Options Trading For Beginners: Guide On How To Become an Option Trader

Disclaimer: The information on this page is for entertainment purposes only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

Today, we get to invest in many securities: stocks, bonds, commodities, mutual funds, futures, options, and more.

Of these options, option trading is one of the most mysterious and difficult to understand. Yes, I am talking about all the weird terms it uses, such as “calls” and “puts”.

While options trading can be a great tool to increase your net worth if you do it right, it can also be a dangerous tool that can lead to bankruptcy when used wrongly.

KEY TAKEAWAYS

- Call Options is the “right to buy” an asset and Put Options is the “right to sell” an asset at a predetermined price before the contract expires.

- Put strategy: Buy puts to hedge your position to serve as an insurance or sell cash secured puts to collect premium.

- Call strategy: Buy call to speculate a raising position to capture a larger gains or sell covered calls to collect premium.

- Never sell naked call, your risk is unlimited as the market price can be infinite in the upward direction.

- Never sell naked put, you will risk having to buy the stock even when you do not have the cash required when the price drop to your strike price.

What are Options Trading?

An option is essentially a contract that grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a set time frame.

Options are derivatives, meaning their value is based on the price of something else, like stocks or ETFs. Your success in options trading hinges on accurately predicting price movements of the underlying asset.

How is Options Trading Different From Stocks Trading?

| Options Trading | Stocks Trading |

|---|---|

| Grants a right, not an obligation | Involves actual ownership of a stock |

| Based on predicting price movements | Tied to the performance of the company |

| Has expiration dates | No expiration; can hold stocks indefinitely |

| Can employ various strategies | Primarily buying low and selling high |

| Used for hedging or speculating | Used for long-term investment growth |

Traders have distinct choices: dabbling in the direct purchase and sale of stocks or leveraging options trading.

- For stocks trading, you gain ownership in a company, potentially receiving dividends and voting rights.

- For options trading, it doesn’t convey ownership but offers flexibility in investment strategies, such as hedging against price declines or generating income on existing stock positions.

Your engagement with options trading requires partnering with options trading platforms or online brokerages that provide the necessary platform and approval for trading options based on your experience and investment profile.

Two Types of Options (Call Options and Put Options)

Options trading presents you with two key investment choices to enhance your financial strategy: Call Options and Put Options.

These derivative contracts offer flexibility, allowing you to leverage market movements without the obligation of asset ownership.

Put Options

Put Options empower you to sell an asset at a predetermined price before the contract expires. You benefit from these if you anticipate a decline in the asset’s price.

Essentially, when you purchase a put option, you’re securing the right to sell at a favorable price, potentially hedging against losses in your portfolio.

Here’s a simple breakdown:

| Asset Price Falls Below Strike | Asset Price Above Strike |

|---|---|

| Your Profit: Increases as price drops. | Your Loss: Limited to Premium Paid. |

Call Options

Call Options grant you the right to buy an asset at a set strike price before expiry. You benefit from these when you predict an asset’s price will rise.

Buying of the call options offer a strategic advantage by providing unlimited profit potential for a fixed cost, which is the premium you pay for the call option itself.

Consider the following details:

| Asset Price Rises Above Strike | Asset Price Remains Below Strike |

|---|---|

| Your Profit: Grows as price rises. | Your Loss: Capped at Premium Paid. |

Key Options Trading Terminology You Must Know

Understanding the specific language of options trading is crucial for successful trading, especially in markets such as Singapore where the dynamics can be unique.

Call Options

A Call Option grants you the right, but not the obligation, to buy an underlying asset at a predetermined Strike Price before the option reaches its Expiration Date.

Put Options

Conversely, a Put Option gives you the right to sell the underlying asset under the same conditions as a call.

Strike Price

The Strike Price is the specified price at which the underlying asset can be bought or sold when exercising an option.

Premium

The Premium is the price you pay for purchasing an option, influenced by factors like Delta, Gamma, Theta, and Vega.

Expiration Date

The Expiration Date, also known as Expiry Date, is the deadline by which the option must be exercised or becomes worthless.

In the Money

An option is In the Money (ITM) when exercising leads to a profitable transaction, based on the current market price relative to the strike price.

At the Money

At the Money (ATM) options have a strike price that is equal to the market price of the underlying asset.

Out of the Money

Out of the Money (OTM) options would result in a loss if exercised, as their strike prices are unfavorable compared to the current market price of the underlying asset.

Options Trading Terminology Summarized

| Term | Description | Example |

|---|---|---|

| Call Option | Right to buy | You anticipate stock growth, and buy a call option to profit. |

| Put Option | Right to sell | You foresee a stock decline, and buy a put option to mitigate losses. |

| Strike Price | Predetermined transaction price | Options grant the purchase of stock at a predetermined amount, even when market price varies. |

| Premium | Market price of the option | Influenced by various market factors like Theta or time decay. |

| Expiration Date | Deadline for exercising the option | Option must be exercised before this date, or it expires worthless. |

| In The Money | Exercising yields a profit | A call option’s strike price is below the market price of the stock. |

| At The Money | Strike price equals market price | Neither a loss nor gain if exercised, excluding the premium cost. |

| Out of The Money | Exercising yields a loss | A call option’s strike price is above the market price of the stock. |

Understanding these terms will help you navigate the options market with greater confidence and precision.

Each element from Delta affecting Premiums to Theta impacting time decay all plays a critical role in your options trading strategy.

Applications of Trading Options

Options trading offers versatile strategies for investors.

Whether you aim to manage risk or engage in speculation, understanding the applications of these strategies is essential.

Hedging: Buying Puts

When you own stocks and anticipate potential drops in their prices, purchasing put options can serve as insurance.

By buying puts, you gain the right to sell your shares at a predetermined price, safeguarding your portfolio against a decline.

| Strategy | Objective | Limitation |

|---|---|---|

| Buying Puts | Protect stock investments | Limited by the premium paid |

Speculation: Buy calls or sell cash secured puts on bullish securities

If you’re bullish on a security, you can speculate by buying call options or selling cash secured put options.

Buying calls allows you to control a larger amount of stock with a smaller upfront investment, as you only pay the premium.

| Market View | Option Type | Strategy | Potential Outcome |

|---|---|---|---|

| Bullish | Call Options | Buy to capture gains | Unlimited profit potential, risk limited to premium |

| Bullish | Put Options | Sell to collect premium (Cash Secured Put Option) | Profit limited to premium, risk is more extensive |

Speculation: Sell covered calls or buy puts on bearish securities

Conversely, if you expect a security price to fall, selling covered call options or buying puts can be profitable.

Selling covered calls can be advantageous when price stagnation or a slight decline is expected, while buying puts is a direct bet on a significant price decrease.

| Market View | Option Type | Strategy | Potential Outcome |

|---|---|---|---|

| Bearish | Call Options | Sell to collect premium (Covered Call Option) | Profit capped at premium, unlimited risk |

| Bearish | Put Options | Buy for downside speculation | Profit potential substantial, risk limited to premium |

Embrace these trading strategies to align with your market expectations and manage risk efficiently.

Level of Risk in Options Trading

Warning: Option trading is highly risky and if you just started investing, it is not advisable to not trade options, but start with lower risk investment options such as ETFs, REITs and Stocks.

When we talk about options trading, we think of high risk investment, and it is totally true.

However, understanding the varying levels of risk is essential can help you make a more informed decision when you trade options.

Options contracts can have risks ranging from limited to potentially unlimited, depending on how you participate in the market.

Here’s a simple options trading risk analytic chart examining of the key types of positions you might hold:

| Option Type | Description | Risk | Risk Level Ranking |

|---|---|---|---|

| Long Call Option | Buy the right to purchase stock. | Premium paid only. | Avg. Risk |

| Covered Call | Sell a call while owning the stock. | Missing out on higher gains. | Avg. Risk |

| Covered Put | Buy a put while shorting the stock. | Premium paid or missed gains. | Avg. Risk |

| Cash-Secured Put | Sell a put and deposit cash in reserve. | Loss of premium or stock devaluation. | Avg. Risk |

| Naked Put | Sell a put without holding the stock. | Potential to buy stock above market value. | Very Risky (Warning) |

| Naked Call | Sell a call without owning the stock. | Risk is unlimited due to price escalation potential. | Very Risky (Warning) |

- Your risk begins with the long call option, where your loss is limited to the premium you’ve paid. This can be a strategic way to speculate on a stock’s upside with capped risk.

- If you’re selling options, such as a covered call, you’re obligated to sell the stock if exercised. You gain income from the premium but might lose if the stock’s price soars beyond the strike price.

- A covered put can lock in profits on your short positions, but again, the risk is losing the premium paid and potential gains.

- With a cash-secured put, you’re looking at either pocketing the premium or owing stock that might be valued less than your committed cash.

- The most uncertain scenarios involve the naked put, where you risk purchasing the stock at a potentially higher rate.

- Naked call holds the greatest hazard as stock prices can theoretically climb indefinitely, leaving you to cover the soaring costs with unlimited risk potential.

Note: Do note that risk level determination is very subjective, what I find risky may not be for you, and what I find as less risky can be risky for you. Determine your own risk level once you’ve understand the concept of option trading.

What Are The Fees Involved When Trading Options?

When you get into options trading, and trying to open an options trading account, you want to understand the associated fees that comes with this form of investing.

Trading fees vary by broker but generally include commission and regulatory costs.

Commission Fees

Most online brokerages charge a commission fee per trade, which is the cost you pay for each options transaction. This fee varies widely, so it’s smart to compare brokers.

- Fixed cost commission fee structure which multiple the number of contracts you have.

- Percentage cost commission fee structure which multiple the value of your contract.

Regulatory Fees

These are fees imposed by the regulatory body to support their operations.

- Clearing Fee: Typically a small percentage of the trade.

- Trading Fee: Charged by the trading platform and varies across platforms.

Other Considerations

- Investment capital: Ensure you have enough to cover the fees without eroding your potential profits.

- Investment portfolio: Diversify to manage risk, but remember that each trade incurs individual fees.

In short, each options trade you make involves various fees, including commission and regulatory fees, which can impact your investment’s profitability.

Always check with your chosen broker to understand the total cost of your trading activity.

General Options Trading Platform Fees In Singapore

And if you are wondering what are the various fees offered by the different broker here in Singapore, I’ve consolidated some of the top brokerages which offers options trading for you to take a look.

| Stock Brokerage | Commission Fee | Platform Fee | Available Stock Market |

|---|---|---|---|

| Moomoo | SG: 0.03% of trade value, Min. SGD 0.99 per order US: USD 0.65 per contract, Min. USD 1.99 per order HK: 0.03% of trade value, Min. HKD 3.00 per order | SG: 0.03% of trade value, Min. SGD 1.50 per order US: USD 0.30 per contract, Min. USD 0.99 per order HK: HKD 15.00 per order | SG, US and HK Stocks Options |

| Webull | US: USD 0.55 per contract | US: USD 0.00 per contract* | US Stock Options |

| Tiger Brokers | US: USD 0.65 per contract (Min. USD 1.99 per order) HK: 0.2% of trade value (Min. HKD 3.00 per order) | US: USD 0.30 per contract (Min. USD 1.00 per order) HK: HKD 15.00 per order | US and HK Stocks Options |

| Interactive Brokers | SG: SGD 5.00 per contract US: USD 0.65 per contract, Min. USD 1.00 per order HK: HKD 0.2% option value + HKD 3.00 per contract, Min. 18.00 per order | – | SG, US, HK, UK, JP, AUS, IND etc. Stocks Options |

| POEMS | US: USD 0.88 per contract | US: USD 2.88 per order | US Stock Options |

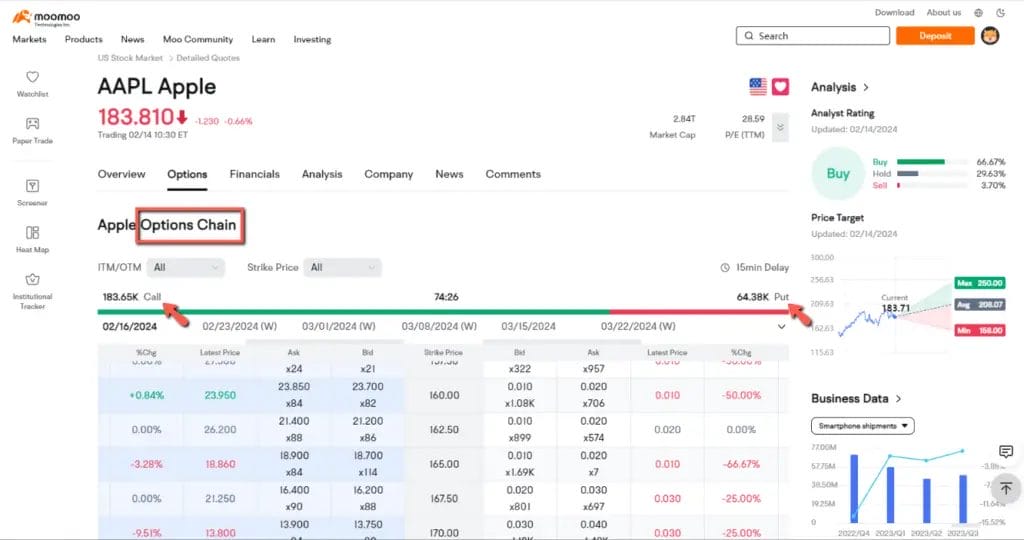

Of this list, I personally use Moomoo for my trades, not only the fees are low, let me access to SG, US and HK stocks, I find it extremely easy to use and offers a highly intuitive user interface with options for me to trade on desktop on through the Moomoo trading App.

They are currently having some promotions for new user sign ups, do have a look and see if this is the platform for you.

- Extra S$20* FREE Cash Coupon.

- Claim 4 x FREE stock bundle worth S$280* with $10,000 deposit & 8 buy trades.

- Get additional S$260* FREE AAPL stock with $100,000 deposit.

- Earn 31 days 6.8%* p.a. return on idle cash with Moomoo Cash Plus

- Low commission fee for SG and HK stocks, ETFs and options.

- Lifetime $0 commission free* for US stocks.

Moomoo Promo: Low Commission + Free Stock

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither the companies mentioned or its affiliates shall be liable for the content of the information provided. The information was accurate to the best knowledge of the author. This advertisement has not been reviewed by the Monetary Authority of Singapore. * T&C Applies

Supported by you when you buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Read Also:

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).