How to Transfer Stocks To Webull For Investors (Step-By-Step Guide)

Have you ever wonder how to transfer stocks to Webull Singapore?

Actually the process is very easy, and it only takes you less than 5 minutes to complete.

Get Started to Make The Stock Transfer to Webull

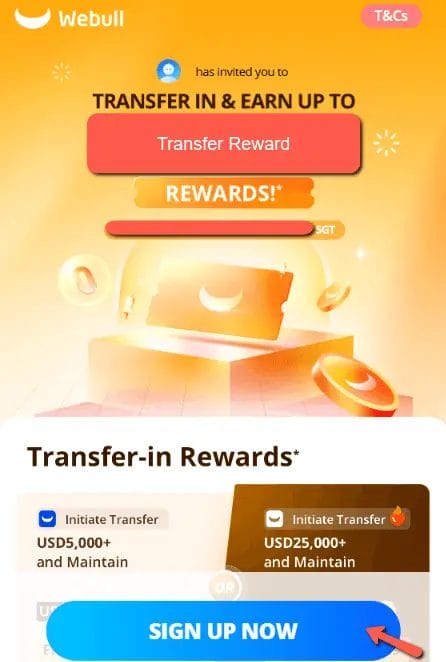

You can get started by opening your Webull Account using this LINK.

Webull SG offers many promotions for new account users to sign up and perks for current users, so do make sure to take advantage of the benefits offered by Webull.

Minimum investment: $0

Stock/ETF Commission Fees: $0 & 0.025% thereafter for US, 0.03% for HK, 0.025% for SG

Options Fees: $0.55 Per Contract

Markets: United States, Hong Kong and Singapore

Suitable For: Beginner and Experience investors or trader looking to invest both locally and internationally.

Once, you’ve opened your account, here’s what you’ll need to do.

How to Transfer Stocks to Webull SG From Another Brokerage?

IMO (in my opinion) Webull Singapore is one of the best MAS Registered Low Cost Brokerage for beginner investors and investors that focus on investing in US stock market.

Webull is ACATS supported, meaning it let you easily transfer your stocks, options and cash balance from any other brokerage to your Webull SG account seamlessly without much hassle. And this process can be completed within 5 minutes.

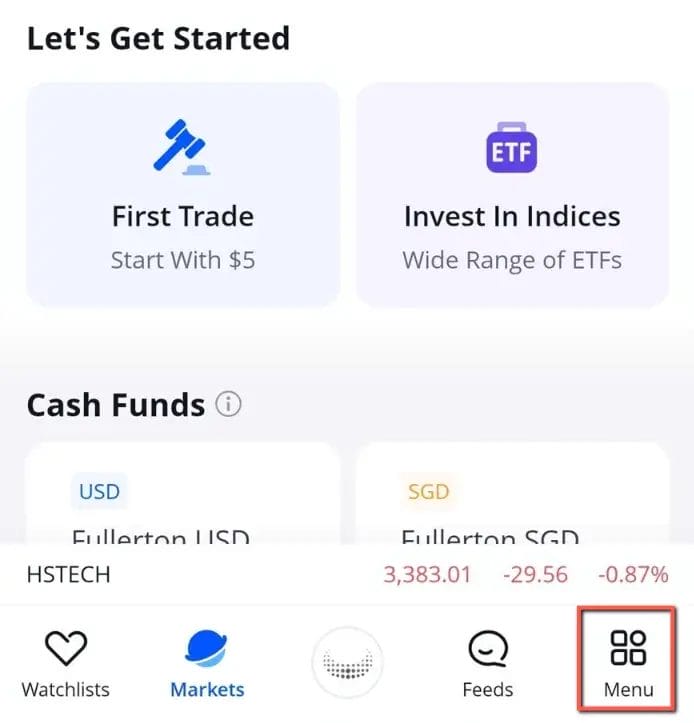

Step 1: Navigating Webull SG Trading App

Sign in your Webull SG account.

Once you’ve signed in, tap on the “Menu“ icon at the bottom right hand corner of the screen.

Menu > More > Transfer

(Images are for illustrative purposes only.)

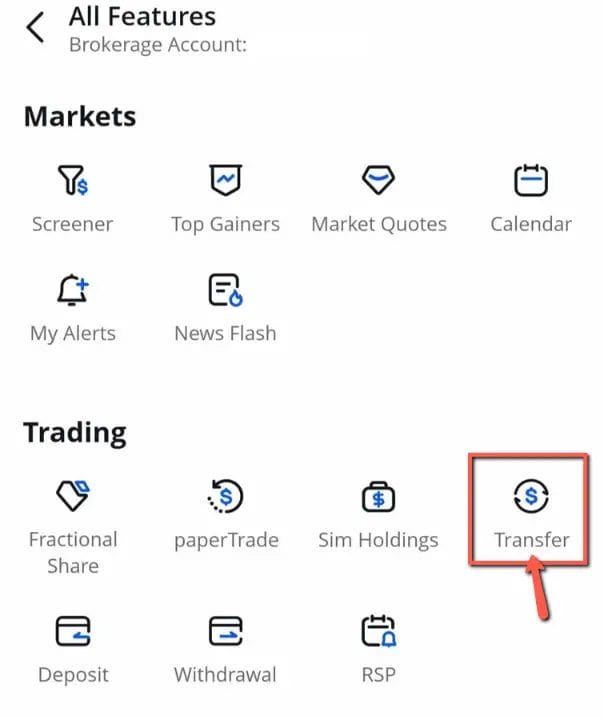

(Images are for illustrative purposes only.)

Step 2: Choosing Your Stock Market

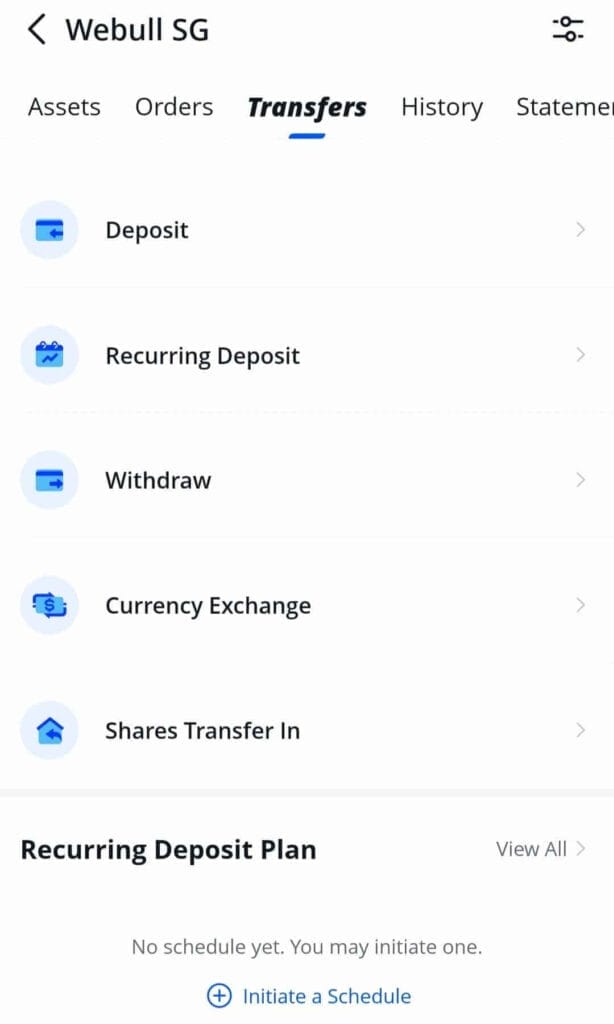

At the “Transfer Tab” you will see options such as “deposit“, “recurring deposit“, “withdraw“, “currency exchange” and “shares transfer in“.

Scroll down and select the “Shares Transfer In“.

Select the “Stock Market” where your current stocks are located and want to transfer into Webull SG.

- If your stock in your external brokerage is in the US Market (NasDaq or NYSE), choose “US Market“

If your stock in your external brokerage is in the HK Market (HKEX), choose “HK Market“If your stock in your external brokerage is in the SG Market (SGX), choose “SG Market“

However, currently Webull only let you transfer of US Stocks, thus you will only see one option.

In this example, I’ve click on the “Transfer US Shares” to make a transfer of stocks from my external brokerage into Webull SG.

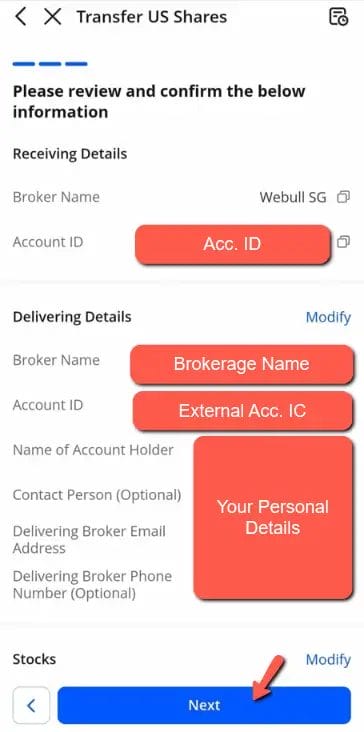

Step 3: Brokerage Info

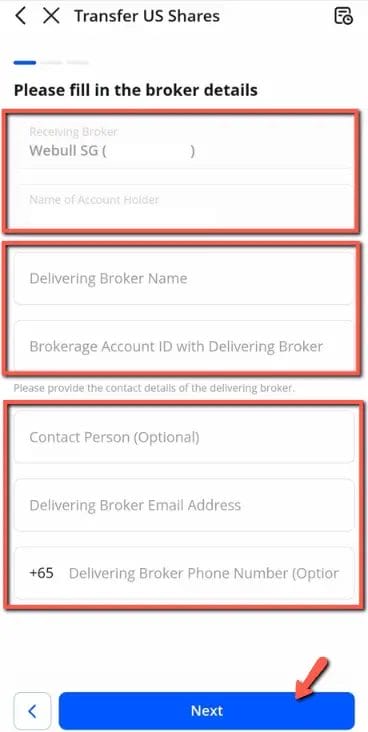

Enter the information of the brokerage you want to transfer from.

When I do this step, here are the information requested separated into 3 sections:

- Section 1: Your Webull SG account and name of the account holder. (Transfer to)

- Section 2: Brokerage Name and Brokerage Account ID of external brokerage. (Transfer from)

- Section 3: Contact Person (Your Name), Contact Number (Your Phone Number), Contact Email (Your Contact Email)

PS. I’ve break it down to “sections so it is easier for you to understand.

Step 4: Stocks Info

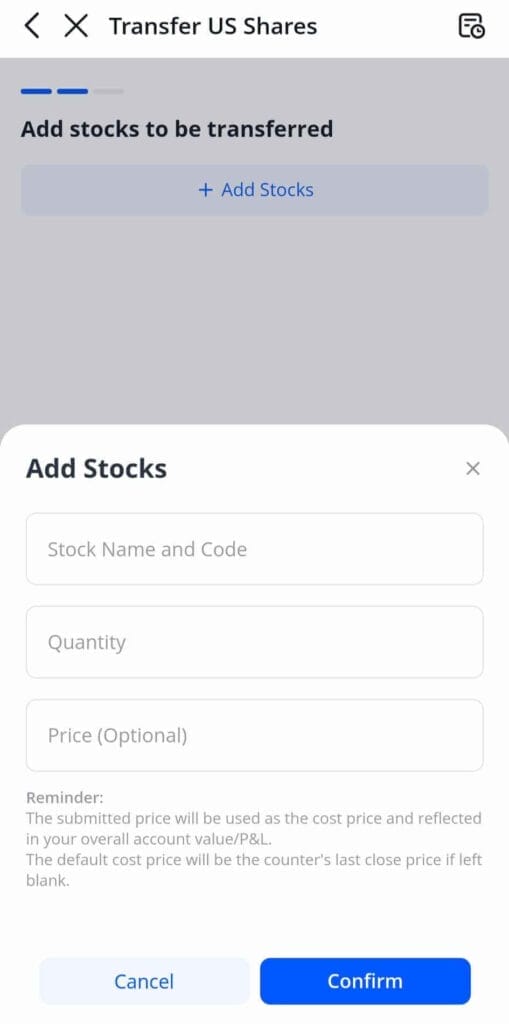

Then you will be asked to fill up your stocks details.

- Stocks Symbol (Ticker symbol of the stocks)

- Quantity (Number of Shares)

- Cost per Share (For your own tracking)

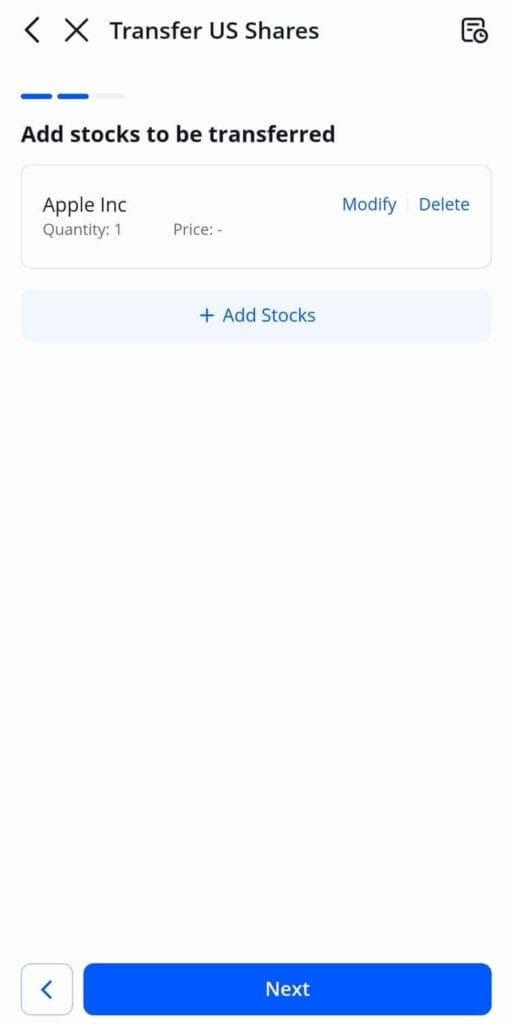

I’ve use 1 Apple Share as an example.

Step 5: Review Your Transfer Details

Do a quick check and review your transfer details.

Check your transfer details:

- Transfer To: Brokerage name, Brokerage Account No.

- Transfer From: Brokerage name, Brokerage Account No. and Account Name

- Stocks Details: Symbol and Quantity

Once done, you can click “Next” and the Webull SG team will help you progress your request.

About Transferring Stocks to Webull SG From Another Brokerage

At the time of writing, there is a few reasons why you may want to transfer your stocks to Webull SG.

- Stocks transfer only take 3 to 5 business days which is very fast!

- Webull SG don’t charge any transfer fees (Amazing right!?!), however we still have to take note that many other brokerage charges “outgoing fee” thus you need to keep that in mind.

- Webull offer “Transfer In Promotion” when you create an account and make the transfer using my exclusive link for IB readers.

Transfer of stocks to Webull can be done with any brokerage:

- Transfer stocks from CDP to Webull (Central Depository to Webull)

- Transfer stocks from Tiger Brokers to Webull

- Transfer stocks from Moomoo to Webull

- Transfer stocks from IBKR to Webull

- Transfer stocks from POEMS to Webull

- Transfer stocks from DBS Vickers to Webull

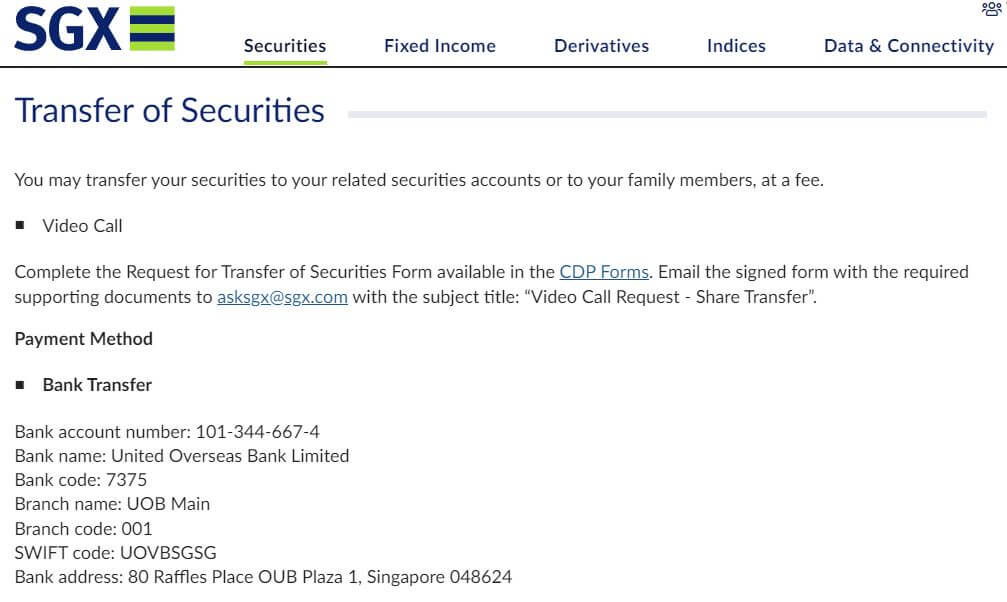

Transfer stocks from CDP to Webull (Central Depository to Webull) can be done similarly, but you’ll need to email SGX to request for the transfer.

My Personal Experience With Webull SG

I find the transfer of stocks to Webull SG to be pretty easy and intuitive just like how I’ve shown you with all the screenshots from my Webull App.

Currently, I sometimes uses Webull App to make some data analysis or to track my watchlist using Webull SG, and it is because of a few reasons:

- Limited time $0 commission on all US Stocks*.

- 3-years $0 commission fee for trading Singapore Stocks*

- Free real-time OPRA and index data*

- Simple to use real-time financial data and valuation tools for fundamental analysis.

- MAS regulated online brokerage that is highly established in the US.

So if you are looking for great deals and easy to use trading platform for trading locally in Singapore, and internationally in the United States and Hong Kong market, Webull SG can be a good choice.

- Claim up to $3,000 FREE Share when you sign up a new account here.

- $0 commission free for US stocks, ETFs, and options.

- 3-Years $0 commission for SG stocks, ETFs, and options.

- Low commission fee for SG, US and HK stocks, ETFs, mutual funds and options.

Webull Promo: Low Commission + Free Stock

Disclaimer: All views expressed in the article are independent opinion of the author, based on my own trading and investing experience. Neither Webull Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

* T&C Applies

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

- Moomoo SG Promotion! $970 Worth of Free Stocks + Perks for New User | April 2024 Updated 🟢

- WeBull SG Promotion! Claim Up to SGD$10,000 FREE + $0 Platform Fee | April 2024 Updated 🟢

- 7 Online Brokerages vs Traditional Brokerages in Singapore: Making The Right Investment Choice

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).