication of positive feedback that contribute to the switching moat’s strength.

5. Customer Testimonials and Reviews

The simplest way is to talk with the customers directly and ask them what they thing and why they are using the product or service.

Alternatively, you can seek out customer testimonials and reviews to understand what the customer things about the company’s switching moat.

Not only you will know what the customer choose the company, you will also understand why the customer stay with the company even where there are so many alternative in the market.

Case Studies: Companies with Switching Moat

To further talk about the concept of switching moat and its impact for a business and for investors, lets take a look at some real-life examples of companies that have strong switching moat:

Example 1: Google LLC

Since you are online, it is impossible for you not to know Google. With google, they have an whole ecosystem where it keeps their customers within its platform, ranging from Gmail, Google search, to Google Workspace, you and live on the internet without actually leaving the platform.

With it’s strong switching moat, Google have been growing rapidly for the past decades growing its user base everyday.

Example 2: Apple Inc.

iPhone, iPad, Mac, iOS system, Apple Safari , these are just some products and service offered by Apple Inc. when you ask someone to stop using Apple products, they will probably say they can’t, because they have everything stored in their iCloud, all their devices are Apple and will not be compatible with Android or Window system.

These users are “Locked” in the Apple ecosystem and they are willingly locked in the system because they enjoy the customer experience, interconnectedness, and convenience that the Apple company provides.

Final Thoughts on Switching Moat

Switching Moat is a powerful economic moat that investors should not ignore when evaluating potential investment opportunities.

Not many companies have a switching moat, but for those who have this moat, and is able to create a high switching costs for customers will enjoy many benefits such as pricing power, long-term stability and growth potential.

Switching moat is a valuable asset, and when investors are doing fundamental analysis of an investment, this should taken into consideration when finding the right stock to buy.

As an investor, we should always looking into the different Economic Moats that a company have to offer before making any investment decisions.

With a long-term value investing mindset, gaining a better understanding of economic moat that give a durable competitive advantage for the business will help you make better informed decisions and building a robust investment portfolio.

Read Also:

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).