Singapore Budget 2024: Key Highlights in 3 Minutes or Less

Today, I’ve just watch the Budget 2024 delivered by Deputy Prime Minister and Finance Minister Lawrence Wong on Friday (Feb 16), there is a lot of good information and key takeaway you may want to know.

Just in case you do not have time to watch the whole Singapore Budget 2024 statement by DPM Lawrence Wong and just want a quick summary, here it is.

Disclaimer: The following summary is according to my own understanding of the Budget 2024, you can read more about it on ST and MOF as well. While the author aims to provide accurate and factual information according to our editorial guideline, this article is not a recommendation or advice, please read our T&C.

Singapore Budget 2024 Highlights

Minister Lawrence Wong announced a significant $1.9 billion boost to the Assurance Package in the Budget speech on Feb 16 (Wahoo!). This boost aims to provide a mix of cash, vouchers, and rebates to support lower-income families and larger households, especially those with seniors and children.

- Support For Singaporeans

- Support For Families

- Support For Seniors

- Investing In Our People

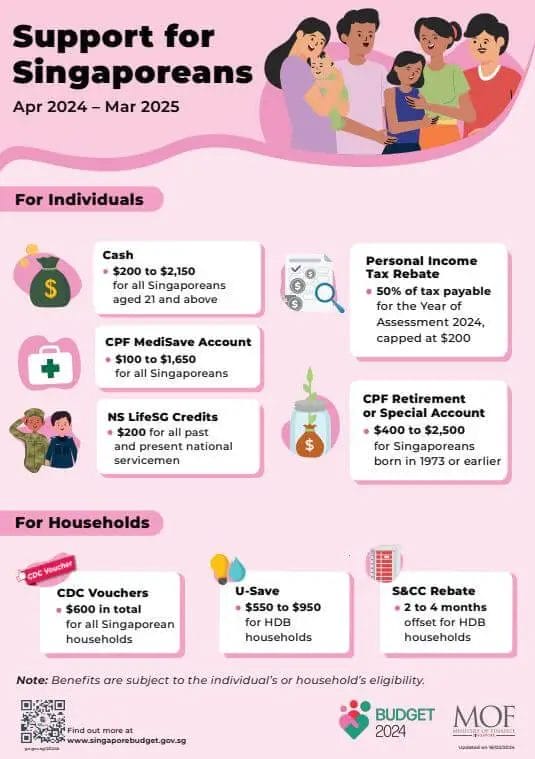

Support For Singaporeans

For Individuals

- $200 to $2,150 for all Singaporeans aged 21 and Above

- $100 to $1,650 to all Singaporeans CPF Medisave Account

- $200 to all NSmen

- 50% income tax rebate cap at $200

- $400 to $2,500 for all Singaporeans CPF Retirement Account (RA) or Special Account (SA) born in 1973 or earlier

For Households

Community Development Council (CDC) Vouchers and Cash Payments

The Assurance Package enhancements include an extra $600 in CDC vouchers for approximately 1.4 million Singaporean households. This will be distributed in two tranches

- First distribution of $300 in end-June 2024.

- Then the remaining $300 in January 2025.

A Cost-of-Living special payment of $200 to $400 in cash will also be given to eligible Singaporeans in September 2024.

| Enhancement | Details |

|---|---|

| CDC Vouchers | Extra $600, split for spending at merchants and hawkers, and supermarkets. |

| Cash Payment | Cost-of-Living special payment of $200 to $400 in cash in September 2024. |

Service and Conservancy Charges (S&CC) Rebate and U-Save Rebates

In January 2025, a one-off service and conservancy charges (S&CC) rebate will benefit more than 950,000 Singaporean households.

Eligible households can also receive 2½ times the regular U-Save rebates. A maximum of $950, covering about four months of utility bills.

| Enhancement | Details |

|---|---|

| S&CC Rebate | One-off rebate in January 2025 to offset half a month of charges. |

| U-Save Rebates | Up to $950 disbursed in April, July, October 2024, and January 2025. |

Support For Families

Supporting Families

- One-Year support for eligible families to rent a HDB flat

- Government supported preschool full-day childcare fee cap at $640 for Anchor Operators and $680 for Partner Operators.

- Preschool subsidy for lower-income families

- ComLink+ Progress Package to support lower-income families

- Dependent-related Personal Income Tax relief raise to $8,000

Supporting Person With Disabilities

- Increase financial support for Singaporean students with special needs in Special Education School and Care Centers

- Expanding Sheltered Workshops and Day Activity Centers to support employment and community integration

GST Voucher Fund and Enterprise Support Package

The GST Voucher Fund will be topped up by $6 billion to help lower and middle-income households.

The Enterprise Support Package, worth $1.3 billion, includes a corporate income tax rebate and cash payouts for businesses managing rising costs.

| Enhancement | Details |

|---|---|

| GST Voucher Fund | Topped up by $6 billion to defray GST expenses for lower- and middle-income households. |

| Enterprise Support Package | $1.3 billion package with corporate income tax rebate and cash payouts for eligible companies. |

Household Benefits Under the Enhanced Assurance Package

Assurance Package enhancements on different households including cash, MediSave top-ups, U-Save and S&CC rebates, and CDC vouchers:

| Household Type | Approximate Benefits |

|---|---|

| Lower-Income (4 members with 2 young children) | $5,500 in benefits |

| Middle-Income (4 members with 2 young children) | $3,000 in benefits |

| Middle-Income (6 members with 2 seniors and 2 young children) | $8,000 in benefits |

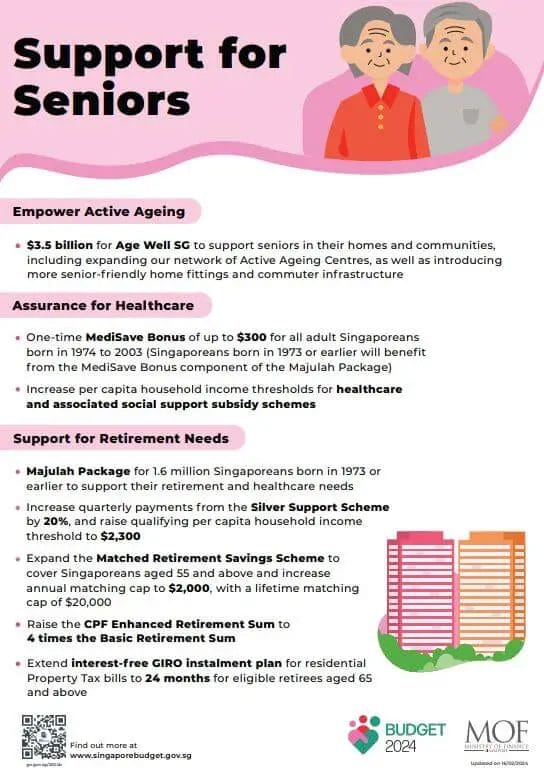

Support For Seniors

Empower Active Aging

- Expanding Active Aging Centers and introducing senior-friendly home fittings and infrastructure.

Assurance For HealthCare

- Majulah Package: One-off $300 Medisave bonus for Singaporeans born in 1973 and earlier.

Support For Retirement Needs

- Enhance Silver Support Scheme by increasing the payment by 20%

- Raise Silver Support Scheme qualifying threshold to $2,300

- Matched Retirement Saving Scheme increase to $2,000 per annual and $20,000 for lifetime matching

Majulah Package (For Singaporeans Born on 1973 or Earlier Only)

- $400 to $1,000 to CPF Retirement Account (RA) or Special Account (SA)

- $1,000 to $1,500 one-off bonus to CPF Retirement Account (RA) or Special Account (SA) for Singaporeans with less than $99,400 (2023 Basic Retirement Sum)

- $750 to $1,500 one-off bonus to CPF Medisave Account

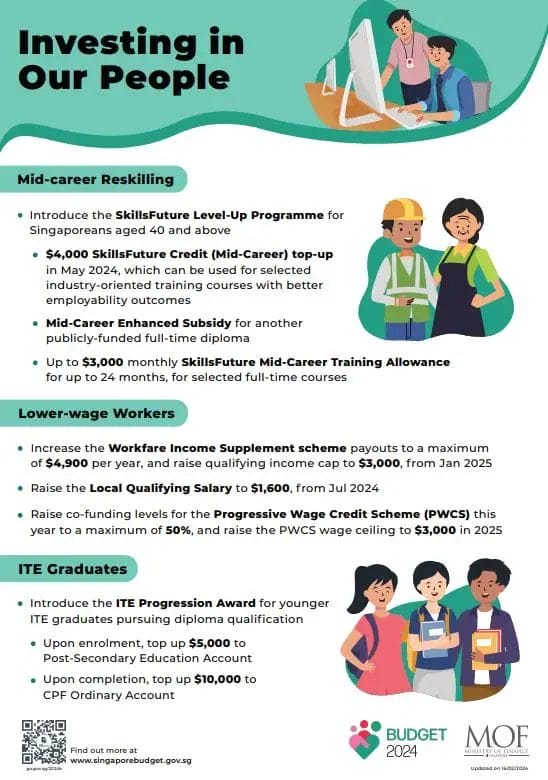

Building Our Shared Future Together: Investing In Our People

Investing In Our People (SkillFuture for Singaporean age 40 and up)

- $4,000 SkillFuture Credits

- $3,000 monthly SkillFuture Mid-Career Training Allowance for selected full-time course

Lower-Wage Workers

- Raise local qualifying salary to $1,600

ITE Graduates

- $5,000 top-up to Post-Secondary Education Account upon enrollment

- $10,000 top-up to CPF Ordinary Account (OA) upon completion

Building Our Shared Future Together

Talking about the future of Singapore, “Building Our Shared Future Together,” they understood that it have been a challenging times.

| Key Insights | Details |

|---|---|

| Economic Climate | Despite the moderation of inflation in 2023, economic growth slowed, and real incomes declined. |

| Early Indicators | The government picked up early indicators of the negative trend, leading to the introduction of the Cost-of-Living Support Package in September 2023. |

Assurance Package and Enterprise Support Package offer near-term relief, Minister Wong stressed the importance of a long-term strategy.

To address inflation sustainably, the focus is on enhancing productivity for both firms and workers, ensuring a continuous rise in real incomes.

Disclaimer: I am not your financial adviser or lawyer, information found on our website is just our opinions, and should be used for entertainment purposes only. You should always ask your financial adviser or lawyer for any financial or law-related advice. By accessing this website you’ve agree on our T&C.

- Singapore Budget 2024: Key Highlights in 3 Minutes or Less

- TD Ameritrade Stop Serving Singapore Retail Investors in Dec 2023…Do This Now!

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).