Best Robo-Advisor Platform In Singapore For Beginners (Ultimate Guide)

Disclaimer: The information on this page is for your convenience only. By accessing this website you’ve agree on our T&C. We do not offer tax or investing advisory or brokerage services, nor do we recommend or advise anyone to buy or sell particular stocks, securities or other investments.

We’re supported by readers who buy via links on our site. While this may influence which products we write, it will not influence our opinions and evaluation. Learn more.

Runner-Ups

Management Fee: 0.6% – 0.8%

Minimum Sum: SGD$0

Cash Only

on website

Management Fee: 0.45% – 0.75%

Minimum Sum: SGD$3,000

Cash Only

on website

Robo-advisor are increasing in popularity in the international stage as well as here in Singapore. Unlike traditional financial advisor, robo-advisors offers low fees option for investors to invest in a diversified portfolio according to their risk-tolerance level and guiding the investor towards their financial goals.

“Personally I am just an average investor just like you, I am not a financial advisor, so I am not here to provide any financial advice. But just like you I am curious about the robo-advisor, thus, I’ve collated all the information I can find to share with you which robo-advisor platform I will prefer if I am to invest using robo-advisor.“

With the major banks such as DBS, OCBC and UOB are offering their own version of robo-advisory service which are the best robo-advisor platform for the average Singaporeans like us?

Best Robo-Advisor Platforms In Singapore

Robo-advisor can help lazy investors like us to build wealth, and a quick search online there are more than 10 financial institute offering robo-advisory services. Here we will compare some key information when picking the best robo-advisor that may suit you.

- Understanding who may benefit from the robo-advisor.

- Management fees and commission

- Minimal account balance

- Amount of support provided to the investors.

Each of the robo-advisor provider earn their place in this list with a passive investor who wants a hands-off approach to investing in mind.

1. Endowus

Best Overall Robo-Advisor For Average Singaporeans

Endowus is a leading Asia’s investment platform, with headquarters in Singapore. Licensed and regulated by Money Authority of Singapore (MAS), Endowus aims to provide effortless investing for investors.

As the first robo-advisor that offers investors the use of both private wealth (cash) and public pension saving (CPF and SRS). Endowus gives investors a variety of options to invest:

- Core Portfolios: Globally diversity portfolios

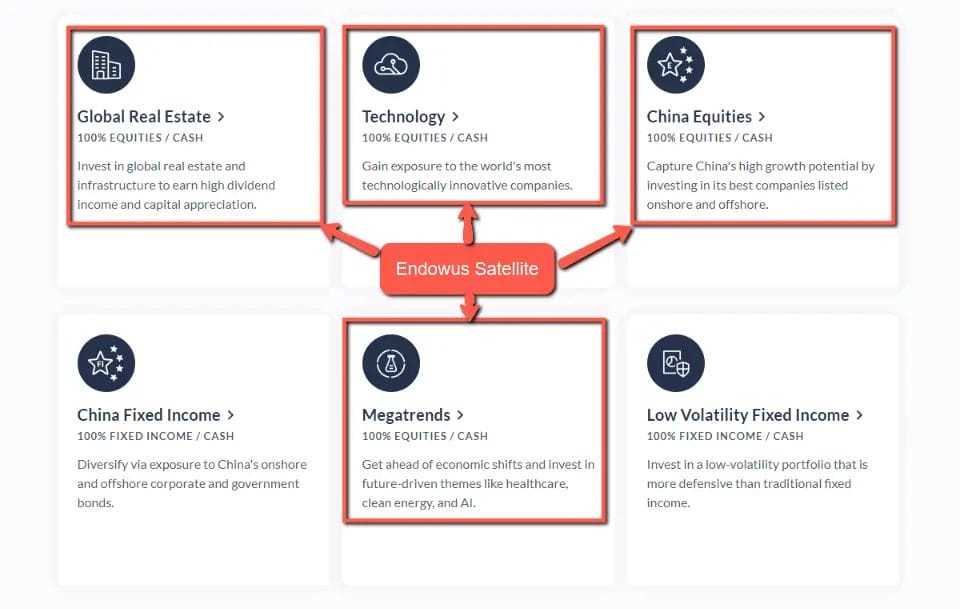

- Satellite Portfolios: Selected market portfolios

- Income Portfolios: Portfolio aim to earn a passive income for the investor

- Cash Smart: High yield cash “savings account”

- Fund Smart: Buying a portfolio of different funds

Partnering with UOB Kay Hian, any investment through Endowus will be recorded in UOB Kay Hian with your own legal name.

| Best For | Any Singaporeans looking to invest their CPF for potential higher returns |

| Fees | 0.25% – 0.6% management fees per year |

| Account Minimum | $1,000 |

| Customer Service | 7 Days (WhatsApp, Phone and Email Support) |

| Automated Rebalancing | Yes, rebalancing is initiated when the asset allocation deviates from the final goals by more than 15%. |

| Funding Options | CPF, SRS and Cash |

| Mobile Apps | iOS, Android, AppGallery (Huawei) |

| Promotions | None. No promotion available at this time |

PROS

✔ Good investor educational resources

✔ Automatic-rebalancing (Periodically)

✔ Use Cash, CPF and SRS to invest

✔ Low-management fee

✔ Good 7 days customer support

✔ Earn high interest rate on cash account

✔ 100% Cashback on trailer fees

✔ High variety of portfolio mix

✔ Available through mobile apps and desktop

CONS

✖ Requires minimum investment of $1,000

WHY I LIKE IT

Personally, I think Endowus is the best robo-advisor in Singapore, not only it offers low management fee, no sales charge and transaction fee. Endowus is one of the few digital investment platform that allow investing with our CPF for a potentially higher returns.

Unlike many other robo-advisor, Endowus create a custody account with your own legal name at UOB Kay Hian, one of the Singapore’s 3 biggest bank, this actually give me an assurance that my money that is invested with Endowus is safe with me.

Of all these different portfolio plans offered by Endowus, I am most interested in their Endowus Satellite portfolio.

As a small investor who is currently in the journey of building wealth and passive income, the Endowus Satellite portfolio offers good range of diversification for riskier investment such as Technology and Megatrends.

China Equities on the other hand are often not available for foreigners like us, but through Endowus Satellite portfolio, investors can participate in China’s growth.

Whereas, as a someone who is trying to build passive income, real estate is probably the easiest way. Having the opportunity to invest in a diversify portfolio of global real estate can be quite attractive.

Furthermore, what catches my eye is their “Cash Smart Account where I can put my “war-chest” at an high yielding “saving account” while waiting for the right time for me to invest.

Overall, if I am going to invest with robo-advisor, I will probably choose Endowus as one of my best choice. Low fees, good assurance with a peace of mind, and options to use my CPF for investing, I really can’t think many robo-advisor can beat this.

2. StashAway

Best Robo-Advisor For Big Investors

StashAway with its headquarters in Singapore, it is a digital wealth management platform that is regulated by MAS aiming to empower people to build long-term wealth through passive investing.

As the 2021 Singapore FinTech Festival winner, StashAway is currently managing assets of more than $1 billion and offering a few different ways for investors to invest:

- General Investing powered by StashAway: Consistent risk for long term-returns

- General Investing powered by BlackRock®: Portfolio with global market exposure.

- Responsible Investing with ESG: Consistent risk for long-term returns with consideration of Environmental, Social, and Governance (ESG) impact.

- Thematic Portfolios: Investing in the latest trend and sectors which may make an impact in the future such as AI, robotics, Blockchain.

- Flexible Portfolios: DIY your own assets similar to traditional investment platform.

Starting with no minimum amount, StachAway have made investing affortable to the masses.

| Best For | People who want a total hands-off approach to investing. |

| Fees | 0.2% – 0.8% management fee per year (approx.) |

| Account Minimum | $0 |

| Customer Service | 7 Days from 5am to 7pm Pacific Time (Phone, Live Chat and Email) |

| Automatic Rebalancing | Yes, automatically rebalance according to market fluctuations |

| Funding Options | SRS and Cash Only |

| Mobile Apps | iOS, Android, AppGallery (Huawei) |

| Promotions | None. No promotion available at this time |

PROS

✔ Basic investor educational resources

✔ No minimum fees

✔ Use Cash and SRS to invest

✔ Automatic-rebalancing (Depends on your portfolio)

✔ Low-expense ratio as you invest more

✔ No account setup or exit fees

✔ Good 7 days customer support

✔ Wide range of investment product to choose including crypto assets

✔ Available through mobile apps and desktop

CONS

✖ High fee if you have small account balance

✖ Tier based fee structure

WHY I LIKE IT

I personally think that StashAway is a good robo-advisor where it can benefit two groups of investors.

- Investors who do not have much money to start investing, since with its no minimum account policy anyone can start “stashing away” and start investing.

- Investors with a lot of money to invest for a low fee investing platform.

Why? Confused? Well… don’t be.

Because comparing with other robo-advisor, StashAway opt for a tier based fee structure where the management fee reduces as you invest more with StashAway.

The tier based fee structure for StashAway offers the investor to give a reducing fee percentage as the investor invest more.

This give the investor more incentive to keep “stashing away” so that the investor can grow their wealth as time passes.

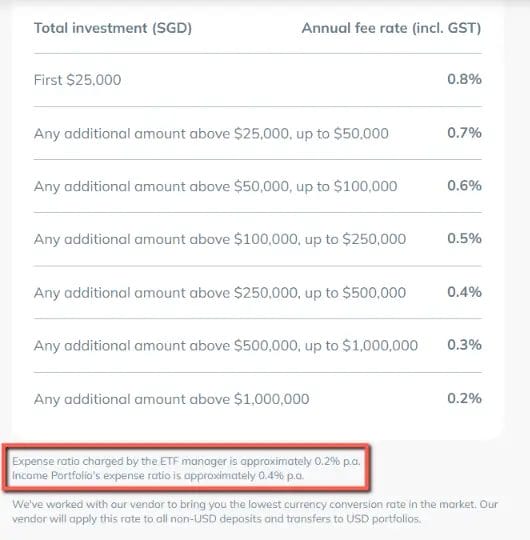

From the chart provided by StashAway, you can get a fee of as low as 0.2% (management fee) + 0.2% (Expense Ratio) when you invest $1,000,000 with StashAway. (Certainly not everyone can “stash away” $1,000,000 for investment thus the fee of 0.2% isn’t as realistic.)

It is more reasonable to assume the expense ratio to be approx. 0.4% p.a. to 1% p.a. making StashAway one of the more premium services unless you are able to invest a lot which gives you a low fee of only 0.4%.

What really stood out for StashAway is that it gives investors the opportunity to invest in a bucket of investment which includes:

- International Equities

- US Equities

- Government bonds

- Real-estate

- Commodities

- Crypto assets

Not many robo-advisor offers the option to invest in investments that includes the major trends such as Fintech, AI, Blockchain and Robotics, making StashAway unique in this area.

Overall, I think StashAway can be a good choice for big investors who are going to invest for the long term. Not only you will get the options to invest in the newest trend for potential high return while keeping your investment diversified, the fees are one of the lowest compared to some of the robo-advisors in this list.

3. MoneyOwl

Best Robo-Advisor For Stability

MoneyOwl is a social enterprise under NTUC Enterprise that is licensed by MAS aiming to help Singaporeans make wise financial decisions through providing financial planning service, getting the right insurance and investing for the future.

As a social enterprise, MoneyOwl’s advisors do not earn commissions, giving customers conflict-free advices that meet their best interest first. Integrated with national schemes, MoneyOwl is one of the few robo-advisors that let investors invest using their CPF and SRS in additional to Cash options. Currently MoneyOwl offers a few investment solutions:

- Dimensional Portfolio: Focuses on the long-term growth using a broadly diversified portfolio including global assets into the mix for stable investment.

- WiseSaver Portfolio: A high yield “saving account” offering high liquidity low risk option to part your cash.

- WiseIncome Portfolio: Multi-asset portfolio focused on earning passive income for the investors with flexible quarterly payout option suitable for investors at different stage of life.

MoneyOwl is an all in one platform for investors who are looking to manage their finance regardless of which stage they are in their life.

| Best For | The average Singaporean moms and pops who are looking for stability and building a passive income portfolio |

| Fees | 0.50% – 0.60% management fees per year (approx.) |

| Account Minimum | $1,000 |

| Customer Service | 5 days, 9.00a.m. to 6.00p.m. Singapore Time (Live Chat, Phone and Email) |

| Automatic Rebalancing | Yes, automated rebalancing when meaningful deviation from strategic asset allocation. |

| Funding Options | Cash, SRS and CPF |

| Mobile Apps | iOS and Android |

| Promotions | None. No promotion available at this time |

PROS

✔ Extensive investor educational resources

✔ Wide range of investing options

✔ Low-expense ratio

✔ Good way to build passive income

✔ Access to human financial advisors

✔ Automatic-rebalancing (Occasionally)

✔ Available through mobile apps and desktop

CONS

✖ Only 5 days customer support from Monday to Friday.

WHY I LIKE IT

Personally, I think MoneyOwl is a great choice for investors who are looking to park their money for the long-term. With the 3 different types of portfolio offered by MoneyOwl; Dimentional, WiseSaver and WiseIncome, I personally feel that MoneyOwl is designed to cater for investors of any age and in any stage of their life.

- Dimensional portfolio is great for any investor looking for long term low risk passive investing.

- WiseSaver is great for investors to park their money at an high yield “saving account” while waiting for the chance to invest when the market is “cheap”.

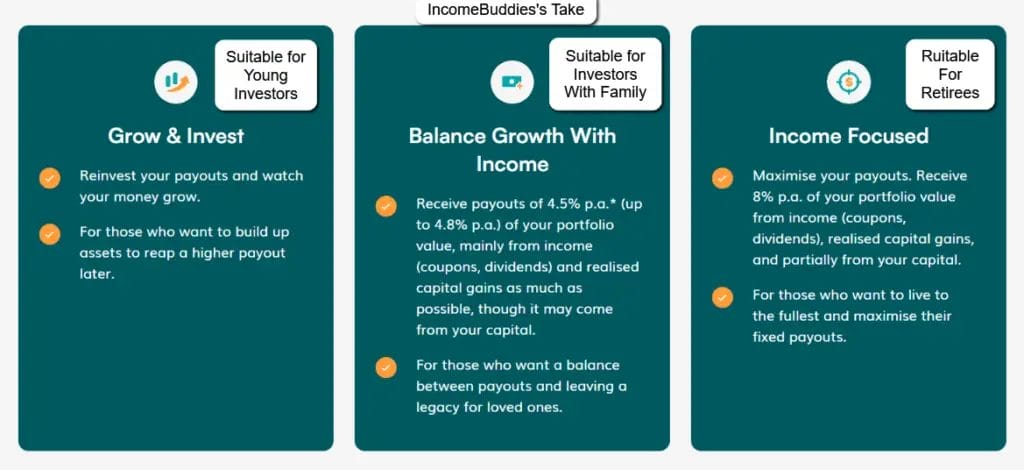

- WiseIncome is probably what interest me most, not only it provides one of the “laziest solution” for passive income, it offers 3 different ways to build cashflow depending on the different stage of life you are in.

What really makes MoneyOwl special is WiseIncome, it offer different types of passive investing payout which helps you to maximize your returns according to the different stage of your life.

Personally, I think that “Grow & Invest” is perfect for young investors because it allows your investment to grow, allowing the magic of compounding to do it’s job.

“Balance Growth With Income” gives you an average growth rate with some passive income, making it an attractive option for investors who are looking to have an additional income stream stream to help supplement their daily expenses.

“Income Focused” on the other hand will be more suitable for retirees who are looking to use the passive income for retirement payout, but on the flipside, the total investment with MoneyOwl will decrease overtime meaning the passive income payout will decrease overtime as well.

Overall, I think MoneyOwl shows to be a very comprehensive robo-advisor which helps take care of almost all the financial needs of the investor. Not only it allows investors to use CPF,SRS and cash to invest for a potential higher return, MoneyOwl have one of the lowest fees amount all the robo-advisors. If you are looking for stability, MoneyOwl can be a good choice.

How To Pick The Best Robo Advisor In Singapore?

Picking the right robo-advisor as a Singapore investor is not easy, with so many investing platforms to choose form, only a handful can be a great way to build wealth. Some have high fees, while others have limited options or complicated fee structure.

Here are some criteria you may want to consider when choosing the right robo-advisor platform for you.

1. Know Why You Want To Invest Using Robo-Advisor

Understanding the reason why your want to invest with robo-advisor is essential if you are finding the right platform. Each robo-advisor are different from each other in terms of suitability for different types of investors.

Reasons why people invest using robo-advisor:

- Investor invest because they want to build a passive income.

- Investor wants to take away the headache of deciding what investments to buy and wants some way to automate the investment.

- Investor wants to build a nest egg for future retirement.

- Investor wants a way to buy high risk types of investments, but wants to reduce the risk through proper diversification.

- Investor want to have the option to buy investments around the globe which normally will be quite difficult.

When considering which platform to invest, think about what the robo-advisor platform can provide which normal stocks trading platform do not.

The better you are able to know what you want from a robo-advisor the easier you can choose the right platform for your investing journey

2. Know If You Can Use CPF and SRS To Invest

CPF and SRS are a great way for you to invest, especially if you are a young investor with a long investing time-horizon, or if you have used up your cash for your investment.

When you invest using CPF and SRS correctly, you can stand to earn 8 to 12% from your money which can be quite significant when compounded for a long time.

Although all the robo-advisor listed here are regulated by MAS, only a few selected robo-advisor allows you to use CPF and SRS for investment.

Thus, investing with a robo-advisor it is good to choose one which offers you option to use CPF to earn extra interest.

3. Caution need to be taken when using your CPF for investment

Unlike the United States where they only have an 401k where you get no interest from putting your money into the account, our CPF minimally let us grow our retirement fund at a 2.5% with almost zero risk.

Our OA account gives us an no risk 2.5% annual return, and for the first $20,000, it gives us an additional 1% return. Thus, when using your CPF for investment, you must be sure that you will get a much better return than the “zero risk” 2.5% return.

4. Understand The Robo-Advisor’s Fee Structure

Fees is the worst enemy of great investment returns. And understanding the different fee structure for the robo-advisor of your choice is important as a smart investor.

There are generally different types of fee structure for different robo-advisors in Singapore:

- Tier based percentage fee structure for the amount invested using the platform

- Flat percentage fee structure where the same fee is paid regardless how much an investor invest.

- Combination fee structure where additional fees is added for different services.

Picking the wrong robo-advisor with complex fee structure can be confusing, and fees can quickly add up to thousands of dollars a year.

Generally, robo-advisors in Singapore have a fee of 0.2% to 1.5% per annual, and as a small investor, a fee of approx. 0.5 to 0.8% is consider reasonable. Higher fees can sometimes be justifiable as these robo-advisor provides options to invest in areas which can have the potential of getting amazing returns.

My Takaway

Robo-advisor proves to be an effective way for investors to diversify their portfolio while automating their investing, letting the power of compounding to work it’s magic and grow your income.

However, like every investing tools, robo-advisor might not be suitable for those who wants a more hands-on approach to investing.

Personally, I like to manage my own investment portfolio, and I find joy in picking stocks to buy and sell. If you are like me, you may want to invest in the traditional way. That is when you’ll need to know which are the best online brokers in Singapore, brokers that is designed for both beginners and professional investors.

Although it take quite a bit of time, and a steep learning curve, the returns can be pretty good. In additional, you need to learn and get educated in investing before you should pick any individual stocks to trade.

- Learn fundamental analysis to understand the fundamentals of the company.

- Learn technical analysis to understand the short term movement of the stock prices of the company.

If you want to pick your own stocks like me, check out my other guides on how to start opening an stock brokerage account and invest:

- How to buy Singapore listed Stocks in Singapore.

- How to buy US Stocks in Singapore.

- How to buy China Stocks in Singapore.

- Best Online Stocks Trading Platform For Beginners in Singapore

Disclaimer: Only those robo-advisor which I can find from their website shows CPF or SRS are possible funding options to invest will be referred as “Yes” for the option to invest using CPF or SRS, but for those which I am unable to find the information saying CPF is available to use for investing, I will assume only cash can be used for investment. Do check with the relative platforms on the information for accuracy before making any investment decision.

Read Also

- How to Use Webull Singapore to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- How to Use Moomoo to Trade, Buy and Sell Stocks? (Beginner’s Guide)

- Best Trading Platform For Beginners in Singapore (Students, NSF, Fresh Graduates)

- Day Trading For Beginners: Guide On How To Become a Day Trader

- Average Brokerage Fee in Singapore: 20+ Broker Fees Compared

Join 900+ BUDDIES who are growing their wealth with our weekly Income Newsletter

Antony C. is a dividend investor with over 15+ years of investing experience. He’s also the book author of “Start Small, Dream Big“, certified PMP® holder and founder of IncomeBuddies.com (IB). At IB, he share his personal journey and expertise on growing passive income through dividend investing and building online business. Antony has been featured in global news outlet including Yahoo Finance, Nasdaq and Non Fiction Author Association (NFAA).